- Hong Kong

- /

- Entertainment

- /

- SEHK:136

3 Promising Penny Stocks With Market Caps Under US$4B

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, the S&P 500 Index has advanced, supported by sectors like utilities and real estate, while small-cap indices such as the Russell 2000 have shown strong performance. In this context, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or newer companies. These stocks can offer growth potential at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.07B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £433.13M | ★★★★☆☆ |

Click here to see the full list of 5,781 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Ruyi Holdings (SEHK:136)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across the People's Republic of China, Hong Kong, Europe, and internationally, with a market cap of HK$24.88 billion.

Operations: The company's revenue primarily comes from its content production business, generating CN¥1.63 billion, and its online streaming and gaming operations, which contribute CN¥3.01 billion.

Market Cap: HK$24.88B

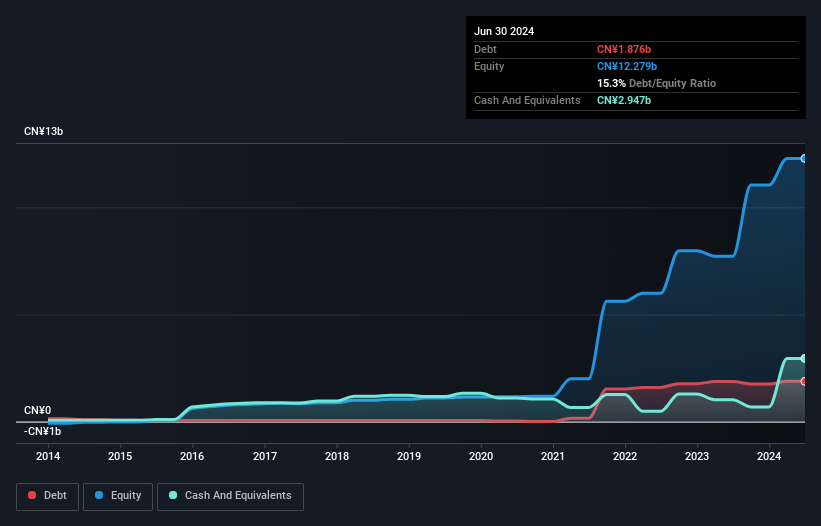

China Ruyi Holdings Limited, with a market cap of HK$24.88 billion, recently reported half-year sales of CN¥1.84 billion, reflecting significant growth from CN¥804.06 million a year ago, while reducing its net loss to CN¥114.65 million from CN¥262.25 million. Despite this improvement, the company experienced shareholder dilution and lower profit margins compared to last year due to large one-off losses impacting earnings quality. However, it maintains strong liquidity with short-term assets exceeding liabilities and more cash than total debt, suggesting financial stability amidst its rapid earnings growth surpassing industry averages over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of China Ruyi Holdings.

- Understand China Ruyi Holdings' earnings outlook by examining our growth report.

Zhejiang Hengtong HoldingLtd (SHSE:600226)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Hengtong Holding Co., Ltd. engages in the research, development, production, and sale of biological pesticides, veterinary drugs, and animal feed additives both in China and internationally, with a market cap of CN¥6.72 billion.

Operations: No specific revenue segments are reported for Zhejiang Hengtong Holding Co., Ltd.

Market Cap: CN¥6.72B

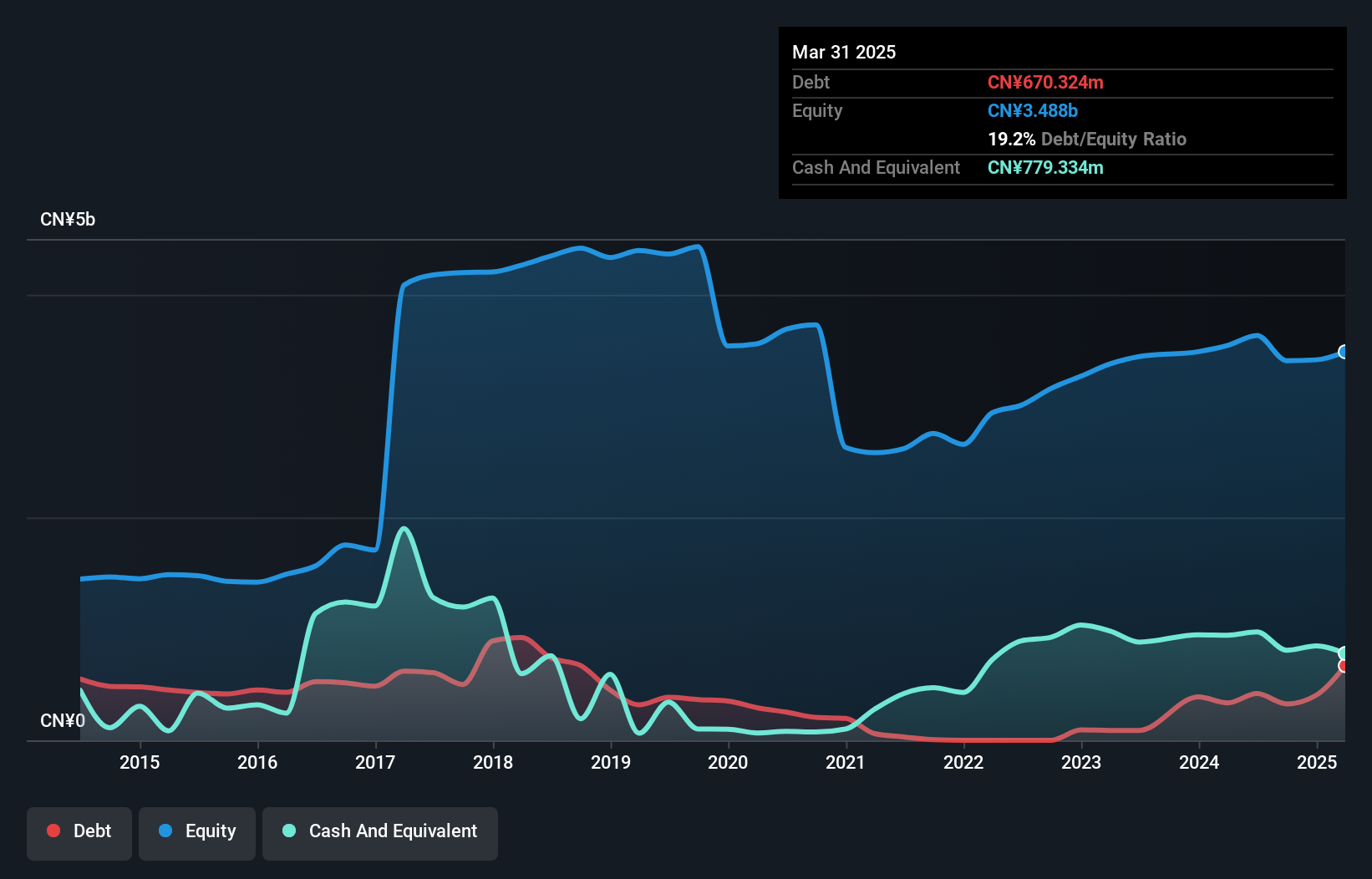

Zhejiang Hengtong Holding Co., Ltd., with a market cap of CN¥6.72 billion, reported half-year revenue growth to CN¥561.18 million from CN¥281.26 million year-over-year, indicating robust sales expansion. However, profit margins have declined to 18.6% from 34.1%, and the company faces challenges with negative operating cash flow impacting debt coverage despite having more cash than total debt and sufficient short-term assets to cover liabilities. While earnings per share remained stable at CNY 0.04, the board's inexperience and increased debt-to-equity ratio suggest areas needing attention for sustained growth potential in this volatile segment.

- Get an in-depth perspective on Zhejiang Hengtong HoldingLtd's performance by reading our balance sheet health report here.

- Understand Zhejiang Hengtong HoldingLtd's track record by examining our performance history report.

Beijing LeiKe Defense Technology (SZSE:002413)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing LeiKe Defense Technology Co., Ltd. operates in the defense technology sector and has a market cap of approximately CN¥6.12 billion.

Operations: The company generates revenue primarily from its Computer, Communications and Other Electronic Equipment Manufacturing segment, totaling CN¥1.21 billion.

Market Cap: CN¥6.12B

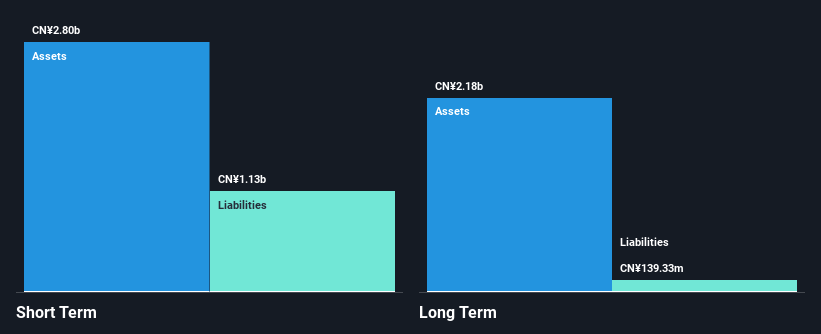

Beijing LeiKe Defense Technology, with a market cap of CN¥6.12 billion, has faced challenges with declining revenue and profitability. For the half year ended June 30, 2024, the company reported a net loss of CN¥66.43 million compared to a net income in the previous year. Despite being unprofitable, it maintains a strong cash position exceeding its debt and sufficient short-term assets to cover liabilities. The company's positive free cash flow provides more than three years of runway if maintained at current levels. However, increasing losses over five years highlight ongoing financial struggles in this volatile sector.

- Navigate through the intricacies of Beijing LeiKe Defense Technology with our comprehensive balance sheet health report here.

- Examine Beijing LeiKe Defense Technology's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Reveal the 5,781 hidden gems among our Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of China, Hong Kong, Europe, and internationally.

Excellent balance sheet with moderate growth potential.