- Chile

- /

- Water Utilities

- /

- SNSE:ESSBIO-C

We Think That There Are More Issues For Essbio (SNSE:ESSBIO-C) Than Just Sluggish Earnings

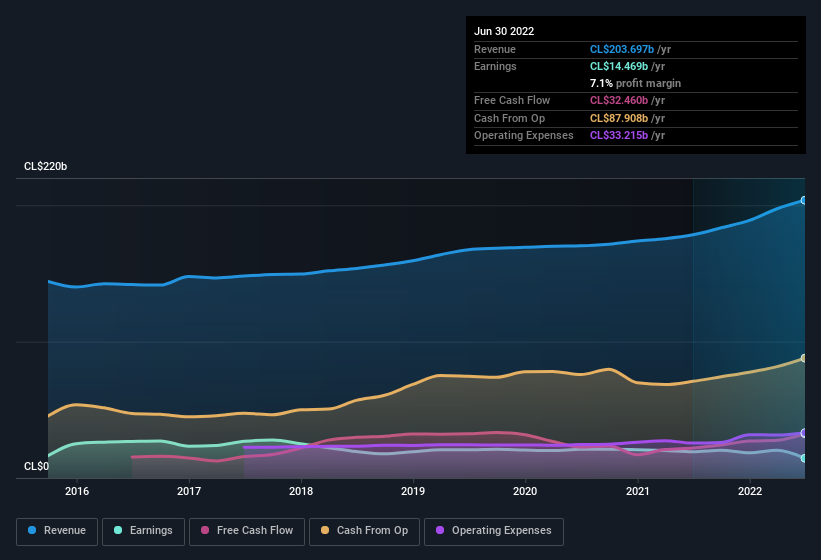

Essbio S.A.'s (SNSE:ESSBIO-C) recent weak earnings report didn't cause a big stock movement. However, we believe that investors should be aware of some underlying factors which may be of concern.

See our latest analysis for Essbio

An Unusual Tax Situation

We can see that Essbio received a tax benefit of CL$5.3b. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Essbio.

Our Take On Essbio's Profit Performance

Essbio reported that it received a tax benefit, rather than paid tax, in its last report. Given that sort of benefit is not recurring, a focus on the statutory profit might make the company seem better than it really is. Because of this, we think that it may be that Essbio's statutory profits are better than its underlying earnings power. The good news is that its earnings per share increased slightly in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Essbio, you'd also look into what risks it is currently facing. Case in point: We've spotted 4 warning signs for Essbio you should be mindful of and 2 of them are significant.

Today we've zoomed in on a single data point to better understand the nature of Essbio's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Essbio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ESSBIO-C

Essbio

Primarily engages in the provision of sanitation services in Chile.

Proven track record second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion