- Canada

- /

- Metals and Mining

- /

- TSX:ELO

TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the Canadian market navigates through fluctuating bond yields and a complex economic landscape, investors are closely watching how these factors impact stock valuations. Amidst this backdrop, penny stocks—though an outdated term—remain an intriguing investment area for those seeking opportunities in smaller or newer companies. This article will explore three such stocks that exhibit financial strength, offering potential value and growth prospects in the evolving market conditions of early 2025.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$968.15M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.44 | CA$122.52M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.43 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$641.85M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$29.82M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.67M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.21 | CA$232.09M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Eloro Resources (TSX:ELO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eloro Resources Ltd. focuses on the exploration and development of mineral properties in Bolivia and Peru, with a market cap of CA$95.48 million.

Operations: Eloro Resources Ltd. has not reported any specific revenue segments, focusing instead on the exploration and development of mineral properties in Bolivia and Peru.

Market Cap: CA$95.48M

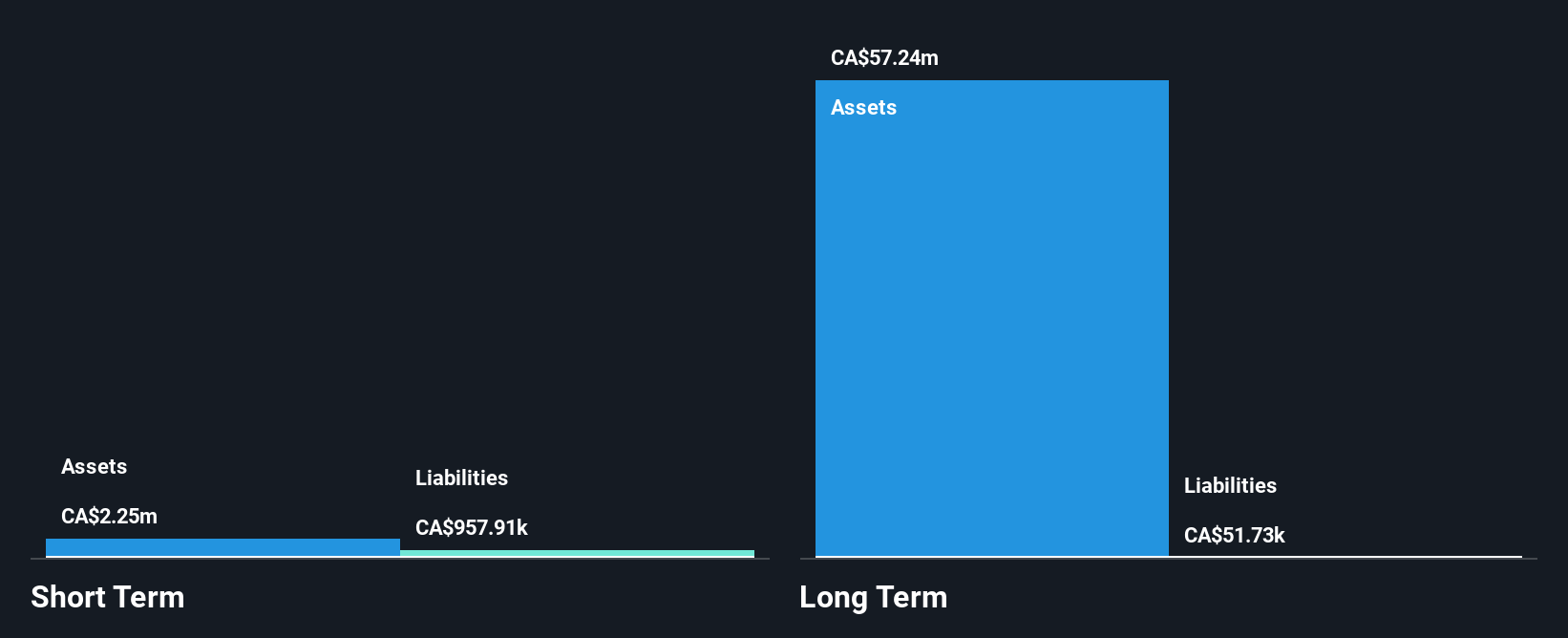

Eloro Resources Ltd., with a market cap of CA$95.48 million, is focused on mineral exploration in Bolivia and Peru but remains pre-revenue. Recent drilling at the Iska Iska project has shown promising results, particularly in the tin domain, indicating potential resource expansion. Despite a lack of revenue and profitability, Eloro's debt-free status and recent capital raise offer some financial stability. However, short-term liabilities slightly exceed assets, highlighting liquidity challenges. The management team is experienced with an average tenure of 3.9 years, which may aid in navigating these operational hurdles as they continue exploration efforts.

- Unlock comprehensive insights into our analysis of Eloro Resources stock in this financial health report.

- Understand Eloro Resources' earnings outlook by examining our growth report.

Mandalay Resources (TSX:MND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mandalay Resources Corporation, with a market cap of CA$392.54 million, is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Canada, Australia, Sweden, and Chile.

Operations: The company generates revenue primarily from its Metals & Mining segment, focusing on Gold & Other Precious Metals, which amounted to $224.44 million.

Market Cap: CA$392.54M

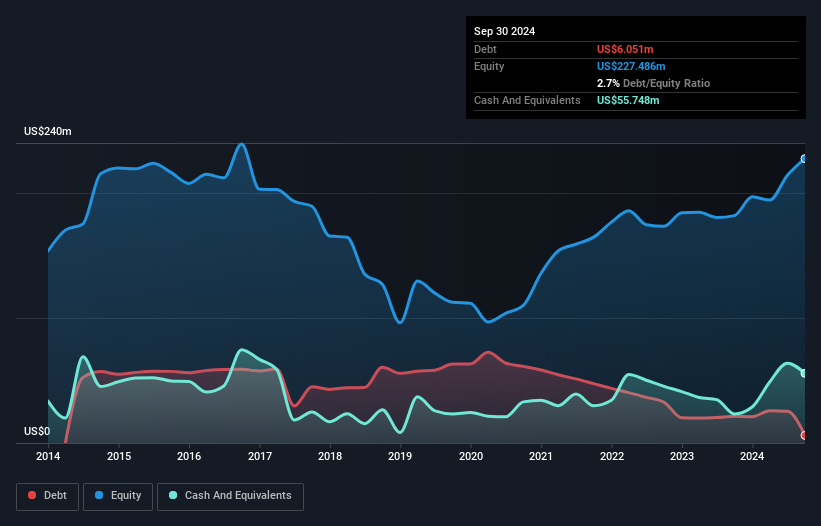

Mandalay Resources Corporation, with a market cap of CA$392.54 million, is positioned in the Metals & Mining sector with a focus on gold and other precious metals, generating US$224.44 million in revenue. The company has demonstrated strong financial health, maintaining more cash than its total debt and achieving a significant reduction in its debt-to-equity ratio over five years. Recent exploration success at the Björkdal operation in Sweden could extend mine life significantly. Although insider selling was noted recently, Mandalay's earnings growth has been robust, outpacing industry averages and reflecting high-quality earnings potential.

- Navigate through the intricacies of Mandalay Resources with our comprehensive balance sheet health report here.

- Gain insights into Mandalay Resources' future direction by reviewing our growth report.

Probe Gold (TSX:PRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Probe Gold Inc. is a precious metal exploration company focused on acquiring, exploring, and developing gold properties in Canada with a market cap of CA$335.13 million.

Operations: Probe Gold Inc. does not report any revenue segments as it is primarily engaged in the exploration and development of gold properties in Canada.

Market Cap: CA$335.13M

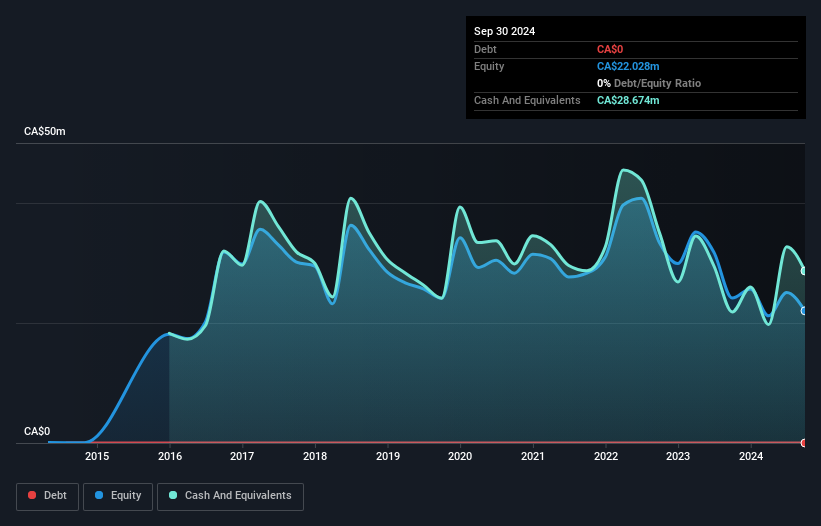

Probe Gold Inc., with a market cap of CA$335.13 million, is pre-revenue and focused on expanding its gold exploration footprint in Canada. Recent strategic acquisitions, including the Stella Property and Bermont Claims, enhance its land position in Quebec's Val-d’Or region. Despite being unprofitable and experiencing increased losses over the past five years, Probe maintains a stable cash runway exceeding one year without debt concerns. The company has engaged in significant environmental studies for its Novador project to secure necessary permits while advancing exploration activities through infill drilling programs aimed at resource conversion for future feasibility assessments.

- Take a closer look at Probe Gold's potential here in our financial health report.

- Assess Probe Gold's future earnings estimates with our detailed growth reports.

Taking Advantage

- Click this link to deep-dive into the 934 companies within our TSX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eloro Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELO

Eloro Resources

Engages in the exploration and development of mineral properties in Bolivia and Peru.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion