- Canada

- /

- Capital Markets

- /

- TSX:WNDR

January 2025 TSX Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As 2025 unfolds, the Canadian market is navigating a landscape marked by fluctuating bond yields and robust economic indicators, with investors reassessing their expectations amidst policy uncertainties. In such a dynamic environment, identifying stocks with potential becomes crucial, especially those that might not be on everyone's radar. Penny stocks—often smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth and value beyond the usual suspects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$968.15M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.44 | CA$122.52M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.43 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$641.85M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$29.82M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.67M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.21 | CA$232.09M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$231.32 million, offers drilling services across North America, Europe, the Middle East, Africa, South America, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue is primarily derived from its Mining segment, contributing $280.96 million, and its Water segment, which adds $38.25 million.

Market Cap: CA$231.32M

Foraco International SA, with a market cap of CA$231.32 million, reported third-quarter sales of US$77.66 million and net income of US$7.84 million, reflecting a decline from the previous year. Despite high debt levels (net debt to equity ratio at 77.3%), the company's interest payments are well covered by EBIT (5.1x). Short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. The management team is relatively new but supported by an experienced board with an average tenure of 17.4 years. Analysts forecast earnings growth and suggest potential undervaluation compared to peers and industry standards.

- Click here and access our complete financial health analysis report to understand the dynamics of Foraco International.

- Evaluate Foraco International's prospects by accessing our earnings growth report.

Haivision Systems (TSX:HAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Haivision Systems Inc. offers mission-critical, real-time video networking and visual collaboration solutions across Canada, the United States, and internationally with a market cap of CA$135.22 million.

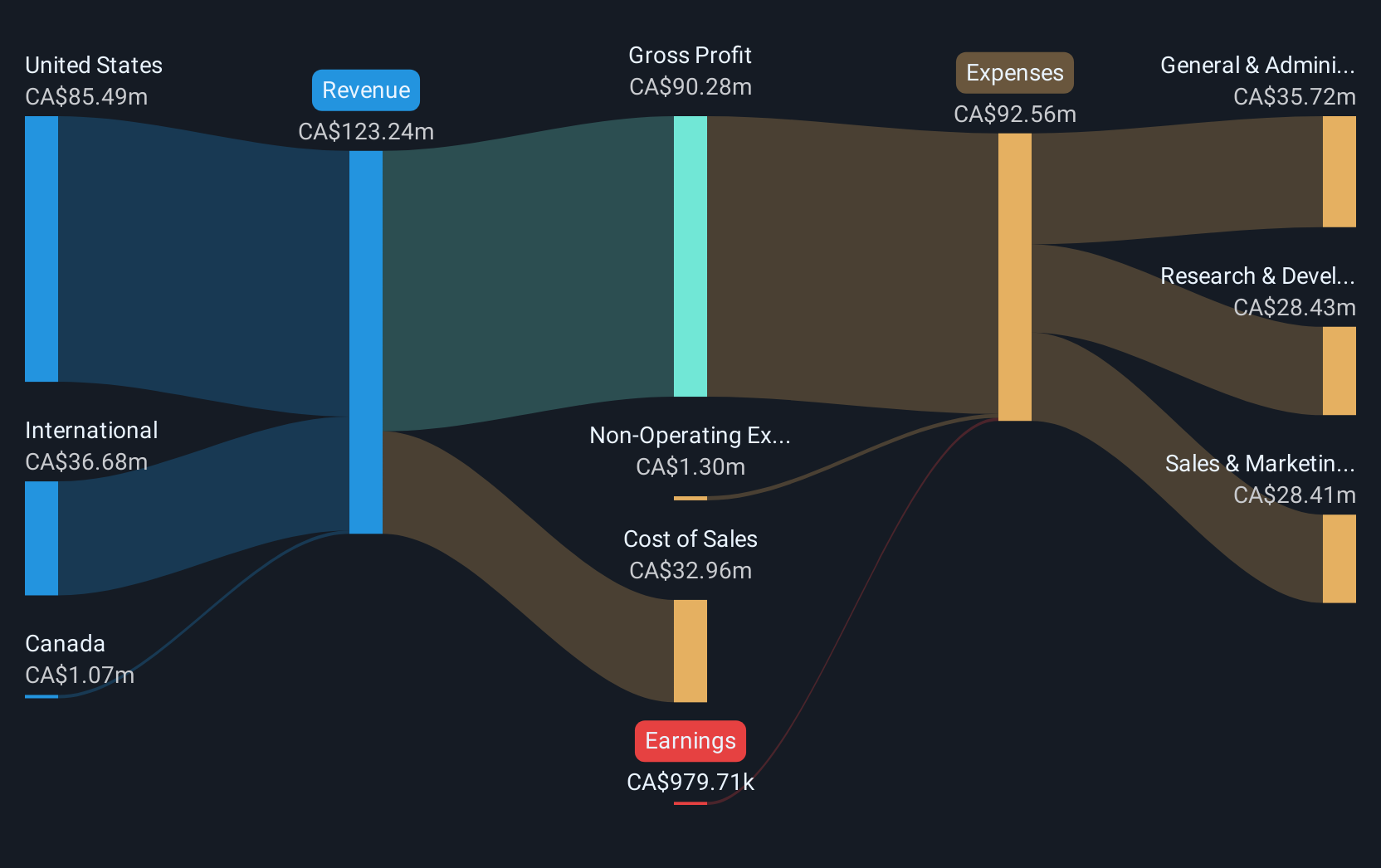

Operations: The company generates CA$129.54 million in revenue from its Internet Telephone segment.

Market Cap: CA$135.22M

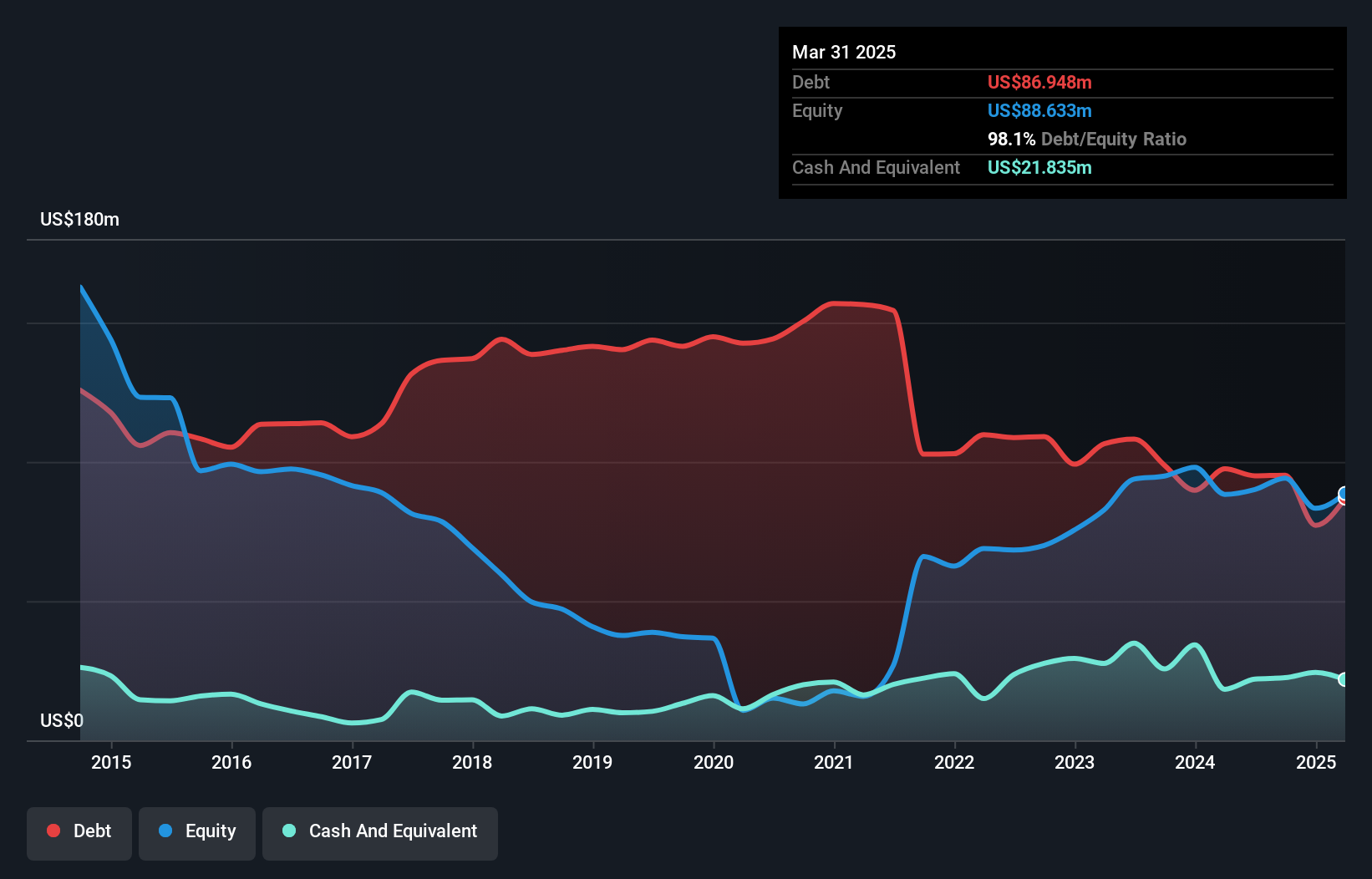

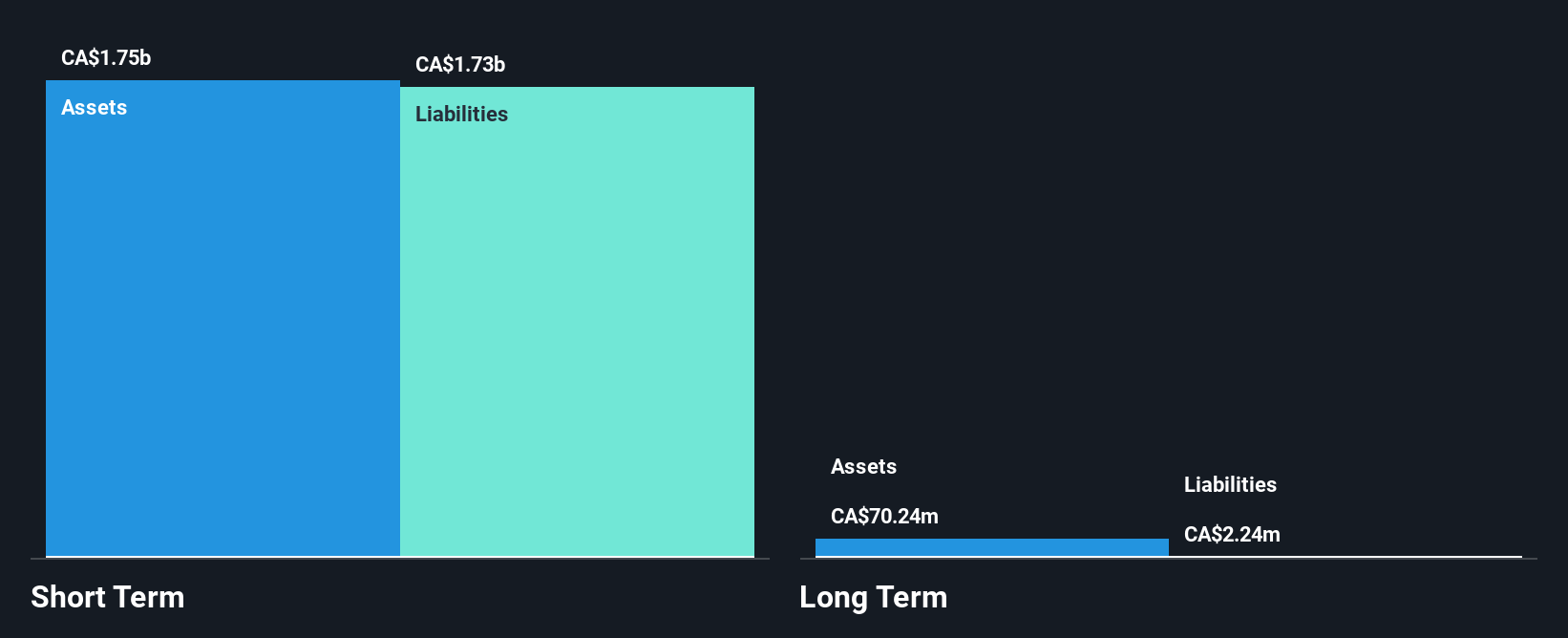

Haivision Systems Inc., with a market cap of CA$135.22 million, reported full-year sales of CA$129.54 million, transitioning from a net loss to a net income of CA$4.7 million compared to the previous year. The company maintains strong liquidity with short-term assets exceeding both short and long-term liabilities, while its debt levels are manageable, covered by operating cash flow and more cash than total debt. Despite recent earnings decline in Q4 2024, Haivision's profitability marks an improvement over past performance. Analysts anticipate earnings growth and value potential below current price targets despite low return on equity at 4.9%.

- Get an in-depth perspective on Haivision Systems' performance by reading our balance sheet health report here.

- Gain insights into Haivision Systems' outlook and expected performance with our report on the company's earnings estimates.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WonderFi Technologies Inc. focuses on developing and acquiring technology platforms for digital asset investments, with a market cap of CA$238.11 million.

Operations: The company generates revenue primarily from its Trading segment, which accounts for CA$46.69 million, and its Payments segment, contributing CA$3.95 million.

Market Cap: CA$238.11M

WonderFi Technologies Inc., with a market cap of CA$238.11 million, has seen significant developments, including the appointment of Paul Pathak to its board and providing strong fourth-quarter guidance with expected revenue growth to CA$20.5 - CA$21.0 million. Despite recent earnings volatility and a net loss reduction for Q3 2024, WonderFi's transition to profitability is notable, although its operating cash flow remains negative. The company benefits from short-term assets exceeding liabilities and more cash than debt but faces challenges like high share price volatility and low return on equity at 2.6%.

- Dive into the specifics of WonderFi Technologies here with our thorough balance sheet health report.

- Examine WonderFi Technologies' earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Investigate our full lineup of 934 TSX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WonderFi Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WNDR

WonderFi Technologies

Engages in the development and acquisition of technology platforms to facilitate investments in the emerging industry of digital assets.

Reasonable growth potential with adequate balance sheet.