Discovering January 2025's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate a turbulent start to 2025, marked by inflation concerns and political uncertainties, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory. Despite these challenges, the resilient U.S. labor market and cautious Federal Reserve stance offer a mixed backdrop for investors seeking potential opportunities in lesser-known equities. In such an environment, identifying promising small-cap stocks requires careful consideration of their growth potential and resilience against economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 23.14% | -3.64% | 30.64% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that offers hardware, electrical, multimedia, home, and leisure products across Sweden, Norway, Finland, and internationally with a market cap of approximately SEK13.69 billion.

Operations: The company generates revenue primarily from its retail specialty segment, amounting to SEK11.00 billion.

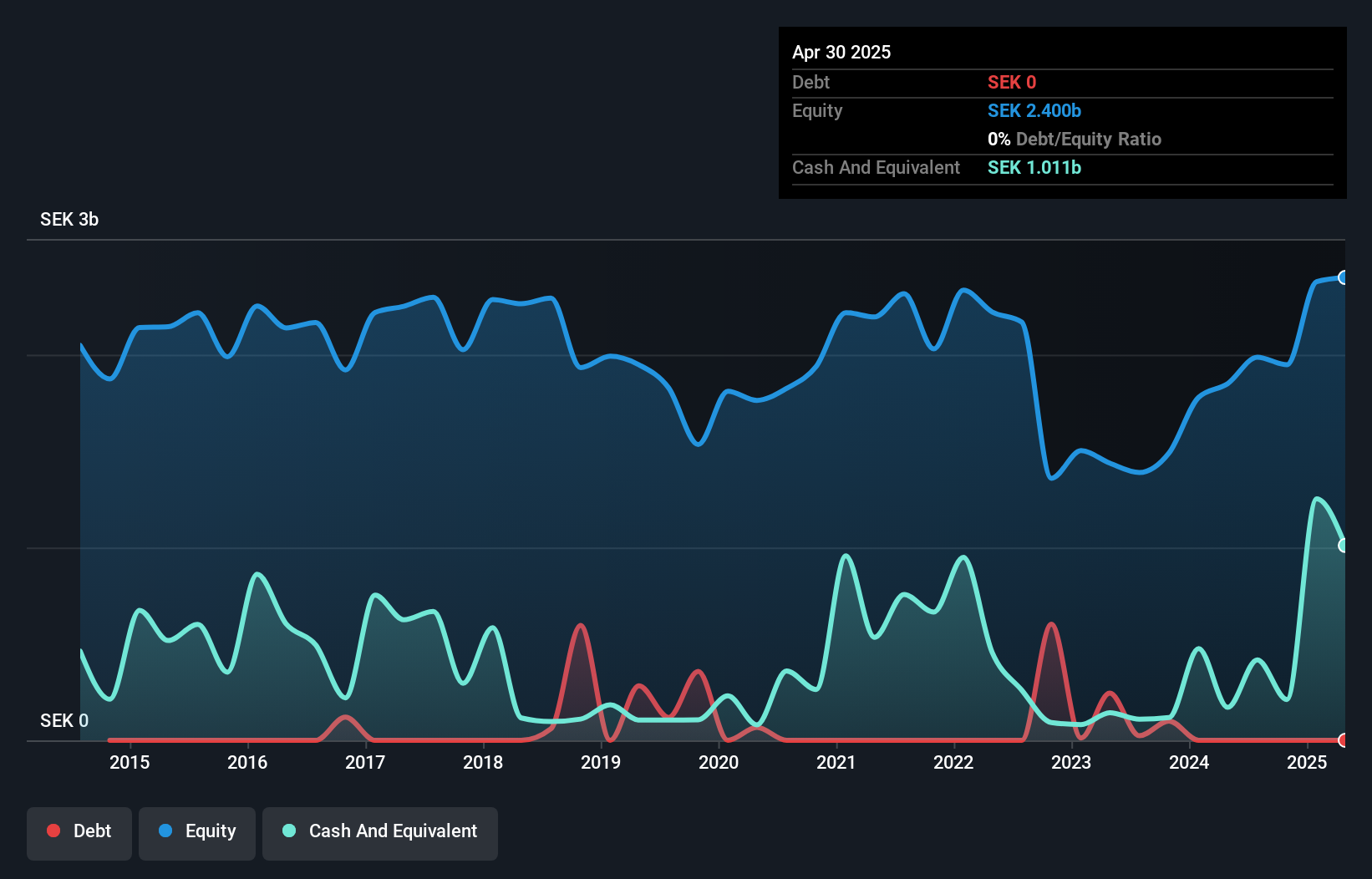

Clas Ohlson, a small player in the specialty retail space, has shown impressive growth with earnings surging by 161% over the past year, outpacing its industry. This growth is reflected in recent sales figures: December 2024 net sales hit SEK 1.60 billion, marking a 12% rise from the previous year. The company operates debt-free now compared to five years ago when it had a debt-to-equity ratio of 23%. Trading at about 60% below estimated fair value and boasting high-quality earnings alongside positive free cash flow, Clas Ohlson seems well-positioned for continued financial health.

- Click here and access our complete health analysis report to understand the dynamics of Clas Ohlson.

China Sports Industry Group (SHSE:600158)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Sports Industry Group Co., Ltd. operates in the real estate and sports sectors both within China and internationally, with a market cap of CN¥7.35 billion.

Operations: China Sports Industry Group generates revenue primarily through its real estate and sports business operations. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

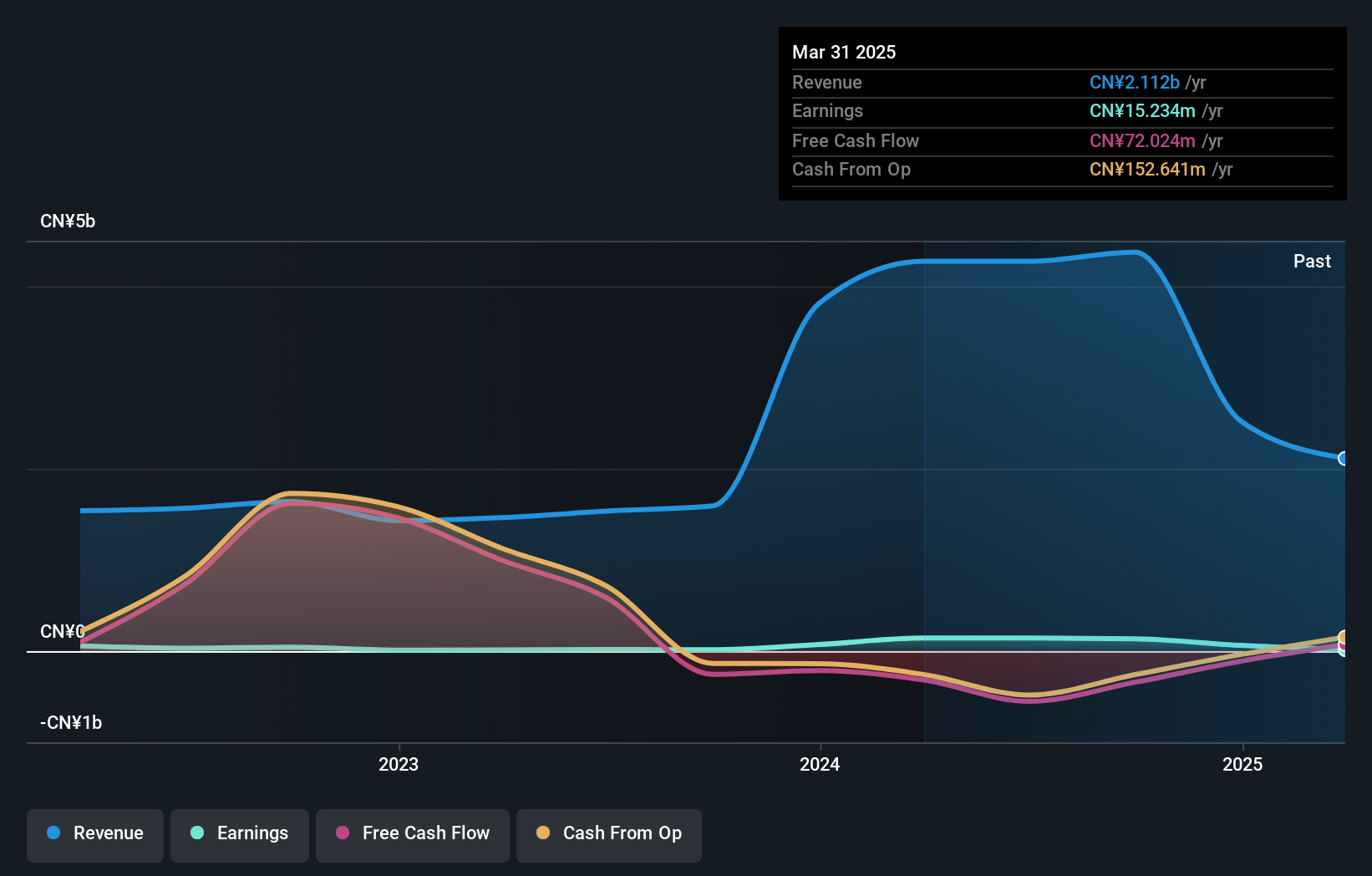

China Sports Industry Group has demonstrated notable financial improvement, with earnings skyrocketing by 841% over the past year, outpacing the Real Estate sector's downturn of 38%. The company's revenue for the first nine months of 2024 reached CNY 1.55 billion, a significant jump from CNY 992.51 million in the previous year. Net income turned positive at CNY 23.16 million compared to a loss of CNY 39.17 million last year, indicating strong recovery and operational efficiency. Despite challenges in free cash flow positivity, its debt-to-equity ratio has improved from 16% to just over 6% in five years, reflecting prudent financial management.

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Value Rating: ★★★★★★

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is engaged in the production and sale of medicines in China, with a market cap of CN¥11.94 billion.

Operations: Henan Lingrui Pharmaceutical generates revenue primarily through the production and sale of medicines in China. The company's financial performance is influenced by its ability to manage costs effectively, impacting its profitability metrics such as gross profit margin or net profit margin.

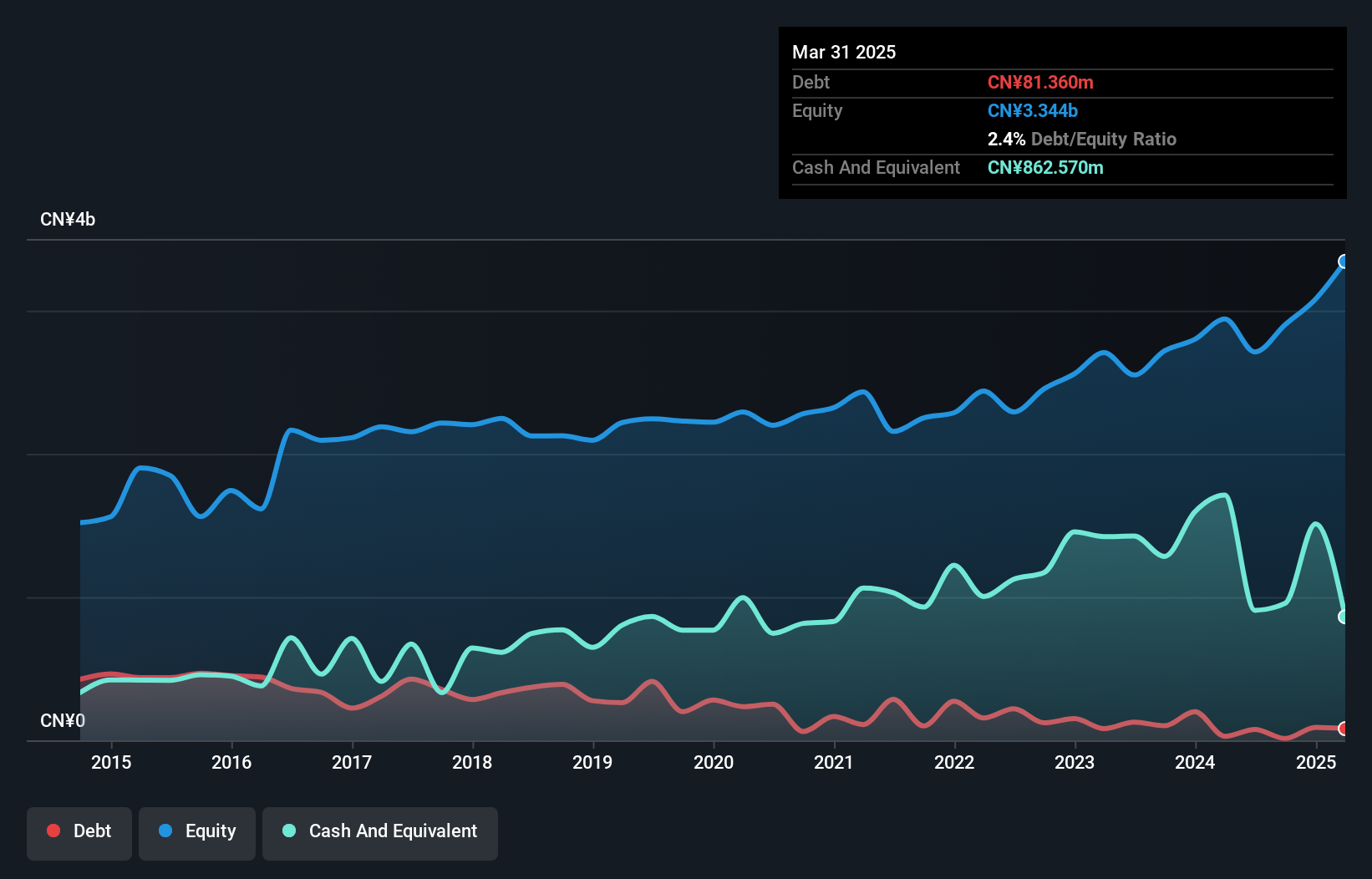

Henan Lingrui Pharmaceutical, a nimble player in the pharma sector, has shown impressive earnings growth of 28% over the past year, outpacing the industry average. The company's debt to equity ratio has significantly decreased from 9% to a mere 0.4% over five years, indicating prudent financial management. With net income rising to CNY 573 million for nine months ending September 2024 and basic earnings per share climbing to CNY 1.02 from CNY 0.83 last year, Henan Lingrui seems well-positioned for future growth while trading at an attractive valuation below its estimated fair value by more than half.

Where To Now?

- Navigate through the entire inventory of 4631 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Lingrui Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600285

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives