- China

- /

- Hospitality

- /

- SZSE:000796

Undiscovered Gems on None for January 2025

Reviewed by Simply Wall St

As we navigate the early days of 2025, global markets are grappling with mixed signals from economic indicators and geopolitical developments. In the U.S., small-cap stocks have faced particular challenges, underperforming larger counterparts amid inflation concerns and political uncertainty. In this environment, identifying promising investments requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Caissa Tosun DevelopmentLtd (SZSE:000796)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caissa Tosun Development Co., Ltd. operates in the travel and tourism industry both within China and internationally, with a market capitalization of CN¥6.25 billion.

Operations: Caissa Tosun Development Co., Ltd. generates revenue primarily from its travel and tourism operations within China and internationally. It has a market capitalization of CN¥6.25 billion.

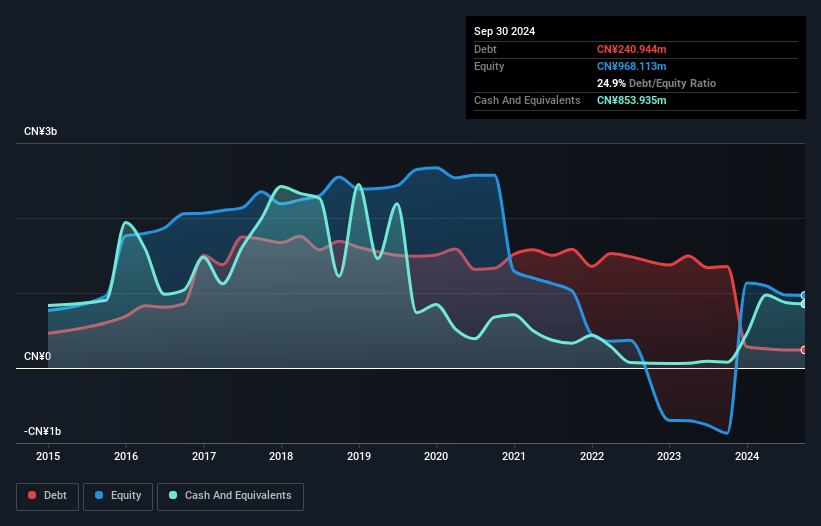

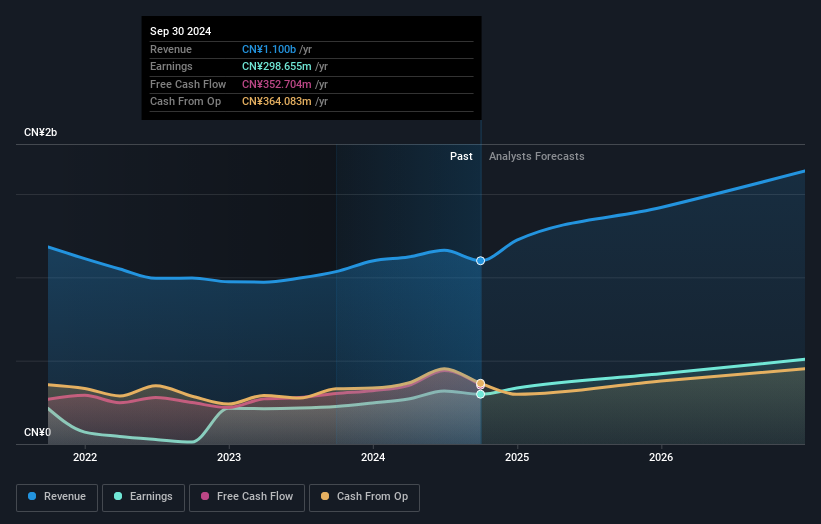

Caissa Tosun Development, a smaller player in its industry, has recently shown signs of improvement. Despite a net loss of CNY 18.16 million for the first nine months of 2024, this is significantly better than the previous year's loss of CNY 235.78 million. Revenue increased to CNY 507.53 million from CNY 483 million, indicating some positive momentum. The company seems to be trading at a good value compared to its peers and industry standards, offering potential upside for investors who can tolerate volatility as its share price has been highly volatile over the past three months.

- Click here to discover the nuances of Caissa Tosun DevelopmentLtd with our detailed analytical health report.

Gain insights into Caissa Tosun DevelopmentLtd's past trends and performance with our Past report.

Ningbo Ligong Environment And Energy TechnologyLtd (SZSE:002322)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Ligong Environment And Energy Technology Co., Ltd specializes in the research, development, production, sale, and service of online monitoring equipment for the electric power industry in China and has a market cap of CN¥4.59 billion.

Operations: Ningbo Ligong primarily generates revenue through the sale of online monitoring equipment for the electric power industry in China. The company's cost structure includes research, development, production, and service expenses associated with these products. Gross profit margin trends can offer insights into its operational efficiency over time.

