- China

- /

- Semiconductors

- /

- SHSE:688536

Insider-Favored Growth Companies To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, marked by inflation fears and political uncertainties, investors are keenly observing how these factors impact growth stocks. With small-cap stocks underperforming and value stocks holding up better than their growth counterparts, insider ownership can be a key indicator of confidence in a company's potential amidst such volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

3Peak (SHSE:688536)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3Peak Incorporated focuses on the research, development, and sale of analog integrated circuit products both in China and internationally, with a market cap of CN¥11.31 billion.

Operations: The company's revenue from the integrated circuit industry amounts to CN¥1.13 billion.

Insider Ownership: 14.8%

Earnings Growth Forecast: 78.2% p.a.

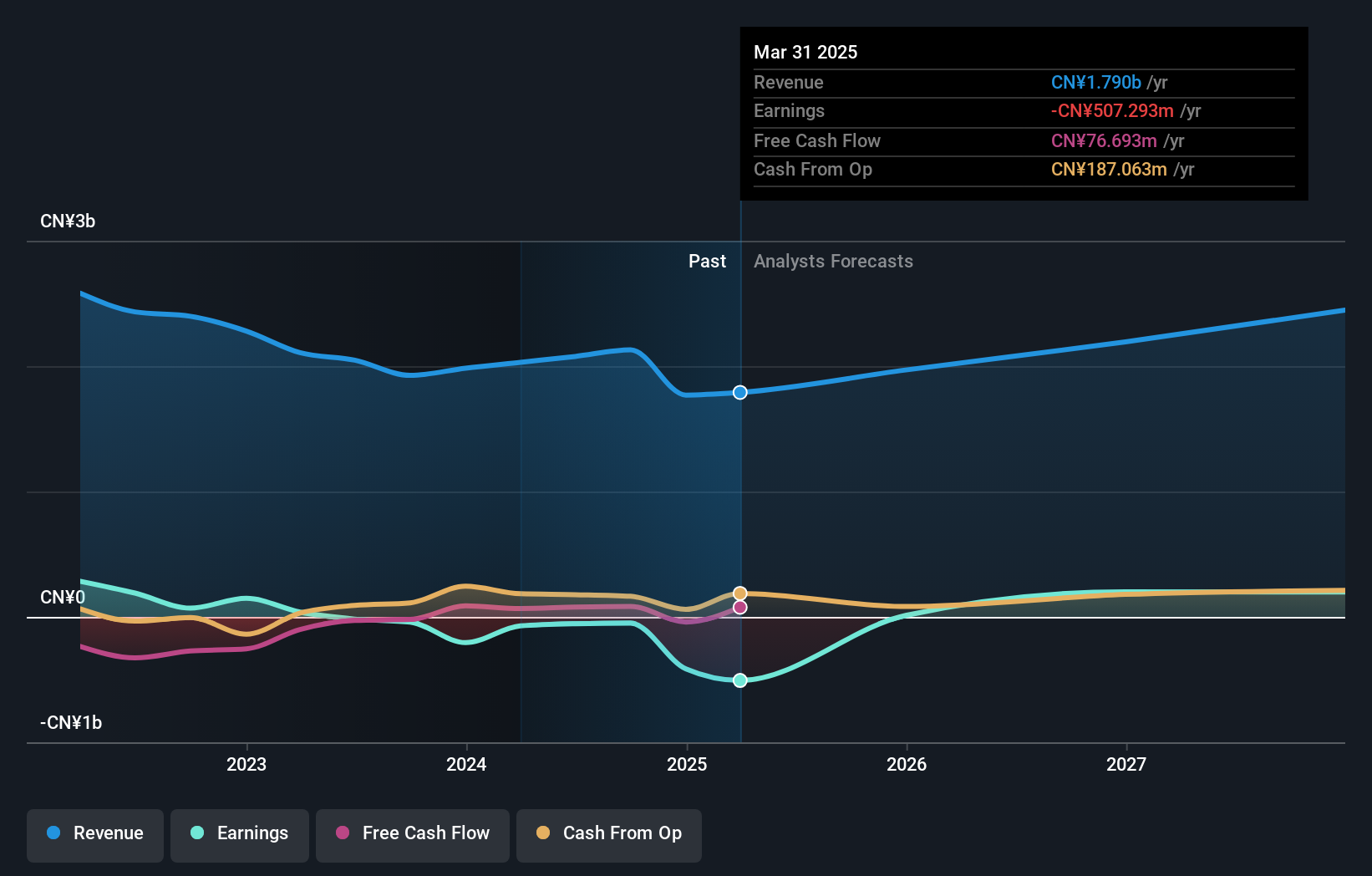

3Peak is expected to become profitable in the next three years, with revenue growth forecasted at 29% annually, outpacing the Chinese market's 13.3%. Despite a recent net loss of CNY 98.73 million for the first nine months of 2024, analysts agree on a potential stock price increase of 48%. However, its return on equity is projected to remain low at 5.9%, and there has been no substantial insider trading activity recently.

- Navigate through the intricacies of 3Peak with our comprehensive analyst estimates report here.

- The analysis detailed in our 3Peak valuation report hints at an deflated share price compared to its estimated value.

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and institutions in China and internationally, with a market cap of CN¥16.93 billion.

Operations: The company generates revenue of CN¥5.47 billion from its information security industry segment, providing cybersecurity solutions to a diverse clientele both domestically and abroad.

Insider Ownership: 22%

Earnings Growth Forecast: 38.2% p.a.

Qi An Xin Technology Group is trading significantly below its estimated fair value, with earnings projected to grow at 38.2% annually, surpassing the Chinese market's average. Despite a net loss of CNY 1.18 billion for the first nine months of 2024, revenue growth is expected at 14.7% per year. The company recently held shareholder meetings but reported no substantial insider trading activity over the past three months. Return on equity remains forecasted low at 3.8%.

- Dive into the specifics of Qi An Xin Technology Group here with our thorough growth forecast report.

- Our valuation report unveils the possibility Qi An Xin Technology Group's shares may be trading at a premium.

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd., with a market cap of CN¥11.33 billion, operates in the technology sector focusing on providing intelligent information solutions.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for SDIC Intelligence Xiamen Information Co., Ltd. If you can provide the revenue data, I would be happy to help summarize it for you.

Insider Ownership: 28.6%

Earnings Growth Forecast: 65.7% p.a.

SDIC Intelligence Xiamen Information is experiencing strong revenue growth, with sales reaching CNY 897.38 million for the first nine months of 2024, up from CNY 750.49 million a year ago. The company reduced its net loss to CNY 241.83 million and aims for profitability within three years, with earnings expected to grow at an impressive rate of over 65% annually. Despite low forecasted return on equity, insider trading activity remains minimal in recent months.

- Unlock comprehensive insights into our analysis of SDIC Intelligence Xiamen Information stock in this growth report.

- According our valuation report, there's an indication that SDIC Intelligence Xiamen Information's share price might be on the expensive side.

Summing It All Up

- Delve into our full catalog of 1444 Fast Growing Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if 3Peak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688536

3Peak

Engages in the research and development, and sale of analog integrated circuit products in China and internationally.

Flawless balance sheet with high growth potential.