- Canada

- /

- Oil and Gas

- /

- TSX:NVA

3 Stocks Estimated To Be Trading At Discounts Of Up To 41.5%

Reviewed by Simply Wall St

In the midst of recent global market fluctuations, driven by cautious Fed commentary and political uncertainties, investors are increasingly focused on finding opportunities that may be undervalued. With U.S. stocks experiencing broad-based losses and economic indicators showing mixed signals, identifying stocks trading at significant discounts can offer potential value in a volatile environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Bank (SHSE:601187) | CN¥5.69 | CN¥11.34 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| T'Way Air (KOSE:A091810) | ₩2505.00 | ₩4994.20 | 49.8% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409580.73 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥13.24 | CN¥26.38 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

Here's a peek at a few of the choices from the screener.

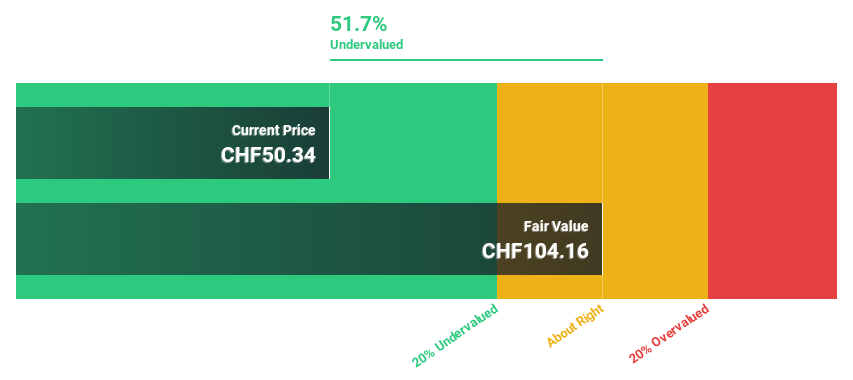

Julius Bär Gruppe (SWX:BAER)

Overview: Julius Bär Gruppe AG is a Swiss company offering wealth management solutions across Switzerland, Europe, the Americas, Asia, and internationally, with a market cap of CHF11.83 billion.

Operations: The company's revenue primarily comes from its Private Banking segment, which generated CHF3.15 billion.

Estimated Discount To Fair Value: 41.5%

Julius Bär Gruppe is trading at CHF57.76, significantly below its estimated fair value of CHF98.8, indicating it may be undervalued based on cash flows. Despite a dividend yield of 4.5% that isn't well covered by earnings, the company shows promising growth prospects with forecasted annual earnings growth of 22.4%, outpacing the Swiss market's 11.6%. However, challenges include a high bad loans ratio and declining profit margins from last year’s levels.

- According our earnings growth report, there's an indication that Julius Bär Gruppe might be ready to expand.

- Take a closer look at Julius Bär Gruppe's balance sheet health here in our report.

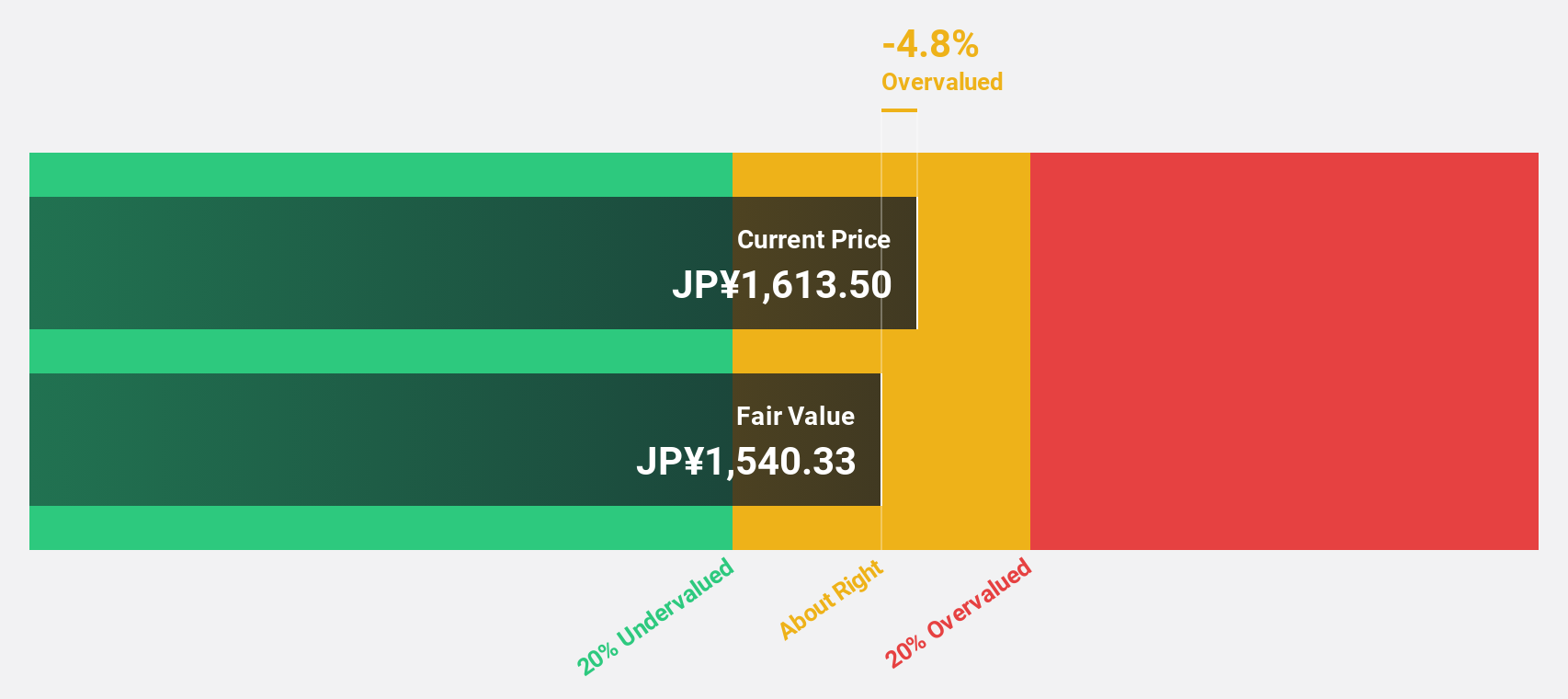

SHIFT (TSE:3697)

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan with a market cap of ¥311.05 billion.

Operations: The company generates revenue primarily from Software Testing Related Services at ¥71.34 billion and Software Development Related Services at ¥35.01 billion.

Estimated Discount To Fair Value: 12.8%

SHIFT is trading at ¥17,735, below its estimated fair value of ¥20,335.92, suggesting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 30.1% annually, surpassing the JP market's 8%. However, profit margins have decreased from last year’s 7.1% to 4.6%. Recent share buybacks totaling ¥999.61 million indicate efforts to enhance shareholder value but haven't stabilized the highly volatile share price recently observed.

- Our comprehensive growth report raises the possibility that SHIFT is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of SHIFT stock in this financial health report.

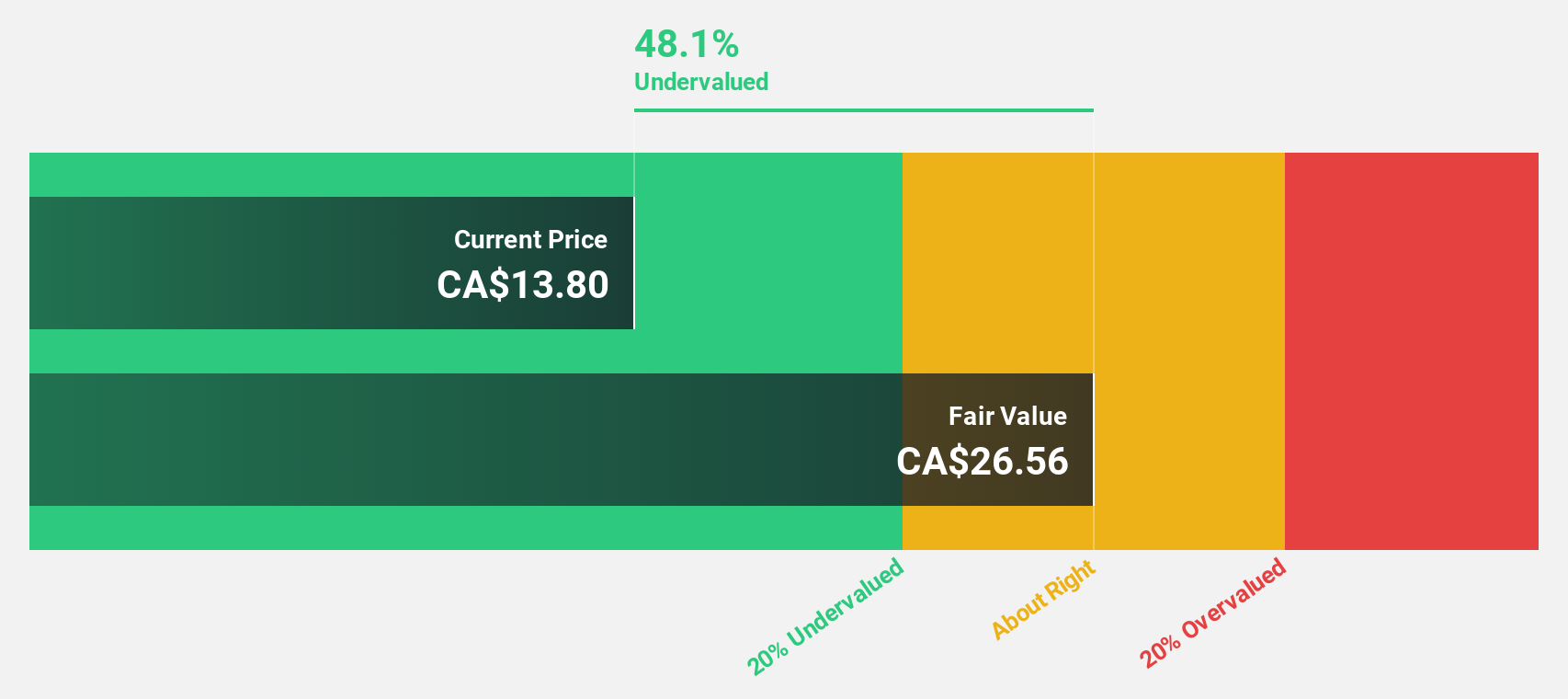

NuVista Energy (TSX:NVA)

Overview: NuVista Energy Ltd. is involved in the exploration, development, and production of oil and natural gas reserves in the Western Canadian Sedimentary Basin, with a market cap of CA$2.70 billion.

Operations: The company's revenue is primarily generated from its oil and gas exploration and production segment, amounting to CA$1.16 billion.

Estimated Discount To Fair Value: 30.5%

NuVista Energy, trading at CA$13.14, is significantly undervalued based on cash flows with an estimated fair value of CA$18.89. Earnings are projected to grow 22.5% annually, outpacing the Canadian market's 15.5%. Despite recent earnings declines and revised production guidance for Q4 2024, NuVista completed a share buyback worth CA$23.7 million, reflecting confidence in its valuation and potential for recovery as production levels are expected to rise by year-end.

- Insights from our recent growth report point to a promising forecast for NuVista Energy's business outlook.

- Get an in-depth perspective on NuVista Energy's balance sheet by reading our health report here.

Make It Happen

- Navigate through the entire inventory of 868 Undervalued Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuVista Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NVA

NuVista Energy

Together with its subsidiary, engages in the exploration, development, and production of oil and natural gas reserves in the Western Canadian Sedimentary Basin.

Undervalued with reasonable growth potential.