- India

- /

- Metals and Mining

- /

- NSEI:GPIL

Exploring Undiscovered Gems With Potential This October 2024

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, small-cap stocks have been under pressure, with indices like the Russell 2000 experiencing declines. In this environment, investors may find opportunities in lesser-known companies that demonstrate resilience and potential for growth despite broader market headwinds. Identifying such undiscovered gems involves looking for strong fundamentals, innovative business models, and strategic positioning within their industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, with a market cap of ₹122.12 billion, is involved in the mining of iron ores in India through its subsidiaries.

Operations: GPIL's primary revenue stream is from its Iron & Steel segment, generating ₹54.49 billion.

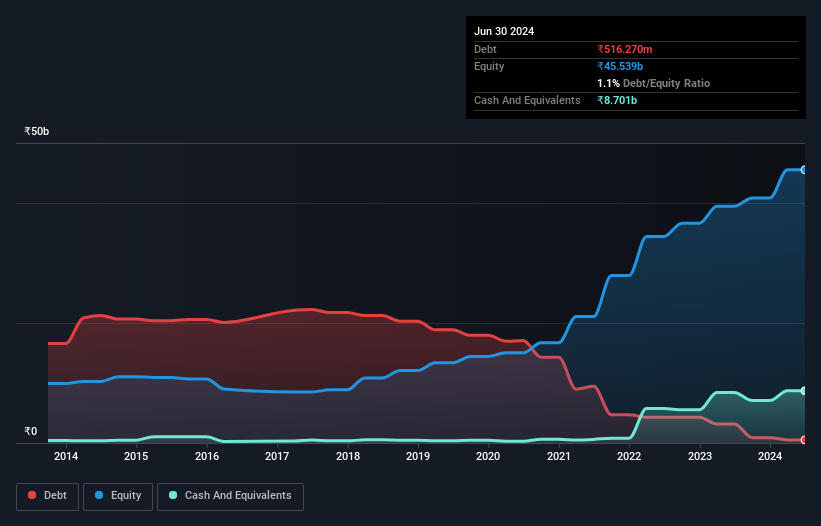

Godawari Power & Ispat (GPIL) stands out with a price-to-earnings ratio of 14.2x, significantly lower than the Indian market's 32.2x, signaling good value. Over the past five years, earnings have grown at an impressive rate of 20.3% annually, though recent growth at 13.7% lags behind industry peers' 19.9%. The company's debt to equity has impressively decreased from 124.3% to just 0.7%, indicating strong financial management and more cash on hand than total debt obligations—a positive sign for investors eyeing stability and potential growth in this sector-focused player amidst ongoing sustainability initiatives like their waste heat recovery project with Siemens Energy.

- Take a closer look at Godawari Power & Ispat's potential here in our health report.

Assess Godawari Power & Ispat's past performance with our detailed historical performance reports.

Suzhou Veichi Electric (SHSE:688698)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Veichi Electric Co., Ltd. specializes in developing, manufacturing, and marketing industrial automation control products and system solutions both in China and internationally, with a market cap of CN¥6.74 billion.

Operations: Veichi Electric generates revenue primarily from its industrial automation control products and system solutions. The company's financial performance is reflected in its market capitalization of CN¥6.74 billion.

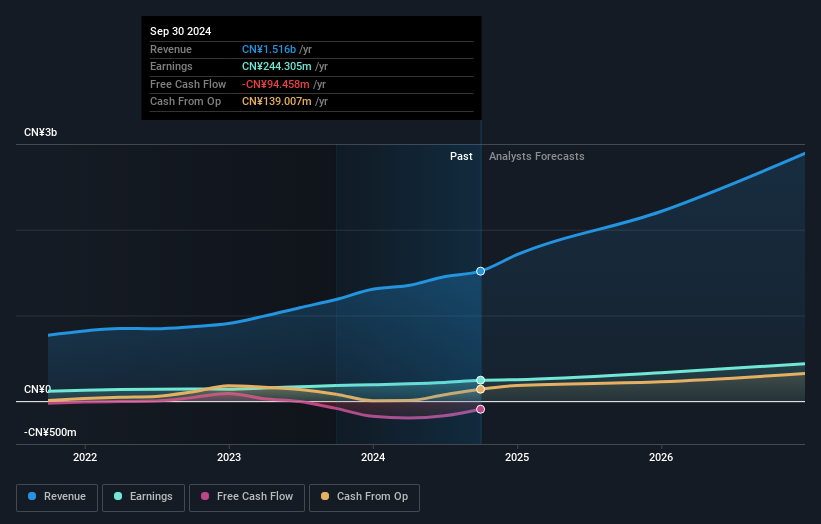

Suzhou Veichi Electric, a promising player in the electrical sector, has shown impressive growth with earnings increasing by 34.1% over the past year, outpacing the industry average of 1.5%. Its debt to equity ratio decreased significantly from 38.4% to just 0.4% over five years, indicating robust financial health and more cash than total debt. The company's price-to-earnings ratio stands at a favorable 29x compared to the CN market's average of 34x, suggesting good value potential. Despite recent volatility in share price and lack of free cash flow positivity, its forecasted earnings growth remains strong at around 27% annually.

- Delve into the full analysis health report here for a deeper understanding of Suzhou Veichi Electric.

Learn about Suzhou Veichi Electric's historical performance.

COVER (TSE:5253)

Simply Wall St Value Rating: ★★★★★★

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market cap of ¥108.77 billion.

Operations: COVER generates revenue through its virtual platform, VTuber production, and media mix businesses. The company has a market capitalization of ¥108.77 billion.

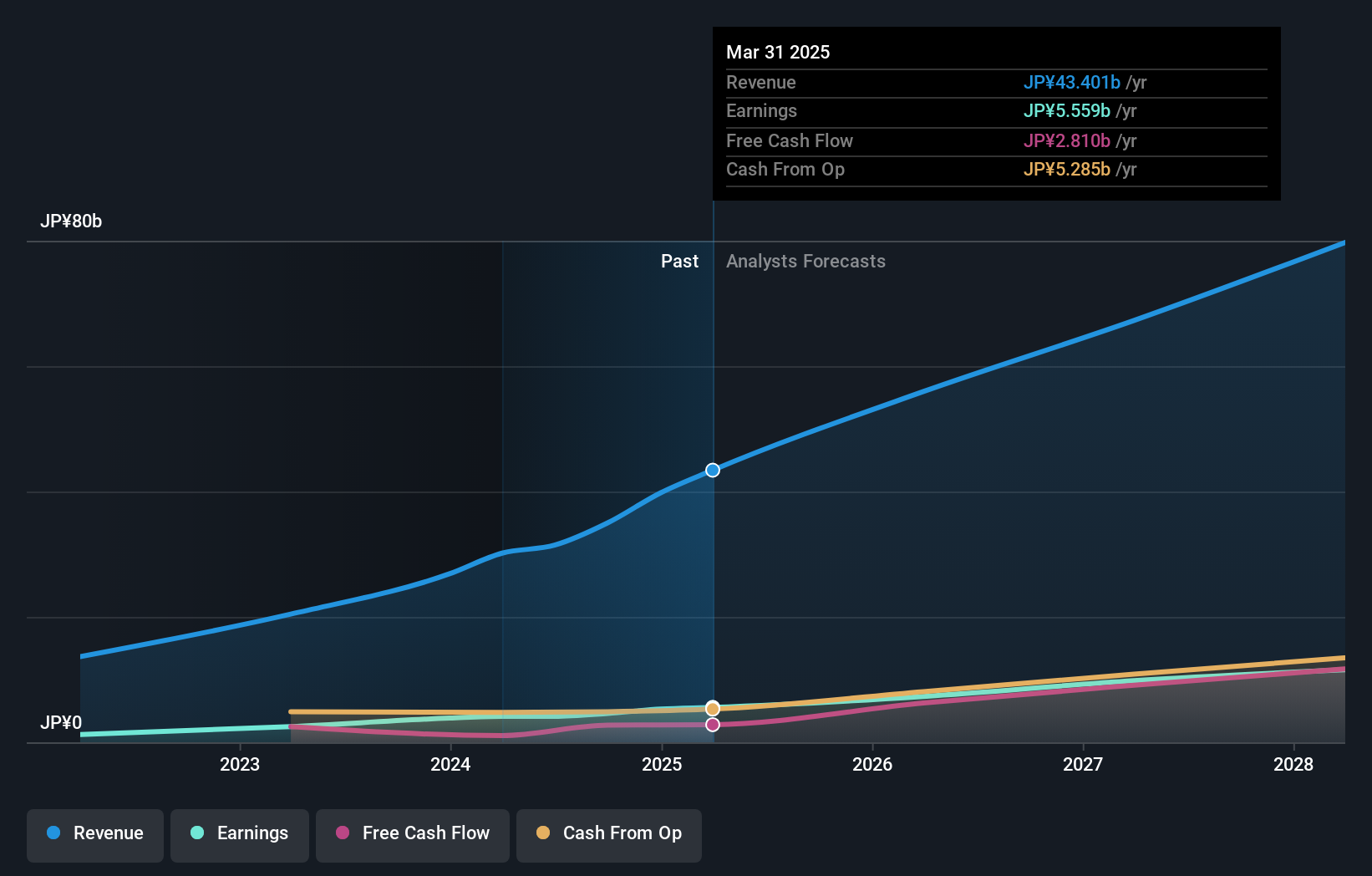

COVER, a small cap player in the entertainment sector, is trading at 49.7% below its estimated fair value, suggesting potential for growth. The company boasts high-quality earnings and has experienced impressive earnings growth of 40.1% over the past year, outpacing the industry average of -14.1%. Notably debt-free for five years, COVER faces no interest coverage issues and enjoys positive free cash flow. Despite recent share price volatility, its profitability ensures a stable cash runway. Looking ahead, earnings are projected to grow by 19.44% annually, indicating promising future prospects within its market segment.

- Get an in-depth perspective on COVER's performance by reading our health report here.

Gain insights into COVER's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Explore the 4735 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GPIL

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives