Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see SMU S.A. (SNSE:SMU) is about to trade ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 1st of February will not receive this dividend, which will be paid on the 5th of February.

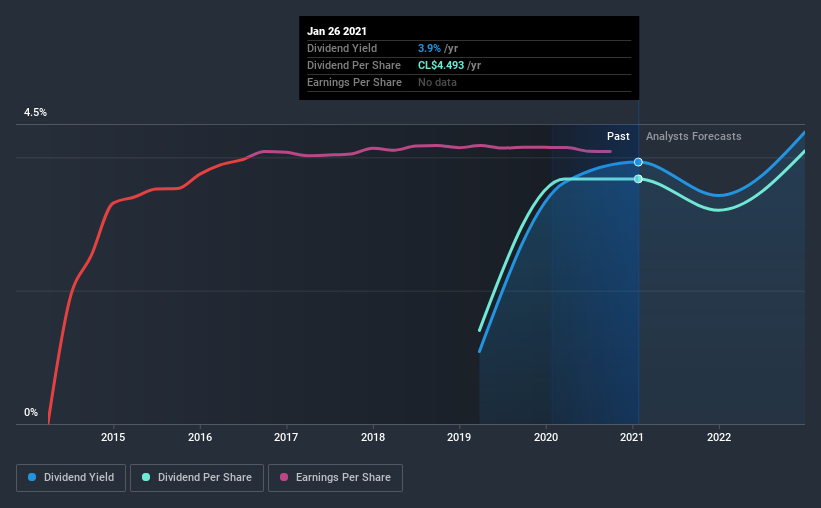

SMU's upcoming dividend is CL$1.84 a share, following on from the last 12 months, when the company distributed a total of CL$4.49 per share to shareholders. Based on the last year's worth of payments, SMU stock has a trailing yield of around 3.9% on the current share price of CLP114.37. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for SMU

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. SMU distributed an unsustainably high 128% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Thankfully its dividend payments took up just 26% of the free cash flow it generated, which is a comfortable payout ratio.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and SMU fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see SMU has grown its earnings rapidly, up 54% a year for the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. SMU has delivered an average of 62% per year annual increase in its dividend, based on the past two years of dividend payments. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Should investors buy SMU for the upcoming dividend? It's good to see earnings per share growing and low cashflow payout ratio, although we're uncomfortable with SMU's paying out such a high percentage of its profit. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of SMU's dividend merits.

In light of that, while SMU has an appealing dividend, it's worth knowing the risks involved with this stock. For instance, we've identified 4 warning signs for SMU (1 doesn't sit too well with us) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade SMU, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:SMU

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026