- China

- /

- Interactive Media and Services

- /

- SZSE:300785

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have shown mixed performances with the S&P 500 and Nasdaq Composite closing out a strong year despite some recent declines, while economic indicators like the Chicago PMI suggest challenges in manufacturing. In this environment of fluctuating indices and economic signals, identifying high growth tech stocks involves looking for companies that can navigate these conditions effectively by demonstrating resilience and innovation in their business models.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Queclink Wireless Solutions Co., Ltd. provides IoT solutions globally and has a market cap of CN¥6.18 billion.

Operations: Queclink Wireless Solutions specializes in providing IoT solutions worldwide. The company generates revenue primarily through its diverse range of IoT products and services, catering to various industries.

Queclink Wireless Solutions has demonstrated robust growth with a 23% annual increase in revenue, outpacing the CN market's 13.5%. This growth is complemented by a significant earnings surge of 46.4% over the past year, exceeding industry averages. The recent launch of the GL533CG tracker underscores Queclink's commitment to innovation, enhancing asset security and operational efficiency for businesses in challenging environments. With earnings expected to grow by 26.7% annually, Queclink is strategically positioned to capitalize on expanding market demands while maintaining technological leadership in asset tracking solutions.

- Click to explore a detailed breakdown of our findings in Queclink Wireless Solutions' health report.

Beijing Zhidemai Technology (SZSE:300785)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhidemai Technology Co., Ltd. engages in Internet information promotion activities both within China and internationally, with a market cap of CN¥6.18 billion.

Operations: Zhidemai Technology focuses on internet information promotion activities across domestic and international markets. The company operates with a market capitalization of CN¥6.18 billion, leveraging digital platforms to drive its revenue streams.

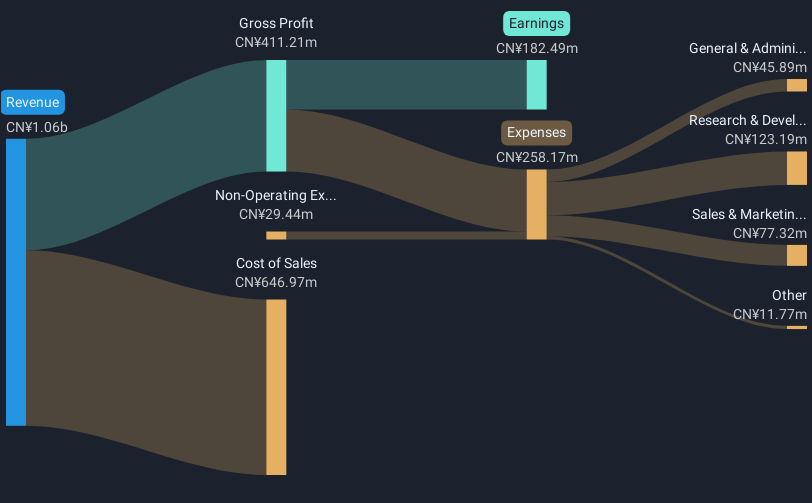

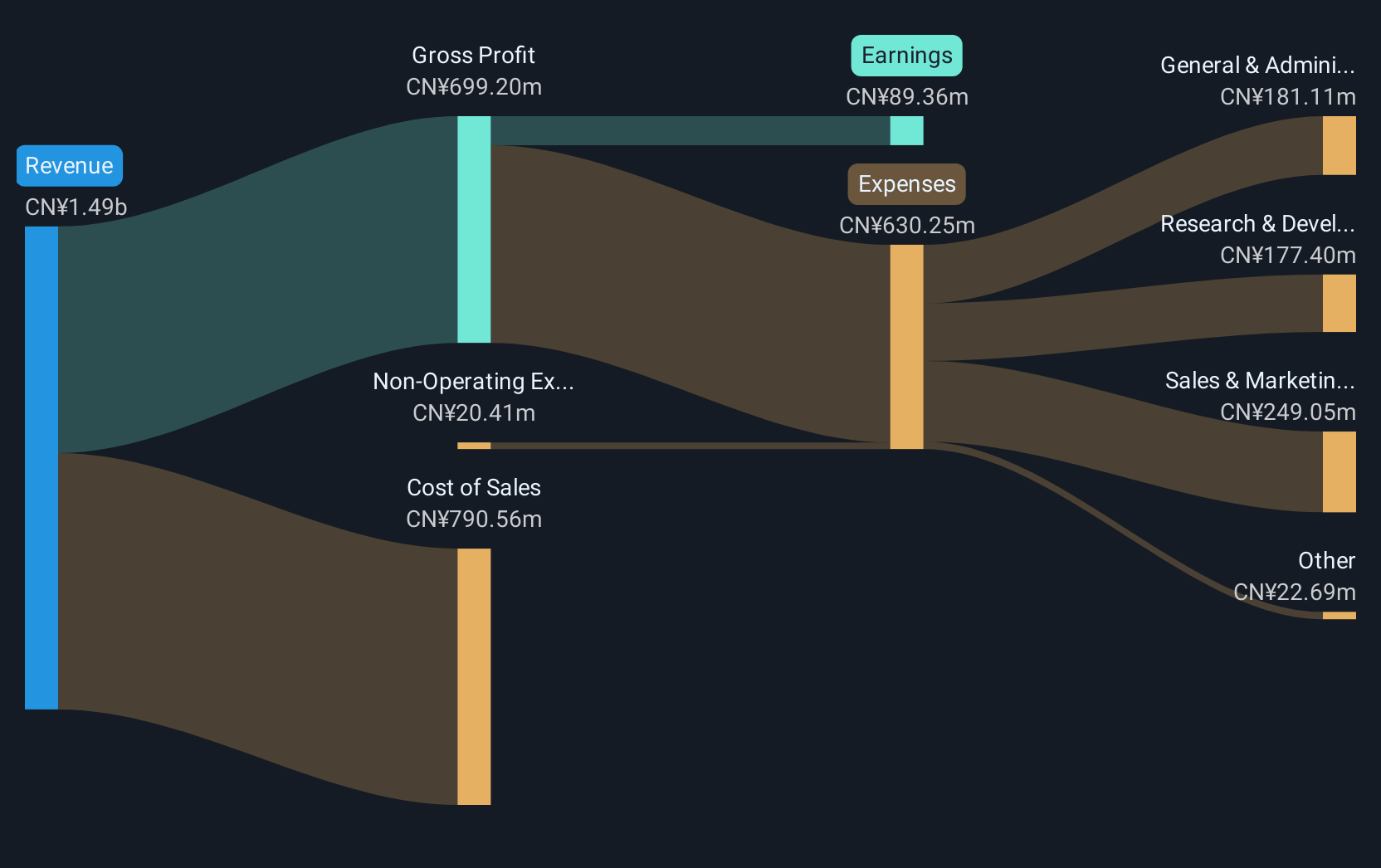

Beijing Zhidemai Technology's recent performance reflects a dynamic yet challenging landscape, with revenue climbing to CNY 1.01 billion, up from CNY 959.05 million year-over-year. Despite this growth, net income has significantly decreased to CNY 3.8 million from CNY 14.06 million, indicating pressures that overshadow the revenue upticks. The company is navigating these challenges by reshaping its governance structure and policy framework, as evidenced by recent leadership changes and amendments to its articles of association aimed at bolstering operational resilience and strategic agility in a competitive tech environment.

- Delve into the full analysis health report here for a deeper understanding of Beijing Zhidemai Technology.

Gain insights into Beijing Zhidemai Technology's past trends and performance with our Past report.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: King Slide Works Co., Ltd. specializes in the R&D, design, and sale of rail kits for servers and network communication equipment in Taiwan, with a market capitalization of NT$139.61 billion.

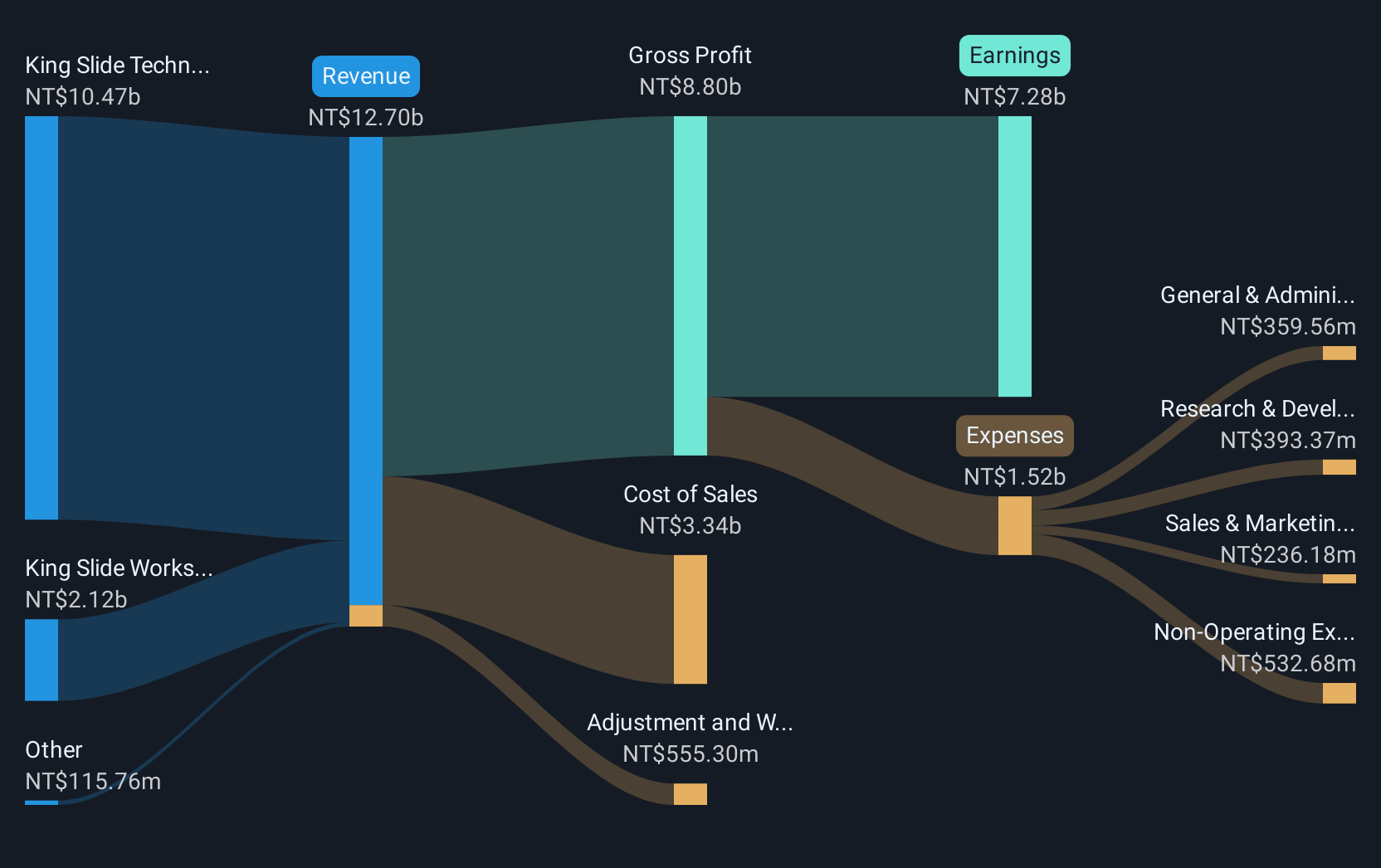

Operations: The company focuses on the R&D, design, and sale of rail kits through its subsidiaries, with Chuan Yi Company contributing NT$7.12 billion and Chuanhu Company adding NT$2.16 billion to its revenue streams.

King Slide Works has demonstrated robust growth, with its third-quarter sales more than doubling to TWD 2.58 billion from TWD 1.42 billion in the previous year, and net income also saw a significant rise to TWD 1.15 billion from TWD 982 million. This financial uptrend is backed by strategic presentations at major tech forums, suggesting a strong market engagement strategy that enhances its industry footprint. Notably, the company's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term growth in the highly competitive tech sector.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1264 more companies for you to explore.Click here to unveil our expertly curated list of 1267 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Zhidemai Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300785

Beijing Zhidemai Technology

Engages in the Internet information promotion activities in China and internationally.

Flawless balance sheet with reasonable growth potential.