Global markets have experienced a turbulent start to 2025, with U.S. equities facing pressure from inflation concerns and political uncertainty, while European indices showed resilience amid expectations of interest rate cuts. In such a fluctuating market landscape, investors often seek opportunities in smaller or newer companies that might offer growth potential at more accessible price points. Penny stocks, despite their somewhat dated name, continue to represent an intriguing investment area for those willing to explore beyond traditional large-cap securities. This article will explore several penny stocks that exhibit robust financial strength and could potentially offer value in the current economic climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bangkok Land (SET:BLAND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bangkok Land Public Company Limited operates in real estate development, exhibition and convention services, food and beverage, education, and hotel investments in Thailand with a market cap of THB9.89 billion.

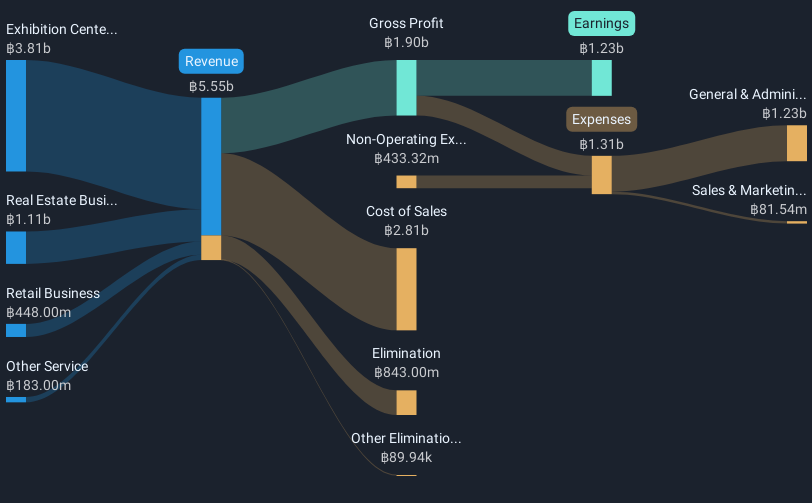

Operations: The company's revenue is primarily derived from its Exhibition Center Business (THB3.81 billion), followed by the Real Estate Business (THB1.11 billion), Retail Business (THB448 million), and Other Service segment (THB183 million).

Market Cap: THB9.89B

Bangkok Land has shown significant earnings growth, with a remarkable 89.5% increase over the past year, surpassing its five-year average and outperforming the real estate industry's negative trend. The company's revenue is primarily driven by its Exhibition Center Business, contributing THB3.81 billion. Despite a low return on equity of 3.1%, Bangkok Land's debt management appears sound, with operating cash flow covering 34.1% of debt and interest payments well-covered by EBIT at 7.1 times coverage. Recent earnings reports highlight improved financial performance with net income turning positive compared to losses in previous periods, though impacted by large one-off gains.

- Take a closer look at Bangkok Land's potential here in our financial health report.

- Understand Bangkok Land's track record by examining our performance history report.

MYS Group (SZSE:002303)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. is engaged in the development, production, and sale of packaging products both in China and internationally, with a market cap of CN¥5.07 billion.

Operations: MYS Group Co., Ltd. does not have specific revenue segments reported.

Market Cap: CN¥5.07B

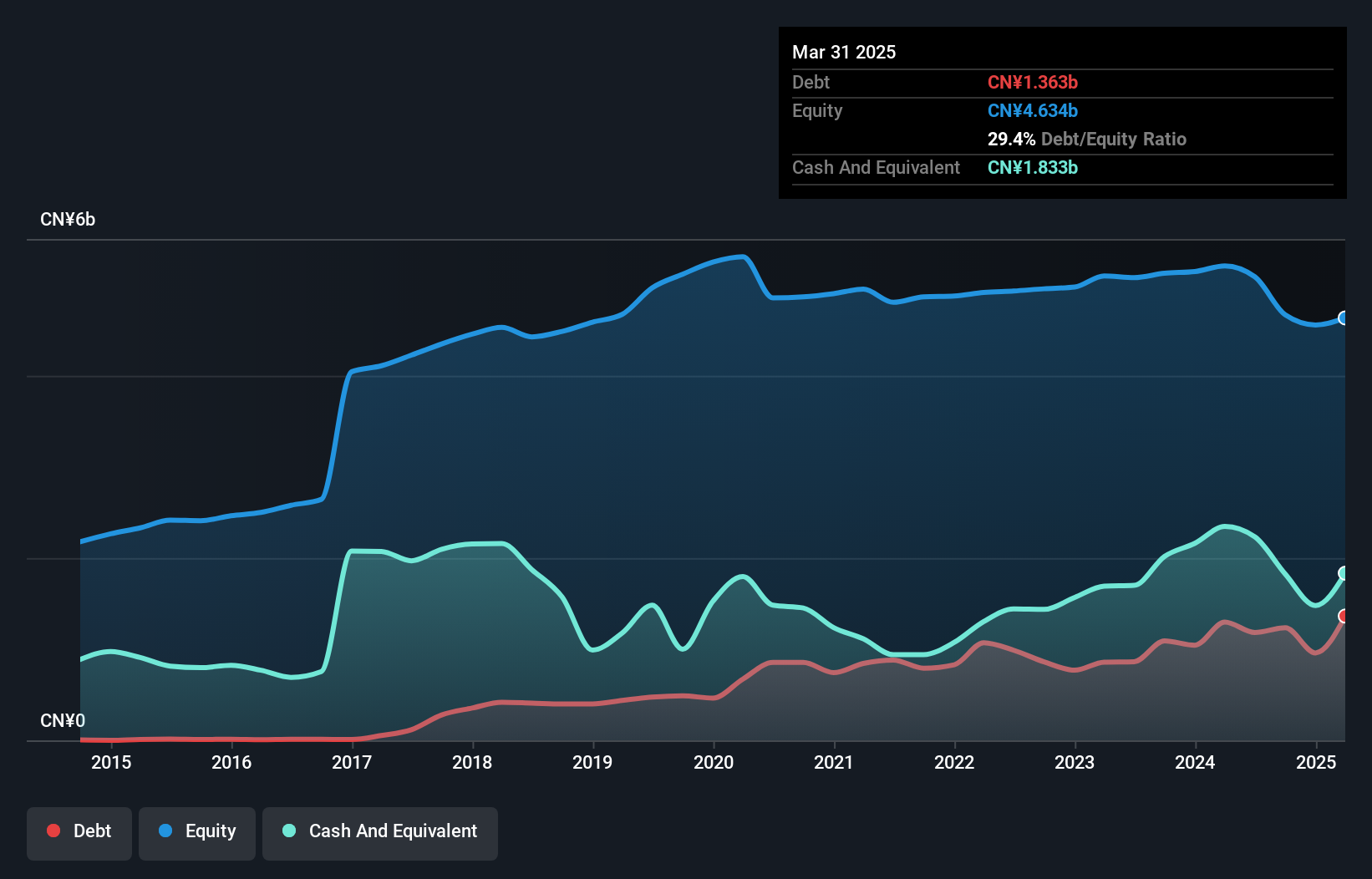

MYS Group Co., Ltd. has demonstrated a robust financial position with short-term assets of CN¥3.6 billion exceeding both its short-term and long-term liabilities, indicating strong liquidity management. The company reported earnings growth of 36% over the past year, surpassing its five-year average decline, which suggests a positive turnaround in profitability. Despite this growth, the company's return on equity remains low at 5.5%, and its dividend yield of 14.5% is not well covered by free cash flows, raising sustainability concerns. Recent events include a completed acquisition of a 10% stake valued at approximately CN¥420 million by several investors in December 2024, reflecting investor interest and confidence in MYS Group's potential amidst ongoing challenges in maintaining dividend coverage and improving return metrics.

- Unlock comprehensive insights into our analysis of MYS Group stock in this financial health report.

- Examine MYS Group's past performance report to understand how it has performed in prior years.

Guangzhou Devotion Thermal Technology (SZSE:300335)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangzhou Devotion Thermal Technology Co., Ltd. (SZSE:300335) operates in the thermal technology sector and has a market cap of approximately CN¥2.28 billion.

Operations: Guangzhou Devotion Thermal Technology Co., Ltd. has not reported any revenue segments.

Market Cap: CN¥2.28B

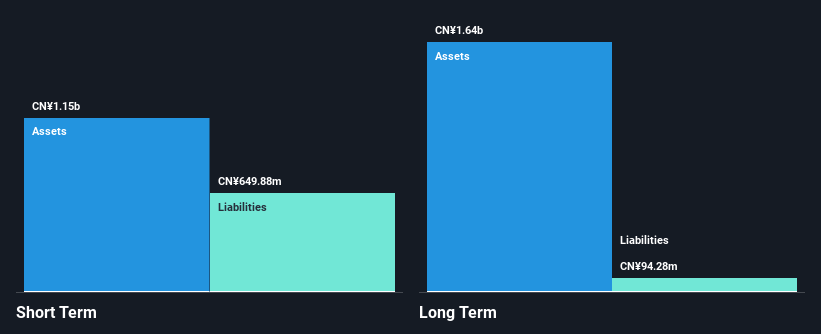

Guangzhou Devotion Thermal Technology shows a mixed financial profile with short-term assets of CN¥1.1 billion comfortably covering both short and long-term liabilities, highlighting solid liquidity. However, the company faces challenges with declining earnings growth over the past year and a low return on equity of 4.5%. Despite maintaining stable basic earnings per share, profit margins have decreased from 9.9% to 4.9%, indicating profitability pressures. The company's debt management is strong, supported by high-quality earnings and effective interest coverage, though dividend sustainability remains questionable due to insufficient coverage by earnings.

- Jump into the full analysis health report here for a deeper understanding of Guangzhou Devotion Thermal Technology.

- Gain insights into Guangzhou Devotion Thermal Technology's past trends and performance with our report on the company's historical track record.

Next Steps

- Click through to start exploring the rest of the 5,713 Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002303

MYS Group

Develops, produces, and sells packaging products in China and internationally.

Excellent balance sheet, good value and pays a dividend.