- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche (SWX:ROG) Valuation After FDA Expansion of PATHWAY and VENTANA HER2 Diagnostic Test Uses

Reviewed by Simply Wall St

Roche Holding (SWX:ROG) just picked up an FDA win for expanded use of its PATHWAY anti HER2 and VENTANA HER2 tests, widening the pool of metastatic breast cancer patients eligible for ENHERTU based on more granular HER2 profiling.

See our latest analysis for Roche Holding.

That FDA nod slots into a busy few weeks for Roche, with new oncology and diagnostics data out of major conferences and fresh European approvals helping underpin a roughly 24.6% 3 month share price return and 29.8% 1 year total shareholder return, suggesting positive momentum is building.

If this kind of pipeline progress has your attention, it is also worth exploring other innovative names in the sector through our curated healthcare stocks.

Yet with shares already near analyst targets but still trading at a steep discount to some intrinsic value estimates, investors now have to ask: is Roche a buy on underappreciated growth, or has the market caught up?

Most Popular Narrative: 3.2% Overvalued

With Roche shares closing near CHF 321.90 against a narrative fair value around CHF 312, the story hinges on how far future earnings can stretch this gap.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, down from 24.3x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 30.9x.

Curious how modest growth, rising margins, and a lower future earnings multiple still add up to a richer valuation than today? The narrative connects these moving pieces in a way that might surprise you, but the real twist is how much faith it puts in Roche’s long term earnings power and competitive moat. Want to see the full logic behind that stance before you decide where you stand?

Result: Fair Value of $312 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, meaningful biosimilar erosion after 2026 and ongoing China pricing pressure could quickly undermine those optimistic earnings assumptions and compress Roche’s valuation.

Find out about the key risks to this Roche Holding narrative.

Another View: Market Ratio Says Cheap, Not Rich

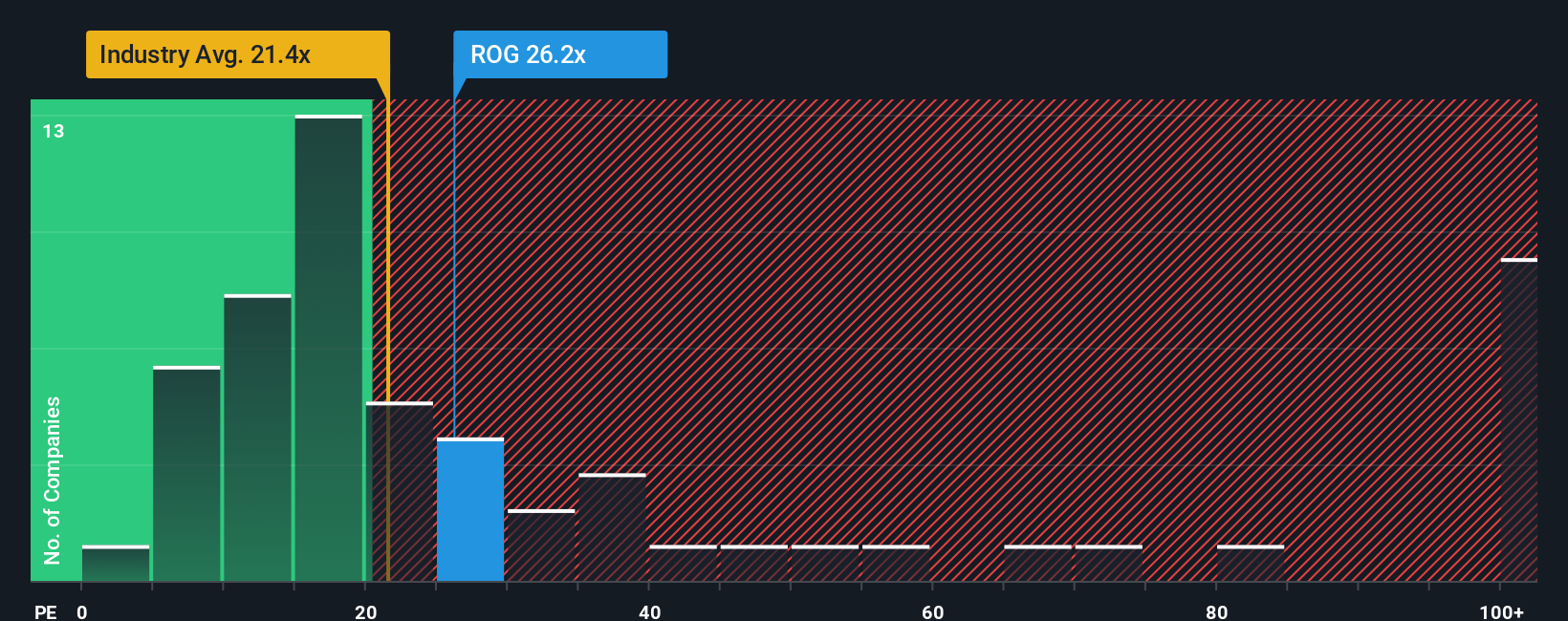

While the narrative fair value suggests Roche is about 3.2% overvalued, our earnings based valuation tells a different story. At roughly 29 times earnings versus a fair ratio of 36.7 times and peers at 81.2 times, the shares screen as materially cheaper than both fair value and competitors. Is the market underestimating Roche’s staying power, or simply pricing in more risk than the models suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roche Holding Narrative

If you see the story differently and would rather dig into the numbers yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing move?

Before the market prices in the next wave of winners, use the Simply Wall Street Screener to surface high conviction ideas that match your strategy and risk profile.

- Capture potential multi baggers early by targeting these 3612 penny stocks with strong financials that already back their low prices with real financial strength.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks that blend medical innovation with data driven intelligence.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that can support attractive yields without sacrificing balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)