As global markets navigate a choppy start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly watching economic indicators and policy shifts for guidance. In this environment, identifying promising small-cap stocks requires a focus on companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 23.14% | -3.64% | 30.64% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Yongjin Technology Group (SHSE:603995)

Simply Wall St Value Rating: ★★★★★☆

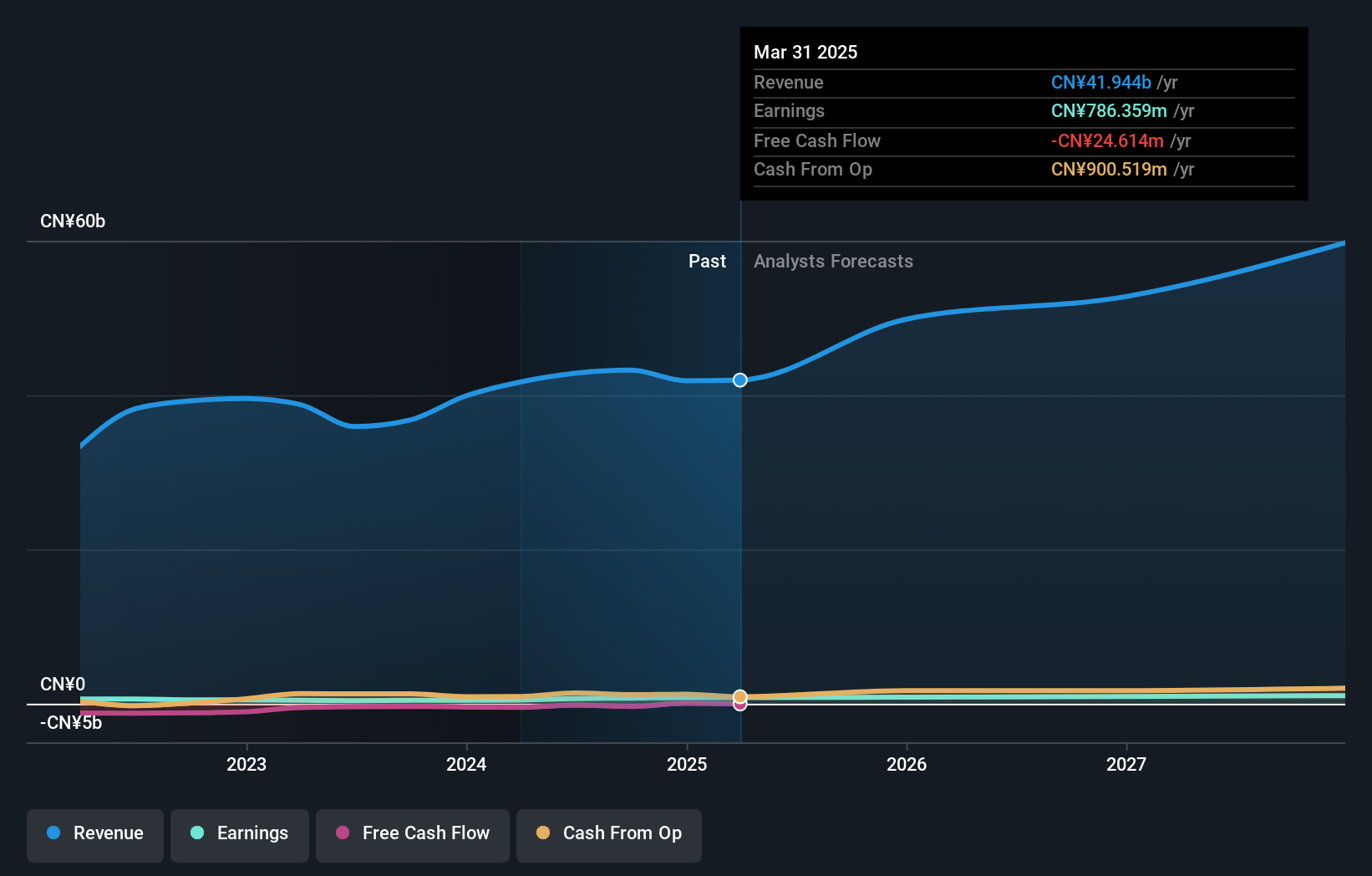

Overview: Yongjin Technology Group Co., Ltd. specializes in the research, development, production, and sale of cold-rolled stainless steel sheets and strips with a market capitalization of approximately CN¥6.74 billion.

Operations: Yongjin Technology Group generates its revenue primarily from the sale of cold-rolled stainless steel sheets and strips. The company has a market capitalization of approximately CN¥6.74 billion.

Yongjin Technology Group, a smaller player in its sector, has shown impressive earnings growth of 59.6% over the past year, outpacing the broader Metals and Mining industry. Despite an increased debt to equity ratio from 21.9% to 61.4% over five years, its interest payments are well-covered by EBIT at a strong 10.2x coverage level. The company trades at a price-to-earnings ratio of 9.3x, which is favorable compared to the CN market's average of 34.2x, suggesting potential value for investors seeking opportunities in this space despite not being free cash flow positive yet.

