- China

- /

- Electrical

- /

- SHSE:600268

Unearthing Undiscovered Gems with Promising Potential This December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, small-cap stocks have faced particular challenges, with indices like the S&P 600 experiencing notable declines. Despite these headwinds, the ongoing economic growth and robust consumer spending present opportunities for investors to identify undiscovered gems that may thrive in this environment. In such conditions, a good stock is often characterized by strong fundamentals and resilience to broader market volatility, making them potential candidates for closer examination as we enter December 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

VSTECS Holdings (SEHK:856)

Simply Wall St Value Rating: ★★★★☆☆

Overview: VSTECS Holdings Limited is an investment holding company that develops IT product channels and provides technical solution integration services in North Asia and South East Asia, with a market cap of approximately HK$7.46 billion.

Operations: VSTECS Holdings generates revenue primarily from three segments: Enterprise Systems (HK$44.82 billion), Consumer Electronics (HK$31.69 billion), and Cloud Computing (HK$3.44 billion). The Enterprise Systems segment is the largest contributor to its revenue stream, followed by Consumer Electronics and Cloud Computing.

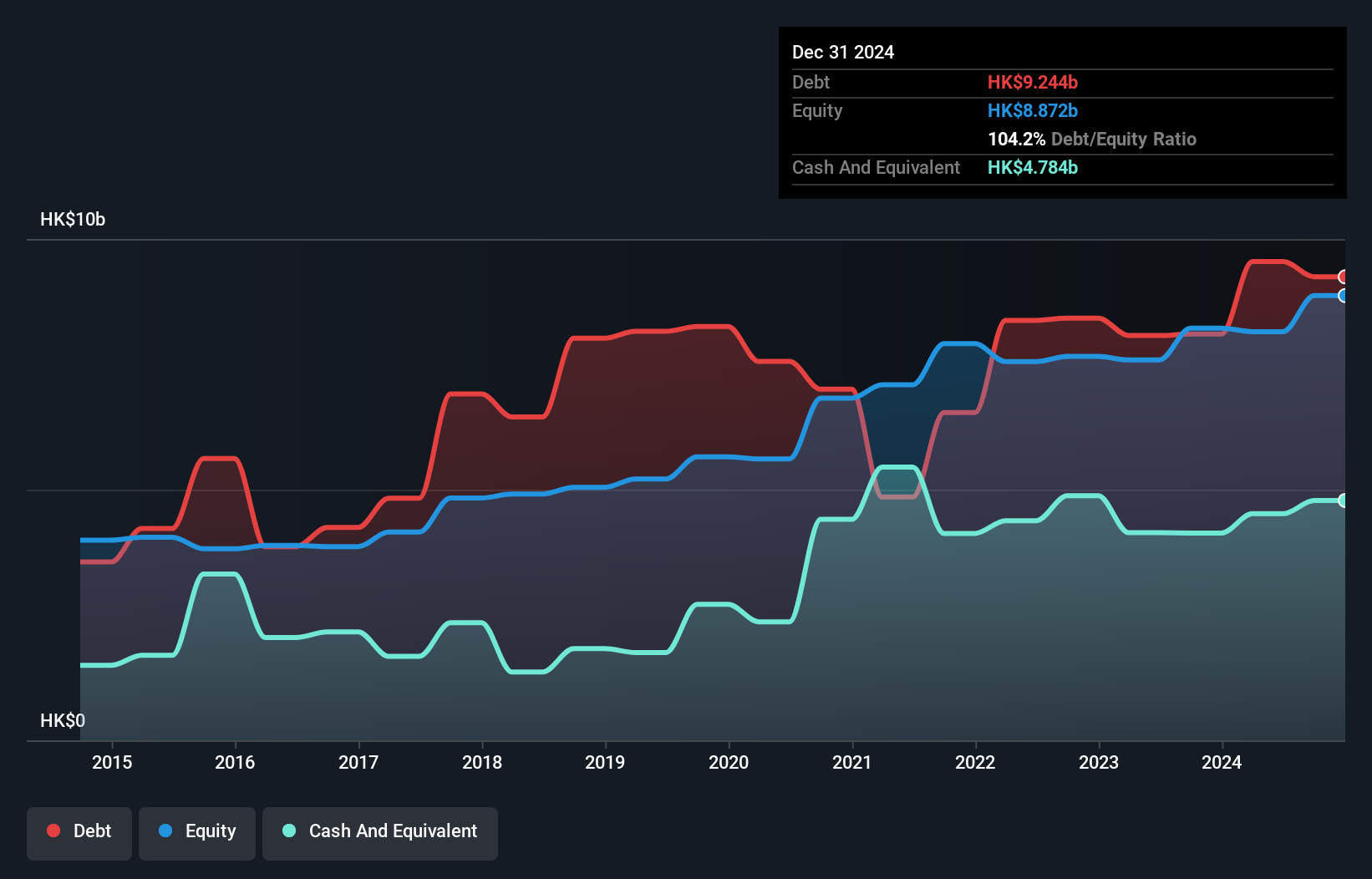

VSTECS Holdings, a small cap player in the electronics sector, showcases a mixed financial profile with its high-quality earnings and a price-to-earnings ratio of 8.8x, which is below the Hong Kong market average of 9.9x. Despite this attractive valuation, its net debt to equity ratio stands at 61.7%, indicating significant leverage that isn't well covered by operating cash flow. Over five years, VSTECS has reduced its debt to equity from 156.5% to 117.2% while maintaining positive free cash flow and EBIT covering interest payments by 4.1 times, suggesting prudent financial management amidst industry challenges and executive changes.

- Dive into the specifics of VSTECS Holdings here with our thorough health report.

Review our historical performance report to gain insights into VSTECS Holdings''s past performance.

Guodian Nanjing Automation (SHSE:600268)

Simply Wall St Value Rating: ★★★★★★

Overview: Guodian Nanjing Automation Co., Ltd. is involved in the manufacture and sale of industrial power automation equipment both within China and internationally, with a market cap of CN¥6.88 billion.

Operations: Guodian Nanjing Automation generates its revenue primarily from the power automation equipment segment, amounting to CN¥8.05 billion.

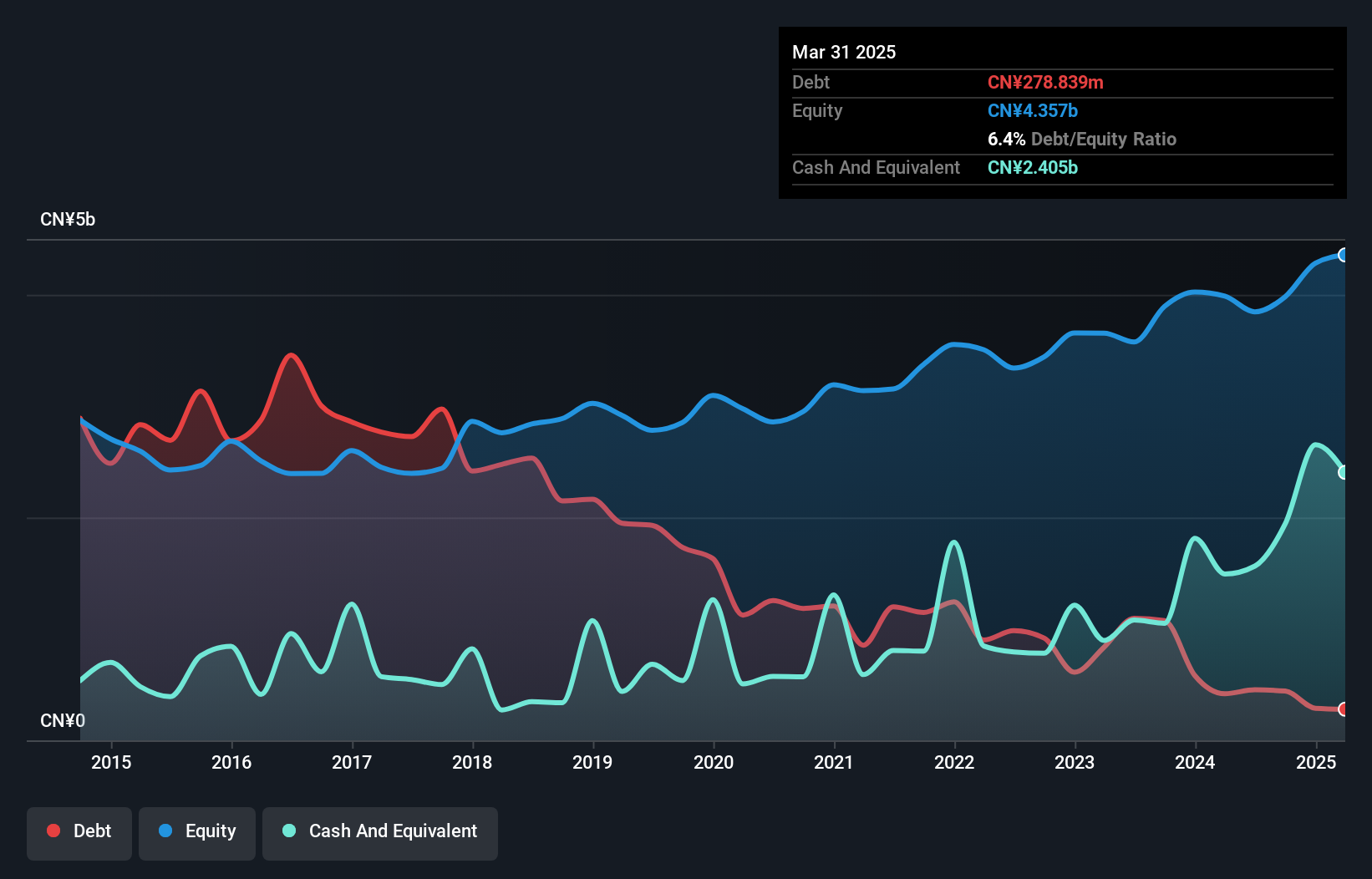

Guodian Nanjing Automation, a smaller player in the electrical industry, has demonstrated robust performance with earnings surging 43.4% over the past year, surpassing industry growth of 1.1%. The firm reported sales of CNY 5.54 billion for nine months ending September 2024, up from CNY 5.11 billion the previous year, and net income rose to CNY 104.86 million from CNY 57.72 million. With high-quality earnings and a debt-to-equity ratio reduced to 11.1% over five years, it trades at a significant discount to its estimated fair value by about 91%, suggesting potential undervaluation opportunities for investors.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company involved in the design, development, and production of mask products in China with a market cap of CN¥5.14 billion.

Operations: Newway Photomask generates revenue primarily from electronic components and parts, totaling CN¥793.19 million.

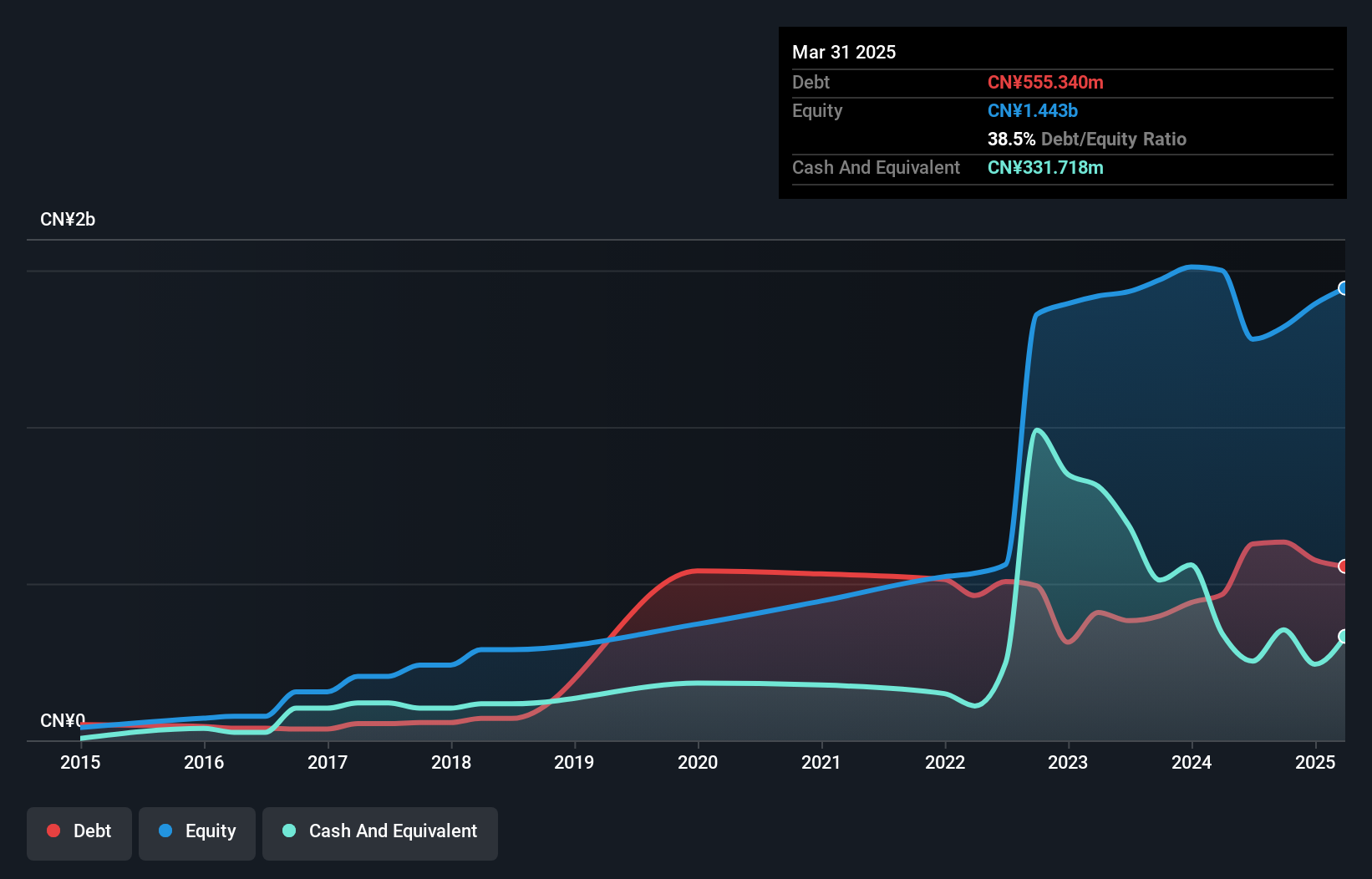

Shenzhen Newway, a nimble player in the photomask industry, has shown solid financial health with a net debt to equity ratio of 21.2%, which is deemed satisfactory. The company’s earnings growth of 13% over the past year outpaced the electronic industry average of 1.9%, highlighting its competitive edge. Trading at a price-to-earnings ratio of 32.4x, it offers good value relative to peers and the broader Chinese market at 35.5x. Recent buyback activities saw Shenzhen Newway repurchasing nearly 1 million shares for CNY 50.66 million, indicating confidence in its future prospects despite no recent purchases reported since October 2024.

Key Takeaways

- Get an in-depth perspective on all 4625 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600268

Guodian Nanjing Automation

Engages in the provision of industrial power automation equipment in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion