- China

- /

- Auto Components

- /

- SHSE:603997

3 Stocks Possibly Priced Below Their Estimated Value In November 2024

Reviewed by Simply Wall St

As global markets navigate a tumultuous period marked by mixed economic signals and cautious corporate earnings, investors are keenly observing potential opportunities in undervalued stocks. With major indices experiencing fluctuations amid a busy earnings season and economic uncertainties, identifying stocks that may be priced below their estimated value could offer strategic entry points for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.24 | 49.9% |

| Elica (BIT:ELC) | €1.73 | €3.44 | 49.7% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.45 | CN¥22.89 | 50% |

| Ingenia Communities Group (ASX:INA) | A$4.70 | A$9.43 | 50.2% |

| Cosmax (KOSE:A192820) | ₩157800.00 | ₩315109.78 | 49.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥3950.00 | ¥7853.37 | 49.7% |

| EVERTEC (NYSE:EVTC) | US$33.02 | US$65.79 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.90 | €5.77 | 49.7% |

| Open Lending (NasdaqGM:LPRO) | US$6.14 | US$12.21 | 49.7% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

Let's dive into some prime choices out of the screener.

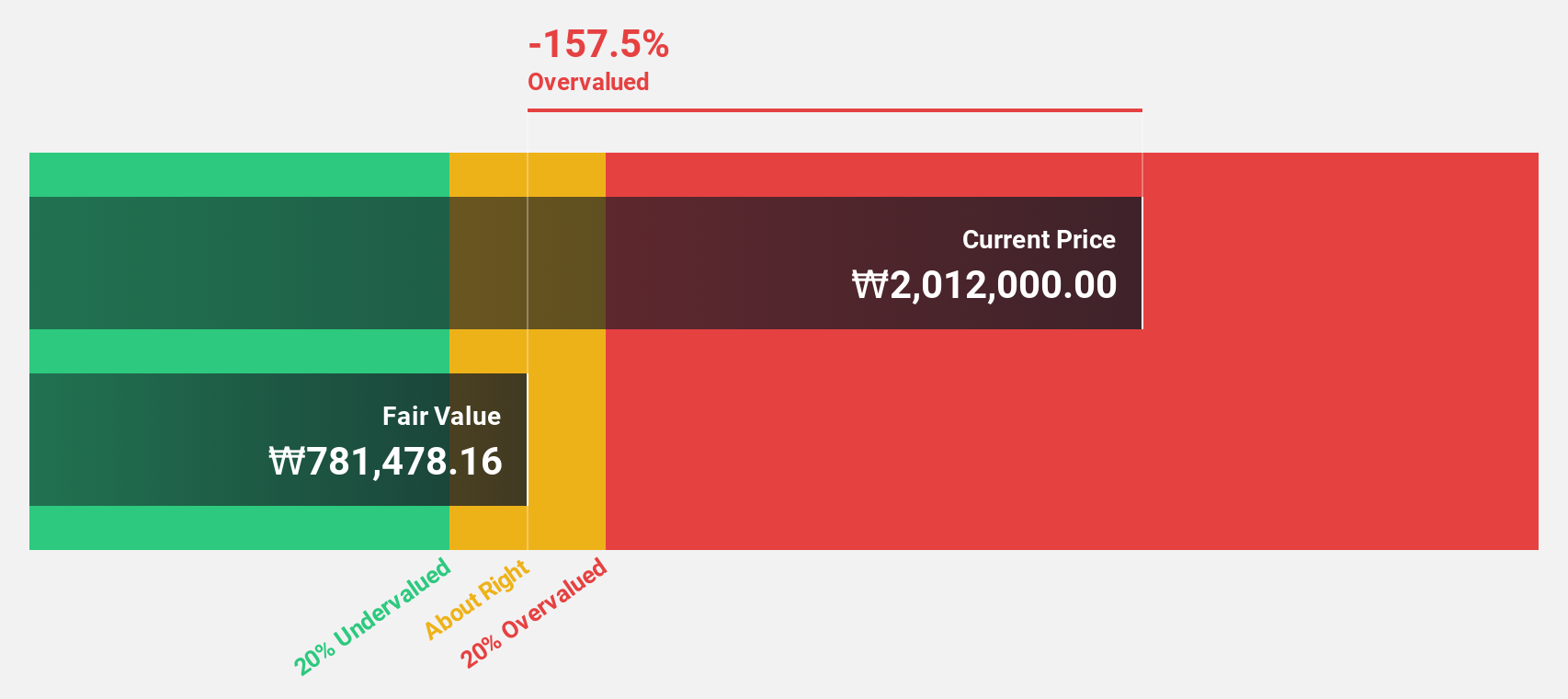

Hyosung Heavy Industries (KOSE:A298040)

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment both in South Korea and internationally, with a market cap of ₩4.13 trillion.

Operations: The company's revenue segments include Heavy Industry at ₩3.35 trillion and Construction at ₩1.78 trillion.

Estimated Discount To Fair Value: 47%

Hyosung Heavy Industries appears undervalued based on cash flows, trading at ₩450,000, significantly below its estimated fair value of ₩848,764.24. Despite debt concerns not fully covered by operating cash flow, the company shows strong potential with earnings expected to grow 36.6% annually over the next three years and a high return on equity forecast of 21.8%. Recent earnings growth of 117.9% underscores its robust financial performance amidst market conditions.

- Our growth report here indicates Hyosung Heavy Industries may be poised for an improving outlook.

- Dive into the specifics of Hyosung Heavy Industries here with our thorough financial health report.

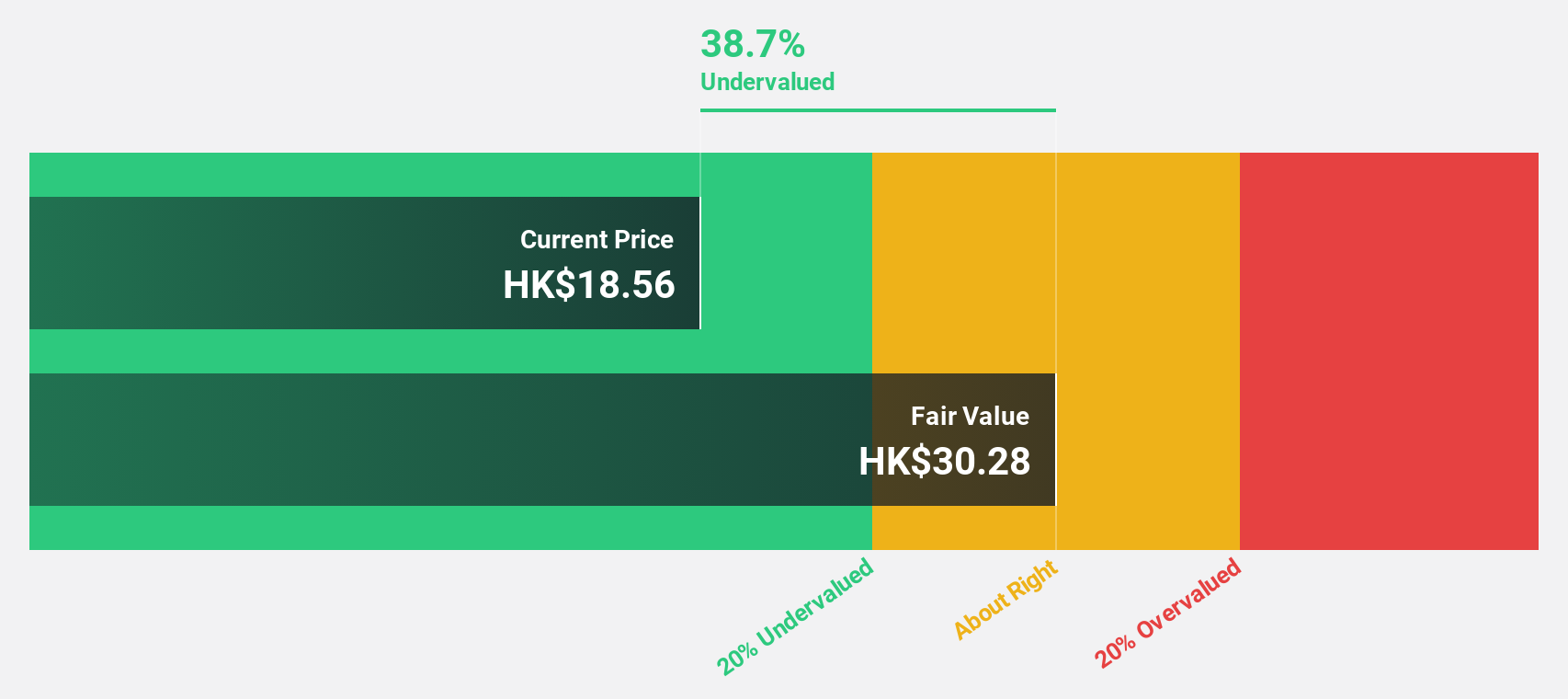

Swire Properties (SEHK:1972)

Overview: Swire Properties Limited, along with its subsidiaries, is involved in the development, ownership, and operation of mixed-use commercial properties across Hong Kong, Mainland China, the United States, and other international locations with a market cap of approximately HK$95.46 billion.

Operations: The company's revenue is primarily derived from Property Investment, which accounts for HK$14.39 billion, with additional contributions from Hotels at HK$945 million and Property Trading at HK$119 million.

Estimated Discount To Fair Value: 13.3%

Swire Properties is trading at HK$16.4, approximately 13.3% below its estimated fair value of HK$18.91, despite a decline in net income to HK$1.8 billion for H1 2024 from the previous year. The company has initiated a significant share buyback program, potentially enhancing shareholder value through improved earnings per share and net asset value per share metrics. However, profit margins have decreased significantly, and insider selling raises concerns about future performance stability amidst expected earnings growth of 25.6% annually over three years.

- The growth report we've compiled suggests that Swire Properties' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Swire Properties.

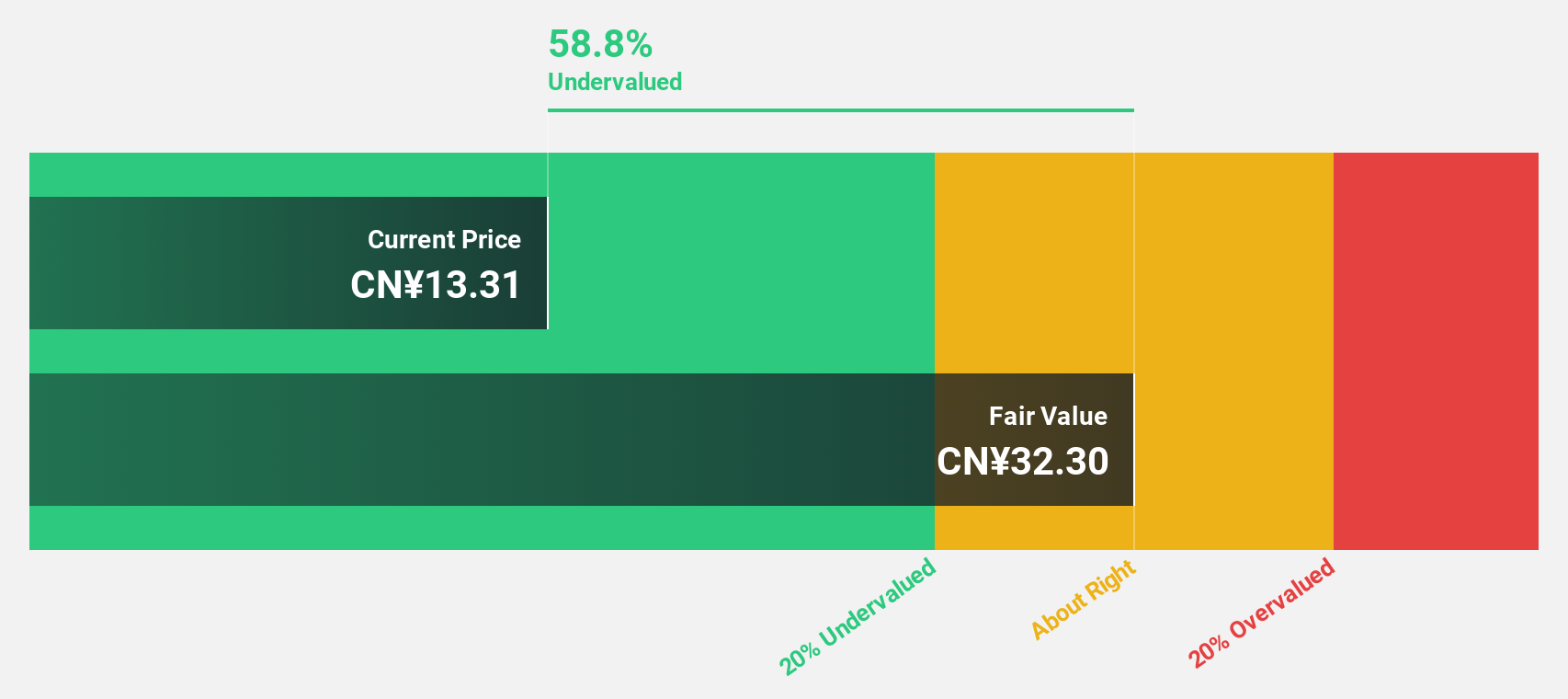

Ningbo Jifeng Auto Parts (SHSE:603997)

Overview: Ningbo Jifeng Auto Parts Co., Ltd. is a Chinese company specializing in the manufacturing of automotive interior parts, with a market cap of CN¥17.15 billion.

Operations: The company generates revenue from the production of automotive interior components in China.

Estimated Discount To Fair Value: 49.5%

Ningbo Jifeng Auto Parts is trading at CNY 13.87, significantly below its estimated fair value of CNY 27.48, despite a net loss of CNY 531.94 million for the first nine months of 2024 compared to a profit last year. Revenue growth is expected at 17.3% annually, outpacing the broader market's forecasted growth rate and suggesting potential profitability within three years, although shareholder dilution has occurred recently.

- Our comprehensive growth report raises the possibility that Ningbo Jifeng Auto Parts is poised for substantial financial growth.

- Navigate through the intricacies of Ningbo Jifeng Auto Parts with our comprehensive financial health report here.

Summing It All Up

- Unlock our comprehensive list of 956 Undervalued Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jifeng Auto Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603997

Ningbo Jifeng Auto Parts

Manufactures automotive interior parts in China.

Very undervalued with reasonable growth potential.