Suzhou Shijia Science & Technology Inc. (SZSE:002796) Shares May Have Slumped 30% But Getting In Cheap Is Still Unlikely

Suzhou Shijia Science & Technology Inc. (SZSE:002796) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

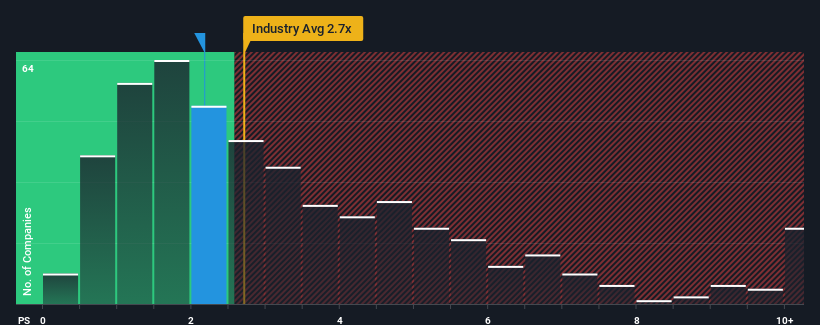

Even after such a large drop in price, it's still not a stretch to say that Suzhou Shijia Science & Technology's price-to-sales (or "P/S") ratio of 2.2x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 2.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Suzhou Shijia Science & Technology

How Suzhou Shijia Science & Technology Has Been Performing

As an illustration, revenue has deteriorated at Suzhou Shijia Science & Technology over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Suzhou Shijia Science & Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Suzhou Shijia Science & Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Suzhou Shijia Science & Technology would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 6.9% decrease to the company's top line. As a result, revenue from three years ago have also fallen 41% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 27% shows it's an unpleasant look.

With this in mind, we find it worrying that Suzhou Shijia Science & Technology's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Following Suzhou Shijia Science & Technology's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Suzhou Shijia Science & Technology currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

You should always think about risks. Case in point, we've spotted 3 warning signs for Suzhou Shijia Science & Technology you should be aware of.

If you're unsure about the strength of Suzhou Shijia Science & Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002796

Suzhou Shijia Science & Technology

Manufactures and sells elevator system products and precision metal plate systems in China and internationally.

Adequate balance sheet with questionable track record.