- China

- /

- Electronic Equipment and Components

- /

- SHSE:603583

Exploring High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape marked by fluctuating consumer confidence and economic indicators, the technology sector continues to capture attention with its potential for high growth. In this environment, identifying promising tech stocks involves assessing their ability to innovate and adapt amidst broader market trends, such as those seen in recent shifts within major indices like the Nasdaq Composite.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. specializes in the development and manufacturing of linear motion products, with a market capitalization of CN¥9.50 billion.

Operations: Jiecang Linear Motion Technology generates revenue primarily from the linear drive industry, with reported earnings of CN¥3.50 billion. The company's market capitalization stands at CN¥9.50 billion.

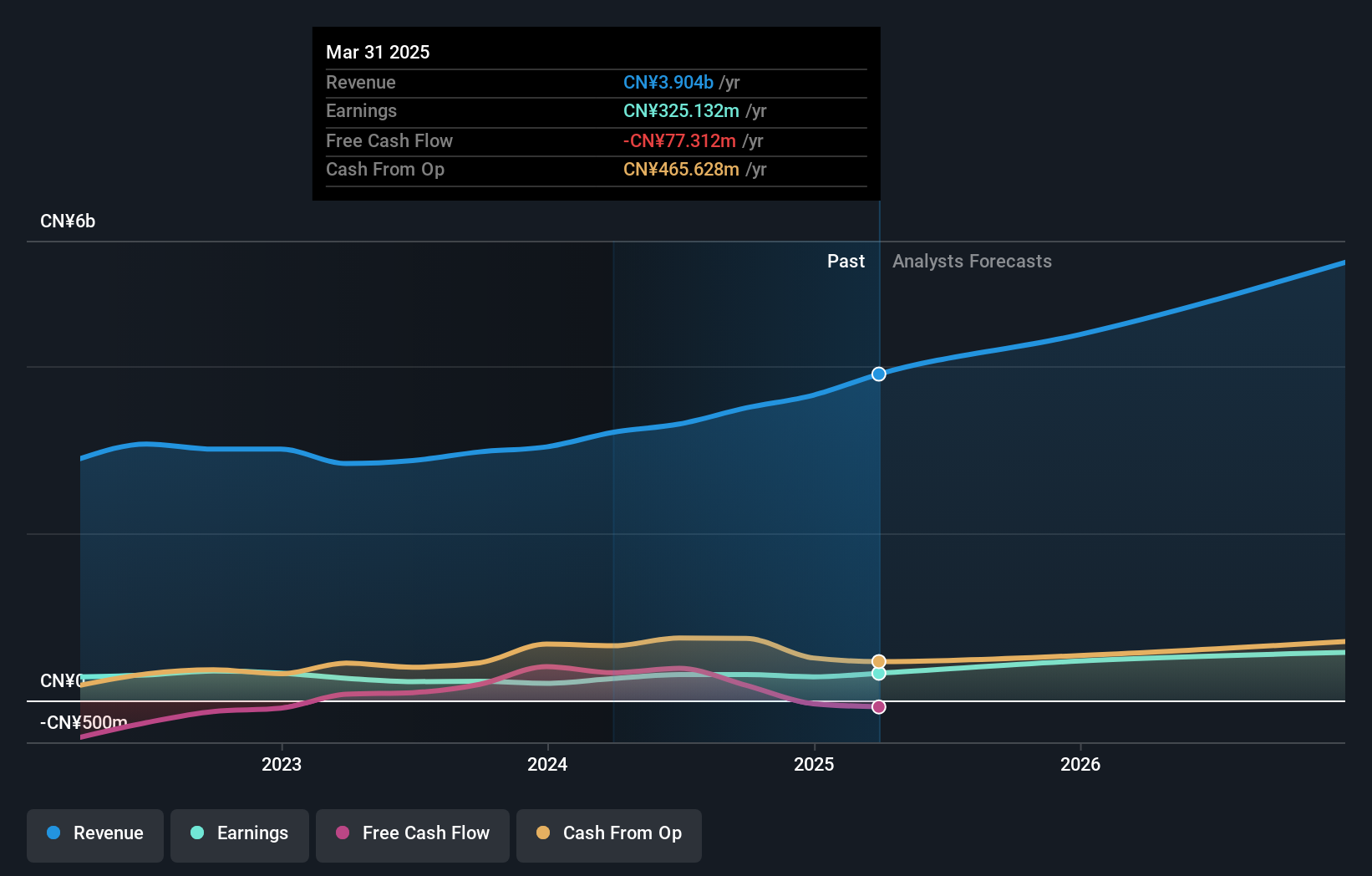

Zhejiang Jiecang Linear Motion Technology has demonstrated robust financial performance, with a notable increase in sales reaching CNY 2.57 billion, up from CNY 2.10 billion year-over-year, reflecting a growth of 22%. This surge is supported by an impressive rise in net income to CNY 293.2 million from CNY 188.43 million, alongside earnings per share growth from CNY 0.49 to CNY 0.76 over the same period. The company's commitment to innovation is evident in its R&D investments which are crucial for sustaining long-term competitiveness in the high-tech industry; however, specific figures on R&D spending were not disclosed this period. Looking ahead, Zhejiang Jiecang's strategic focus on expanding its product lines and enhancing operational efficiencies might continue to bolster its market position despite forecasts suggesting revenue growth (15.8% annually) slightly trailing behind the broader tech sector's rapid pace. Earnings are expected to climb at an annual rate of approximately 25%, outpacing both local and industry averages, indicating potential for sustained profitability amidst evolving market demands.

- Click here to discover the nuances of Zhejiang Jiecang Linear Motion TechnologyLtd with our detailed analytical health report.

Understand Zhejiang Jiecang Linear Motion TechnologyLtd's track record by examining our Past report.

Suzhou Sushi Testing GroupLtd (SZSE:300416)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Sushi Testing Group Co., Ltd. offers environmental and reliability test verification equipment and analysis services, with a market cap of CN¥5.92 billion.

Operations: Suzhou Sushi Testing Group Co., Ltd. specializes in providing equipment and solutions for environmental and reliability testing, alongside offering analysis services.

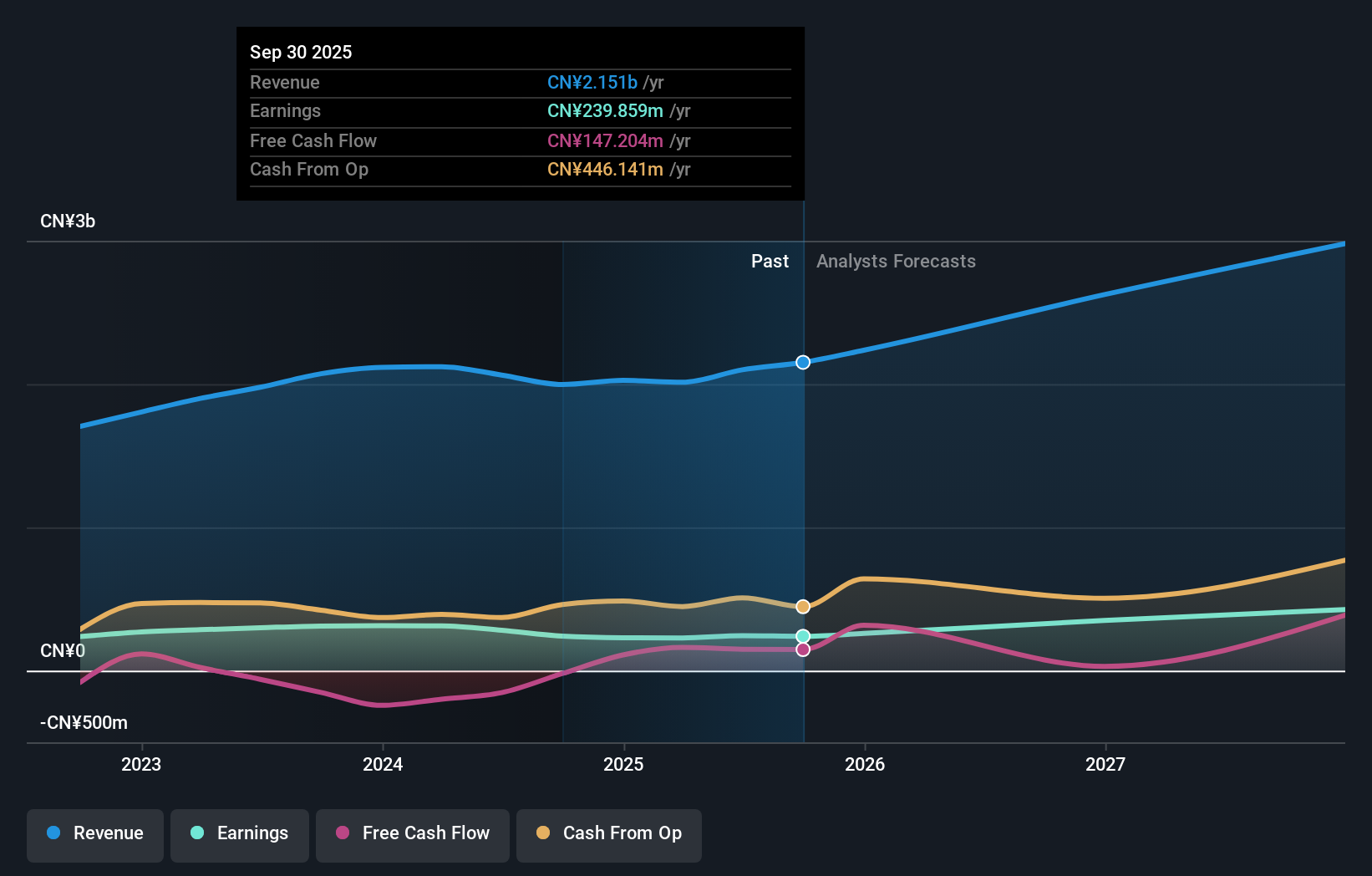

Suzhou Sushi Testing GroupLtd. has navigated a challenging fiscal period, with a decrease in sales and net income as reported for the nine months ending September 2024; sales dropped to CNY 1.41 billion from CNY 1.53 billion, and net income fell to CNY 146.39 million from CNY 220.32 million year-over-year. Despite these setbacks, the company's commitment to shareholder value is evident through its recent buyback of 502,000 shares for CNY 4.78 million. Looking forward, Suzhou Sushi is poised for recovery with projected revenue growth at an annual rate of 20.1% and earnings growth at an impressive rate of 31.7%, outstripping broader market forecasts significantly—indicative of potential resilience and adaptability in its operational strategy amidst evolving industry dynamics.

Hualan Biological Vaccine (SZSE:301207)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hualan Biological Vaccine Inc. focuses on the research, development, production, and sale of vaccines in China with a market capitalization of approximately CN¥10.42 billion.

Operations: Hualan Biological Vaccine Inc. generates revenue primarily through the development and sale of vaccines in China. The company operates with a market capitalization of approximately CN¥10.42 billion, focusing on innovative vaccine solutions to cater to public health needs.

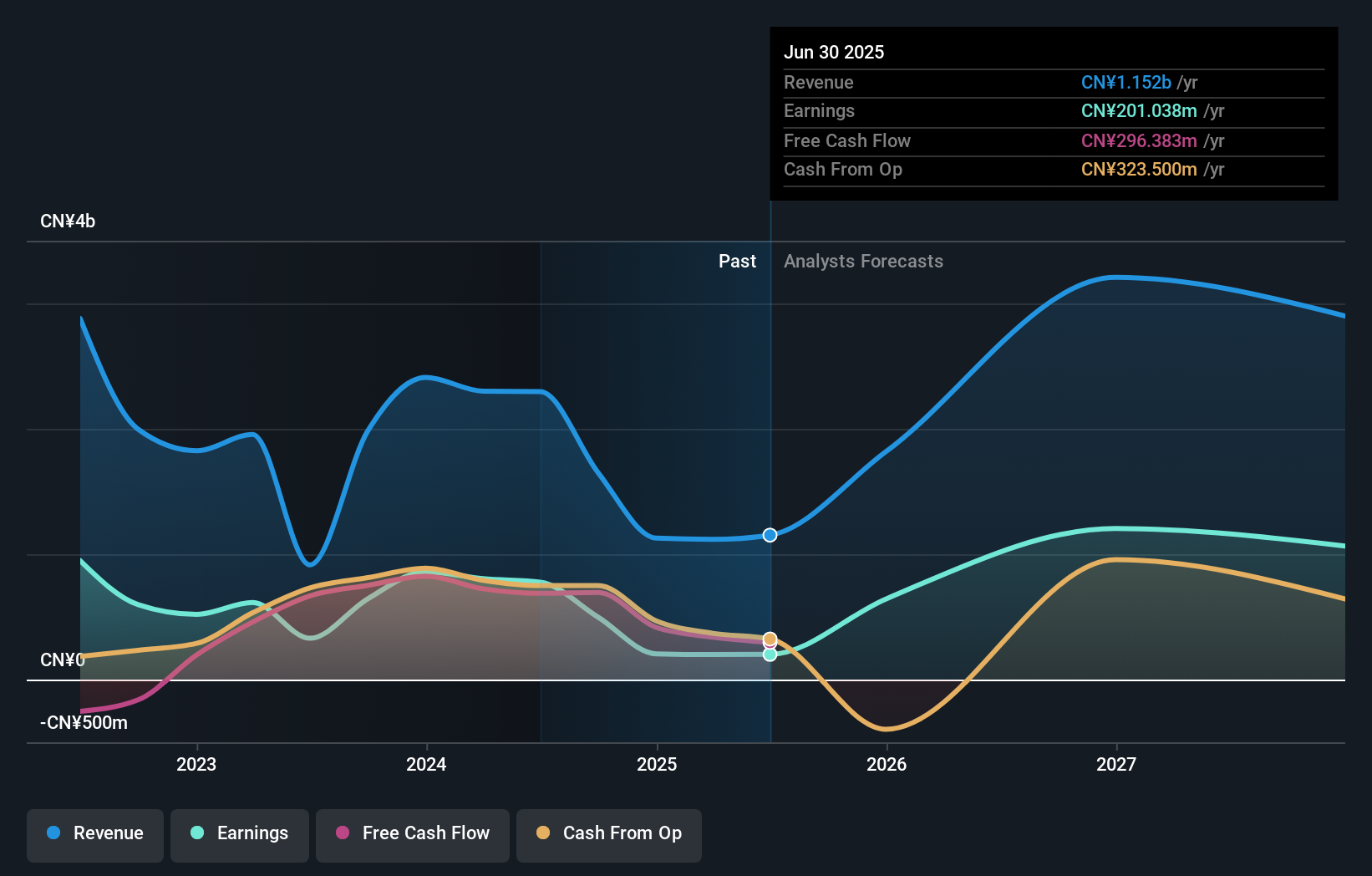

Despite a challenging year with reduced sales and net income, Hualan Biological Vaccine remains poised for significant growth, with revenue and earnings forecasted to increase by 28.0% and 33.3% annually. The firm's commitment to innovation is underscored by its substantial investment in R&D, crucial for staying competitive in the fast-evolving biotech sector. With a strategy focused on enhancing product offerings and operational efficiency, Hualan Biological Vaccine is well-positioned to capitalize on market opportunities and expand its influence in the healthcare industry.

Taking Advantage

- Dive into all 1266 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiecang Linear Motion TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603583

Zhejiang Jiecang Linear Motion TechnologyLtd

Zhejiang Jiecang Linear Motion Technology Co.,Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives