- China

- /

- Electrical

- /

- SZSE:002141

Spotlight On Global Penny Stocks For May 2025

Reviewed by Simply Wall St

Global markets have been buoyed by easing trade tensions and better-than-expected earnings, with U.S. stocks climbing and European indices showing robust growth. Amid these positive developments, investors are keenly observing how smaller companies might capitalize on the shifting economic landscape. Although the term 'penny stock' may seem outdated, these low-priced shares of smaller or newer companies can still offer significant opportunities when underpinned by strong financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.41 | SGD166.17M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.84 | SEK287.94M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.895 | MYR1.4B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.35 | MYR1.02B | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.755 | £424.34M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.008 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,651 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AInnovation Technology Group (SEHK:2121)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AInnovation Technology Group Co., Ltd, along with its subsidiaries, focuses on the research, development, and sale of artificial intelligence-based software and hardware technology solutions in China, with a market cap of HK$2.25 billion.

Operations: The company generates revenue from its Artificial Intelligence Service segment, amounting to CN¥1.22 billion.

Market Cap: HK$2.25B

AInnovation Technology Group has demonstrated a focus on artificial intelligence solutions, generating CN¥1.22 billion in revenue from its AI Service segment despite reporting a net loss of CN¥593.81 million for 2024. The company benefits from strong short-term asset coverage over liabilities and more cash than debt, indicating financial stability amidst volatility in share price and unprofitability. Recent strategic cooperation with Bentley Systems aims to leverage AI in engineering software, potentially enhancing growth prospects. However, the stock remains highly volatile and trades significantly below estimated fair value, reflecting market skepticism about near-term profitability improvements.

- Click to explore a detailed breakdown of our findings in AInnovation Technology Group's financial health report.

- Evaluate AInnovation Technology Group's prospects by accessing our earnings growth report.

Bros Eastern.Ltd (SHSE:601339)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bros Eastern., Ltd is involved in the research, development, production, and sale of dyed mélange and color-spun yarns, with a market cap of CN¥7.42 billion.

Operations: There are no reported revenue segments for Bros Eastern., Ltd.

Market Cap: CN¥7.42B

Bros Eastern., Ltd has shown resilience in the dyed mélange and color-spun yarn market with a market cap of CN¥7.42 billion. Despite a slight decline in sales from CN¥1,834.16 million to CN¥1,730.92 million year-over-year for Q1 2025, net income increased significantly to CN¥173.47 million from CN¥80.33 million, indicating improved profitability margins amidst stable weekly volatility and satisfactory debt levels. The company trades at a favorable price-to-earnings ratio compared to the broader Chinese market, suggesting potential undervaluation relative to peers despite challenges such as low return on equity and an unstable dividend track record.

- Click here and access our complete financial health analysis report to understand the dynamics of Bros Eastern.Ltd.

- Learn about Bros Eastern.Ltd's future growth trajectory here.

Infund Holding (SZSE:002141)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Infund Holding Co., Ltd. operates in China, focusing on the production of micro enameled wire and veterinary vaccines, with a market cap of CN¥2.33 billion.

Operations: There are no specific revenue segments reported for Infund Holding Co., Ltd.

Market Cap: CN¥2.33B

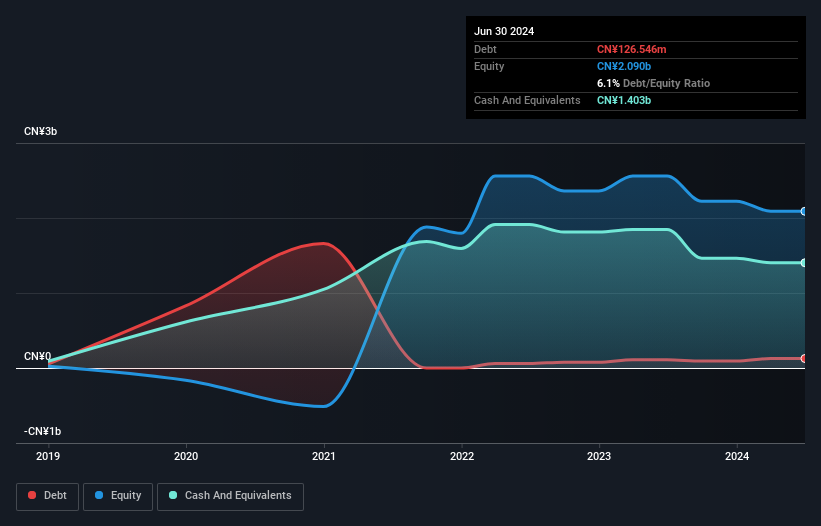

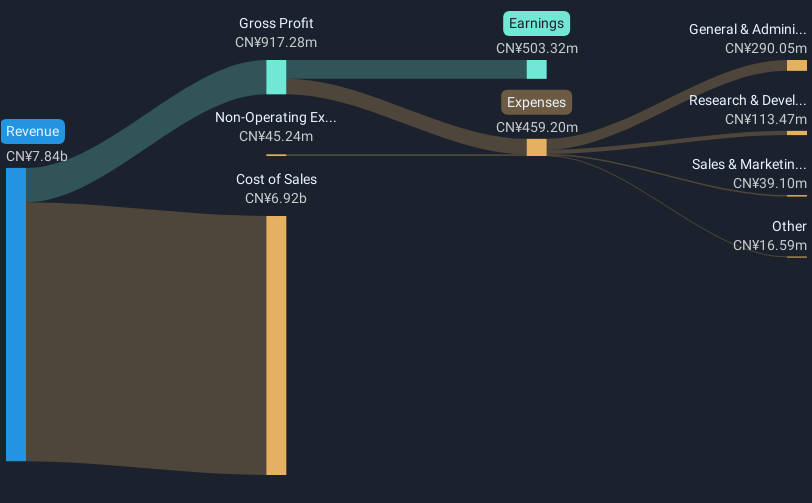

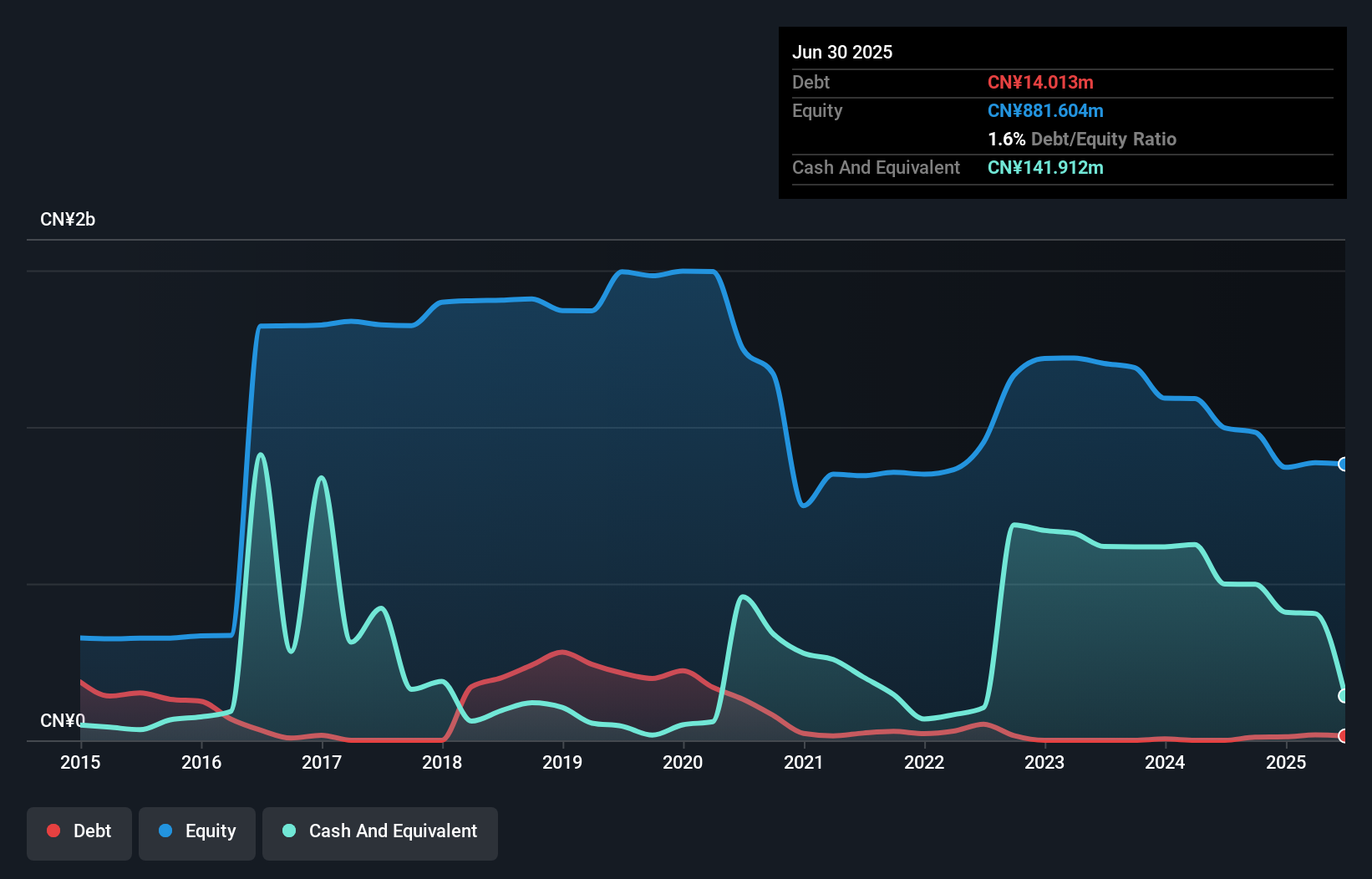

Infund Holding Co., Ltd. has demonstrated significant revenue growth, reporting CN¥294.68 million in Q1 2025 compared to CN¥16.65 million the previous year, alongside a net income of CN¥14.21 million reversing a prior loss. Despite being unprofitable historically, the company has reduced losses over five years and improved its debt position with more cash than total debt and a reduced debt-to-equity ratio from 11.3% to 1.9%. However, challenges remain with less than one year of cash runway and negative return on equity at -12.88%, though short-term assets comfortably cover liabilities.

- Take a closer look at Infund Holding's potential here in our financial health report.

- Evaluate Infund Holding's historical performance by accessing our past performance report.

Where To Now?

- Get an in-depth perspective on all 5,651 Global Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Infund Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002141

Infund Holding

Engages in the micro enameled wire and veterinary vaccine businesses in China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives