COLTENE Holding AG (VTX:CLTN), might not be a large cap stock, but it saw a decent share price growth in the teens level on the SWX over the last few months. As a small cap stock, hardly covered by any analysts, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Today I will analyse the most recent data on COLTENE Holding’s outlook and valuation to see if the opportunity still exists.

Check out our latest analysis for COLTENE Holding

What's the opportunity in COLTENE Holding?

According to my valuation model, COLTENE Holding seems to be fairly priced at around 13% below my intrinsic value, which means if you buy COLTENE Holding today, you’d be paying a fair price for it. And if you believe the company’s true value is CHF88.31, then there isn’t much room for the share price grow beyond what it’s currently trading. Furthermore, COLTENE Holding’s low beta implies that the stock is less volatile than the wider market.

Can we expect growth from COLTENE Holding?

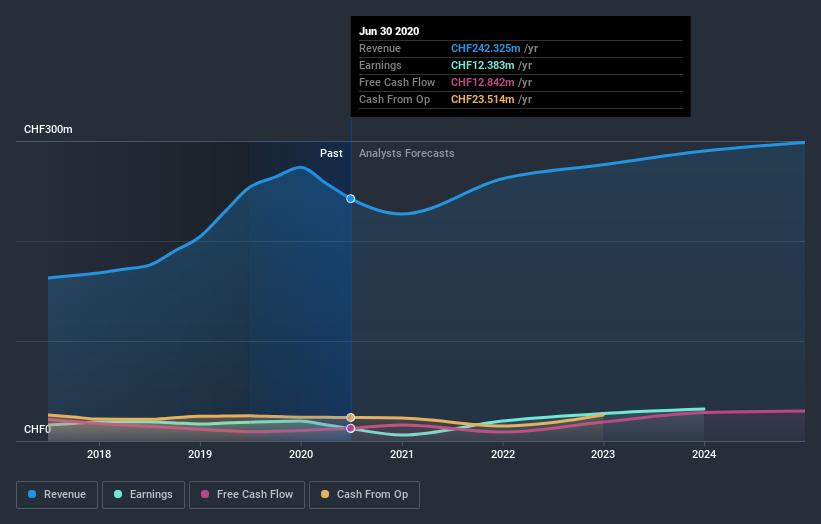

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to more than double over the next couple of years, the future seems bright for COLTENE Holding. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Are you a shareholder? CLTN’s optimistic future growth appears to have been factored into the current share price, with shares trading around its fair value. However, there are also other important factors which we haven’t considered today, such as the track record of its management team. Have these factors changed since the last time you looked at the stock? Will you have enough conviction to buy should the price fluctuates below the true value?

Are you a potential investor? If you’ve been keeping an eye on CLTN, now may not be the most optimal time to buy, given it is trading around its fair value. However, the optimistic prospect is encouraging for the company, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

If you want to dive deeper into COLTENE Holding, you'd also look into what risks it is currently facing. For example - COLTENE Holding has 3 warning signs we think you should be aware of.

If you are no longer interested in COLTENE Holding, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

When trading COLTENE Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:CLTN

COLTENE Holding

Develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories in Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)