- China

- /

- Construction

- /

- SHSE:603316

Chengbang Eco-EnvironmentLtd (SHSE:603316 investor five-year losses grow to 27% as the stock sheds CN¥222m this past week

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Chengbang Eco-Environment Co.,Ltd. (SHSE:603316), since the last five years saw the share price fall 28%. And it's not just long term holders hurting, because the stock is down 22% in the last year. On top of that, the share price is down 14% in the last week.

Since Chengbang Eco-EnvironmentLtd has shed CN¥222m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Chengbang Eco-EnvironmentLtd

Because Chengbang Eco-EnvironmentLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Chengbang Eco-EnvironmentLtd saw its revenue shrink by 17% per year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 5% per year in that time. We doubt many shareholders are delighted with this share price performance. Risk averse investors probably wouldn't like this one much.

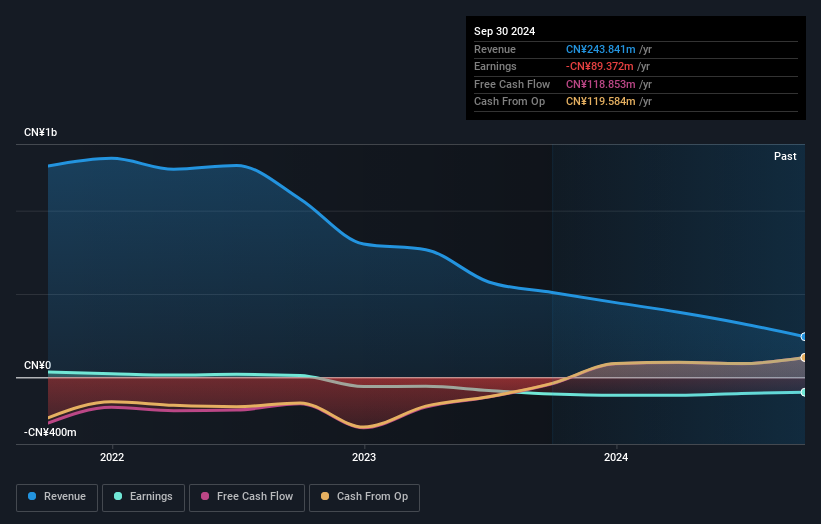

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Chengbang Eco-EnvironmentLtd's earnings, revenue and cash flow.

A Different Perspective

Chengbang Eco-EnvironmentLtd shareholders are down 22% for the year, but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Chengbang Eco-EnvironmentLtd you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603316

Chengbang Eco-EnvironmentLtd

Primarily operates in the construction industry in China.

Slightly overvalued with imperfect balance sheet.