- China

- /

- Auto Components

- /

- SHSE:603048

Undiscovered Gems Three Promising Stocks For January 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing how these dynamics might impact potential opportunities in overlooked segments. In this environment, identifying promising stocks involves seeking companies that demonstrate resilience and adaptability amidst economic uncertainty, offering potential value even when broader market sentiment is cautious.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

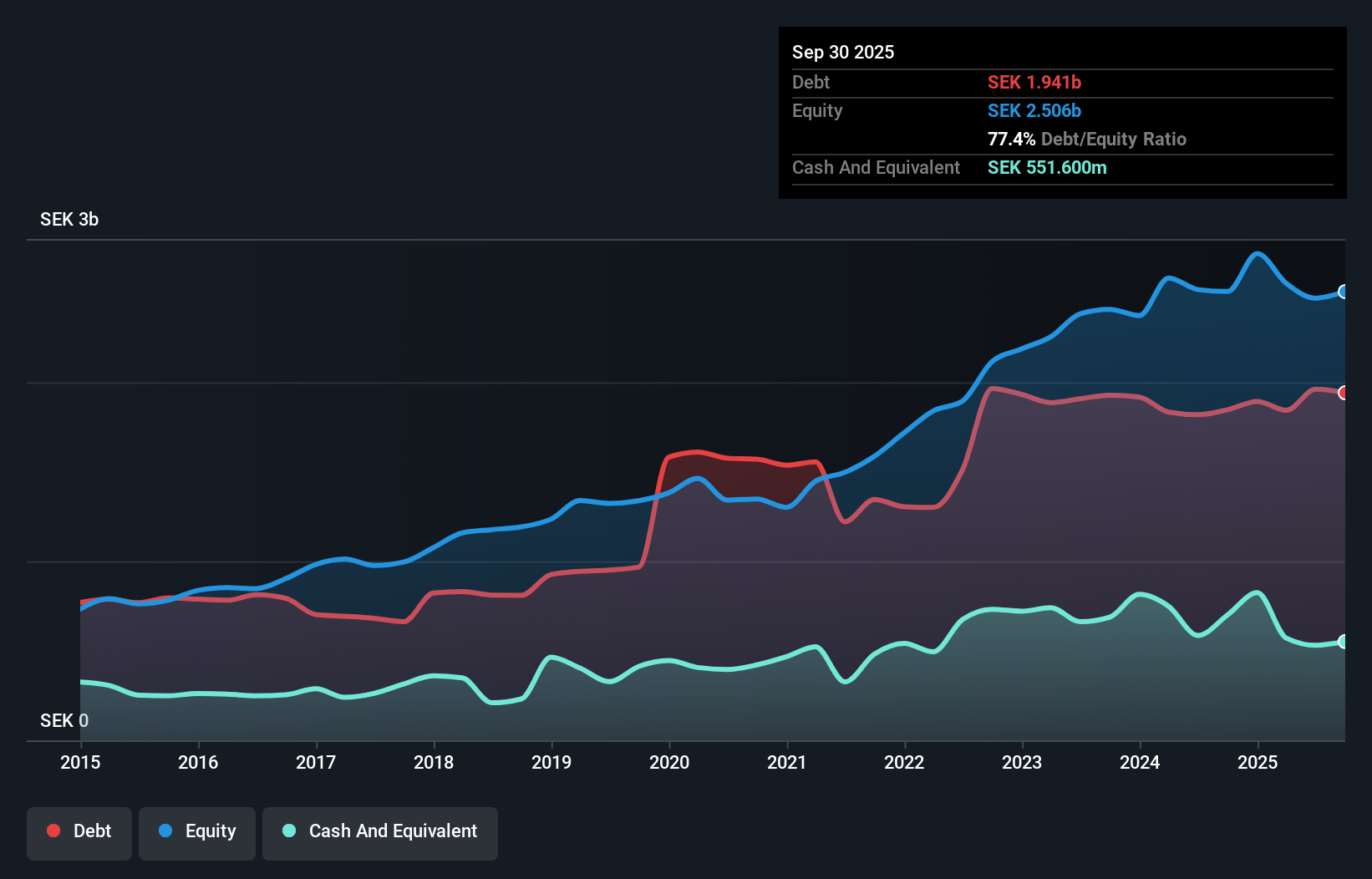

Nederman Holding (OM:NMAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nederman Holding AB (publ) is an environmental technology company that operates globally across the Americas, Asia Pacific, Europe, the Middle East, and Asia with a market capitalization of approximately SEK7.50 billion.

Operations: Nederman Holding generates revenue through its four primary segments: Process Technology (SEK1.64 billion), Duct & Filter Technology (SEK864.50 million), Monitoring & Control Technology (SEK784.40 million), and Extraction & Filtration Technology (SEK2.61 billion).

Nederman Holding, a company with a smaller market capitalization, is trading at 24.7% below its estimated fair value, offering potential upside for investors. Despite having high-quality earnings and positive free cash flow, the firm's net debt to equity ratio stands at a concerning 45.7%, indicating significant leverage. Over the past year, Nederman's earnings growth was negative at -5.5%, yet it still outperformed the building industry average of -17.5%. Recent financial results show sales of SEK 1,415 million in Q3 2024 compared to SEK 1,574 million last year and net income of SEK 70 million down from SEK 85 million previously.

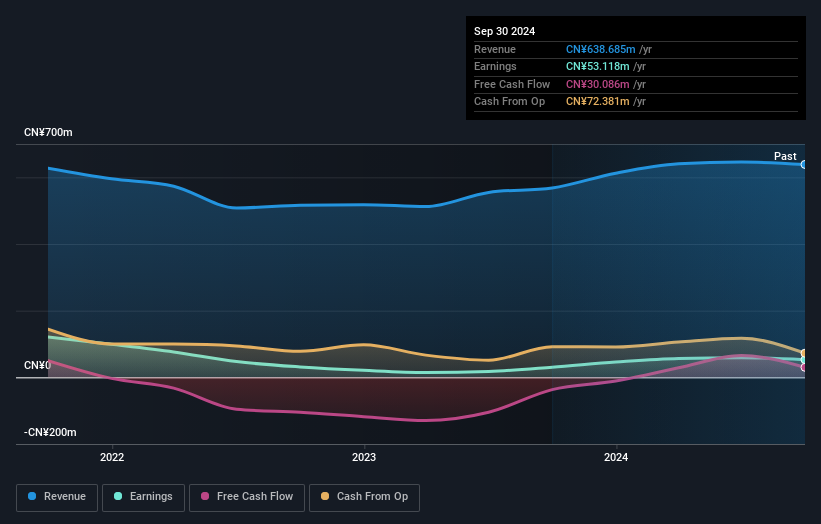

Zhejiang Liming Intelligent ManufacturingLtd (SHSE:603048)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Liming Intelligent Manufacturing Co., Ltd. is a company engaged in the production and sale of automotive components, with a market capitalization of approximately CN¥2.27 billion.

Operations: The company's primary revenue stream is from the sale of car parts, generating approximately CN¥638.68 million.

Zhejiang Liming Intelligent Manufacturing, a smaller player in the auto components sector, has shown impressive earnings growth of 75.2% over the past year, outpacing the industry average of 10.5%. Despite this recent surge, their earnings have decreased by 34.8% annually over five years. The company reported sales of CN¥455 million and net income of CN¥36.78 million for nine months ending September 2024, reflecting a stable performance compared to last year’s figures. A one-off gain of CN¥13.7 million impacted recent results, highlighting potential volatility but also opportunities for future growth within its niche market space.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Liming Intelligent ManufacturingLtd.

Understand Zhejiang Liming Intelligent ManufacturingLtd's track record by examining our Past report.

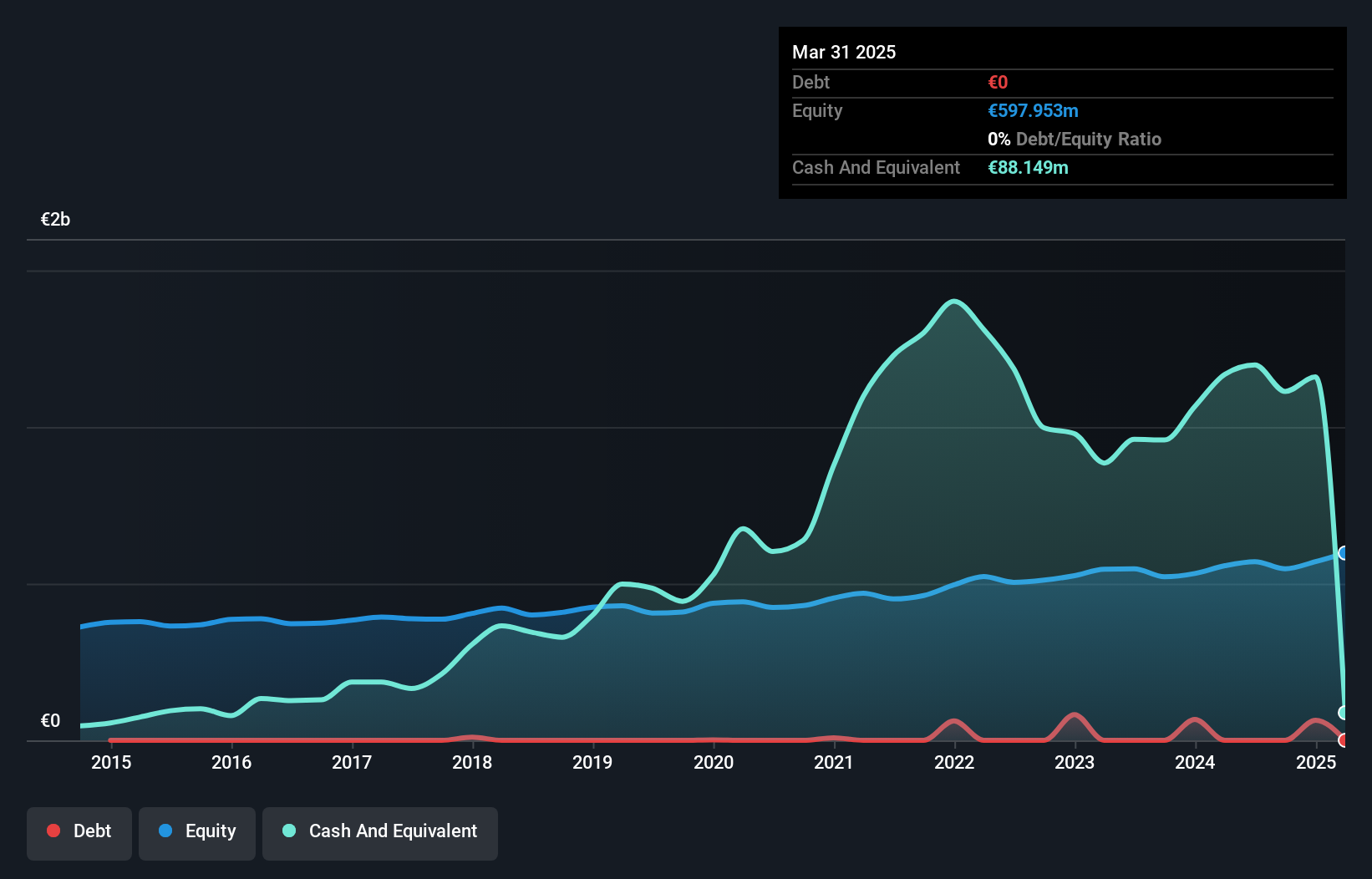

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €696.23 million, operates through its subsidiaries to offer financial services to private, corporate, and institutional clients in Germany.

Operations: MLP SE generates revenue primarily from Financial Consulting (€436.56 million), FERI (€253.38 million), and Banking (€216.22 million) segments, with additional contributions from DOMCURA and Deutschland.Immobilien. The company's net profit margin shows a notable trend, reflecting its ability to manage costs effectively across these diverse revenue streams.

MLP's recent performance highlights its potential as a promising investment. Over the past year, earnings surged by 30%, outpacing the Capital Markets industry growth of 12%. The company is debt-free, which eliminates concerns over interest payments and strengthens its financial position. MLP's earnings for Q3 2024 were impressive, with net income reaching €10.29 million compared to €6.59 million in the previous year, while revenue climbed to €249.03 million from €209.67 million a year ago. Trading at nearly 44% below estimated fair value suggests room for appreciation if current trends continue favorably for MLP.

- Click here to discover the nuances of MLP with our detailed analytical health report.

Assess MLP's past performance with our detailed historical performance reports.

Next Steps

- Navigate through the entire inventory of 4618 Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Liming Intelligent ManufacturingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603048

Zhejiang Liming Intelligent ManufacturingLtd

Zhejiang Liming Intelligent Manufacturing Co.,Ltd.

Excellent balance sheet with acceptable track record.