- Canada

- /

- Metals and Mining

- /

- TSXV:ALDE

Top 3 TSX Penny Stocks With Market Caps Over CA$3M To Watch

Reviewed by Simply Wall St

The early days of 2025 have seen significant market activity, with bond yields rising sharply before retreating due to positive U.S. inflation data, impacting both stock valuations and investor sentiment. Amidst these shifts, investors are reminded that earnings play a crucial role in driving market direction, highlighting the importance of selecting stocks with strong financial health. While the term "penny stocks" might seem outdated, these smaller or newer companies continue to offer potential growth opportunities when they demonstrate robust balance sheets and resilience in challenging markets.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.44 | CA$968.15M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.44 | CA$122.52M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.61 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$641.85M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$29.82M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.67M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.18 | CA$232.09M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Blueberries Medical (CNSX:BBM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Blueberries Medical Corp. focuses on the growth, cultivation, and development of medicinal cannabis and related products in Colombia, with a market cap of CA$3.99 million.

Operations: The company's revenue is derived from its cannabis cultivation and extraction facilities, totaling CA$0.27 million.

Market Cap: CA$3.99M

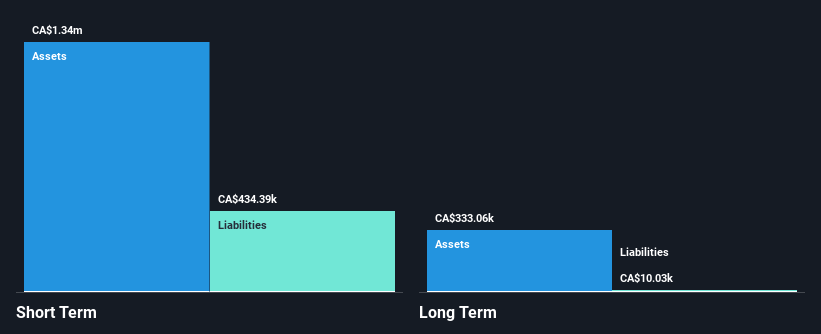

Blueberries Medical Corp., with a market cap of CA$3.99 million, is pre-revenue, generating less than US$1 million annually. Recent earnings show declining sales but reduced net losses year-over-year. The company is debt-free and has an experienced management team with an average tenure of four years. Despite having short-term assets exceeding liabilities, Blueberries faces a cash runway of less than a year under current conditions. Recent executive changes include the appointment of Thomas P. Rodríguez as CFO, indicating strategic leadership adjustments to enhance financial strategy and compliance within the organization amidst ongoing operational challenges in the cannabis sector.

- Take a closer look at Blueberries Medical's potential here in our financial health report.

- Gain insights into Blueberries Medical's past trends and performance with our report on the company's historical track record.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldebaran Resources Inc. focuses on the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina, with a market cap of CA$295.65 million.

Operations: Aldebaran Resources Inc. does not report any revenue segments, as its activities are centered on acquiring, exploring, and evaluating mineral properties in Canada and Argentina.

Market Cap: CA$295.65M

Aldebaran Resources Inc., with a market cap of CA$295.65 million, is pre-revenue and focuses on mineral exploration in Canada and Argentina. Recently added to the S&P/TSX Venture Composite Index, the company reported a reduced net loss for Q1 2024 compared to the previous year. It announced significant increases in mineral resources at its Altar project, including substantial copper and gold reserves. Despite no debt and experienced management, Aldebaran's auditor expressed going concern doubts due to its financial position. The company is actively pursuing drilling activities aimed at advancing towards a Pre-Feasibility Study by H2 2026.

- Click here and access our complete financial health analysis report to understand the dynamics of Aldebaran Resources.

- Understand Aldebaran Resources' track record by examining our performance history report.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FPX Nickel Corp. is a junior mining company focused on the acquisition, exploration, and development of nickel mineral resource properties in Canada, with a market cap of CA$77.14 million.

Operations: FPX Nickel Corp. does not have reported revenue segments as it is primarily engaged in the exploration and development of nickel mineral resource properties in Canada.

Market Cap: CA$77.14M

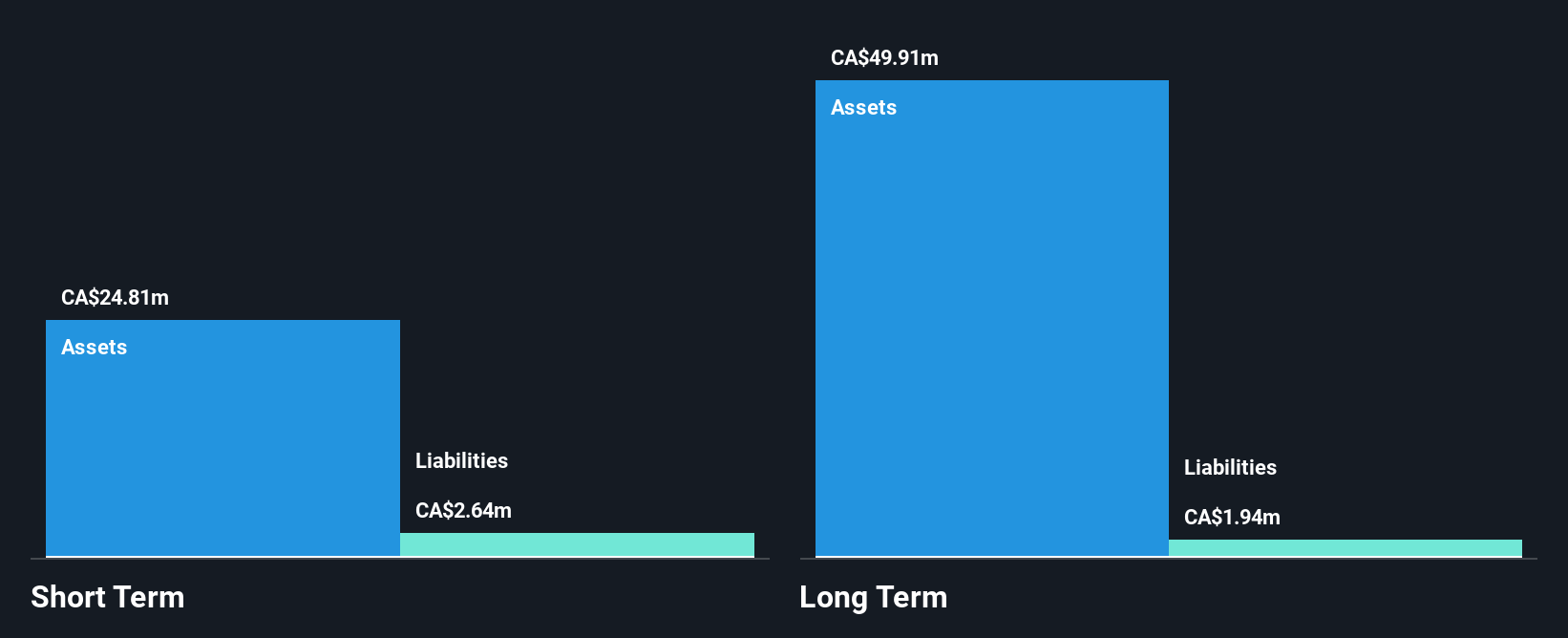

FPX Nickel Corp., with a market cap of CA$77.14 million, is pre-revenue and focused on nickel exploration in Canada. The company has no debt, and its short-term assets significantly exceed liabilities, supporting a cash runway exceeding three years. Despite being unprofitable with declining earnings over the past five years, FPX's recent Economic Impact Study for the Baptiste Nickel Project highlights substantial projected economic contributions and job creation during its development phases. Recent activities include share buybacks and expansion of mineral claims at Decar Nickel District to enhance project flexibility, though it was recently dropped from the S&P/TSX Venture Composite Index.

- Jump into the full analysis health report here for a deeper understanding of FPX Nickel.

- Assess FPX Nickel's future earnings estimates with our detailed growth reports.

Key Takeaways

- Click this link to deep-dive into the 934 companies within our TSX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Aldebaran Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALDE

Aldebaran Resources

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives