- China

- /

- Electronic Equipment and Components

- /

- SHSE:688320

Highlighting Shanghai Baolong Automotive And 2 Other Top Growth Stocks With Insider Ownership

Reviewed by Simply Wall St

In a week marked by cautious sentiment following the Federal Reserve's rate cut and ongoing concerns about political uncertainty, global markets have experienced notable fluctuations, with U.S. stocks declining and European indices facing their biggest losses in months. Amid this backdrop of economic volatility, investors often look for growth companies with high insider ownership as these firms can offer potential resilience due to aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

Let's dive into some prime choices out of the screener.

Shanghai Baolong Automotive (SHSE:603197)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Baolong Automotive Corporation manufactures and sells automotive parts and components, with a market capitalization of CN¥8.02 billion.

Operations: Shanghai Baolong Automotive Corporation's revenue is derived from the manufacturing and sale of automotive parts and components.

Insider Ownership: 32.5%

Revenue Growth Forecast: 23.1% p.a.

Shanghai Baolong Automotive's revenue is forecast to grow at 23.1% annually, outpacing the Chinese market's 13.7%. Earnings are expected to increase by 36.7% per year, surpassing market averages. Despite trading significantly below estimated fair value and having no recent substantial insider trading activity, profit margins have declined from last year. The company's debt coverage by operating cash flow is weak, and earnings quality is impacted by large one-off items.

- Take a closer look at Shanghai Baolong Automotive's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Shanghai Baolong Automotive's current price could be quite moderate.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Hechuan Technology Co., Ltd. specializes in the research and development, manufacturing, sale, and application integration of industrial automation products and has a market cap of CN¥7.38 billion.

Operations: The company's revenue segments include the research and development, manufacturing, sale, and application integration of industrial automation products.

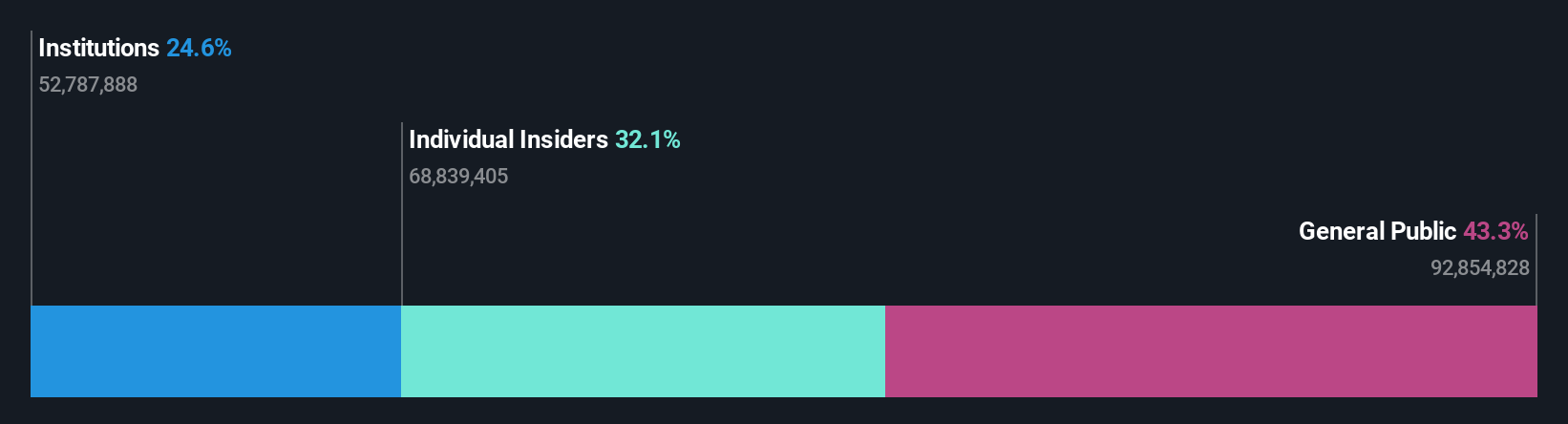

Insider Ownership: 30.8%

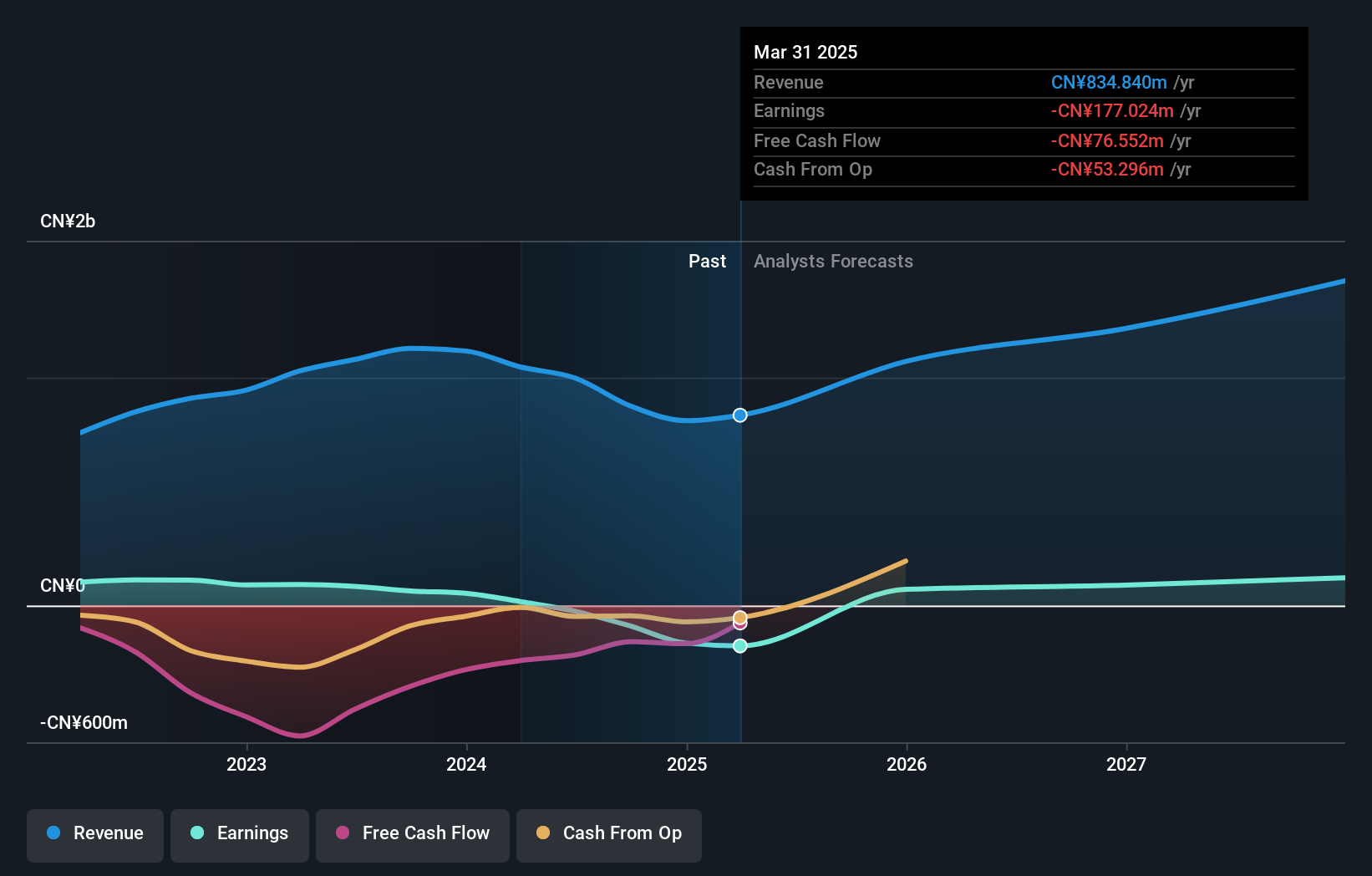

Revenue Growth Forecast: 19.8% p.a.

Zhejiang Hechuan Technology's revenue is forecast to grow at 19.8% annually, exceeding the Chinese market average of 13.7%. However, recent earnings reports show a decline in sales to CNY 643.6 million and a net loss of CNY 80.63 million for the first nine months of 2024, compared to profits last year. Despite high volatility in share price and being dropped from the S&P Global BMI Index, insider trading activity remains stable with no substantial buying or selling reported recently.

- Dive into the specifics of Zhejiang Hechuan Technology here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Zhejiang Hechuan Technology is priced higher than what may be justified by its financials.

Shenzhen King Explorer Science and Technology (SZSE:002917)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen King Explorer Science and Technology Corporation engages in the research, design, development, manufacturing, and sale of intelligent equipment systems for civil explosive production and blasting service companies both in China and internationally, with a market cap of CN¥3.36 billion.

Operations: Shenzhen King Explorer Science and Technology Corporation generates revenue through its intelligent equipment systems designed for civil explosive production and blasting service companies, serving both domestic and international markets.

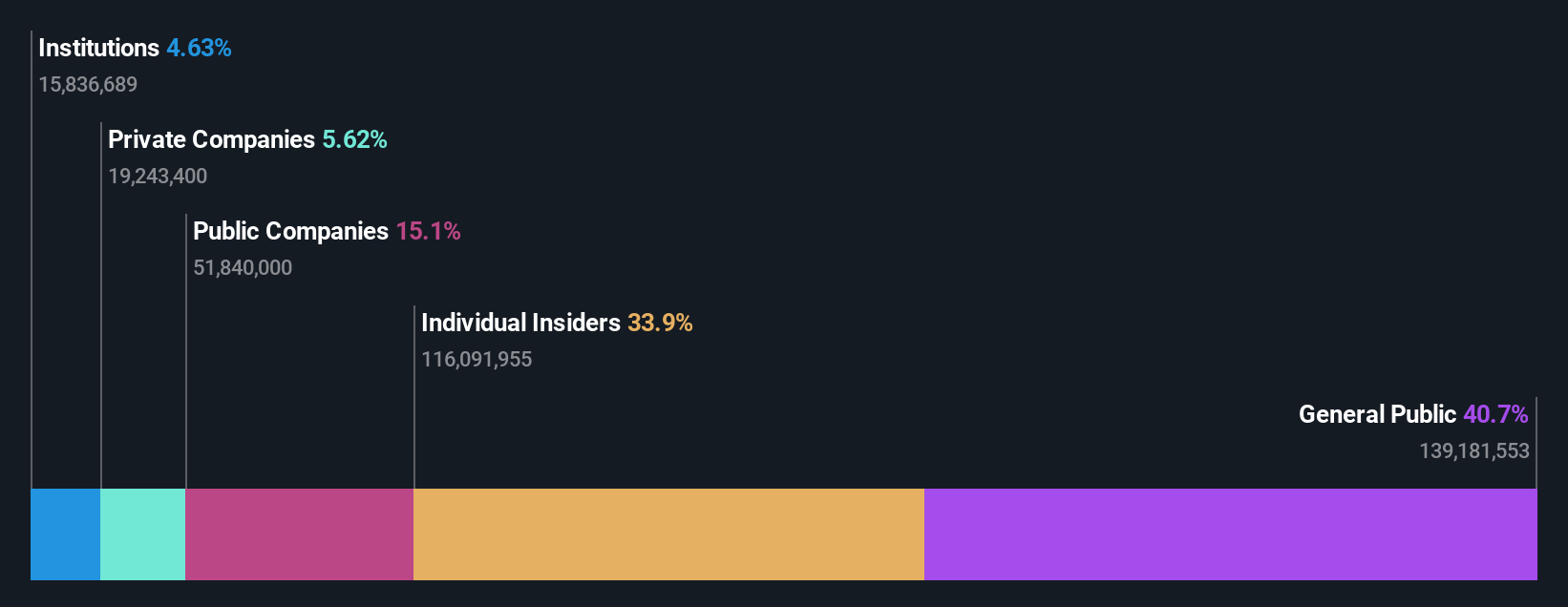

Insider Ownership: 33.9%

Revenue Growth Forecast: 25.1% p.a.

Shenzhen King Explorer Science and Technology demonstrates strong growth potential with earnings forecasted to increase significantly at 38.6% annually, outpacing the Chinese market's 25.5%. Revenue is also expected to grow rapidly at 25.1% per year, surpassing market averages. The company reported improved performance for the first nine months of 2024, with sales reaching CNY 1.18 billion and net income rising to CNY 107.67 million from CNY 80.81 million last year, despite a low forecasted return on equity of 14.9%.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen King Explorer Science and Technology.

- Our expertly prepared valuation report Shenzhen King Explorer Science and Technology implies its share price may be lower than expected.

Make It Happen

- Unlock our comprehensive list of 1514 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hechuan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688320

Zhejiang Hechuan Technology

Engages in the research and development, manufacturing, sale, and application integration of industrial automation products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives