Discovering Undiscovered Gems on None Exchange in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, small-cap stocks have faced heightened challenges, with indices like the Russell 2000 experiencing notable declines. Despite the broader market's volatility, economic indicators such as robust consumer spending and steady job growth offer a glimmer of optimism for discerning investors seeking opportunities in lesser-known equities. In this environment, identifying promising stocks involves looking beyond short-term fluctuations to find companies with strong fundamentals and potential for growth in niche sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Shipping Corporation of India | 25.17% | 7.01% | 13.70% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| BLS E-Services | NA | 5.87% | 46.48% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| KP Green Engineering | 51.37% | 120.79% | 51.32% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Junhe Pumps HoldingLtd (SHSE:603617)

Simply Wall St Value Rating: ★★★★★☆

Overview: Junhe Pumps Holding Co., Ltd specializes in the production and sale of household water pumps in China, with a market capitalization of approximately CN¥2.52 billion.

Operations: Junhe Pumps Holding Co., Ltd generates revenue primarily from its machinery segment, specifically household water pumps, amounting to CN¥1.07 billion.

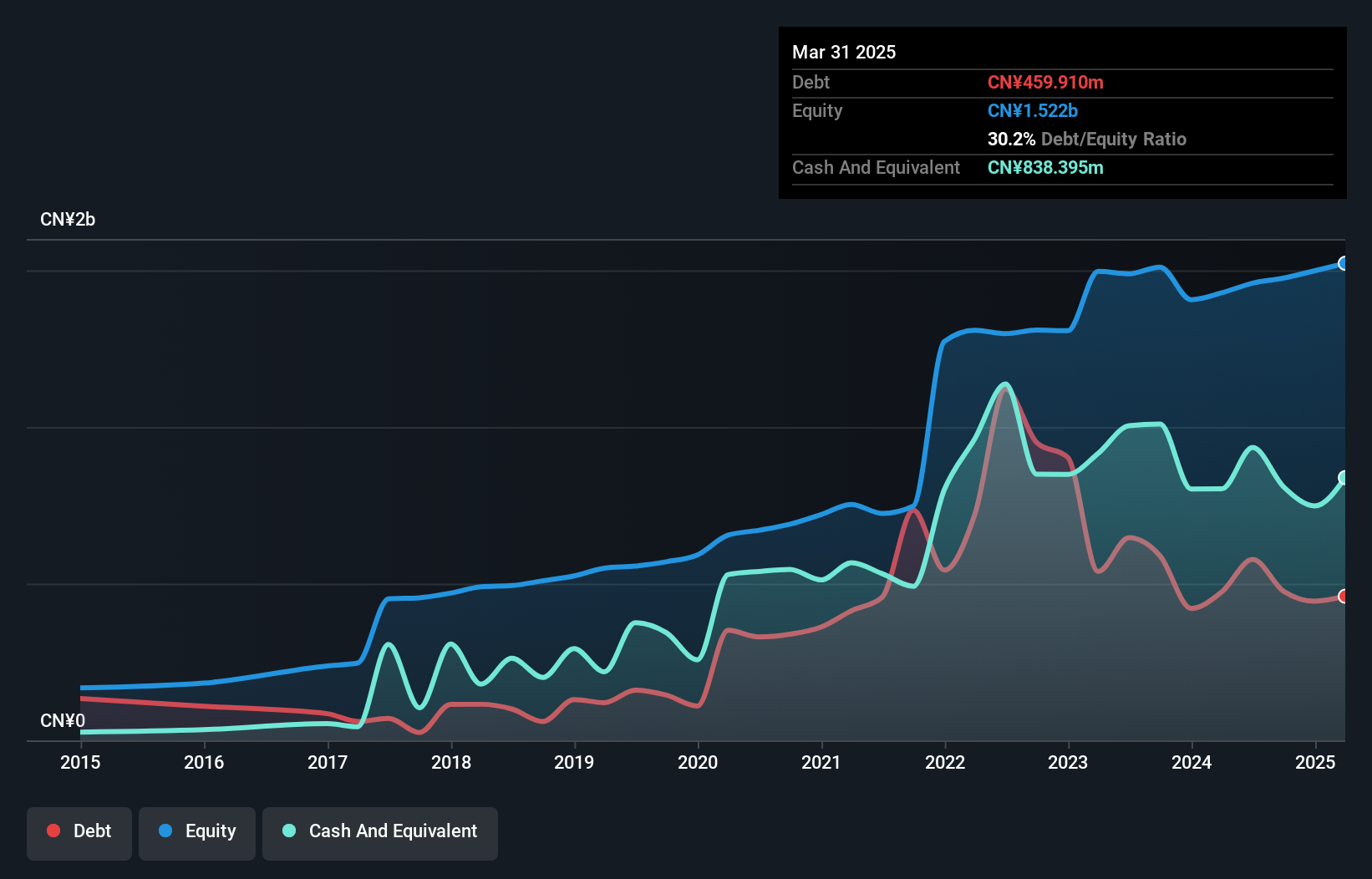

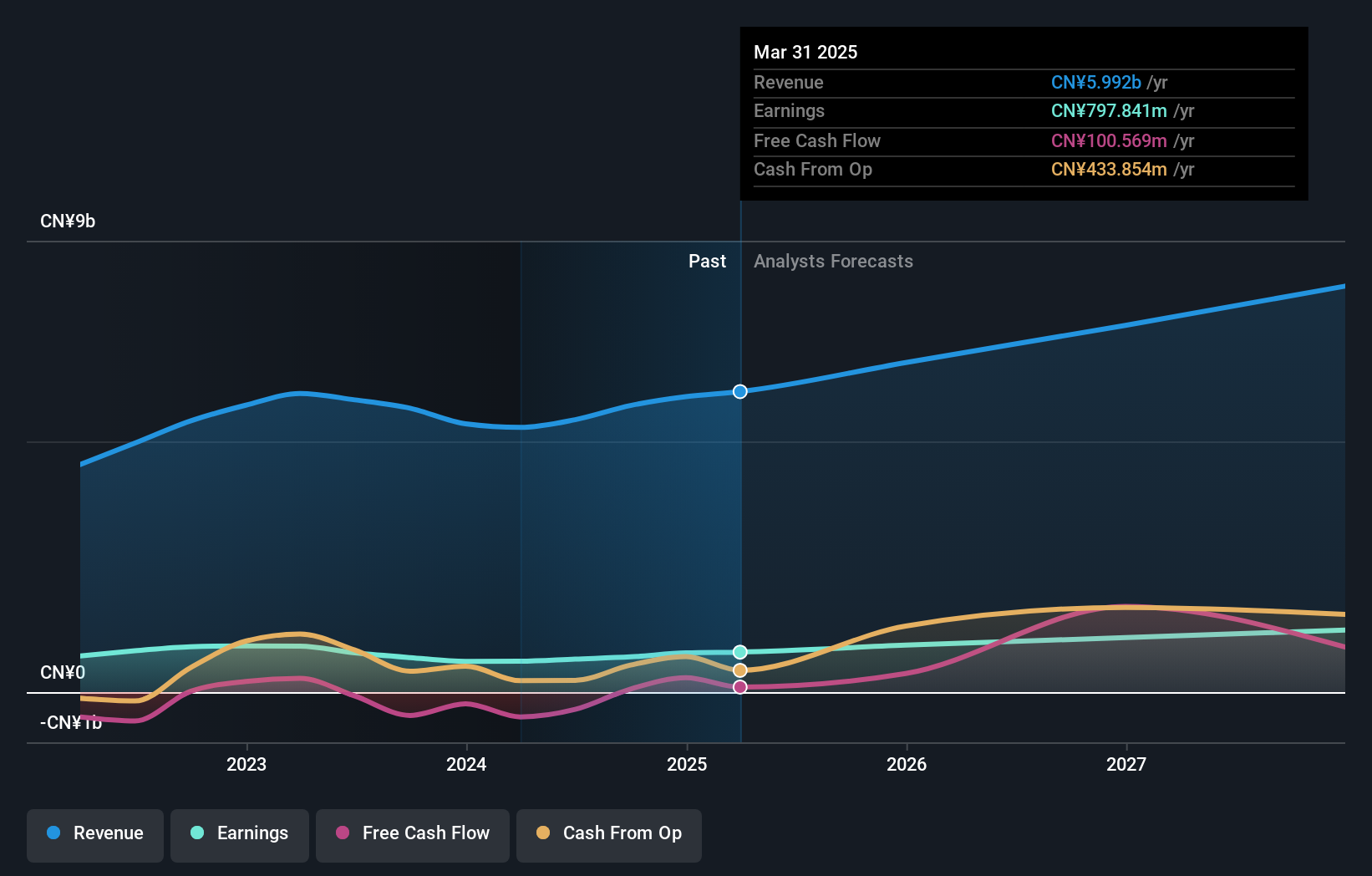

Junhe Pumps Holding Ltd, a notable player in the machinery sector, has shown impressive growth with earnings surging 45.5% over the past year, outpacing the industry's -0.06%. The company's debt to equity ratio has risen from 25.3% to 32.2% over five years, but it holds more cash than its total debt, indicating sound financial health. Recent earnings reports highlight a rise in net income to CNY 61.81 million from CNY 41.31 million last year and sales reaching CNY 847.93 million compared to CNY 492.46 million previously, reflecting robust operational performance and potential for continued growth within its niche market segment.

- Dive into the specifics of Junhe Pumps HoldingLtd here with our thorough health report.

Explore historical data to track Junhe Pumps HoldingLtd's performance over time in our Past section.

Guobang Pharma (SHSE:605507)

Simply Wall St Value Rating: ★★★★★★

Overview: Guobang Pharma Ltd. is involved in the research, development, production, and sale of pharmaceutical and veterinary products with a market capitalization of CN¥11.35 billion.

Operations: Guobang Pharma generates revenue primarily from its pharmaceutical and veterinary product segments. The company's cost structure is influenced by production and development expenses associated with these products. Its net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

Guobang Pharma, a smaller player in the pharmaceutical arena, has shown promising financial health and growth potential. Over the past five years, its debt to equity ratio improved significantly from 34.4% to 11.6%, indicating better financial management. The company's earnings grew by 1.9% last year, outpacing the industry average of -2.5%. Recent buybacks saw Guobang repurchasing over six million shares for CNY 101 million, reflecting confidence in its valuation as it trades at a substantial discount of 93.5% below estimated fair value. With net income rising to CNY 578.88 million this year compared to CNY 489.07 million previously, Guobang appears well-positioned for future growth with forecasts suggesting annual earnings increases of over 22%.

- Click here and access our complete health analysis report to understand the dynamics of Guobang Pharma.

Gain insights into Guobang Pharma's past trends and performance with our Past report.

WinWay Technology (TWSE:6515)

Simply Wall St Value Rating: ★★★★★☆

Overview: WinWay Technology Co., Ltd. engages in the design, processing, and sale of optoelectronic product test fixtures and integrated circuit test interfaces across various regions including Taiwan, the Americas, China, Asia, Europe, and Canada with a market cap of NT$37.47 billion.

Operations: WinWay Technology generates its revenue primarily from the manufacture and sales of photoelectric product testing tools, amounting to NT$4.93 billion.

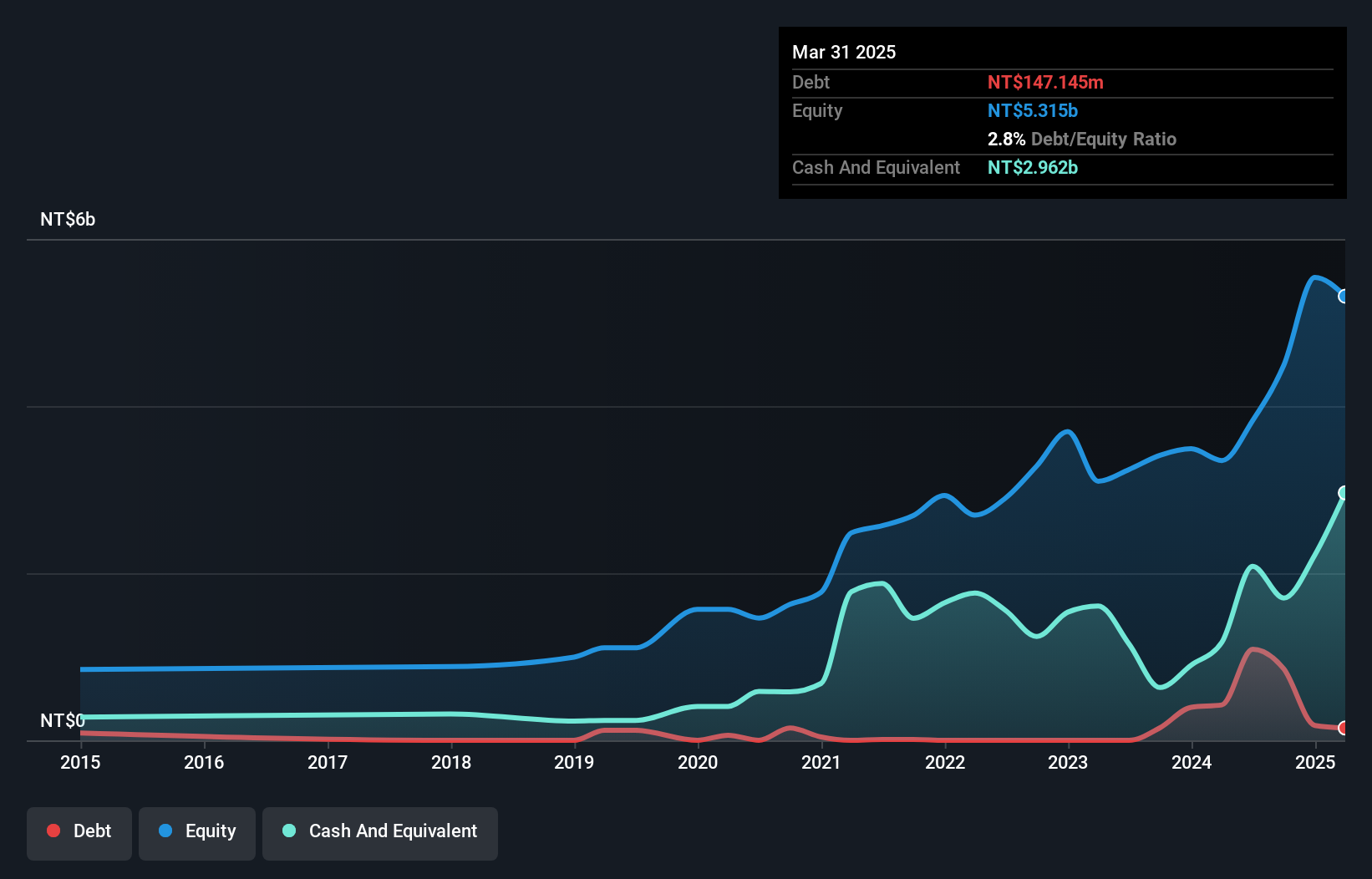

WinWay Technology, a smaller player in the tech space, has shown promising growth with earnings increasing by 9.4% over the past year, outperforming the semiconductor industry average of 5.9%. Their recent financial results highlight significant progress; third-quarter sales jumped to TWD 1.93 billion from TWD 984 million last year, while net income surged to TWD 404 million from TWD 127 million. The company is expanding its footprint by investing US$2 million in a new Malaysian subsidiary to enhance service delivery across Southeast Asia, indicating strategic moves for future growth and market penetration.

Where To Now?

- Reveal the 4625 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603617

Junhe Pumps HoldingLtd

Produces and sells household water pumps in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives