Asian Growth Companies With High Insider Ownership For March 2025

Reviewed by Simply Wall St

As global markets face uncertainties surrounding trade policies and inflation concerns, Asian economies are navigating these challenges with a mix of cautious optimism and strategic growth initiatives. In this environment, companies in Asia that exhibit robust growth potential coupled with high insider ownership can offer unique insights into market resilience and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Samyang Foods (KOSE:A003230) | 11.6% | 30.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Let's review some notable picks from our screened stocks.

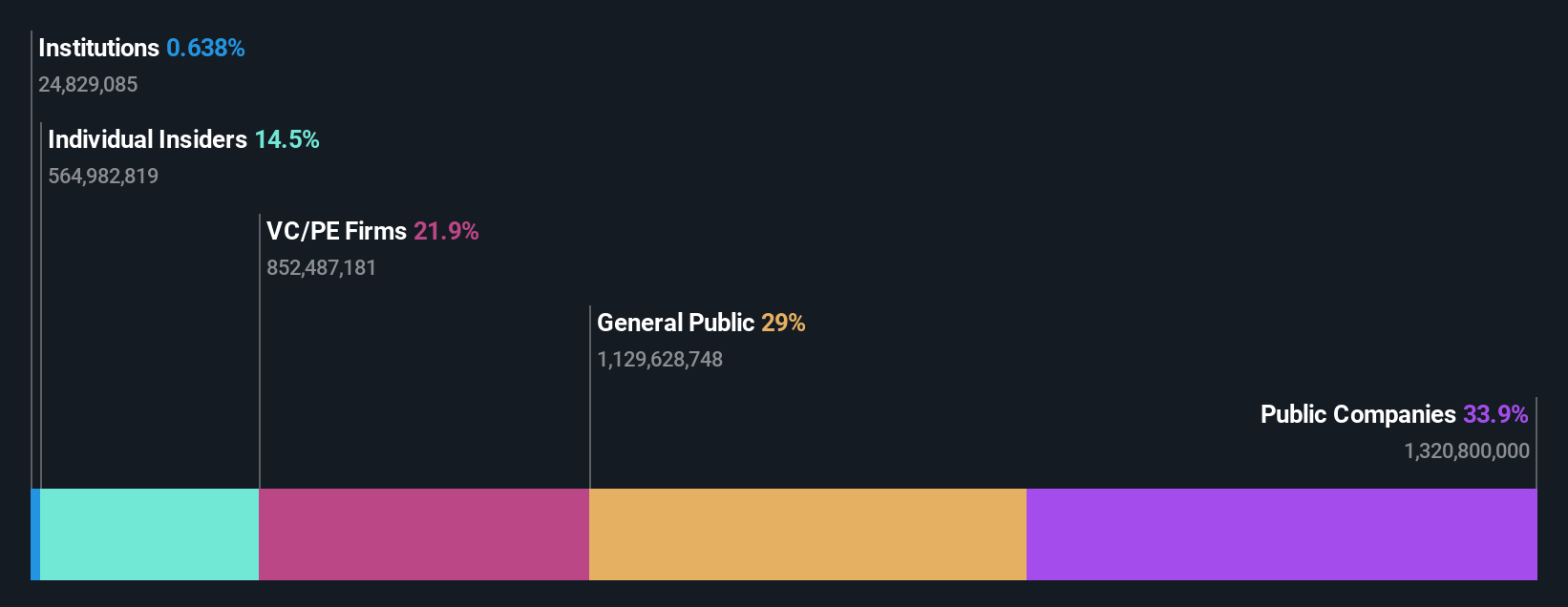

China Youran Dairy Group (SEHK:9858)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Youran Dairy Group Limited is an investment holding company that operates as an integrated provider of products and services in the upstream dairy industry in China, with a market cap of approximately HK$9.65 billion.

Operations: The company's revenue is primarily derived from its Raw Milk Business, generating CN¥14.07 billion, and Comprehensive Ruminant Farming Solutions, contributing CN¥7.65 billion.

Insider Ownership: 14.5%

Earnings Growth Forecast: 98% p.a.

China Youran Dairy Group is forecast to experience significant earnings growth, with a projected annual increase of 98%. Revenue is expected to grow at 8.9% per year, outpacing the Hong Kong market average. Despite its high debt levels and low forecasted return on equity (7.9%), it trades at a good value relative to peers. No substantial insider trading activity has been reported recently, indicating stable insider confidence in the company's prospects.

- Dive into the specifics of China Youran Dairy Group here with our thorough growth forecast report.

- Our valuation report unveils the possibility China Youran Dairy Group's shares may be trading at a discount.

Tianrun Industry Technology (SZSE:002283)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tianrun Industry Technology Co., Ltd. manufactures and sells internal combustion engine crankshafts in China and internationally, with a market cap of CN¥8.63 billion.

Operations: Tianrun Industry Technology generates revenue primarily from the manufacturing and sale of internal combustion engine crankshafts both domestically and internationally.

Insider Ownership: 23.7%

Earnings Growth Forecast: 26.2% p.a.

Tianrun Industry Technology is poised for growth with earnings projected to rise significantly at 26.19% annually, surpassing the Chinese market average. Although its revenue growth of 16.8% per year is slower than some high-growth peers, its price-to-earnings ratio of 24.7x suggests it offers good value relative to the broader market. The company recently announced a share buyback program worth up to ¥50 million, signaling confidence in its future prospects and commitment to shareholder value enhancement.

- Take a closer look at Tianrun Industry Technology's potential here in our earnings growth report.

- According our valuation report, there's an indication that Tianrun Industry Technology's share price might be on the cheaper side.

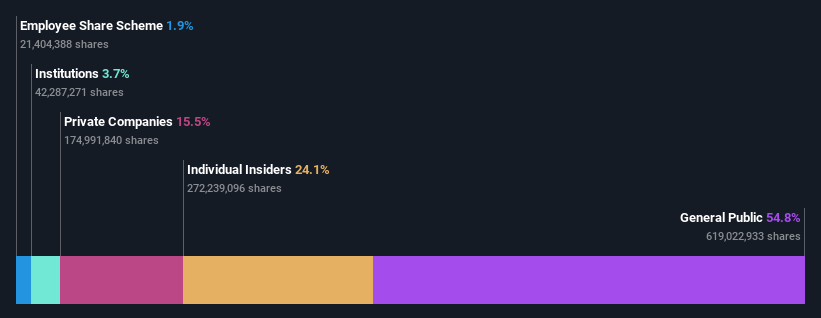

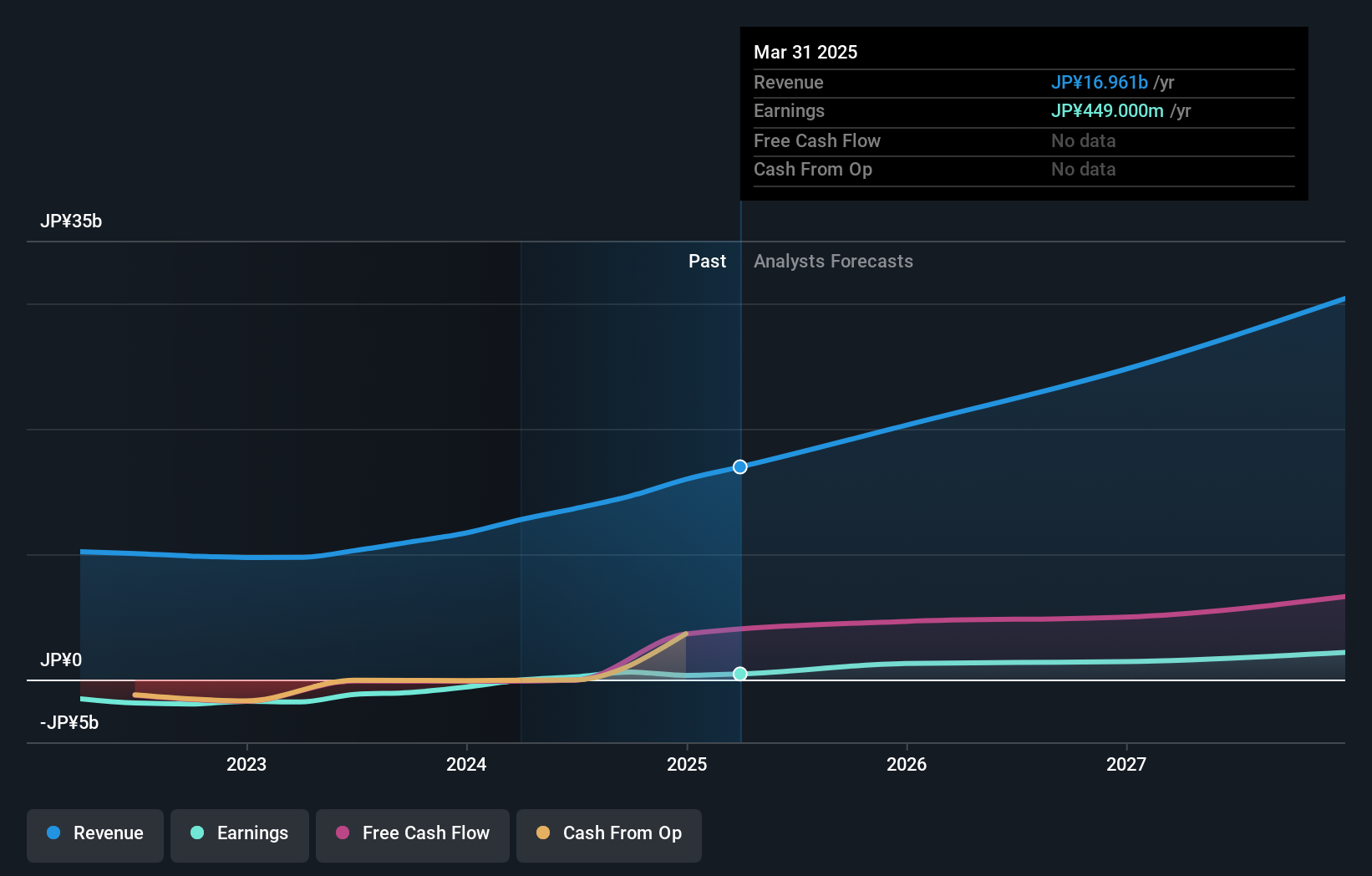

BASEInc (TSE:4477)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BASE, Inc. focuses on planning, developing, and operating web services in Japan with a market cap of ¥59.34 billion.

Operations: The company's revenue is primarily derived from its BASE Business at ¥9.09 billion, followed by the PAY.JP Business at ¥5.73 billion, the YELL BANK Business at ¥902 million, and the Want Jp Business at ¥258 million.

Insider Ownership: 21.3%

Earnings Growth Forecast: 42.9% p.a.

BASE Inc. is positioned for substantial growth, with earnings forecasted to increase significantly at 42.9% annually, outpacing the Japanese market average. Despite a low return on equity forecast of 9.2%, its revenue is expected to grow rapidly at 20.9% per year. The company trades well below its estimated fair value and recently initiated a share buyback program worth ¥1 billion, indicating confidence in enhancing capital efficiency amidst volatile share prices and large one-off items affecting results.

- Get an in-depth perspective on BASEInc's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that BASEInc is priced higher than what may be justified by its financials.

Taking Advantage

- Click here to access our complete index of 640 Fast Growing Asian Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9858

China Youran Dairy Group

An investment holding company, operates as an integrated provider of products and services in the upstream dairy industry in the People's Republic of China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives