Global markets have been experiencing volatility, with U.S. equities declining due to inflation concerns and political uncertainties, while small-cap stocks underperformed their larger counterparts. Amidst these fluctuations, investors often turn their attention to penny stocks, a term that may seem outdated but still signifies smaller or newer companies with potential for growth. By focusing on those with solid financials and clear growth paths, investors can uncover opportunities within this investment area.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Pera Yatirim Holding Anonim Sirketi (IBSE:PEHOL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pera Yatirim Holding Anonim Sirketi operates as a publicly owned real estate investment trust, with a market capitalization of TRY4.34 billion.

Operations: The company generates revenue of TRY22.53 million from creating and developing a real estate portfolio.

Market Cap: TRY4.34B

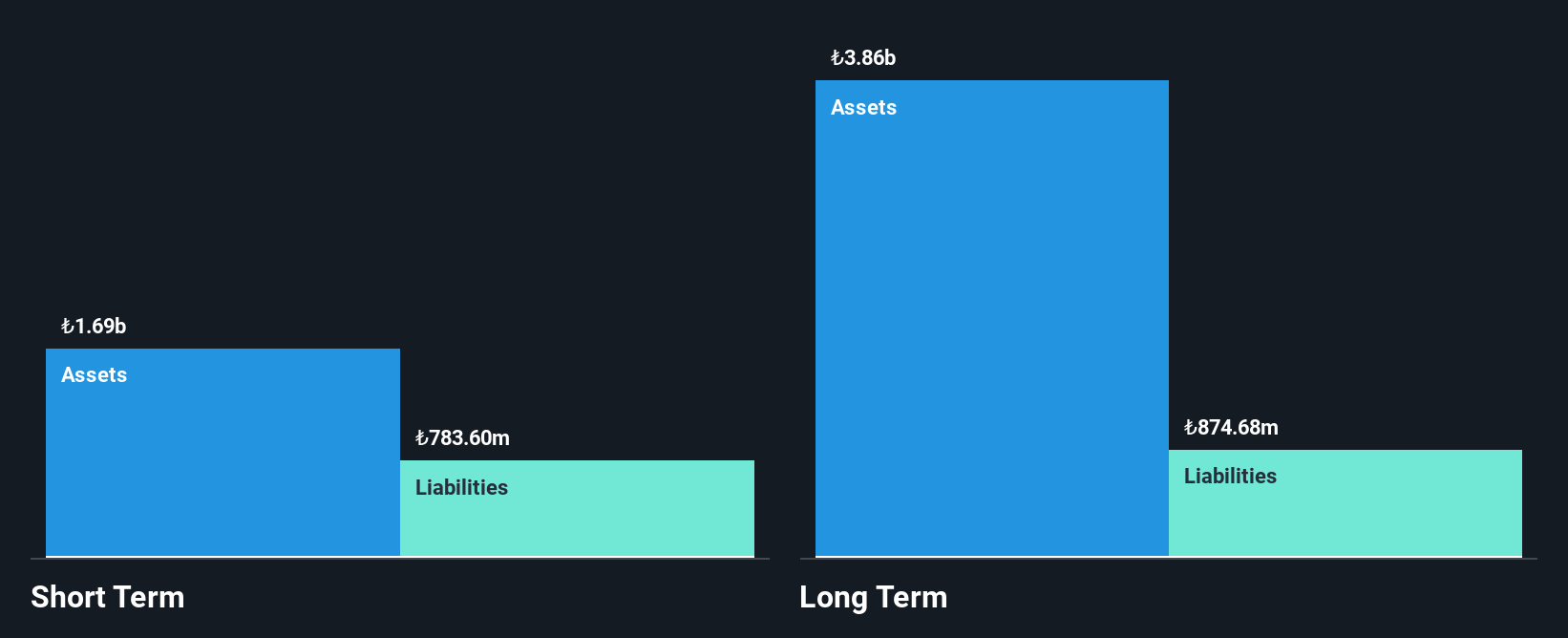

Pera Yatirim Holding Anonim Sirketi, a real estate investment trust with a market cap of TRY4.34 billion, has experienced significant volatility in its share price recently. The company reported third-quarter sales of TRY5.85 million, down from TRY10.14 million the previous year, though net income rose sharply due to large one-off gains impacting results. Despite being debt-free and trading below estimated fair value, Pera Yatirim faces challenges with negative earnings growth over the past year and insufficient short-term assets to cover liabilities. Additionally, it generates less than US$1 million in revenue annually (TRY23M).

- Navigate through the intricacies of Pera Yatirim Holding Anonim Sirketi with our comprehensive balance sheet health report here.

- Understand Pera Yatirim Holding Anonim Sirketi's track record by examining our performance history report.

Xi'an Typical IndustriesLtd (SHSE:600302)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xi'an Typical Industries Co., Ltd focuses on the research, development, production, and sale of industrial sewing machines and has a market cap of CN¥1.66 billion.

Operations: Xi'an Typical Industries Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.66B

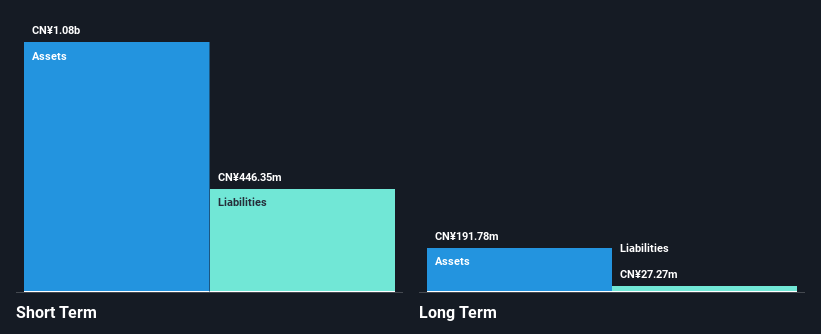

Xi'an Typical Industries Co., Ltd, with a market cap of CN¥1.66 billion, has reported sales of CN¥344.53 million for the nine months ended September 30, 2024, down from CN¥398.81 million the previous year. Despite being unprofitable with a net loss of CN¥47.69 million, it has more cash than total debt and sufficient cash runway for over three years if free cash flow continues to grow at historical rates. The company's experienced management team and board provide stability amidst challenges such as increased debt-to-equity ratio and declining earnings over the past five years at an annual rate of 26.5%.

- Take a closer look at Xi'an Typical IndustriesLtd's potential here in our financial health report.

- Evaluate Xi'an Typical IndustriesLtd's historical performance by accessing our past performance report.

Sichuan Hebang Biotechnology (SHSE:603077)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Hebang Biotechnology Corporation Limited operates in the agricultural, chemical, and new material sectors with a market cap of CN¥15.65 billion.

Operations: No specific revenue segments have been reported for Sichuan Hebang Biotechnology Corporation Limited.

Market Cap: CN¥15.65B

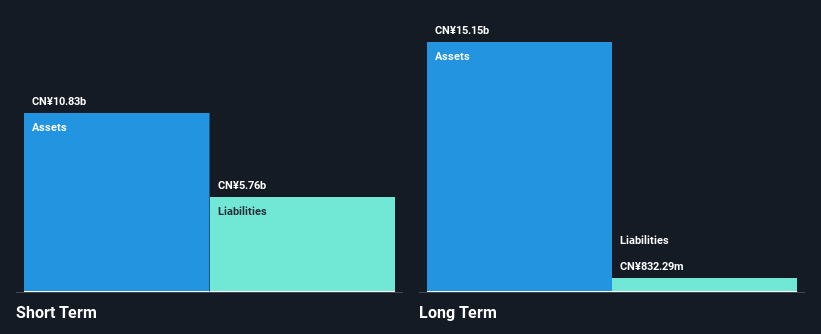

Sichuan Hebang Biotechnology, with a market cap of CN¥15.65 billion, has faced challenges in recent earnings performance, reporting a significant decline in net income to CN¥221.32 million for the first nine months of 2024 from CN¥1,019.04 million the previous year. Despite this downturn and negative earnings growth over the past year, its short-term assets comfortably cover both short and long-term liabilities. The company has initiated a share buyback program worth up to CNY 200 million to maintain shareholder value amidst fluctuating profit margins and low return on equity at 2.4%.

- Click to explore a detailed breakdown of our findings in Sichuan Hebang Biotechnology's financial health report.

- Gain insights into Sichuan Hebang Biotechnology's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Investigate our full lineup of 5,716 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603077

Sichuan Hebang Biotechnology

Provides agricultural, chemical, and new material products.

Adequate balance sheet second-rate dividend payer.