None Reveals 3 Hidden Small Cap Gems with Strong Fundamentals

Reviewed by Simply Wall St

As the global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains, investors are increasingly turning their attention to small-cap stocks that may offer unique opportunities amid broader market fluctuations. In this context, identifying small-cap companies with strong fundamentals becomes crucial for those seeking potential growth in an uncertain environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen China Bicycle Company (Holdings) (SZSE:000017)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen China Bicycle Company (Holdings) Limited operates in the gold jewelry business with a market cap of CN¥2.94 billion.

Operations: Shenzhen China Bicycle Company (Holdings) Limited generates revenue primarily from its gold jewelry business.

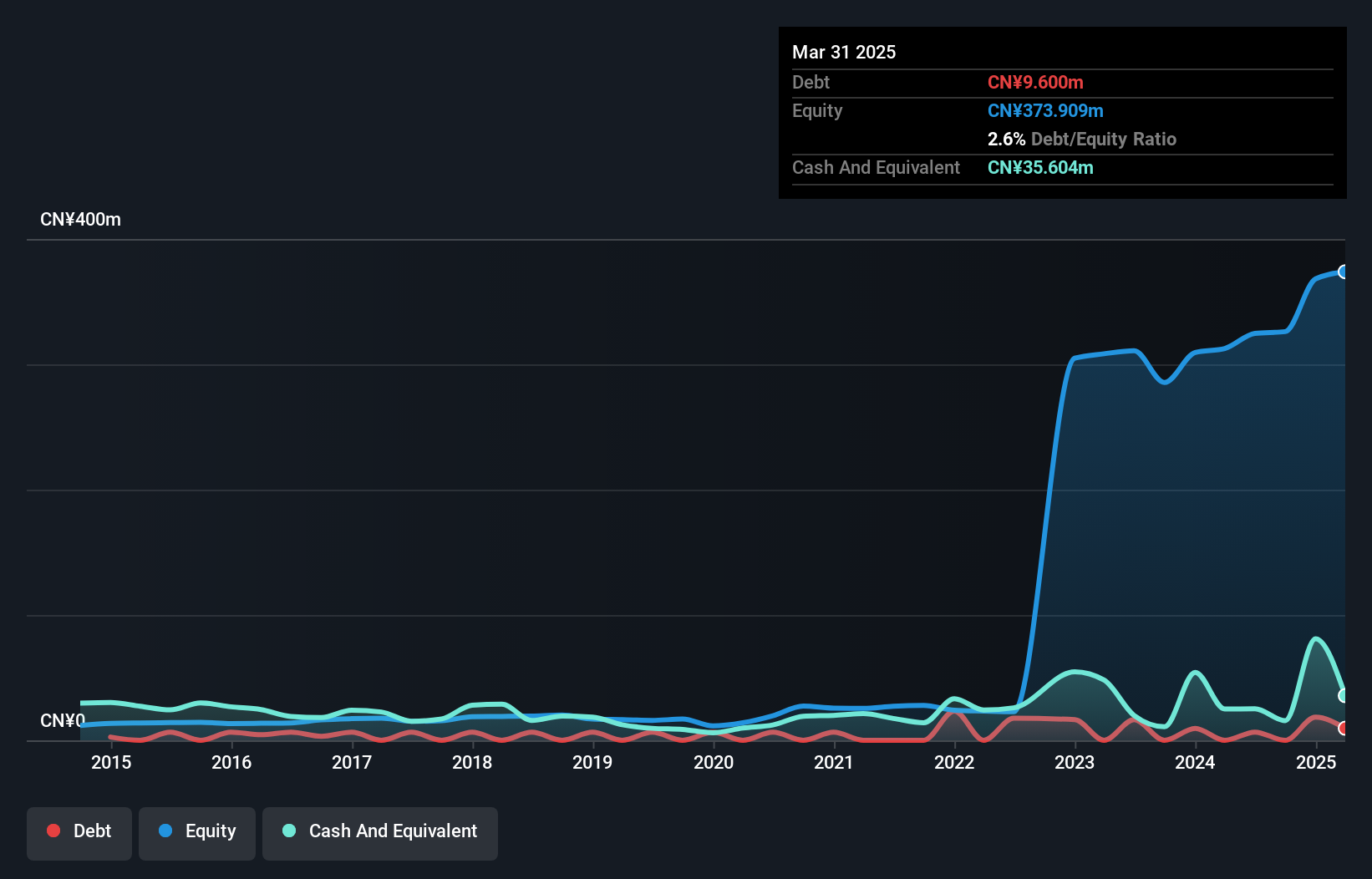

Shenzhen China Bicycle Company, a small player in the market, recently reported sales of CNY 279.46 million for the first nine months of 2024, down from CNY 348.5 million the previous year. Despite this dip in sales, net income rose to CNY 7.42 million from CNY 5.05 million a year ago, reflecting improved profitability with basic earnings per share increasing to CNY 0.0108 from CNY 0.0073. The company is debt-free and boasts high-quality earnings with positive free cash flow, suggesting financial stability despite industry challenges and a competitive environment in the luxury sector.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology focuses on providing educational technology services and solutions, with a market capitalization of CN¥12.83 billion.

Operations: The company generates revenue primarily from its Information Technology Service segment, which amounts to CN¥910.10 million.

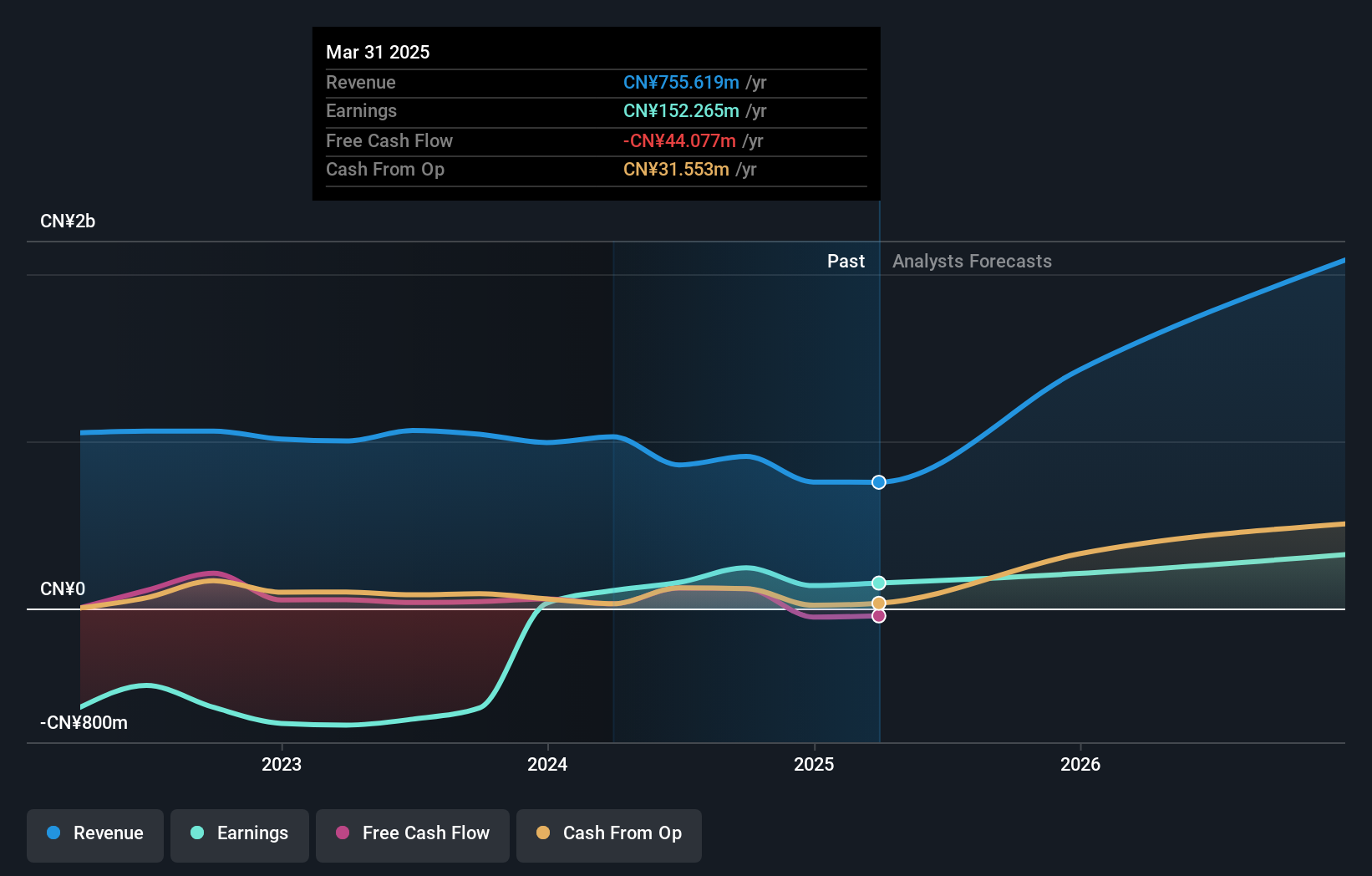

Doushen Education & Technology, a smaller player in the education tech sector, has seen its debt to equity ratio drop significantly from 45.9% to just 0.6% over five years, indicating improved financial health. The company now holds more cash than total debt, enhancing its liquidity position. Despite recent volatility in share price, Doushen's earnings have turned positive this year with a net income of CNY 110.87 million compared to a loss last year. With earnings forecasted to grow at nearly 24% annually and a P/E ratio of 54x below industry average, there seems potential for future growth despite past challenges in revenue decline from CNY 639.74 million to CNY 557.02 million over the same period.

MCLON JEWELLERYLtd (SZSE:300945)

Simply Wall St Value Rating: ★★★★★☆

Overview: MCLON JEWELLERY Co., Ltd. is engaged in the retail of jewelry both in China and internationally, with a market capitalization of CN¥3.01 billion.

Operations: MCLON JEWELLERY Ltd. generates revenue primarily from its jewelry retail operations in China and international markets. The company's net profit margin has shown variability, reflecting changes in cost management and market conditions.

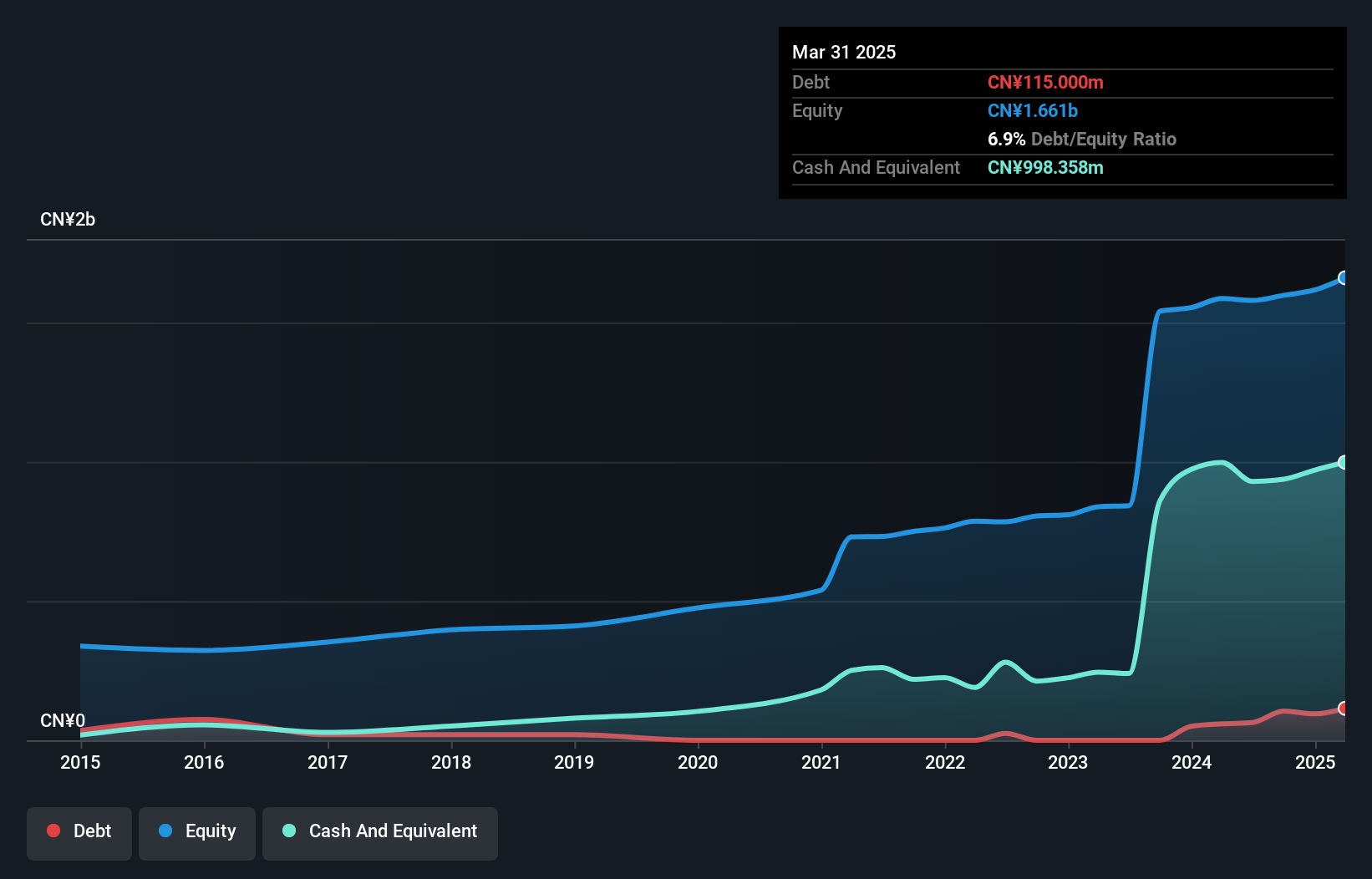

MCLON Jewellery, a smaller player in the luxury sector, has seen its earnings grow by 21.7% over the past year, outpacing the industry's 3.3% growth. The company is trading at a significant discount of 68.5% below estimated fair value and boasts high-quality earnings with interest coverage not being an issue. However, its debt-to-equity ratio has risen from 1.1 to 6.6 over five years, indicating increased leverage which could be a concern if not managed carefully. Recent board changes and steady revenue growth suggest potential for future stability and expansion within their market niche.

Where To Now?

- Discover the full array of 4638 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000017

Shenzhen China Bicycle Company (Holdings)

Engages in the gold jewelry business.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives