As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent volatility and economic indicators presenting varied signals, investors are increasingly focused on companies that demonstrate resilience and potential for growth. In this environment, firms with significant insider ownership often attract attention due to the alignment of interests between management and shareholders, suggesting confidence in their long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Befar GroupLtd (SHSE:601678)

Simply Wall St Growth Rating: ★★★★☆☆

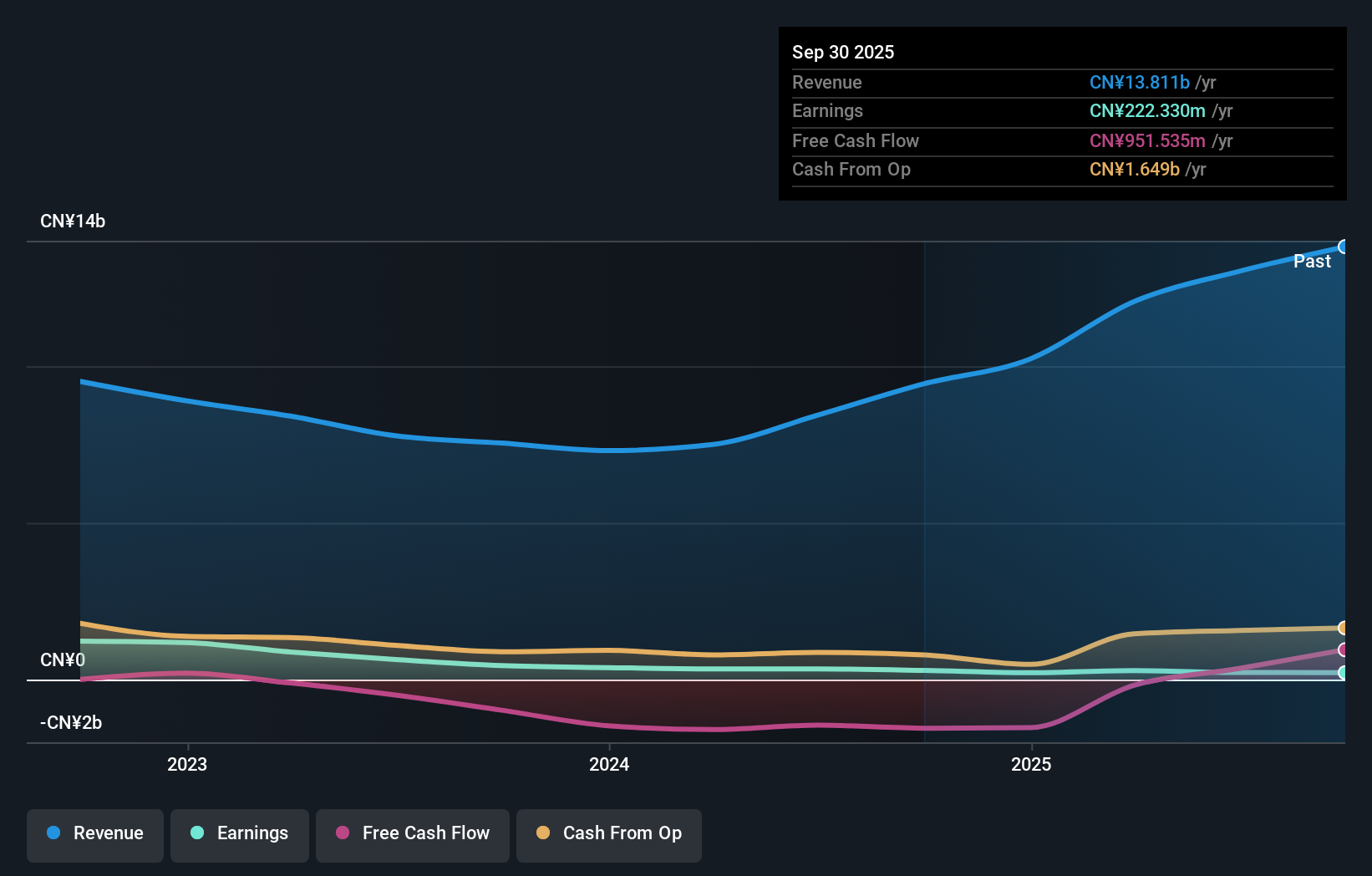

Overview: Befar Group Co., Ltd operates in the production, processing, and sale of organic and inorganic chemical products, primarily focusing on caustic soda, with a market cap of CN¥7.34 billion.

Operations: The company's revenue from the chemical industry segment amounts to CN¥9.44 billion.

Insider Ownership: 13.3%

Earnings Growth Forecast: 47.9% p.a.

Befar Group Ltd. shows significant growth potential with earnings expected to rise 47.9% annually, outpacing the Chinese market's 25%. Despite lower profit margins of 3.1% compared to last year's 5.9%, it trades at a favorable P/E ratio of 26.5x, below the market average of 32.8x, indicating good relative value against peers and industry standards. However, revenue growth is projected at a moderate pace of 13.5% per year, slower than desired for high-growth categories.

- Click to explore a detailed breakdown of our findings in Befar GroupLtd's earnings growth report.

- The analysis detailed in our Befar GroupLtd valuation report hints at an deflated share price compared to its estimated value.

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★☆

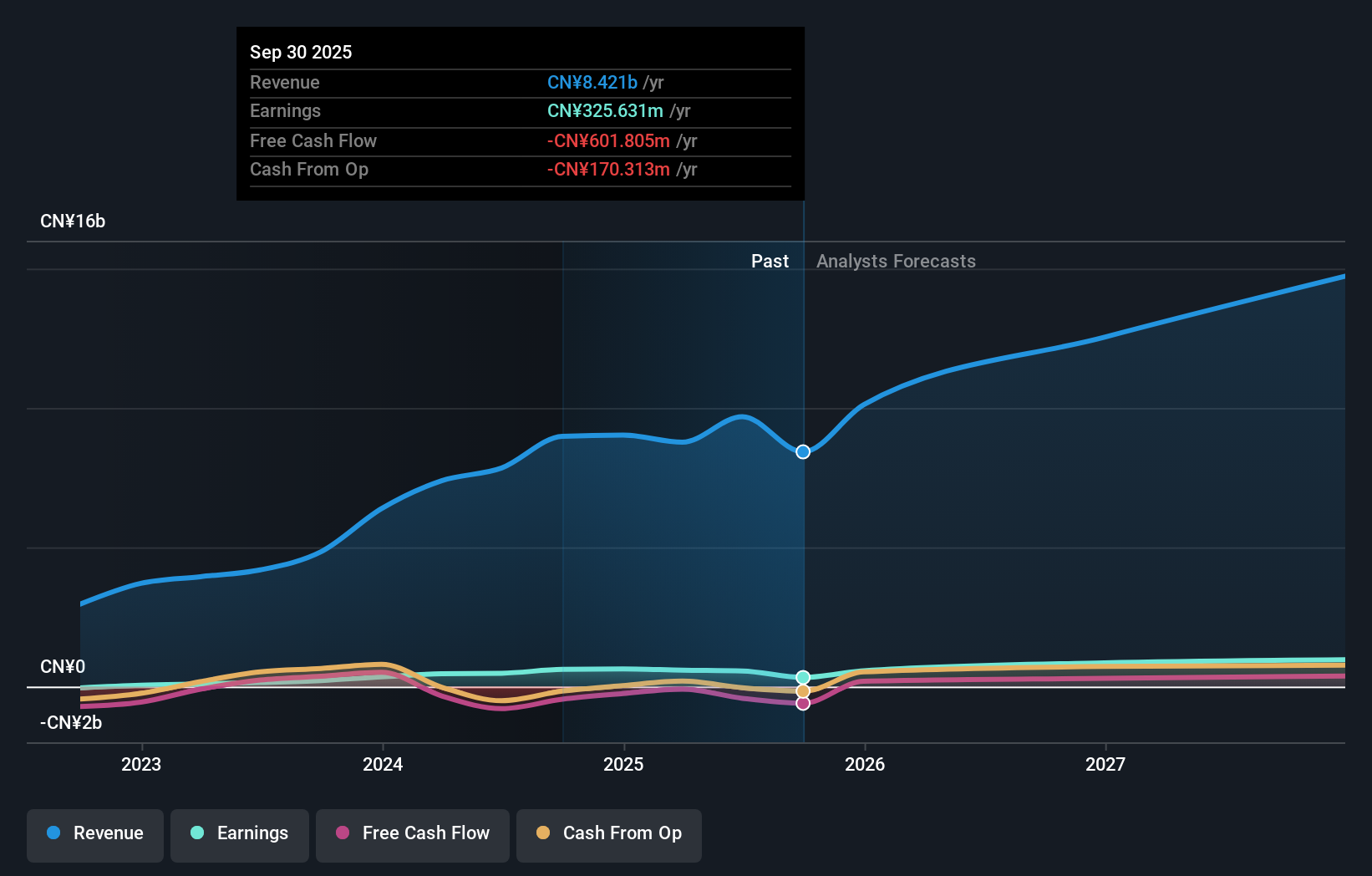

Overview: Arctech Solar Holding Co., Ltd. manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide, with a market cap of CN¥13.45 billion.

Operations: Arctech Solar Holding Co., Ltd. generates revenue through the production and distribution of solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for large-scale and commercial solar installations globally.

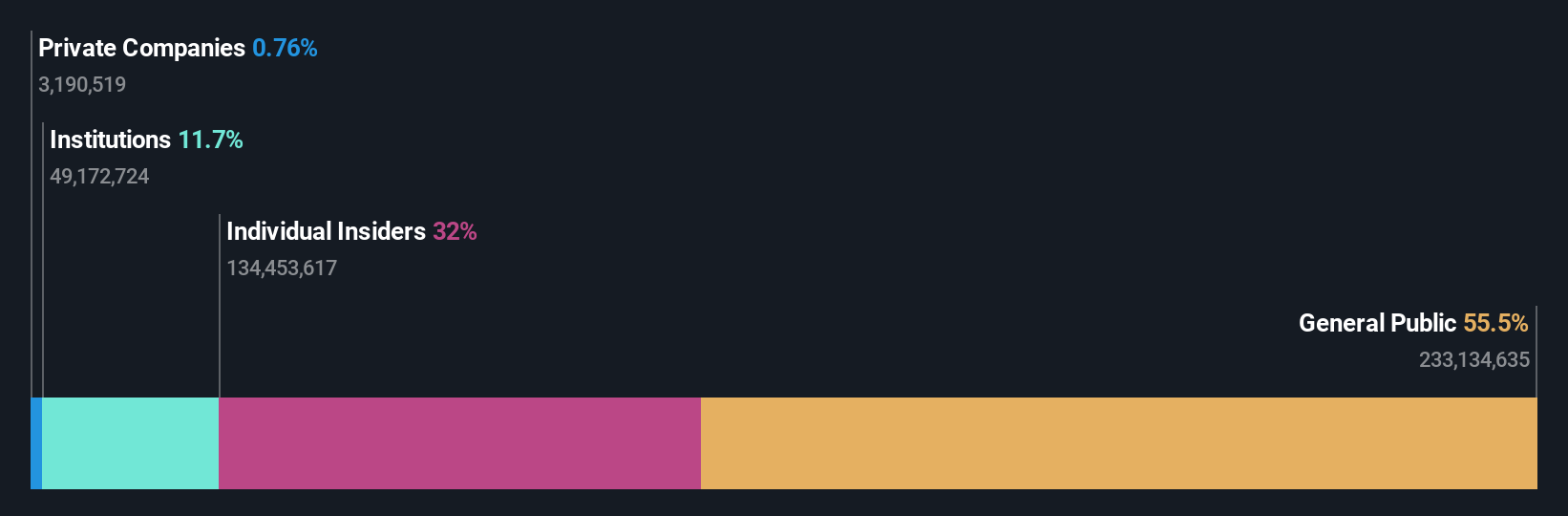

Insider Ownership: 37.9%

Earnings Growth Forecast: 25.6% p.a.

Arctech Solar Holding is experiencing robust growth, with earnings rising by 186.9% over the past year and forecasted to grow at 25.56% annually, surpassing the Chinese market average. Its recent expansion in Europe underscores its strategic positioning in a burgeoning solar market. Despite a volatile share price and a dividend yield of 0.83% not fully covered by free cash flow, it trades below fair value estimates and shows promising revenue growth potential at 19.6% per annum.

- Dive into the specifics of Arctech Solar Holding here with our thorough growth forecast report.

- Our valuation report here indicates Arctech Solar Holding may be undervalued.

Jiangxi Synergy Pharmaceutical (SZSE:300636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Synergy Pharmaceutical Co., Ltd. manufactures and sells active pharmaceutical ingredients (APIs) worldwide, with a market cap of CN¥3.24 billion.

Operations: The company generates revenue primarily through its Pharmaceutical Manufacturing segment, which accounts for CN¥730.98 million.

Insider Ownership: 32.8%

Earnings Growth Forecast: 32.9% p.a.

Jiangxi Synergy Pharmaceutical is experiencing strong growth, with earnings rising 17.4% over the past year and projected to grow significantly at 32.86% annually, outpacing the Chinese market average. Its revenue is forecasted to increase by 23.1% per year, also surpassing market expectations. The company trades at a favorable price-to-earnings ratio of 27.2x compared to the CN market's 32.8x, indicating good relative value despite low future return on equity projections (7.8%).

- Unlock comprehensive insights into our analysis of Jiangxi Synergy Pharmaceutical stock in this growth report.

- In light of our recent valuation report, it seems possible that Jiangxi Synergy Pharmaceutical is trading behind its estimated value.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1498 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Befar GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601678

Befar GroupLtd

Engages in the production, processing, and sale of organic and inorganic chemical products primarily caustic soda in China and internationally.

Reasonable growth potential slight.

Market Insights

Community Narratives