New Huadu Technology (SZSE:002264)

Simply Wall St Value Rating: ★★★★★★

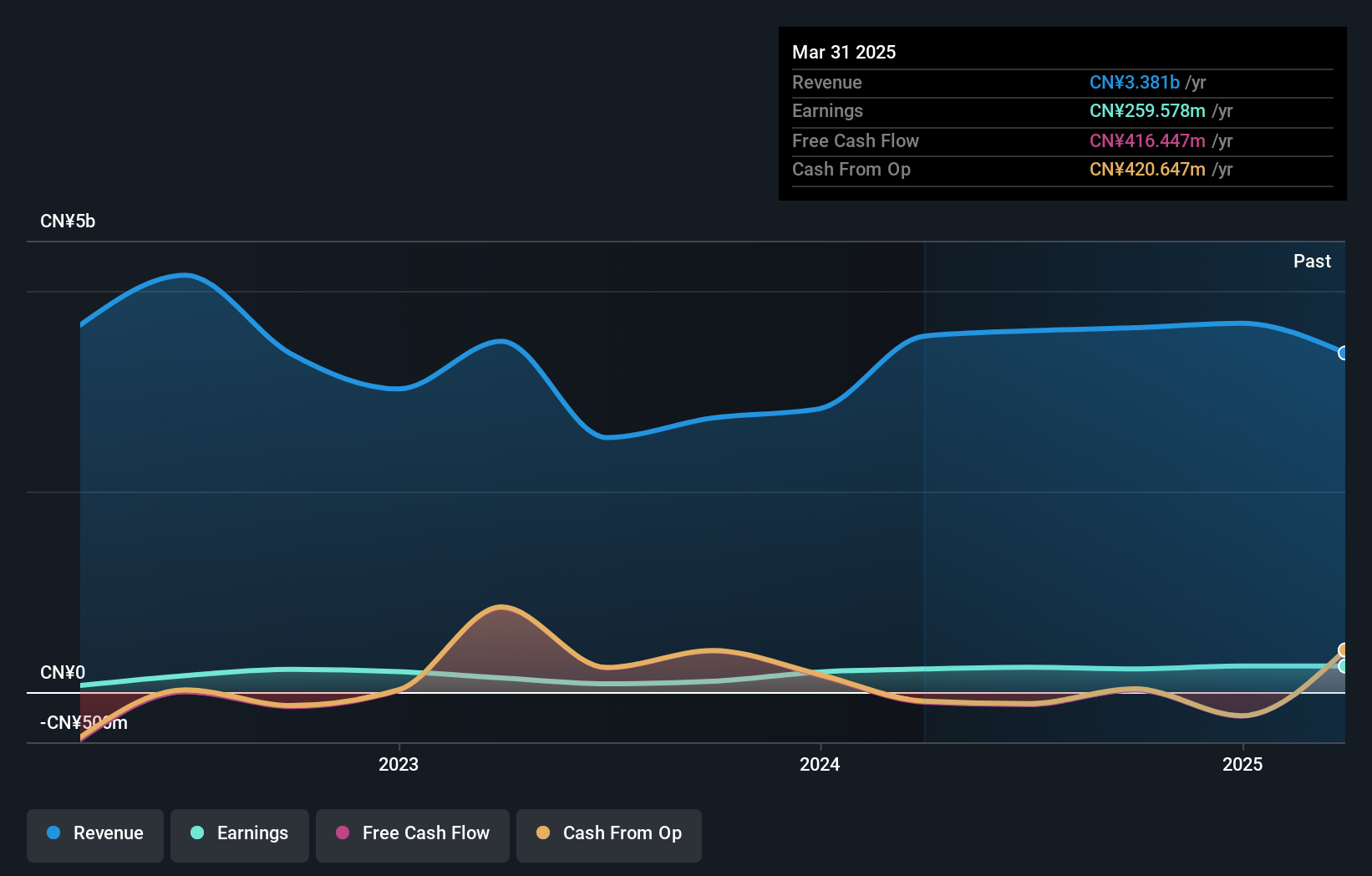

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China with a market capitalization of CN¥4.41 billion.

Operations: The company generates revenue primarily from its Internet marketing operations in China. It has a market capitalization of CN¥4.41 billion, reflecting its position within the sector.

New Huadu Technology, a nimble player in its field, has demonstrated robust financial health with earnings surging by 115.7% over the past year, outpacing the Consumer Retailing industry's 6% growth. The company is trading at a favorable price-to-earnings ratio of 19x compared to the CN market's 34.2x and maintains more cash than total debt, indicating sound financial management. Recent earnings announcements reveal sales of CNY 2.77 billion for nine months ending September 2024, up from CNY 1.97 billion last year, with net income rising to CNY 190 million from CNY 159 million previously.

- Unlock comprehensive insights into our analysis of New Huadu Technology stock in this health report.

MYS Group (SZSE:002303)

Simply Wall St Value Rating: ★★★★★☆

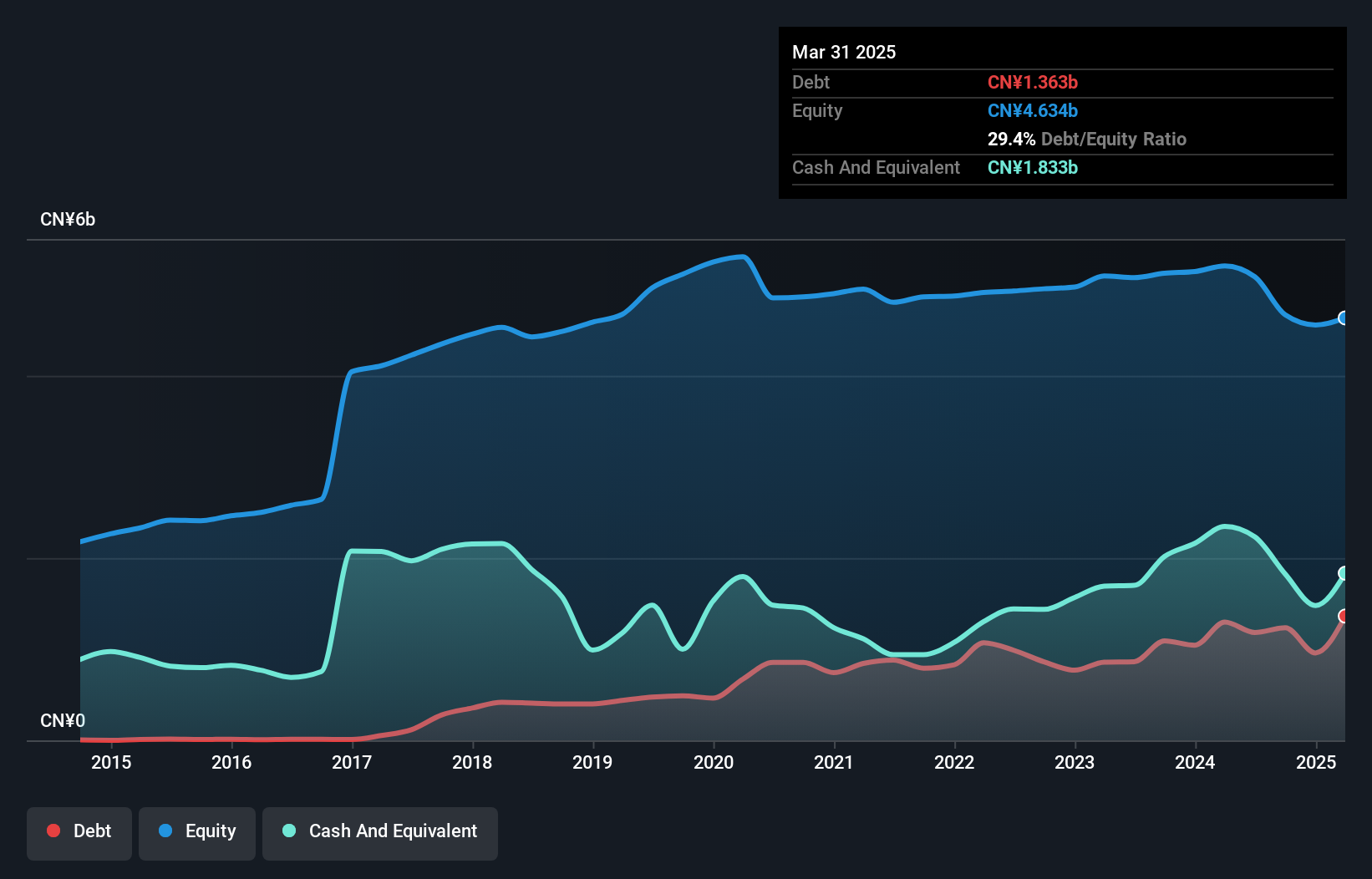

Overview: MYS Group Co., Ltd. develops, produces, and sells packaging products in China and internationally with a market cap of CN¥5.18 billion.

Operations: The company's revenue is primarily derived from its packaging products business. The net profit margin has shown variability, reflecting changes in operating efficiency and cost management.

MYS Group, a compact player in its sector, has been making waves with a notable 36% earnings growth over the past year, outpacing the Packaging industry's 18.4%. The company recently completed a transaction where Guotai Junan Securities and partners acquired a 10% stake for approximately CNY 420 million. Despite earnings declining by an average of 21.7% annually over five years, MYS Group's net income for the first nine months of 2024 rose to CNY 218.74 million from CNY 161.75 million last year, reflecting its high-quality earnings and profitable operations that ensure no cash runway concerns.

- Delve into the full analysis health report here for a deeper understanding of MYS Group.

Understand MYS Group's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 4628 Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002303

MYS Group

Develops, produces, and sells packaging products in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives