- Switzerland

- /

- Medical Equipment

- /

- SWX:CLTN

Don't Buy COLTENE Holding AG (VTX:CLTN) For Its Next Dividend Without Doing These Checks

COLTENE Holding AG (VTX:CLTN) stock is about to trade ex-dividend in four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase COLTENE Holding's shares before the 21st of April in order to receive the dividend, which the company will pay on the 25th of April.

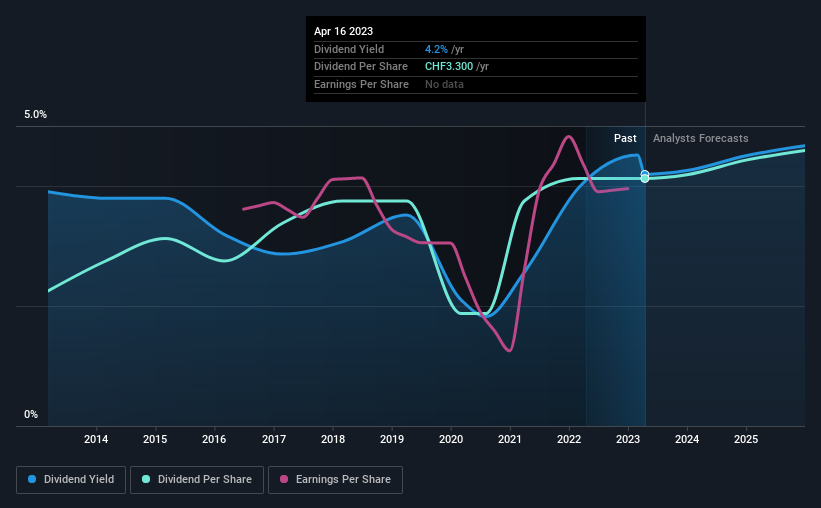

The company's next dividend payment will be CHF3.30 per share, and in the last 12 months, the company paid a total of CHF3.30 per share. Based on the last year's worth of payments, COLTENE Holding has a trailing yield of 4.2% on the current stock price of CHF78.7. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for COLTENE Holding

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. It paid out 76% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the past year it paid out 131% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

While COLTENE Holding's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to COLTENE Holding's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's not encouraging to see that COLTENE Holding's earnings are effectively flat over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. COLTENE Holding has delivered an average of 6.2% per year annual increase in its dividend, based on the past 10 years of dividend payments.

The Bottom Line

Should investors buy COLTENE Holding for the upcoming dividend? It's not great to see earnings per share have been flat and that the company paid out an uncomfortably high percentage of its cash flow over the past year. Cash flows are typically more volatile than earnings, but this is still not what we like to see. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that being said, if you're still considering COLTENE Holding as an investment, you'll find it beneficial to know what risks this stock is facing. In terms of investment risks, we've identified 1 warning sign with COLTENE Holding and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:CLTN

COLTENE Holding

Develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories in Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)