- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

What Does UBS Progress on Crisis Plans Mean for the Stock in 2025?

Reviewed by Bailey Pemberton

If you're trying to figure out what to do with UBS Group stock, you're definitely not alone. With shares up a staggering 259.1% in the last five years and showing a solid 25.2% gain over just the past year, many investors are asking whether now's the time to buy, hold, or look elsewhere. The past few weeks have been quieter, with the price up 0.4% in the last seven days and 1.8% over the last month. That steady climb leaves plenty of people wondering: is there enough upside left, or has most of the growth already been priced in?

Some of that upward momentum can be traced to how UBS is handling recent challenges. Headlines about the bank’s crisis plans and the ongoing integration of Credit Suisse haven’t slowed the stock’s progress. If anything, they've brought clarity to the firm’s risk management and future strategy. Of course, not everything is smooth sailing. Regulatory changes and activist pressure have stirred talk about UBS’s base in Switzerland, but none of this has knocked the long-term growth story off course.

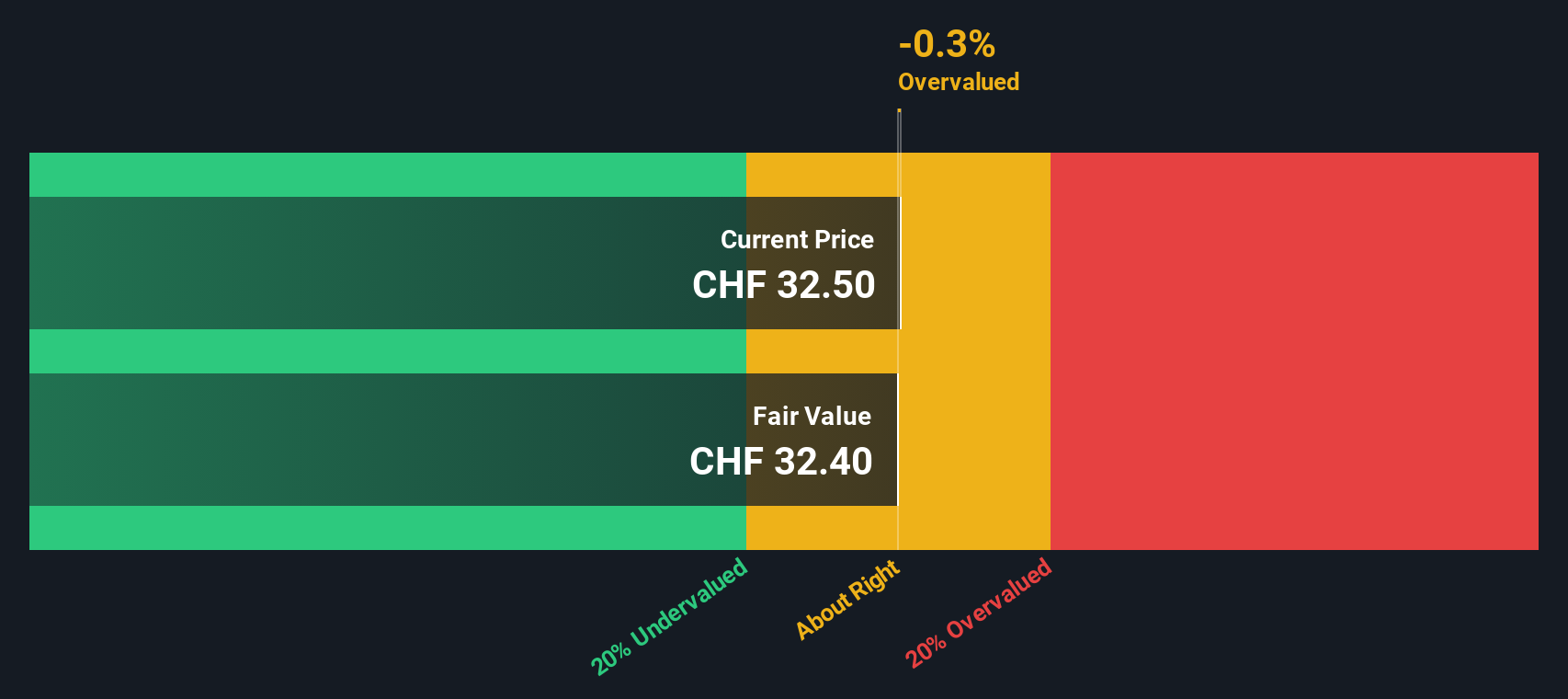

On the valuation front, UBS Group currently earns a value score of 2 out of 6, based on six classic under-valuation checks. That means it passes two of these measures for being undervalued, and fails the rest. This is hardly a slam dunk, but perhaps more nuanced than a quick glance might suggest.

Let’s break down what those valuation checks actually look like, and then take it a step further to see if there’s a smarter way to assess whether UBS still has room to grow.

UBS Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: UBS Group Excess Returns Analysis

The Excess Returns valuation model looks beyond simple profit numbers and focuses instead on how much value a company creates for shareholders after covering its cost of equity. In other words, it examines the difference between what UBS Group earns on its investments and what it costs to fund those investments, providing a lens into real value creation over time.

For UBS Group, the most recent data tells us:

- Book Value: CHF28.17 per share

- Stable EPS: CHF3.58 per share (Source: Weighted future Return on Equity estimates from 8 analysts.)

- Cost of Equity: CHF2.96 per share

- Excess Return: CHF0.62 per share

- Average Return on Equity: 10.73%

- Stable Book Value: CHF33.40 per share (Source: Weighted future Book Value estimates from 8 analysts.)

According to this approach, the intrinsic value comes out to CHF32.41 per share. With UBS currently about 0.8% above this value, the stock is trading at roughly the level its core profitability justifies. That makes it neither a clear bargain nor a glaring overpay at today's price.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out UBS Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: UBS Group Price vs Earnings

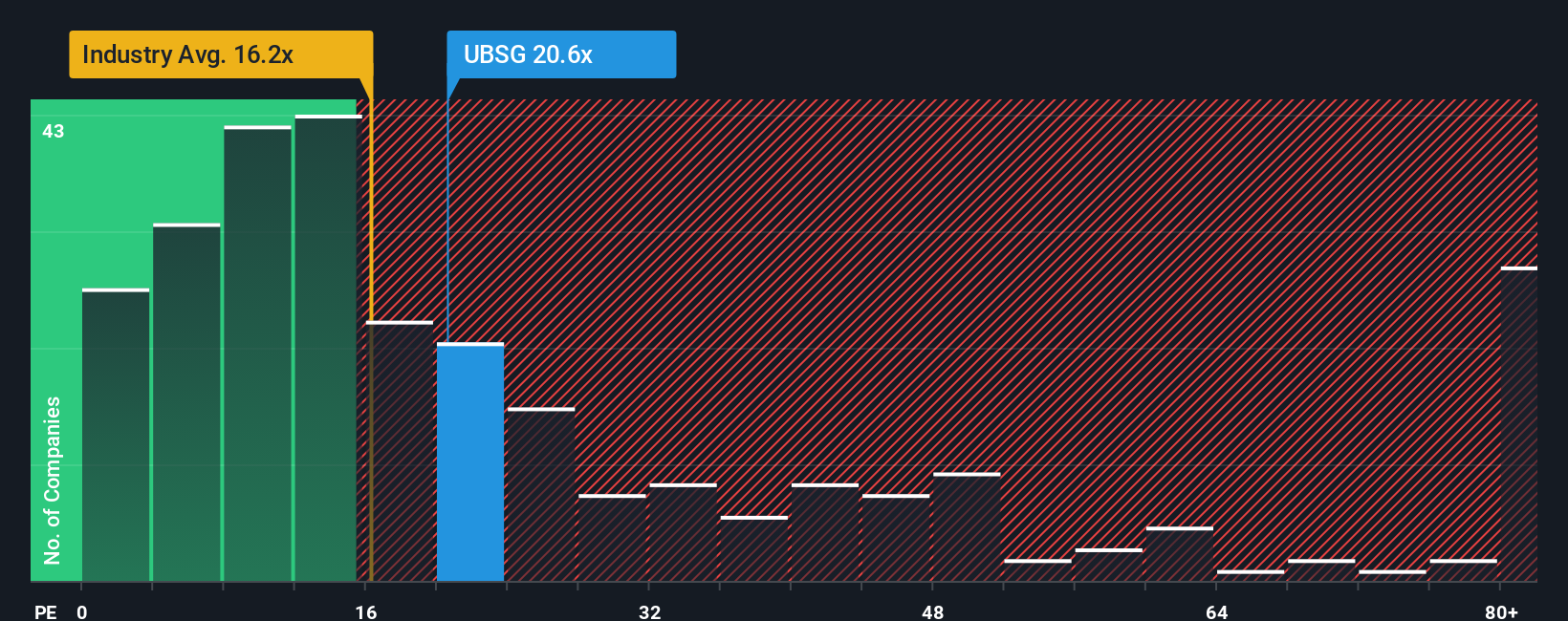

For established companies like UBS Group that are consistently profitable, the price-to-earnings (PE) ratio is a sensible tool to gauge whether a stock is fairly valued. This metric compares the price investors are willing to pay for each unit of earnings, making it a direct reflection of confidence in future profitability.

It's important to remember that a "normal" or "fair" PE ratio isn’t one-size-fits-all. It’s heavily influenced by growth prospects, risk profiles, and sector dynamics. Fast-growing or lower-risk companies often deserve a higher PE than mature or volatile peers.

UBS Group currently trades at a PE of 20.7x. The Capital Markets industry average stands at 19.7x, while UBS’s peer average is slightly higher at 22.5x. This puts UBS right in the mix, neither a standout bargain nor outlandishly expensive by these yardsticks.

However, simply comparing to industry or peer averages misses part of the picture. That is where the Simply Wall St “Fair Ratio” comes in. This proprietary metric goes beyond basic comparisons, instead factoring in the company’s unique earnings growth, profit margins, industry, risk profile, and market capitalization. The “Fair Ratio” for UBS Group weighs in at 26.5x.

With UBS trading at 20.7x and its Fair Ratio at 26.5x, the share price is meaningfully below what the fundamentals might justify. All of these factors suggest the stock could be undervalued on this preferred metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UBS Group Narrative

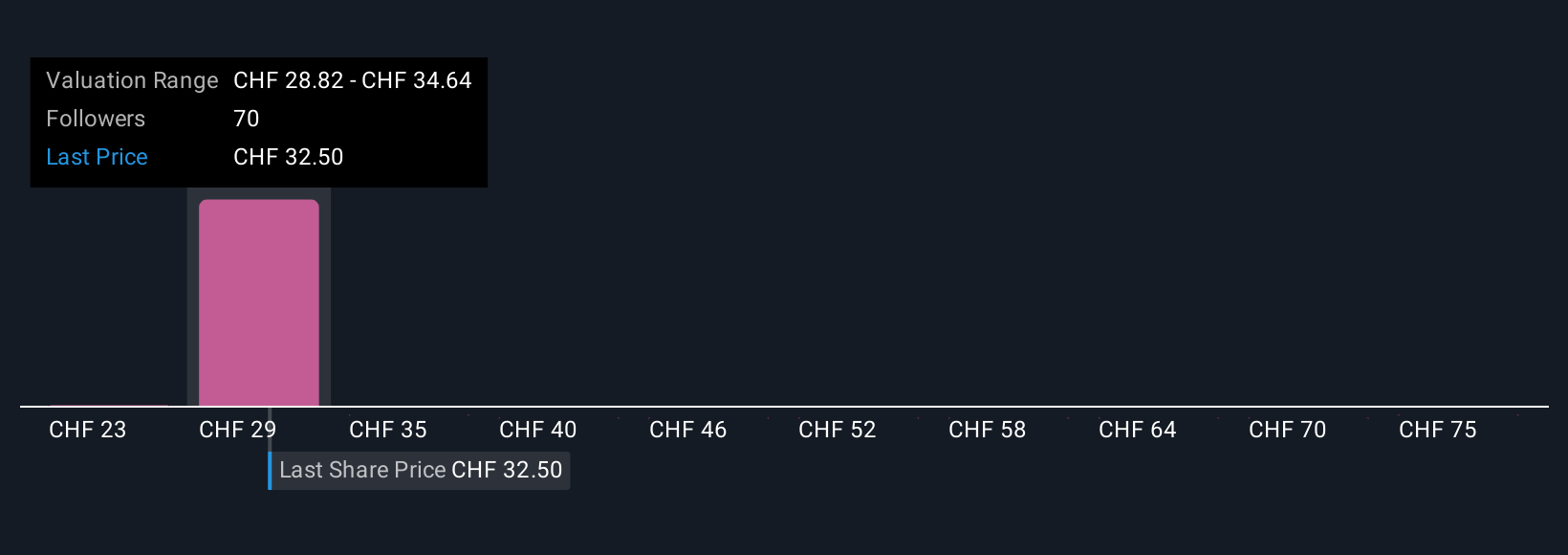

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible tool that lets you tell the story behind your valuation of a company like UBS Group, connecting your perspective—where you think future revenue, earnings, and profit margins will go—to financial forecasts and ultimately a fair value for the stock.

Rather than relying on static numbers or just comparing ratios, Narratives link the company’s big-picture story to a specific forecast, helping you visualize how market events, strategy shifts, and your outlook shape what UBS shares are really worth. Narratives are available to all investors on Simply Wall St’s Community page, where millions share and compare their views, making it easy to see a range of assumptions and fair values based on different stories.

What makes Narratives especially powerful is that they update dynamically when new announcements, news, or financial results are released, so your decision is always based on the latest facts. For UBS Group, for example, Narratives can reflect a highly bullish view, such as a CHF39.5 price target that assumes rapid integration success and margin growth, or a more cautious stance with a CHF21.0 target if you think regulatory risks will bite harder. You decide what story you believe and compare it with the current share price to make smarter, more personalized investment decisions.

Do you think there's more to the story for UBS Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives