- Switzerland

- /

- Professional Services

- /

- SWX:SGSN

3 Stocks Estimated To Be Up To 47.5% Below Intrinsic Value

Reviewed by Simply Wall St

In the midst of a global market landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are navigating through a period of volatility as major indices experience fluctuations. With U.S. stocks showing mixed performance and economic data presenting both challenges and opportunities, identifying undervalued stocks can be a strategic approach to potentially capitalize on market inefficiencies. In such an environment, finding stocks that are estimated to be significantly below their intrinsic value may offer appealing prospects for investors seeking opportunities amidst broader market movements.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥43.43 | CN¥86.61 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.95 | ₹2250.68 | 49.8% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | US$34.58 | US$68.97 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.04 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.82 | 50% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.00 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.45 | 49.7% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2400.00 | CLP4798.13 | 50% |

| Paycor HCM (NasdaqGS:PYCR) | US$19.33 | US$38.52 | 49.8% |

We'll examine a selection from our screener results.

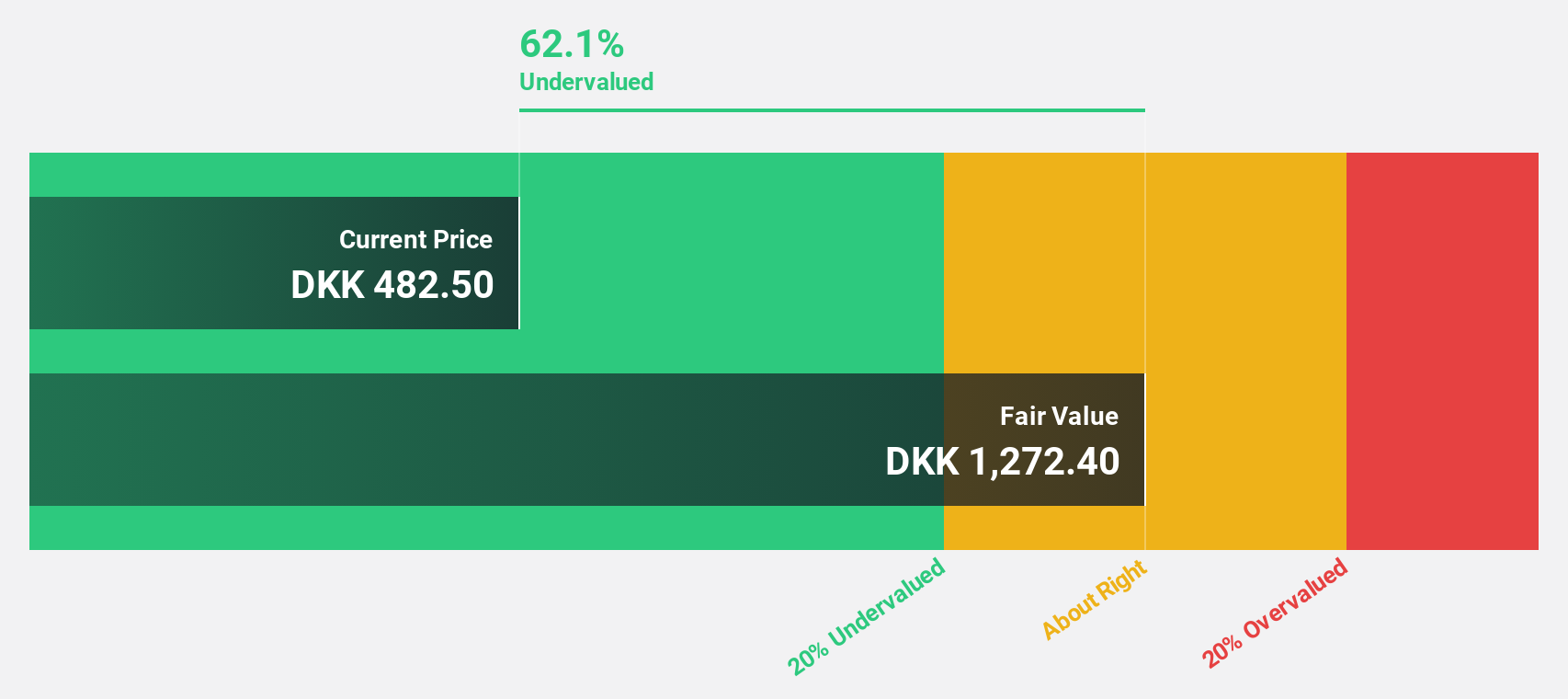

Novo Nordisk (CPSE:NOVO B)

Overview: Novo Nordisk A/S is a global healthcare company involved in the research, development, manufacture, and distribution of pharmaceutical products across various regions including Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America and has a market capitalization of approximately DKK2.75 trillion.

Operations: The company's revenue is primarily derived from two segments: Diabetes and Obesity Care, which generated DKK253.08 billion, and Rare Disease, contributing DKK17.51 billion.

Estimated Discount To Fair Value: 47.5%

Novo Nordisk is trading at DKK 622.6, significantly below its estimated fair value of DKK 1185.16, suggesting it may be undervalued based on cash flows. Despite a volatile share price and an unstable dividend track record, the company's earnings are projected to grow faster than the Danish market at 14.2% annually. Recent FDA approval for Alhemo® and ongoing product developments further bolster its growth prospects amidst legal challenges over insulin pricing strategies.

- Our earnings growth report unveils the potential for significant increases in Novo Nordisk's future results.

- Get an in-depth perspective on Novo Nordisk's balance sheet by reading our health report here.

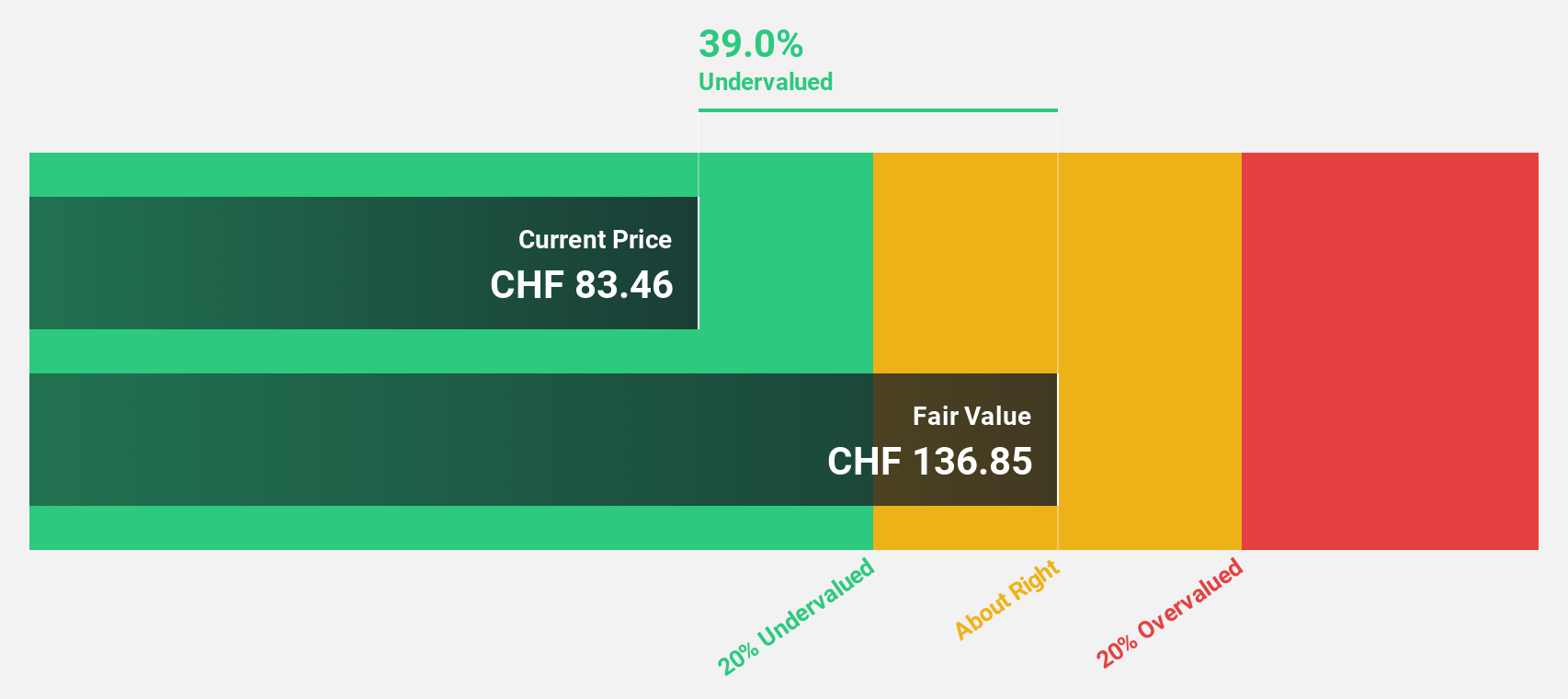

SGS (SWX:SGSN)

Overview: SGS SA is a global leader in inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and the Asia Pacific with a market cap of CHF16.89 billion.

Operations: The company's revenue segments include Business Assurance, which generated CHF755 million.

Estimated Discount To Fair Value: 31.3%

SGS is trading at CHF90.64, significantly below its estimated fair value of CHF131.96, indicating potential undervaluation based on cash flows. Despite a high debt level and slower revenue growth forecast (5.1% annually) compared to significant benchmarks, its earnings are expected to grow faster than the Swiss market at 12% per year. The company plans strategic bolt-on acquisitions with disciplined capital allocation under Strategy '27, aiming for highly synergistic and margin-accretive opportunities.

- According our earnings growth report, there's an indication that SGS might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of SGS.

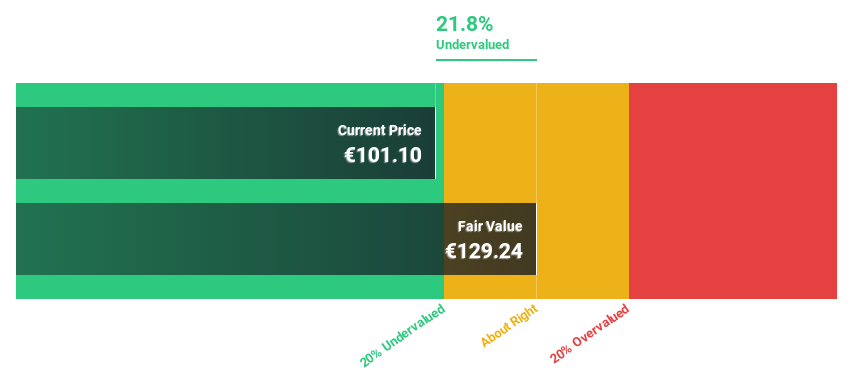

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €2.42 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Operations: The company's revenue segments include Plastics & Devices (€1.13 billion), Advanced Technologies (€5.83 million), and Primary Packaging Glass (€885.56 million).

Estimated Discount To Fair Value: 35.7%

Gerresheimer is trading at €70, below its estimated fair value of €108.81, suggesting it may be undervalued based on cash flows. Despite a high debt level and revised earnings guidance for 2024 and 2025, the company expects significant earnings growth of 21.8% annually over the next three years. The recent FDA Tentative Approval for Lasix ONYU highlights Gerresheimer's innovation capabilities, with full market entry expected post-October 2025 exclusivity expiration.

- The growth report we've compiled suggests that Gerresheimer's future prospects could be on the up.

- Dive into the specifics of Gerresheimer here with our thorough financial health report.

Key Takeaways

- Click through to start exploring the rest of the 868 Undervalued Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGSN

SGS

Provides inspection, testing, and certification services in Europe, Africa, the Middle East, Latin America, North America, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives