Amidst a backdrop of choppy global markets and persistent inflation concerns, investors are increasingly seeking stability in their portfolios. As U.S. equities face downward pressure and interest rate uncertainties loom, dividend stocks present an appealing option for those looking to balance risk with potential income. A good dividend stock typically offers consistent payouts, financial stability, and resilience during economic fluctuations—qualities that can be particularly valuable in the current market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.53% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Shandong Weigao Group Medical Polymer (SEHK:1066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Weigao Group Medical Polymer Company Limited focuses on the R&D, production, wholesale, and sale of medical devices in China with a market cap of approximately HK$19.56 billion.

Operations: Shandong Weigao Group Medical Polymer Company Limited generates revenue from several segments, including Orthopaedic Products (CN¥1.22 billion), Interventional Products (CN¥1.99 billion), Medical Device Products (CN¥6.74 billion), Blood Management Products (CN¥936.84 million), and Pharma Packaging Products (CN¥2.13 billion).

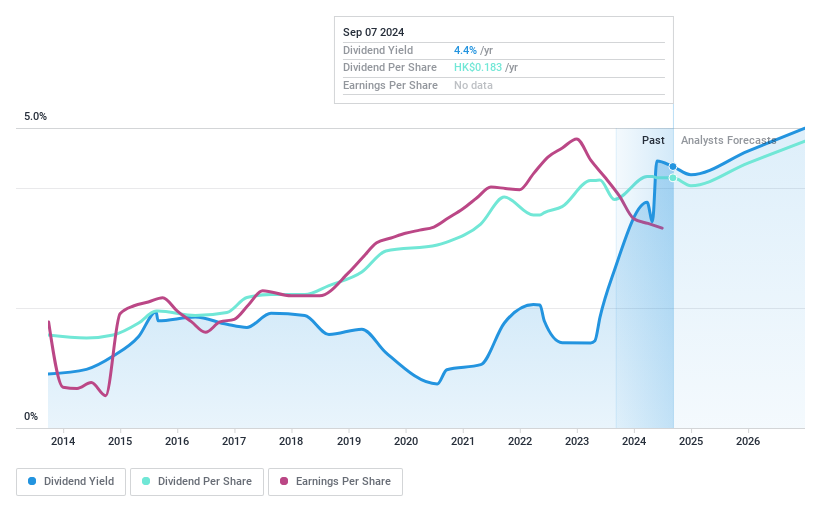

Dividend Yield: 4%

Shandong Weigao Group Medical Polymer's dividend payments are well covered by earnings and cash flows, with payout ratios of 43.9% and 37.5%, respectively. However, the dividend yield of 4.04% is below the top tier in Hong Kong, and its track record has been volatile over the past decade. Recent debt financing from IFC supports expansion plans in South East Asia and capital investments in China, potentially stabilizing future dividends amidst anticipated earnings growth.

- Get an in-depth perspective on Shandong Weigao Group Medical Polymer's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shandong Weigao Group Medical Polymer's current price could be quite moderate.

ZhuZhou QianJin PharmaceuticalLtd (SHSE:600479)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZhuZhou QianJin Pharmaceutical Co., Ltd engages in the research, production, and sale of Chinese patent medicines, chemical medicines, and feminine hygiene products in China with a market cap of CN¥4.33 billion.

Operations: ZhuZhou QianJin Pharmaceutical Co., Ltd's revenue is derived from the sale of Chinese patent medicines, chemical medicines, and feminine hygiene products in China.

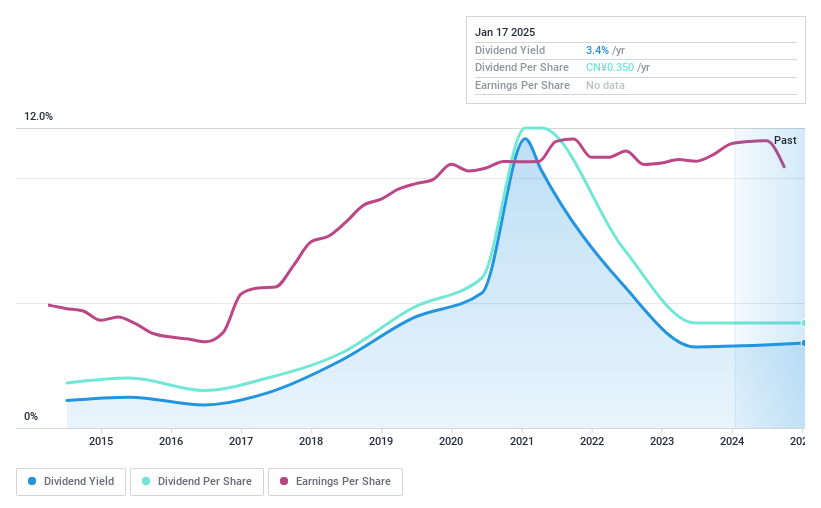

Dividend Yield: 3.4%

ZhuZhou QianJin Pharmaceutical's dividends are covered by earnings and cash flows, with payout ratios of 50.2% and 39.2%, respectively. Despite a top-tier dividend yield of 3.4% in China, the company's dividend history has been unstable over the past decade due to volatility and inconsistent growth. Recent earnings showed a decline in net income to CNY 168.08 million for the nine months ending September 2024, which could impact future payouts.

- Click to explore a detailed breakdown of our findings in ZhuZhou QianJin PharmaceuticalLtd's dividend report.

- Our valuation report here indicates ZhuZhou QianJin PharmaceuticalLtd may be undervalued.

Sanquan Food (SZSE:002216)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanquan Food Co., Ltd. produces and sells frozen food products in China, with a market cap of CN¥9.98 billion.

Operations: Sanquan Food Co., Ltd. generates revenue primarily through the sale of quick-frozen and room temperature food, amounting to CN¥6.77 billion.

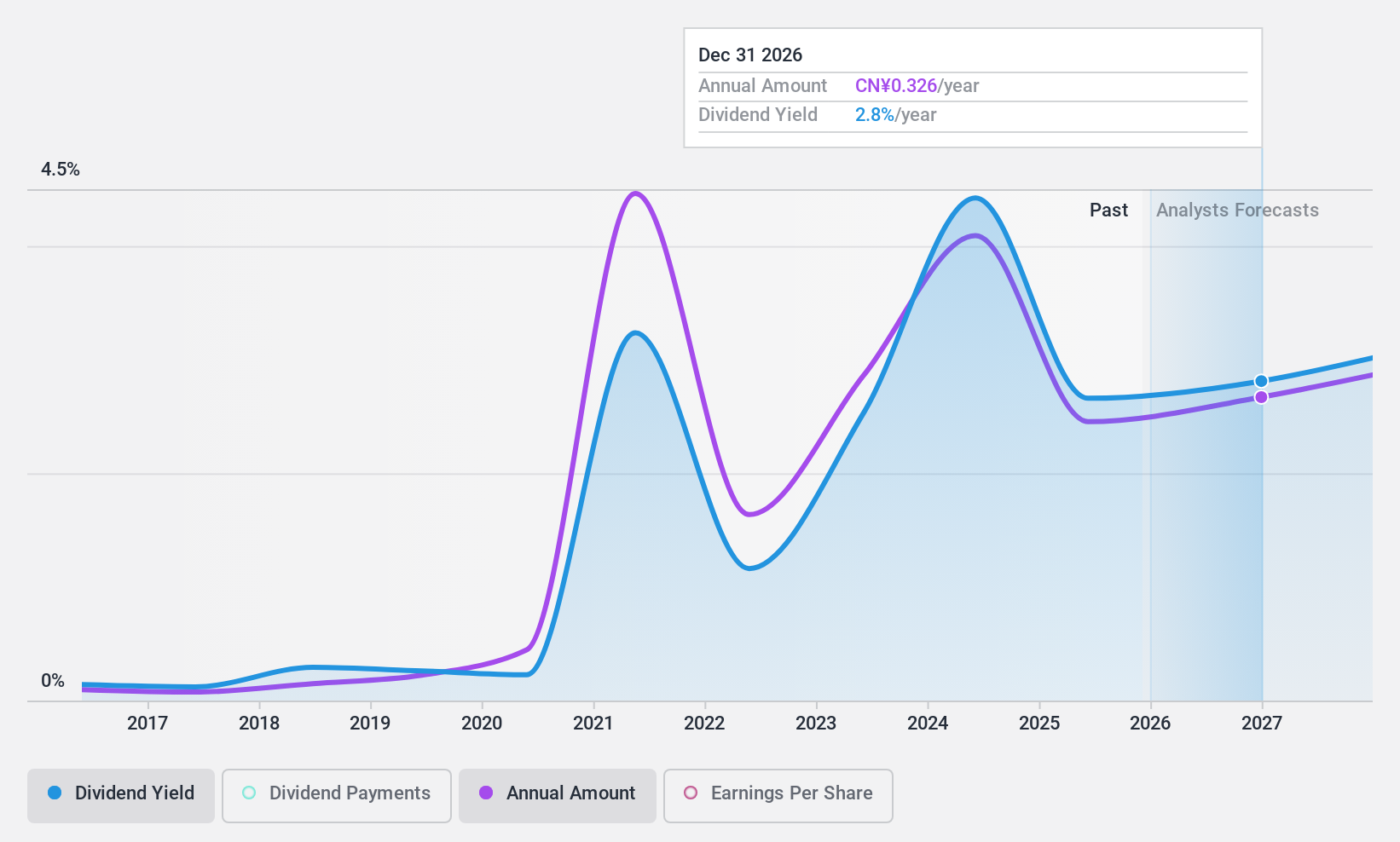

Dividend Yield: 4.4%

Sanquan Food's dividends are supported by earnings and cash flows, with payout ratios of 74.5% and 51.6%, respectively. The dividend yield is notably high at 4.37%, ranking in the top 25% in China, though the dividend history has been volatile over the past decade. Recent earnings for nine months ending September 2024 showed a decline, with net income falling to CNY 394.25 million from CNY 552.26 million a year earlier, potentially impacting future dividends.

- Dive into the specifics of Sanquan Food here with our thorough dividend report.

- Upon reviewing our latest valuation report, Sanquan Food's share price might be too pessimistic.

Seize The Opportunity

- Navigate through the entire inventory of 1994 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZhuZhou QianJin PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600479

ZhuZhou QianJin PharmaceuticalLtd

Researches, produces, and sells Chinese patent medicines, chemical medicines, and feminine hygiene products in China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives