As global markets navigate a mixed economic landscape, characterized by fluctuating consumer confidence and moderate gains in major stock indexes, investors are increasingly focused on identifying growth opportunities. In this environment, companies with high insider ownership can offer appealing prospects, as they often align the interests of management with shareholders and demonstrate confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment both in South Korea and internationally, with a market cap of ₩3.66 trillion.

Operations: The company's revenue segments include Heavy Industry, contributing ₩3.47 trillion, and Construction, accounting for ₩1.76 trillion.

Insider Ownership: 16.4%

Earnings Growth Forecast: 38.6% p.a.

Hyosung Heavy Industries has been added to the KOSPI 200 Index, reflecting its growing prominence. Analysts forecast significant earnings growth of 38.6% annually over the next three years, outpacing the Korean market. Despite trading at a substantial discount to its estimated fair value, debt coverage by operating cash flow remains a concern. The company’s revenue is expected to grow at 10.3% annually, and insider ownership aligns management interests with shareholders, enhancing potential long-term value creation.

- Dive into the specifics of Hyosung Heavy Industries here with our thorough growth forecast report.

- Our valuation report here indicates Hyosung Heavy Industries may be undervalued.

Xi'an Bright Laser TechnologiesLtd (SHSE:688333)

Simply Wall St Growth Rating: ★★★★★☆

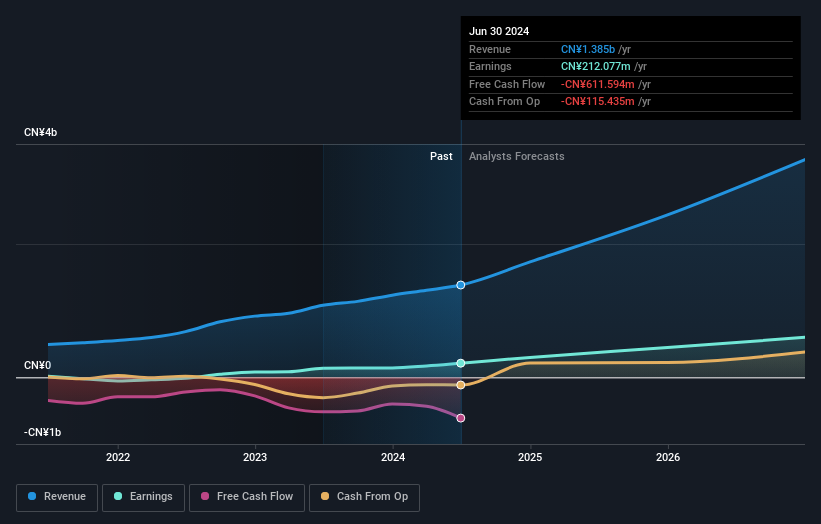

Overview: Xi'an Bright Laser Technologies Co., Ltd. provides metal additive manufacturing and repairing solutions in the People's Republic of China, with a market cap of CN¥10.72 billion.

Operations: The company's revenue segments are not specified in the provided text.

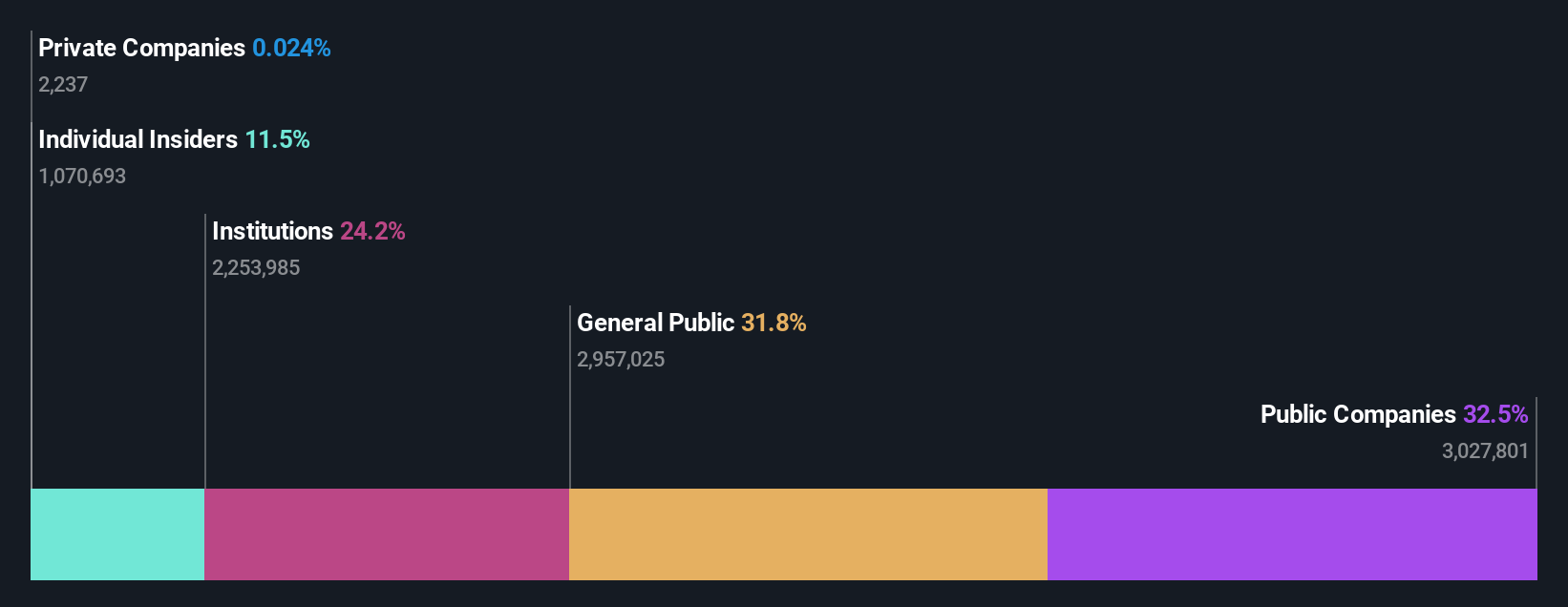

Insider Ownership: 24.6%

Earnings Growth Forecast: 48.5% p.a.

