- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

Ajman Bank PJSC And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate rate cuts and fluctuating indices, investors are increasingly looking for opportunities beyond the usual large-cap stocks. Penny stocks, while an older term, remain relevant as they represent smaller or less-established companies that can offer significant value and growth potential. By focusing on those with strong financials and promising growth trajectories, investors may uncover hidden gems in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.86M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,766 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services in the United Arab Emirates, with a market capitalization of AED4.60 billion.

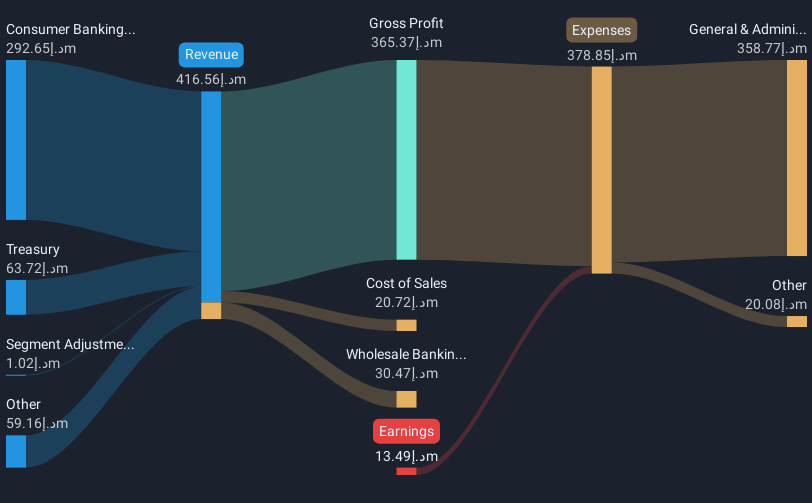

Operations: Ajman Bank PJSC generates its revenue from various segments, including Treasury (AED63.72 million), Consumer Banking (AED292.65 million), and Wholesale Banking (-AED30.47 million).

Market Cap: AED4.6B

Ajman Bank PJSC, with a market cap of AED4.60 billion, has shown improved financial performance recently, reporting a net income of AED74 million for Q3 2024 compared to a loss the previous year. Despite this improvement, the bank remains unprofitable overall and faces challenges such as high levels of bad loans at 11.2%. The management team is relatively new with an average tenure of 1.9 years, which may impact strategic consistency. However, Ajman Bank's funding is primarily from low-risk customer deposits (95%), providing stability in its financial operations amidst volatility in profitability and returns.

- Dive into the specifics of Ajman Bank PJSC here with our thorough balance sheet health report.

- Assess Ajman Bank PJSC's previous results with our detailed historical performance reports.

Dustin Group (OM:DUST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dustin Group AB (publ) operates as an online provider of IT products and services in the Nordic and Benelux regions, with a market cap of approximately SEK1.91 billion.

Operations: The company generates revenue from two main segments: Large Corporate and Public (LCP) at SEK15.44 billion, and Small and Medium-sized Businesses (SMB) at SEK6.04 billion.

Market Cap: SEK1.91B

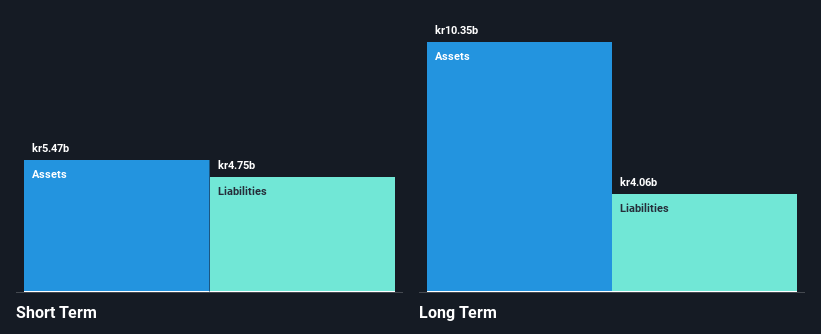

Dustin Group AB, with a market cap of SEK1.91 billion, has faced financial challenges, reporting a net loss of SEK83.2 million for the fourth quarter ending August 31, 2024. The company's earnings have declined by 13% annually over the past five years and its profit margins have decreased to 0.2%. Despite reducing its debt-to-equity ratio from 91.5% to 51.8% over five years and maintaining satisfactory short-term asset coverage, Dustin's interest payments remain under-covered by EBIT at only 1.7 times coverage. Recent board changes may influence strategic direction amidst forecasts of significant revenue decline in early 2025.

- Navigate through the intricacies of Dustin Group with our comprehensive balance sheet health report here.

- Examine Dustin Group's earnings growth report to understand how analysts expect it to perform.

SHL Telemedicine (SWX:SHLTN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SHL Telemedicine Ltd. develops and markets personal telemedicine solutions in Israel, Europe, and internationally with a market cap of CHF39.67 million.

Operations: The company generates revenue from Telemedicine Services amounting to $55.94 million.

Market Cap: CHF39.67M

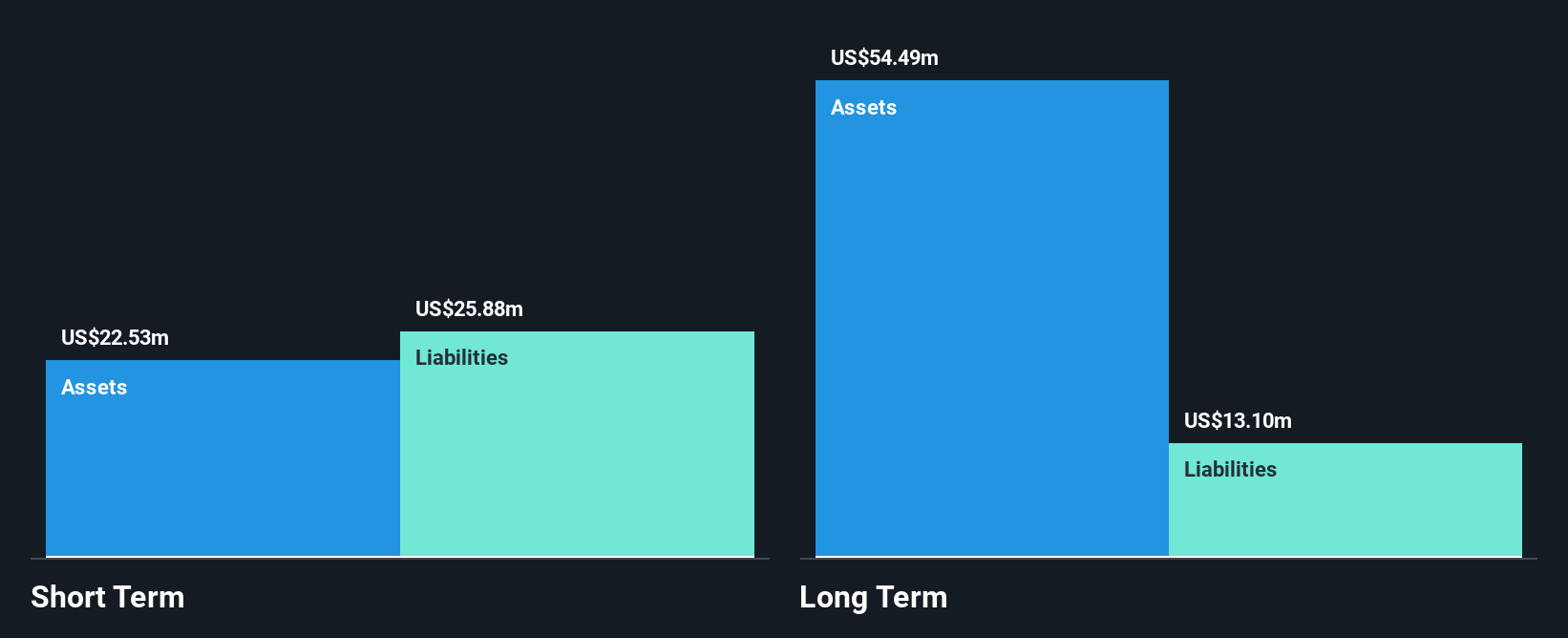

SHL Telemedicine Ltd., with a market cap of CHF39.67 million, faces financial hurdles as it remains unprofitable and has seen losses deepen by 42.8% annually over the past five years. Despite this, the company maintains a solid cash runway exceeding three years and has more cash than total debt, which could provide some stability. Short-term assets significantly cover both short- and long-term liabilities, but earnings have declined from US$29.01 million to US$27.87 million year-over-year for H1 2024, increasing net loss to US$4 million compared to US$2.22 million previously reported for the same period last year.

- Get an in-depth perspective on SHL Telemedicine's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into SHL Telemedicine's track record.

Summing It All Up

- Take a closer look at our Penny Stocks list of 5,766 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services for individuals, businesses, and government institutions in the United Arab Emirates.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives