- China

- /

- Aerospace & Defense

- /

- SHSE:600764

We Think China Marine Information Electronics (SHSE:600764) Can Stay On Top Of Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, China Marine Information Electronics Company Limited (SHSE:600764) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for China Marine Information Electronics

What Is China Marine Information Electronics's Debt?

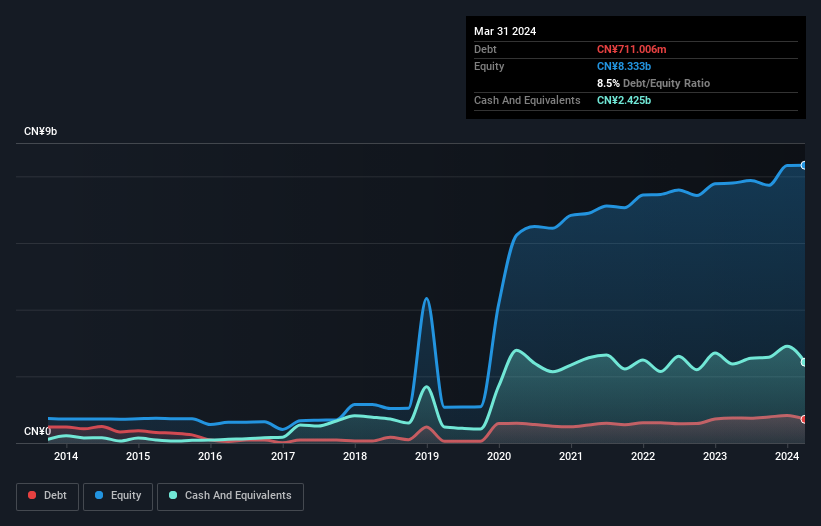

As you can see below, China Marine Information Electronics had CN¥711.0m of debt at March 2024, down from CN¥750.8m a year prior. But on the other hand it also has CN¥2.42b in cash, leading to a CN¥1.71b net cash position.

A Look At China Marine Information Electronics' Liabilities

The latest balance sheet data shows that China Marine Information Electronics had liabilities of CN¥2.66b due within a year, and liabilities of CN¥278.6m falling due after that. On the other hand, it had cash of CN¥2.42b and CN¥4.71b worth of receivables due within a year. So it actually has CN¥4.19b more liquid assets than total liabilities.

This excess liquidity is a great indication that China Marine Information Electronics' balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that China Marine Information Electronics has more cash than debt is arguably a good indication that it can manage its debt safely.

The modesty of its debt load may become crucial for China Marine Information Electronics if management cannot prevent a repeat of the 53% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine China Marine Information Electronics's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While China Marine Information Electronics has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, China Marine Information Electronics's free cash flow amounted to 25% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While it is always sensible to investigate a company's debt, in this case China Marine Information Electronics has CN¥1.71b in net cash and a decent-looking balance sheet. So we don't have any problem with China Marine Information Electronics's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for China Marine Information Electronics that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade China Marine Information Electronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600764

China Marine Information Electronics

Engages in the research and development, manufacture, and sale of electronic defense and information equipment in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives