- China

- /

- Aerospace & Defense

- /

- SHSE:688311

Chengdu M&S Electronics Technology Co.,Ltd. (SHSE:688311) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, Chengdu M&S Electronics Technology Co.,Ltd. (SHSE:688311) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

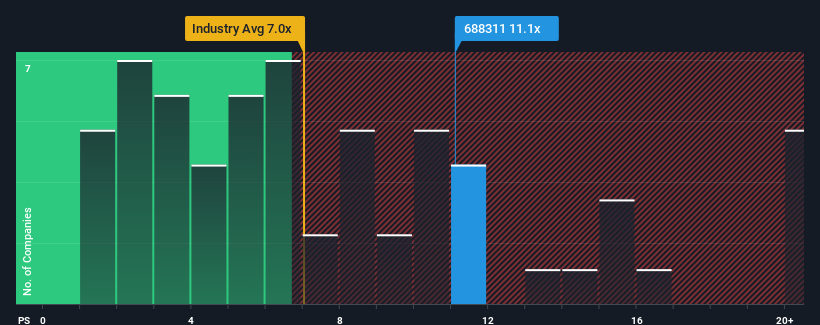

Although its price has dipped substantially, you could still be forgiven for thinking Chengdu M&S Electronics TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.1x, considering almost half the companies in China's Aerospace & Defense industry have P/S ratios below 7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Chengdu M&S Electronics TechnologyLtd

How Has Chengdu M&S Electronics TechnologyLtd Performed Recently?

Chengdu M&S Electronics TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu M&S Electronics TechnologyLtd.How Is Chengdu M&S Electronics TechnologyLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Chengdu M&S Electronics TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. This means it has also seen a slide in revenue over the longer-term as revenue is down 29% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 211% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 32%, which is noticeably less attractive.

With this information, we can see why Chengdu M&S Electronics TechnologyLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Chengdu M&S Electronics TechnologyLtd's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Chengdu M&S Electronics TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Chengdu M&S Electronics TechnologyLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688311

Chengdu M&S Electronics TechnologyLtd

Chengdu M&S Electronics Technology Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.