- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

European Stocks That May Be Undervalued In April 2025

Reviewed by Simply Wall St

As European markets grapple with fresh U.S. trade tariffs and mixed economic signals, the pan-European STOXX Europe 600 Index recently closed about 1.4% lower, reflecting a challenging environment for investors. Despite these headwinds, opportunities may exist in stocks that are perceived as undervalued, particularly those that could benefit from a resilient private sector or favorable geopolitical developments.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Airbus (ENXTPA:AIR) | €162.74 | €316.82 | 48.6% |

| Cenergy Holdings (ENXTBR:CENER) | €9.15 | €17.78 | 48.5% |

| Vimi Fasteners (BIT:VIM) | €0.995 | €1.94 | 48.6% |

| ArcticZymes Technologies (OB:AZT) | NOK16.32 | NOK32.43 | 49.7% |

| Melhus Sparebank (OB:MELG) | NOK167.00 | NOK329.29 | 49.3% |

| Pluxee (ENXTPA:PLX) | €18.858 | €36.78 | 48.7% |

| F-Secure Oyj (HLSE:FSECURE) | €1.806 | €3.51 | 48.5% |

| Fodelia Oyj (HLSE:FODELIA) | €7.00 | €13.91 | 49.7% |

| IONOS Group (XTRA:IOS) | €26.35 | €51.43 | 48.8% |

| Petrolia NOCO (OTCNO:PNO) | NOK0.75 | NOK1.45 | 48.3% |

Let's review some notable picks from our screened stocks.

Figeac Aero Société Anonyme (ENXTPA:FGA)

Overview: Figeac Aero Société Anonyme manufactures, supplies, and sells equipment and sub-assemblies for the aeronautics sector in France with a market cap of €385.59 million.

Operations: The company's revenue is primarily derived from Aerostructures & Aeromotors at €382.40 million, complemented by Diversification Activities contributing €33.50 million.

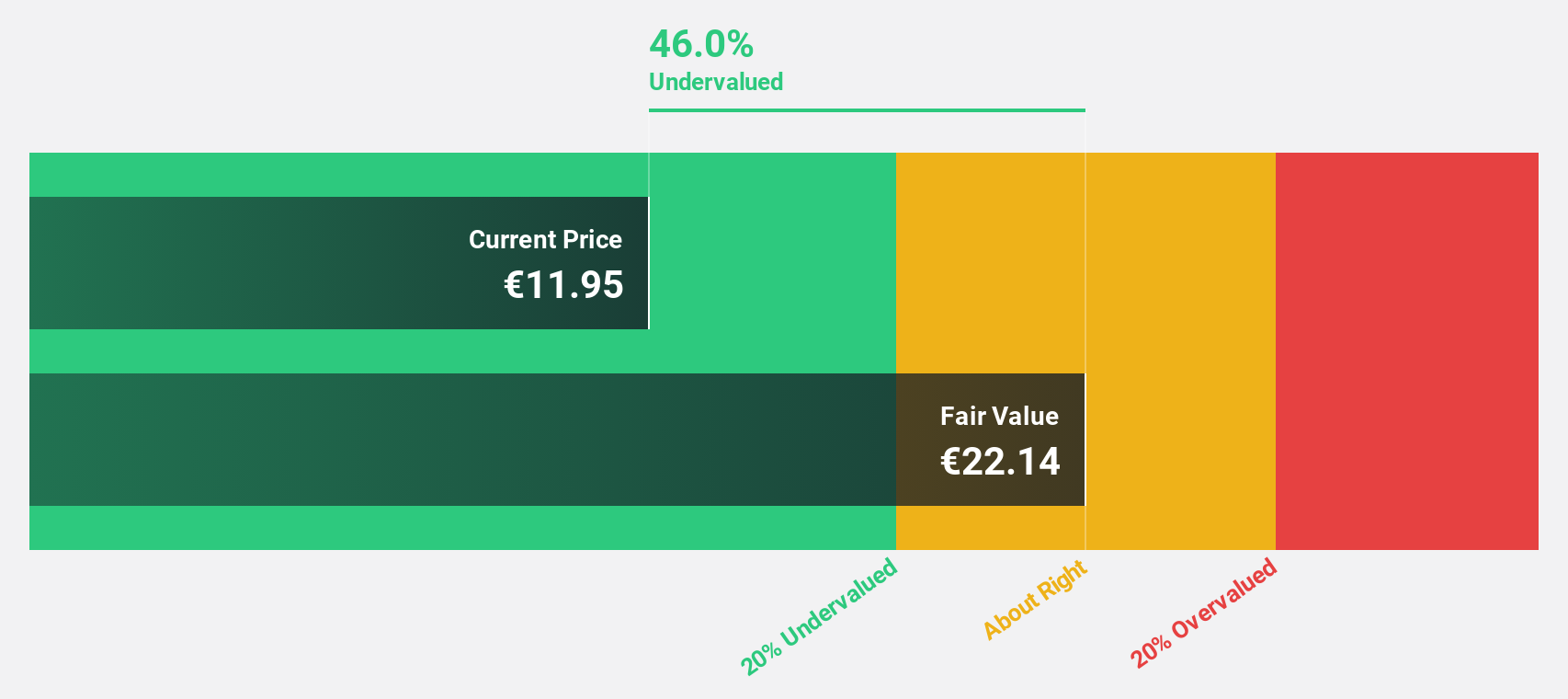

Estimated Discount To Fair Value: 35.9%

Figeac Aero Société Anonyme is trading at €9.10, significantly below its estimated fair value of €14.20, suggesting potential undervaluation based on discounted cash flows. Recent contracts with Textron Aviation Defense and GKN Aerospace highlight strategic growth in North America without requiring significant new investments, optimizing existing capacity and enhancing cash flow management. Earnings have grown 27.7% annually over the past five years, with revenue expected to outpace the French market's growth rate of 5.8% per year.

- Insights from our recent growth report point to a promising forecast for Figeac Aero Société Anonyme's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Figeac Aero Société Anonyme.

PolyPeptide Group (SWX:PPGN)

Overview: PolyPeptide Group AG is a contract development and manufacturing company operating in Europe, the United States, and India with a market cap of CHF555.66 million.

Operations: The company's revenue segments include Custom Projects (€118.15 million), Contract Manufacturing (€174.18 million), and Generics and Cosmetics (€44.47 million).

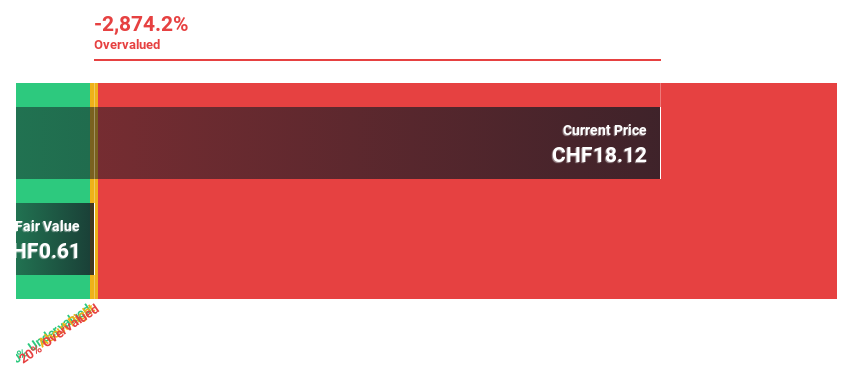

Estimated Discount To Fair Value: 17.7%

PolyPeptide Group is trading at CHF16.84, below its estimated fair value of CHF20.45, indicating potential undervaluation based on cash flows. The company forecasts accelerated revenue growth of 10% to 20% for 2025 and expects profitability within three years, outpacing average market growth. Strategic expansions in Sweden and a partnership with Cytovance Biologics aim to enhance capacity and efficiency, despite recent leadership changes potentially affecting short-term stability.

- In light of our recent growth report, it seems possible that PolyPeptide Group's financial performance will exceed current levels.

- Dive into the specifics of PolyPeptide Group here with our thorough financial health report.

Semperit Holding (WBAG:SEM)

Overview: Semperit Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €296.26 million.

Operations: The company's revenue segments include €383.06 million from Semperit Engineered Applications and €293.74 million from Semperit Industrial Applications.

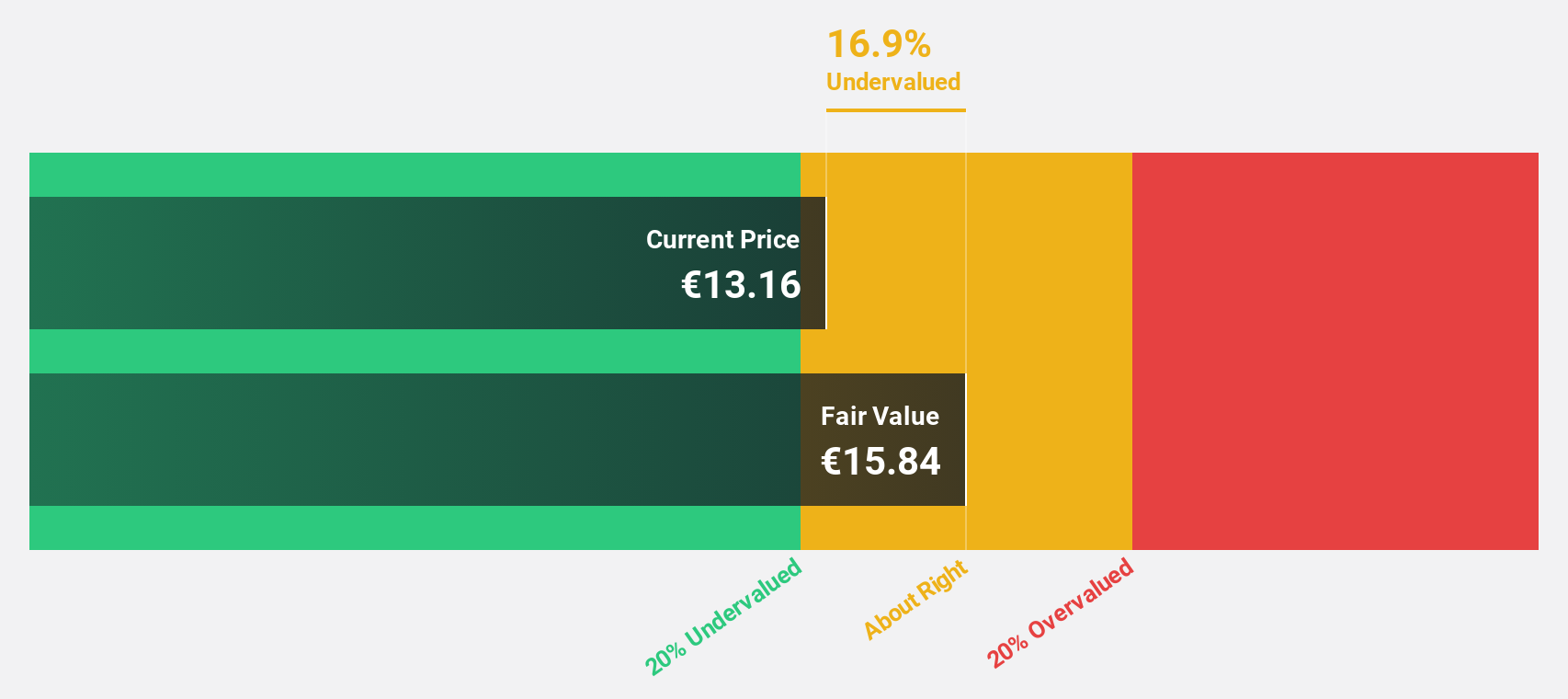

Estimated Discount To Fair Value: 43.8%

Semperit Holding is trading at €14.4, considerably below its estimated fair value of €25.63, highlighting potential undervaluation based on cash flows. Despite a slight decline in annual revenue to €664.13 million for 2024, the company transitioned from a net loss to a net income of €11.5 million year-over-year, reflecting improved profitability prospects with earnings expected to grow significantly above market rates over the next three years. However, dividend coverage remains weak and profit margins have decreased compared to last year.

- Our earnings growth report unveils the potential for significant increases in Semperit Holding's future results.

- Click to explore a detailed breakdown of our findings in Semperit Holding's balance sheet health report.

Where To Now?

- Investigate our full lineup of 198 Undervalued European Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential and good value.

Market Insights

Community Narratives