Further weakness as Guangzhou Seagull Kitchen and Bath Products (SZSE:002084) drops 15% this week, taking five-year losses to 37%

While not a mind-blowing move, it is good to see that the Guangzhou Seagull Kitchen and Bath Products Co., Ltd. (SZSE:002084) share price has gained 21% in the last three months. But over the last half decade, the stock has not performed well. After all, the share price is down 38% in that time, significantly under-performing the market.

If the past week is anything to go by, investor sentiment for Guangzhou Seagull Kitchen and Bath Products isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Guangzhou Seagull Kitchen and Bath Products

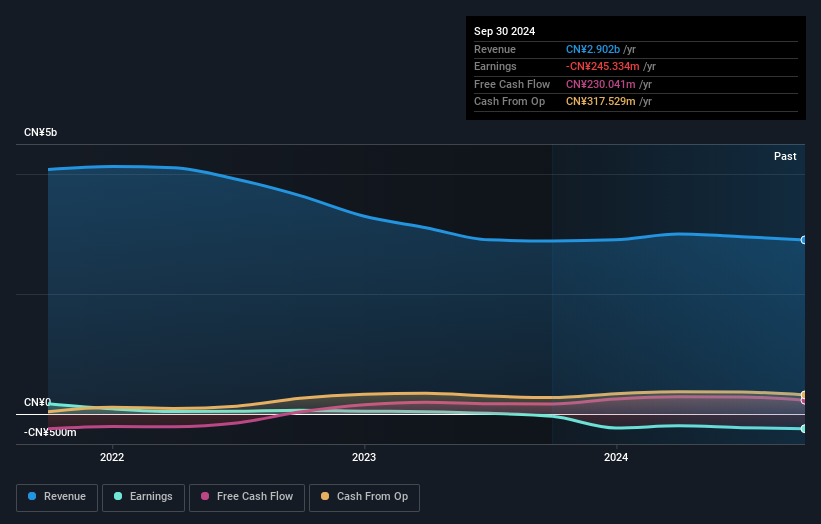

Because Guangzhou Seagull Kitchen and Bath Products made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Guangzhou Seagull Kitchen and Bath Products grew its revenue at 0.7% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 7% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Guangzhou Seagull Kitchen and Bath Products' financial health with this free report on its balance sheet.

A Different Perspective

Guangzhou Seagull Kitchen and Bath Products shareholders are down 19% for the year (even including dividends), but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Guangzhou Seagull Kitchen and Bath Products better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Guangzhou Seagull Kitchen and Bath Products (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

We will like Guangzhou Seagull Kitchen and Bath Products better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002084

Guangzhou Seagull Kitchen and Bath Products

Guangzhou Seagull Kitchen and Bath Products Co., Ltd.

Good value with adequate balance sheet.