Kudelski SA (VTX:KUD) Analysts Are Reducing Their Forecasts For This Year

The analysts covering Kudelski SA (VTX:KUD) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

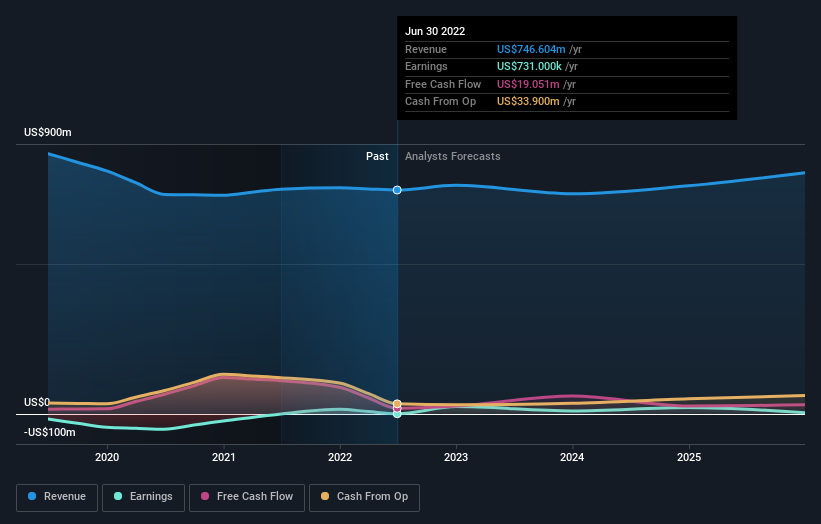

Following the latest downgrade, Kudelski's two analysts currently expect revenues in 2023 to be US$735m, approximately in line with the last 12 months. Statutory earnings per share are presumed to soar 884% to US$0.13. Previously, the analysts had been modelling revenues of US$821m and earnings per share (EPS) of US$0.28 in 2023. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a pretty serious decline to earnings per share numbers as well.

Check out our latest analysis for Kudelski

The consensus price target fell 5.4% to CHF2.27, with the weaker earnings outlook clearly leading analyst valuation estimates. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Kudelski, with the most bullish analyst valuing it at CHF2.50 and the most bearish at CHF1.87 per share. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. One thing that stands out from these estimates is that shrinking revenues are expected to moderate over the period ending 2023 compared to the historical decline of 7.2% per annum over the past five years. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 7.9% annually. So while a broad number of companies are forecast to grow, unfortunately Kudelski is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Kudelski's revenues are expected to grow slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Kudelski.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kudelski might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:KUD

Kudelski

Provides digital access and security solutions for digital television and interactive applications in Switzerland, the United States, France, Germany, Austria, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)