Will Management Restructuring and AI Focus Transform ALSO Holding's (SWX:ALSN) Investment Narrative?

Reviewed by Sasha Jovanovic

- ALSO Holding AG recently announced a major restructuring of its Group Management Board, reducing its size from eight to four members and appointing Wolfgang Krainz as CEO to lead the new team.

- This shift is aimed at streamlining decision-making, enhancing operational efficiency through increased use of AI, and empowering local subsidiaries for quicker market responses.

- We'll explore how this management overhaul and focus on digital platform expansion could shape ALSO Holding's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is ALSO Holding's Investment Narrative?

For anyone considering ALSO Holding, the real conviction lies in believing the company can turn a tighter, more agile management team into faster innovation and execution, especially as digital transformation and AI investments expand. The recent board reshuffling, halving the Group Management Board and appointing Wolfgang Krainz as CEO, is a clear step towards operational streamlining and empowering local teams, which could be positive for short-term delivery and accountability. Yet, past analyst analysis called out concerns around management inexperience and limited board refreshment, both of which may be directly addressed by this strategic overhaul. Importantly, the focus on platform growth and efficiency may shift some near-term catalysts toward technology integration and cloud-driven services, but it also elevates execution risk during the transition. Given recent price weakness, investors should weigh how material these changes may prove in practice.

However, with new faces leading rapid change, uncertainty around execution risk remains something investors should not overlook.

Exploring Other Perspectives

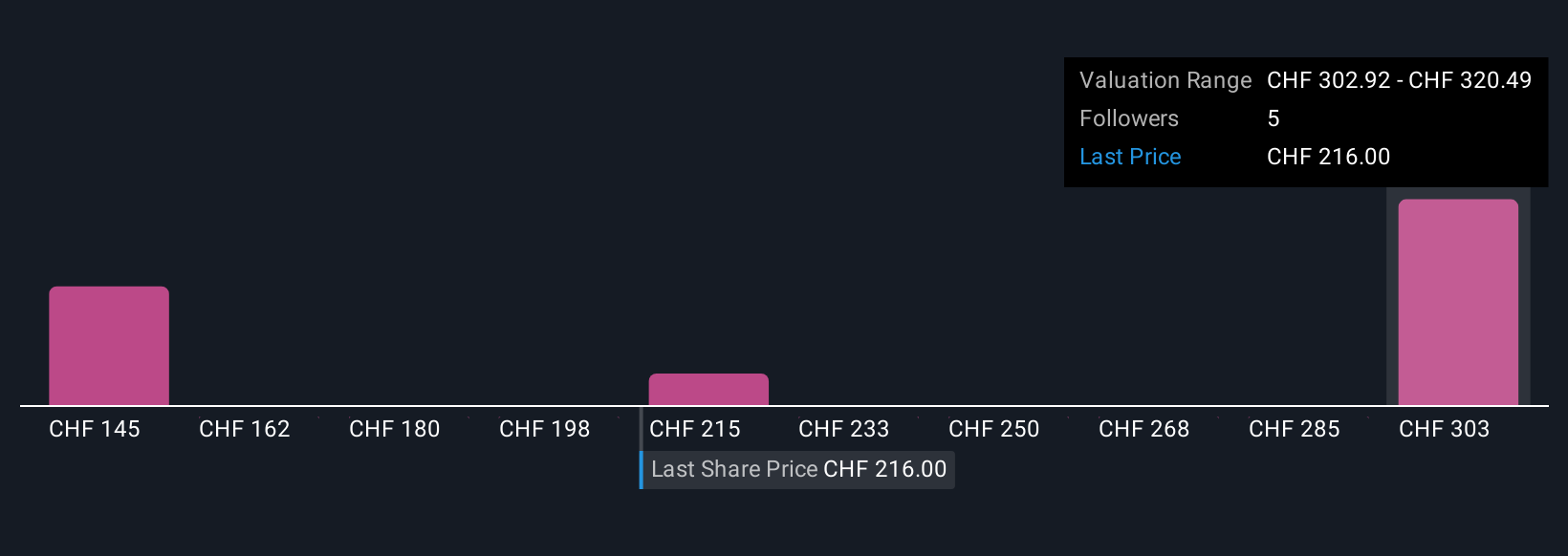

Explore 3 other fair value estimates on ALSO Holding - why the stock might be worth as much as 39% more than the current price!

Build Your Own ALSO Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ALSO Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ALSO Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ALSO Holding's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALSN

ALSO Holding

Operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)