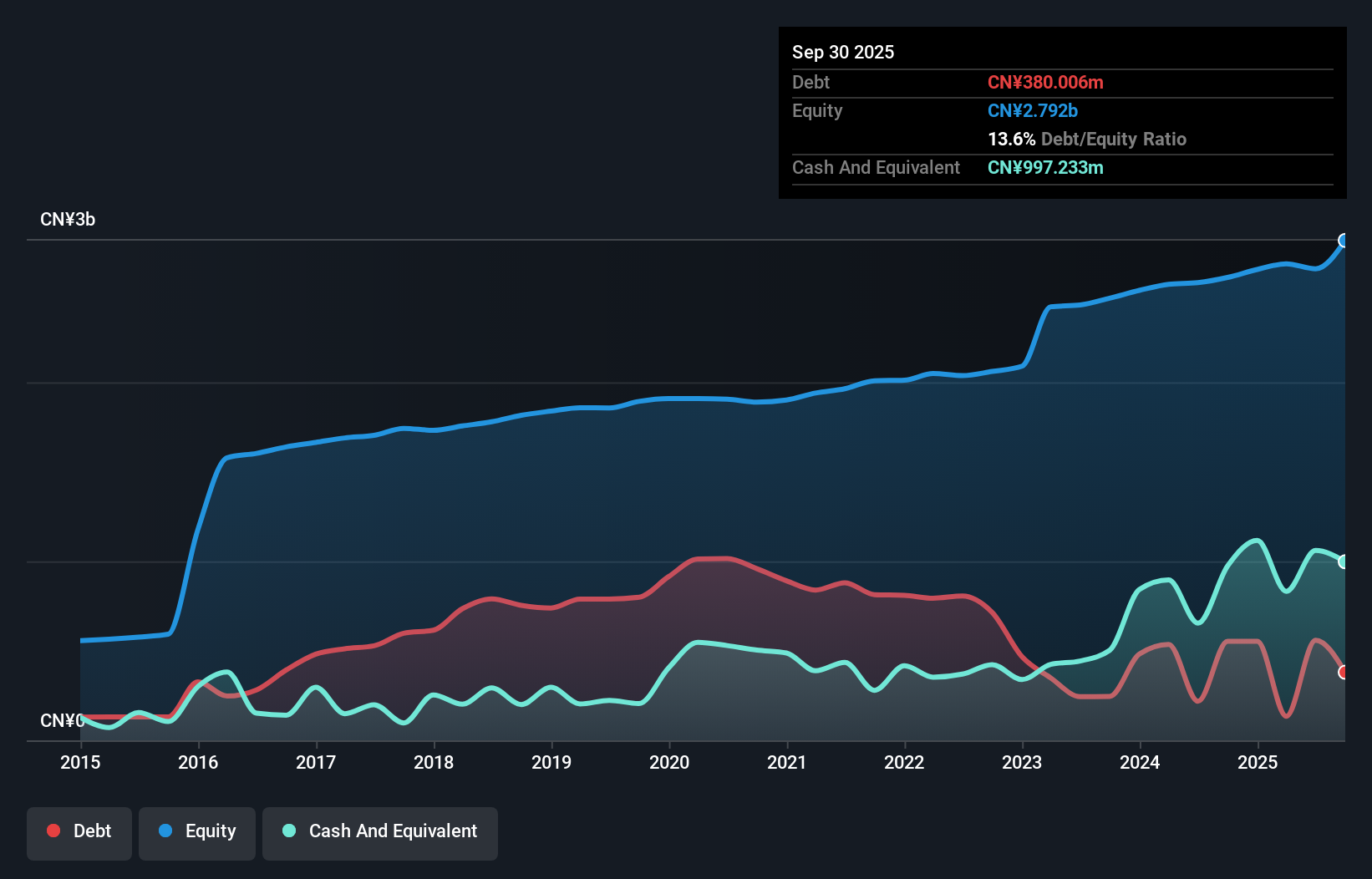

Ningbo Ligong Environment and Energy Technology, a dynamic player in the energy sector, has showcased robust financial health with no debt on its balance sheet, contrasting sharply with a debt to equity ratio of 10.6% five years ago. The company reported CNY 186.57 million in net income for the first nine months of 2024, up from CNY 133.83 million year-on-year, highlighting its impressive earnings growth of 32.8%, far outpacing the electrical industry's average growth rate of just 2.3%. Trading at approximately 34.8% below estimated fair value suggests potential undervaluation relative to peers and industry standards.

Wuchan Zhongda GeronLtd (SZSE:002722)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuchan Zhongda Geron Co., Ltd. engages in the research, development, manufacturing, and sale of textile carders and stainless steel decorative plates in China with a market capitalization of CN¥3.04 billion.

Operations: The company's revenue is primarily derived from its industrial segment, amounting to CN¥2.71 billion. It focuses on the production and sale of textile carders and stainless steel decorative plates.

Wuchan Zhongda Geron Ltd. showcases a promising profile with its price-to-earnings ratio of 20.3x, which is notably below the CN market average of 33.4x, suggesting potential value for investors. Over the last five years, the company has effectively managed its debt, reducing its debt-to-equity ratio from 42.2% to 21.4%, indicating prudent financial management. Earnings have grown by a robust 26% over the past year, outperforming industry standards and demonstrating high-quality earnings with strong interest coverage at 27.8x EBIT to interest payments ratio. Recent results show an increase in net income to CNY113 million from CNY89 million year-over-year despite slightly lower sales figures at CNY1,953 million compared to CNY2,028 million previously reported.

Key Takeaways

- Embark on your investment journey to our 4617 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000796

Caissa Tosun DevelopmentLtd

Engages in travel and tourism related businesses in China and internationally.

Undervalued with excellent balance sheet.