As we enter 2025, global markets have shown mixed signals with U.S. stocks closing out a strong year despite recent volatility, while economic indicators such as the Chicago PMI highlight ongoing challenges in the manufacturing sector. In this environment, identifying promising high-growth tech stocks involves looking for companies that can navigate economic fluctuations and leverage technological advancements to drive sustainable growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider in China with a market cap of CN¥7.04 billion.

Operations: Apex Software generates revenue primarily from its application software service industry, amounting to CN¥707.34 million.

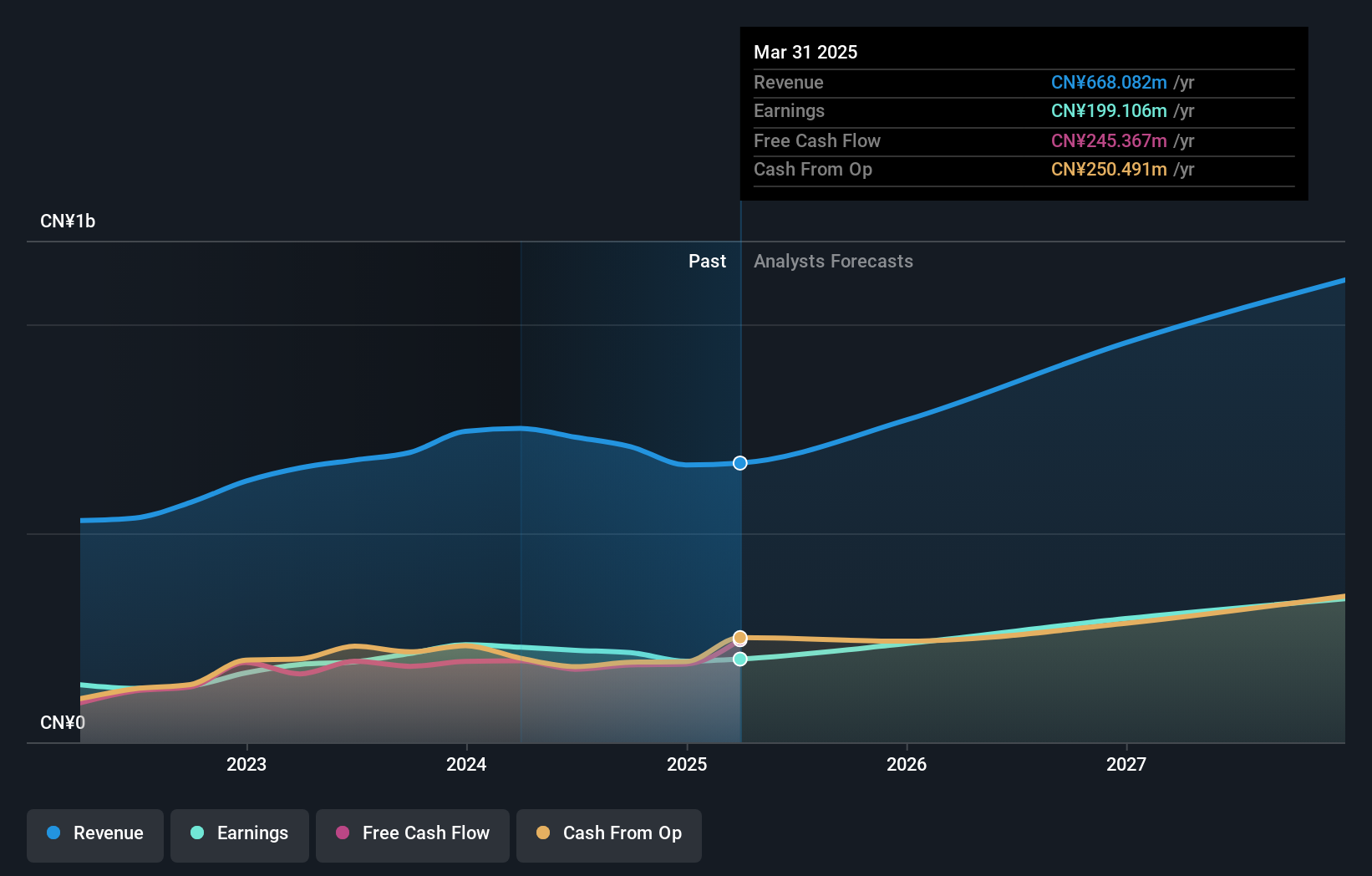

Fujian Apex Software Co., LTD, despite a recent dip in sales and net income as reported for the nine months ending September 2024, shows resilience with a revenue forecast growing at 18.1% annually, outpacing the Chinese market's 13.5%. This growth is underpinned by significant R&D investment, aligning with industry shifts towards more robust software solutions and recurring revenue models. The company's earnings are also expected to surge by 22.6% annually over the next three years, although slightly below China’s market average of 25%. With a high forecasted return on equity of 21.1%, Fujian Apex is positioning itself strongly within the competitive tech landscape through strategic focus on innovation and quality earnings, evidenced by its positive free cash flow status and consistent dividend payouts.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aoshikang Technology Co., Ltd. specializes in the research, development, production, and sale of printed circuit boards with a market capitalization of CN¥7.01 billion.

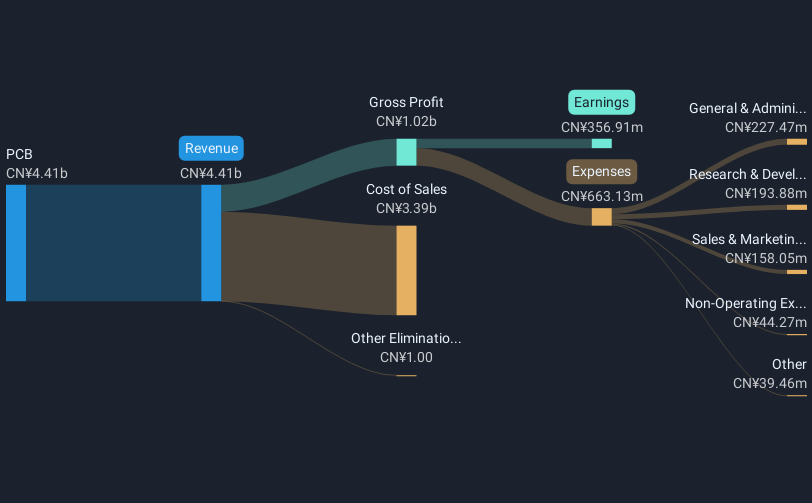

Operations: Aoshikang Technology focuses on the production and sale of printed circuit boards, generating a revenue of CN¥4.41 billion from this segment.

Aoshikang Technology, amidst corporate governance enhancements and a robust earnings report for the nine months ending September 2024, demonstrates notable resilience and potential within the tech sector. With revenues climbing to CNY 3.31 billion, up from CNY 3.22 billion year-over-year, and a strategic focus on R&D that aligns with industry demands for innovative technology solutions, the company is well-positioned to capitalize on market trends. Despite a dip in net income to CNY 278.81 million from CNY 440.52 million, its revenue growth forecast of 19% annually surpasses China's average of 13.5%, coupled with an anticipated earnings growth of approximately 30.7% per year—highlighting its potential in outpacing broader market performance.

Fujian Boss Software (SZSE:300525)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Boss Software Corp. offers software products and services in China with a market capitalization of CN¥10.77 billion.

Operations: The company generates revenue through its software products and services within China. It has a market capitalization of CN¥10.77 billion, indicating its significant presence in the industry.

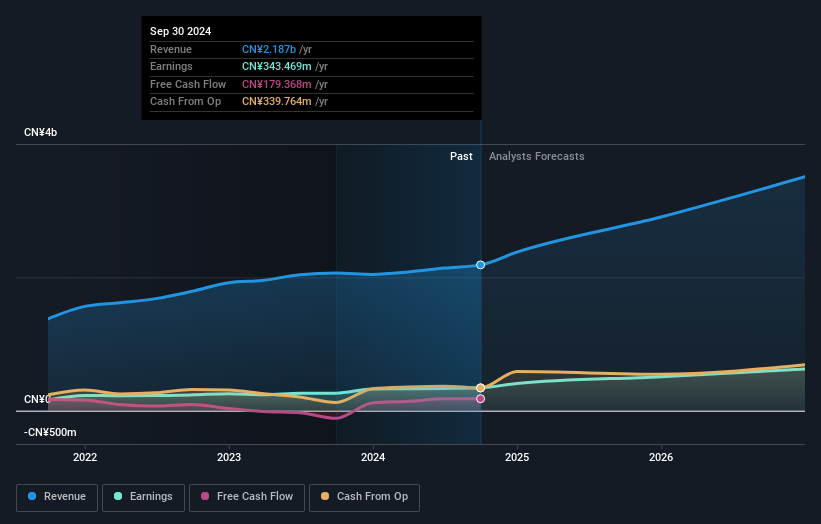

Fujian Boss Software, with its recent earnings report for the nine months ending September 2024, showcases a significant uptick in financial performance. Revenue surged to CNY 1.24 billion from CNY 1.10 billion year-over-year, while net income more than doubled to CNY 34.89 million from CNY 18.08 million, reflecting a robust annualized earnings growth of about 25%. The firm’s commitment to innovation is evident in its R&D initiatives; however, specific figures on R&D spending were not disclosed in the latest reports. This strategic emphasis on development could bolster its competitive edge in the rapidly evolving tech landscape. Additionally, Fujian Boss has actively returned value to shareholders by repurchasing shares worth CNY 77.36 million since June 2024, enhancing shareholder confidence and financial stability amidst dynamic market conditions.

- Navigate through the intricacies of Fujian Boss Software with our comprehensive health report here.

Explore historical data to track Fujian Boss Software's performance over time in our Past section.

Next Steps

- Take a closer look at our High Growth Tech and AI Stocks list of 1266 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603383

Fujian Apex SoftwareLTD

Operates as a professional platform software and information service provider company in China.

Flawless balance sheet and good value.