- China

- /

- Semiconductors

- /

- SHSE:688256

December 2024's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and geopolitical developments, growth stocks have emerged as strong performers, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. In this environment, companies with high insider ownership can offer unique insights into potential growth opportunities, as insiders may have confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Jiangsu Xinquan Automotive TrimLtd (SHSE:603179)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jiangsu Xinquan Automotive Trim Co., Ltd. is a company that designs, develops, manufactures, sells, and supplies auto parts in China with a market cap of CN¥22.51 billion.

Operations: The company generates revenue of CN¥12.86 billion from its Auto Parts & Accessories segment.

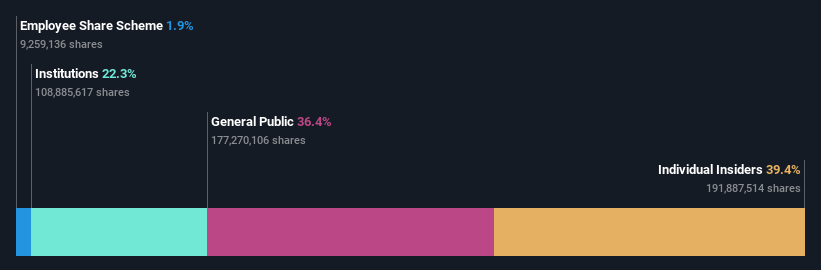

Insider Ownership: 39.4%

Revenue Growth Forecast: 22.7% p.a.

Jiangsu Xinquan Automotive Trim Ltd. is positioned for growth with a Price-To-Earnings ratio of 24.5x, below the CN market average, suggesting good value. The company forecasts revenue growth of 22.7% annually, outpacing the market's 13.8%. Recent earnings show strong performance with sales reaching CNY 9.61 billion and net income at CNY 685.58 million for nine months ending September 2024, reflecting significant year-over-year improvement in financials and earnings per share stability at CNY 1.41.

- Unlock comprehensive insights into our analysis of Jiangsu Xinquan Automotive TrimLtd stock in this growth report.

- Our valuation report here indicates Jiangsu Xinquan Automotive TrimLtd may be undervalued.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

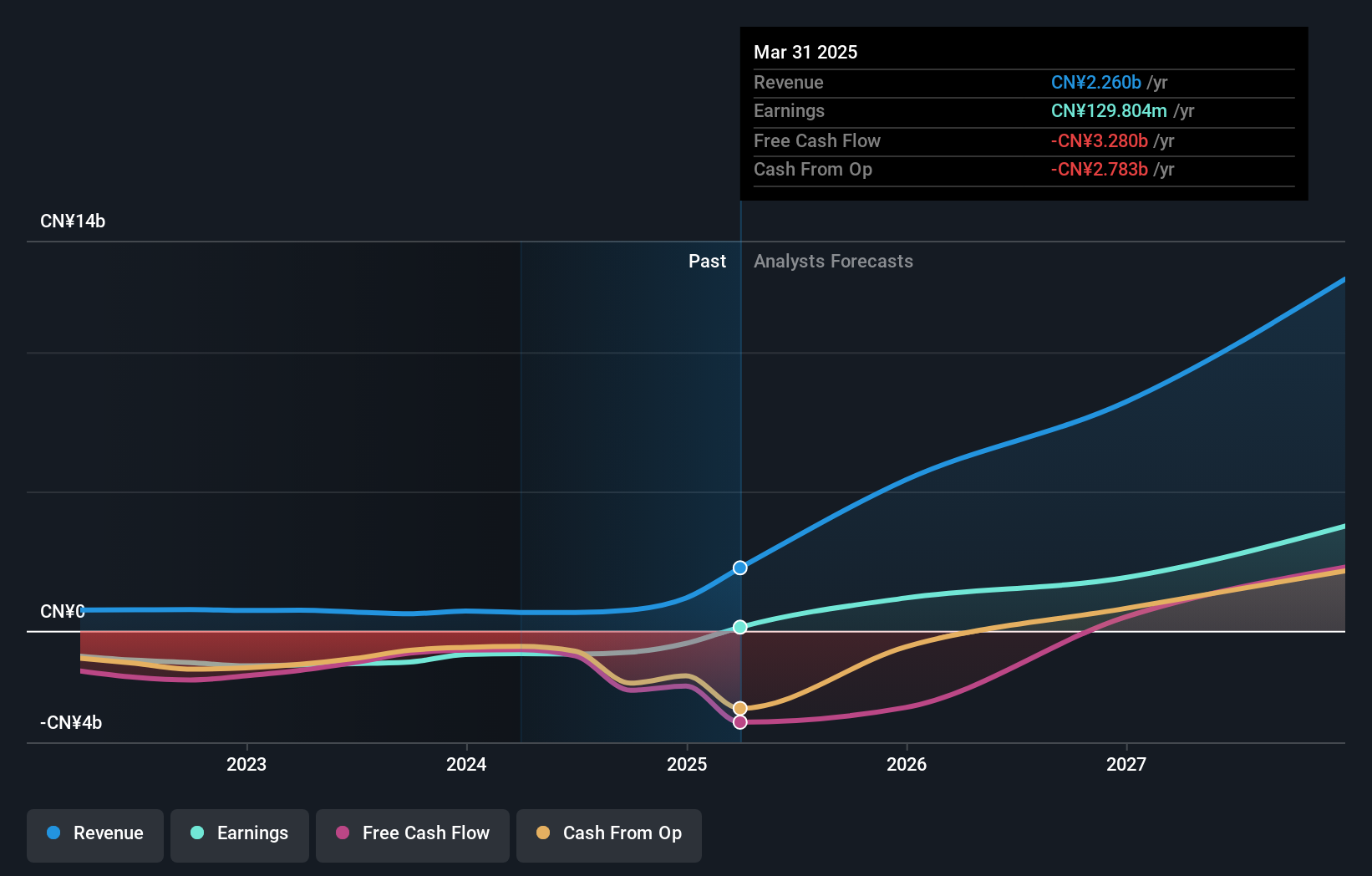

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥227.30 billion.

Operations: The company's revenue is derived from its activities in cloud server chips, edge computing, and terminal equipment segments in China.

Insider Ownership: 28.7%

Revenue Growth Forecast: 44.9% p.a.

Cambricon Technologies is forecasted to achieve significant revenue growth of 44.9% annually, surpassing the Chinese market average. Despite a current net loss of CNY 724.49 million for the nine months ending September 2024, this marks an improvement from last year's figures. The company is expected to become profitable within three years, with earnings projected to grow by 59.32% annually, indicating strong potential for future financial performance despite recent volatility and lack of insider trading activity.

- Dive into the specifics of Cambricon Technologies here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Cambricon Technologies is trading beyond its estimated value.

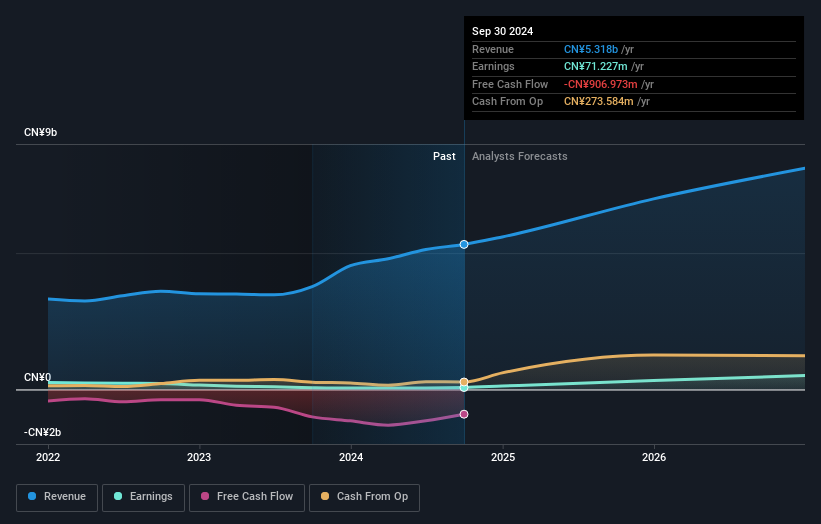

Shenzhen Highpower Technology (SZSE:001283)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Highpower Technology Co., Ltd. is involved in the research, design, development, manufacture, and sale of lithium-ion and nickel-metal hydride batteries in China with a market cap of CN¥4.21 billion.

Operations: Shenzhen Highpower Technology Co., Ltd. generates revenue primarily from the production and sale of lithium-ion and nickel-metal hydride batteries within China.

Insider Ownership: 30.1%

Revenue Growth Forecast: 19.4% p.a.

Shenzhen Highpower Technology is experiencing robust earnings growth, forecasted at 75.7% annually, outpacing the Chinese market's average. Recent earnings for the nine months ending September 2024 showed a net income increase to CNY 77.54 million from CNY 56.61 million year-over-year. The company announced a share buyback program worth up to CNY 200 million, reflecting confidence in its financial health despite low dividend coverage and interest payments not well covered by earnings.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Highpower Technology.

- The valuation report we've compiled suggests that Shenzhen Highpower Technology's current price could be inflated.

Taking Advantage

- Embark on your investment journey to our 1510 Fast Growing Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Flawless balance sheet with high growth potential.