Xi'an Bright Laser Technologies is experiencing strong forecasted growth, with revenue expected to rise 38% annually, outpacing the Chinese market. Earnings are projected to grow significantly at 48.5% per year. Despite recent buyback activities aimed at enhancing shareholder value, the company's net income has declined over the past year. Insider ownership remains high, aligning management interests with shareholders and potentially supporting long-term development strategies despite a low return on equity forecast of 8%.

- Click to explore a detailed breakdown of our findings in Xi'an Bright Laser TechnologiesLtd's earnings growth report.

- Our comprehensive valuation report raises the possibility that Xi'an Bright Laser TechnologiesLtd is priced higher than what may be justified by its financials.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology operates in the education and technology sector, with a market capitalization of CN¥12.83 billion.

Operations: The company generates revenue from its Information Technology Service segment, totaling CN¥910.10 million.

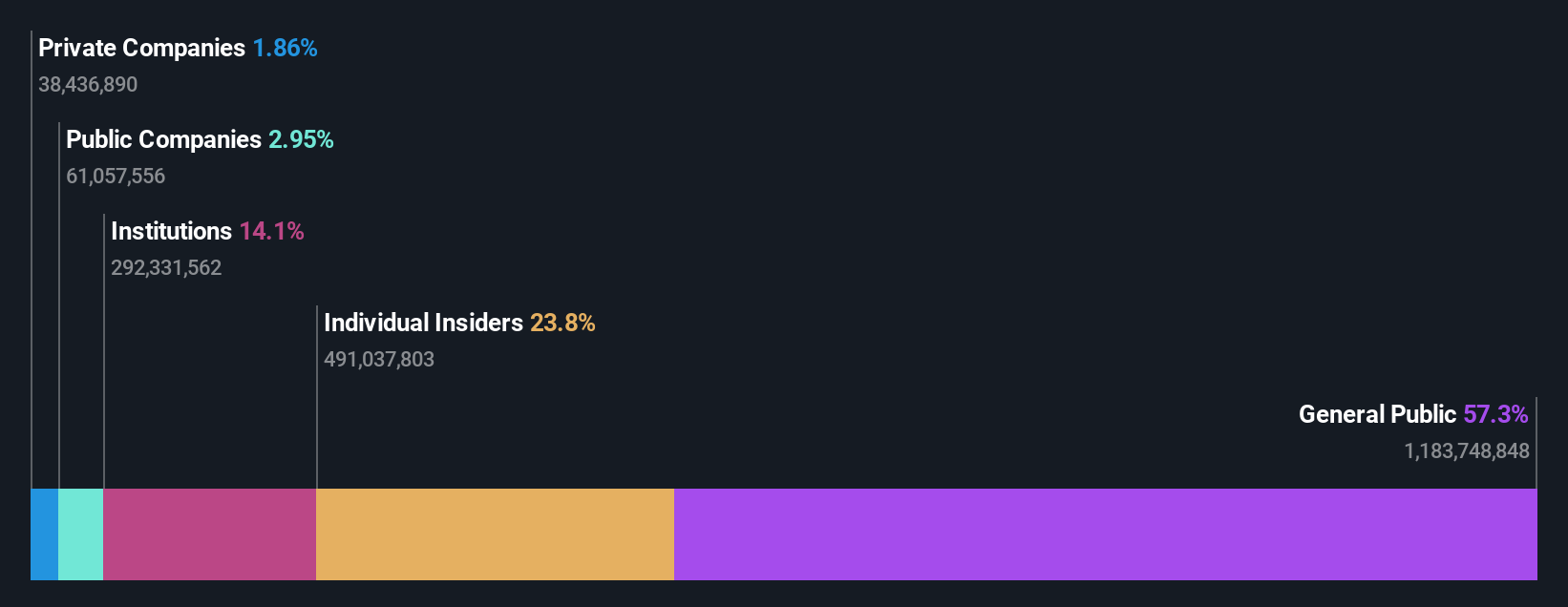

Insider Ownership: 24.1%

Earnings Growth Forecast: 23.8% p.a.

Doushen (Beijing) Education & Technology shows promising growth prospects with earnings forecasted to increase by 23.79% annually, although this is slightly below the broader Chinese market's pace. The company recently turned profitable, reporting a net income of CNY 110.87 million for the first nine months of 2024, reversing a prior loss. Despite high volatility in share price and low return on equity forecasts, its substantial insider ownership could align management interests with shareholders' goals.

- Navigate through the intricacies of Doushen (Beijing) Education & Technology with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Doushen (Beijing) Education & Technology's share price might be too optimistic.

Seize The Opportunity

- Delve into our full catalog of 1505 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Xi'an Bright Laser TechnologiesLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688333

Xi'an Bright Laser TechnologiesLtd

Offers metal additive manufacturing and repairing solutions in the People's Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives