Highlighting Runner (Xiamen) And Two Other Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In this context, understanding the characteristics of strong dividend stocks—such as consistent payout history and financial stability—becomes crucial for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

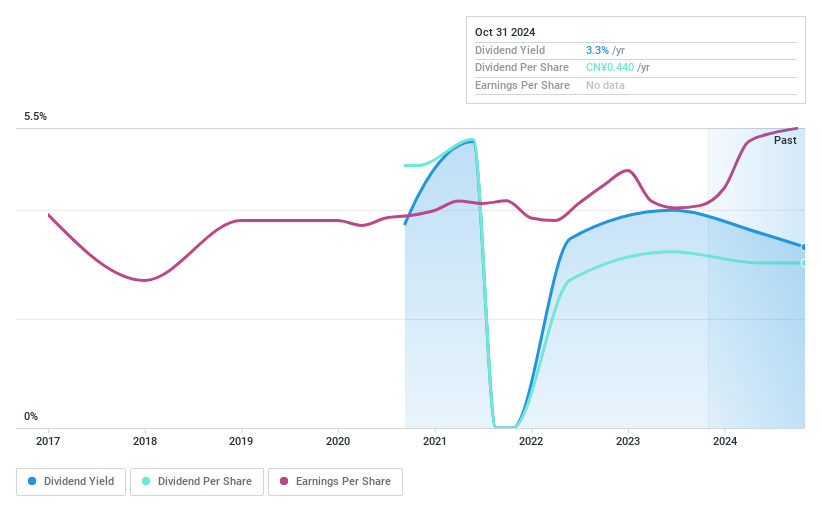

Runner (Xiamen) (SHSE:603408)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Runner (Xiamen) Corp. is involved in the R&D, design, production, and sale of kitchen and bathroom products as well as water purification products both in China and internationally, with a market cap of CN¥5.54 billion.

Operations: Runner (Xiamen) Corp.'s revenue primarily stems from its kitchen and bathroom products and water purification products, serving both domestic and international markets.

Dividend Yield: 3.5%

Runner (Xiamen) offers a compelling dividend profile with a dividend yield of 3.54%, placing it in the top quartile among Chinese dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 55.9% and 46%, respectively. Despite its attractive valuation, trading at a price-to-earnings ratio of 10.8x, Runner's dividends have been unstable over the past four years, showing volatility and occasional declines in payments.

- Navigate through the intricacies of Runner (Xiamen) with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Runner (Xiamen) is priced lower than what may be justified by its financials.

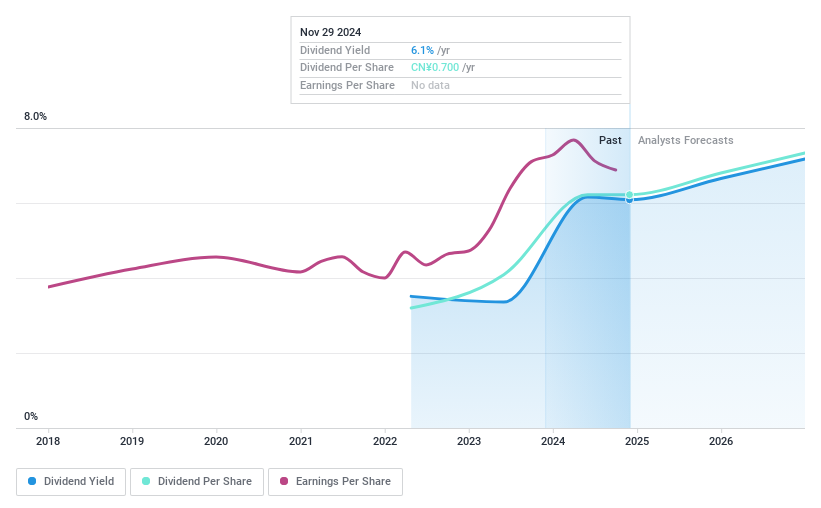

Beijing Caishikou Department StoreLtd (SHSE:605599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Caishikou Department Store Co., Ltd. operates as a retail company with a market cap of CN¥8.83 billion, focusing on department store operations in China.

Operations: The primary revenue segment for Beijing Caishikou Department Store Co., Ltd. is the sale of gold and jewellery, generating CN¥19.53 billion.

Dividend Yield: 6%

Beijing Caishikou Department Store Ltd. offers a dividend yield of 5.98%, ranking in the top 25% of Chinese dividend payers, with dividends covered by both earnings (payout ratio: 81.4%) and cash flows (cash payout ratio: 61.6%). Despite only three years of dividend history, payments have been stable and growing without volatility. The stock trades at a favorable P/E ratio of 13.6x compared to the market average, suggesting good relative value among peers.

- Get an in-depth perspective on Beijing Caishikou Department StoreLtd's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Beijing Caishikou Department StoreLtd's current price could be quite moderate.

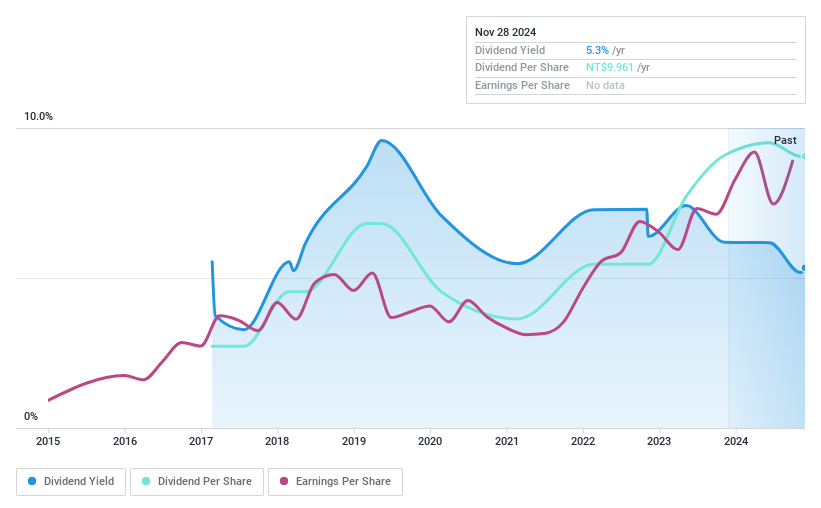

Nova Technology (TPEX:6613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nova Technology Corporation offers services to semiconductor, photonics, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers in Taiwan, China, and internationally with a market cap of NT$13.41 billion.

Operations: Nova Technology Corporation's revenue segments include NT$6.22 billion from China and NT$3.73 billion from Taiwan.

Dividend Yield: 5.5%

Nova Technology's dividend yield of 5.47% places it in the top 25% of Taiwan's market, supported by earnings and cash flows with payout ratios of 62.2% and 63.8%, respectively. Despite an increase in dividends over eight years, payments have been volatile and unreliable, recently decreasing to TWD 3.00 per share for the first half of 2024. The stock trades at a significant discount to its estimated fair value, presenting potential value opportunities amidst earnings growth challenges due to shareholder dilution.

- Click here and access our complete dividend analysis report to understand the dynamics of Nova Technology.

- Our valuation report unveils the possibility Nova Technology's shares may be trading at a discount.

Seize The Opportunity

- Explore the 1958 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603408

Runner (Xiamen)

Engages in the research and development, design, production, and sale of kitchen and bathroom products, water purification products, and other products in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.