3 Companies On The SIX Swiss Exchange That May Be Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

The Swiss market recently demonstrated resilience, bouncing back from early losses to close slightly higher, with the SMI index showing a modest gain. In this fluctuating environment, identifying stocks that may be trading below their estimated value can present opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF302.40 | CHF568.93 | 46.8% |

| Georg Fischer (SWX:GF) | CHF59.10 | CHF110.25 | 46.4% |

| ALSO Holding (SWX:ALSN) | CHF261.00 | CHF365.07 | 28.5% |

| lastminute.com (SWX:LMN) | CHF18.76 | CHF29.72 | 36.9% |

| Clariant (SWX:CLN) | CHF12.56 | CHF21.55 | 41.7% |

| Barry Callebaut (SWX:BARN) | CHF1518.00 | CHF2287.69 | 33.6% |

| Comet Holding (SWX:COTN) | CHF309.00 | CHF528.31 | 41.5% |

| Dätwyler Holding (SWX:DAE) | CHF161.80 | CHF239.95 | 32.6% |

| SGS (SWX:SGSN) | CHF95.18 | CHF150.94 | 36.9% |

| Sensirion Holding (SWX:SENS) | CHF70.60 | CHF117.92 | 40.1% |

Here's a peek at a few of the choices from the screener.

ALSO Holding (SWX:ALSN)

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.20 billion.

Operations: The company's revenue segments include €4.62 billion from Central Europe and €5.24 billion from Northern/Eastern Europe.

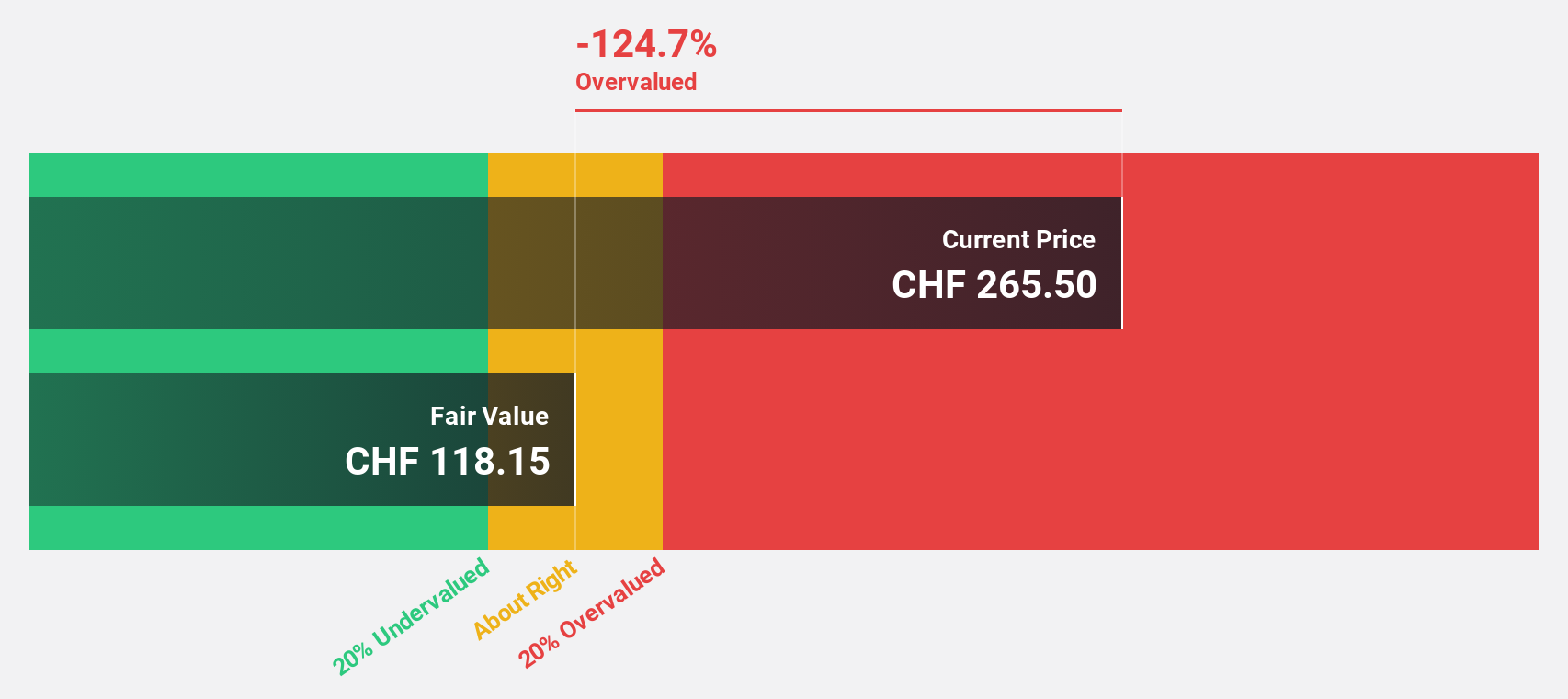

Estimated Discount To Fair Value: 28.5%

ALSO Holding AG is trading at CHF261, significantly below its estimated fair value of CHF365.07, indicating potential undervaluation based on cash flows. Despite recent volatility and a decline in sales and net income for the first half of 2024, earnings are forecast to grow at 24.5% annually over the next three years, outpacing the Swiss market average. However, its Return on Equity is expected to remain modest at 15.4%.

- Our expertly prepared growth report on ALSO Holding implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in ALSO Holding's balance sheet health report.

SGS (SWX:SGSN)

Overview: SGS SA offers inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and the Asia Pacific, with a market cap of CHF17.74 billion.

Operations: The company's revenue from Business Assurance services amounts to CHF755 million.

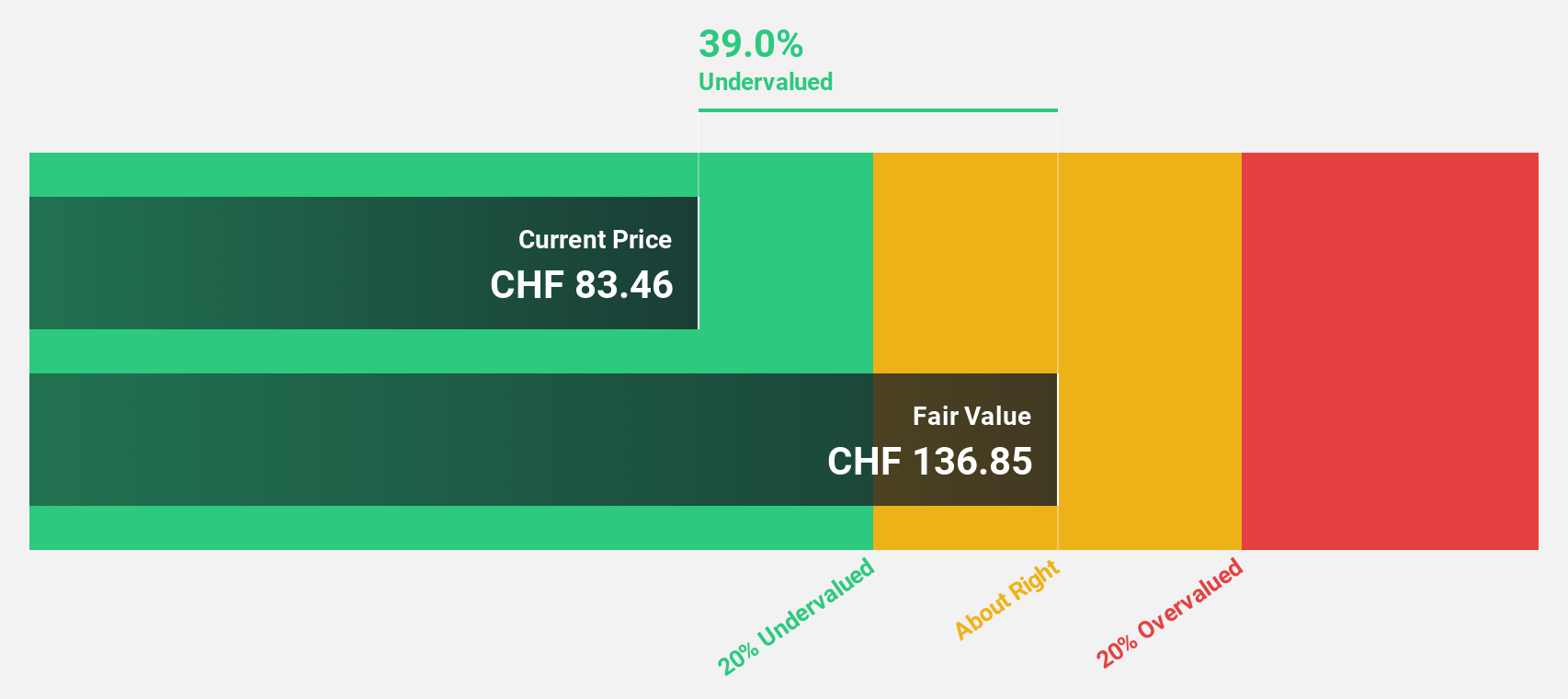

Estimated Discount To Fair Value: 36.9%

SGS is trading at CHF95.18, significantly below its estimated fair value of CHF150.94, highlighting potential undervaluation based on cash flows. Despite high debt levels and a dividend not fully covered by earnings, SGS's earnings are forecast to grow 12.45% annually, outpacing the Swiss market average of 11.7%. Recent half-year results show stable sales growth but slight declines in net income and EPS compared to the previous year.

- Our earnings growth report unveils the potential for significant increases in SGS' future results.

- Unlock comprehensive insights into our analysis of SGS stock in this financial health report.

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and financial institutions globally, with a market cap of CHF4.31 billion.

Operations: The company's revenue is primarily generated from its Product segment, which accounts for $879.99 million, and its Services segment, contributing $132.98 million.

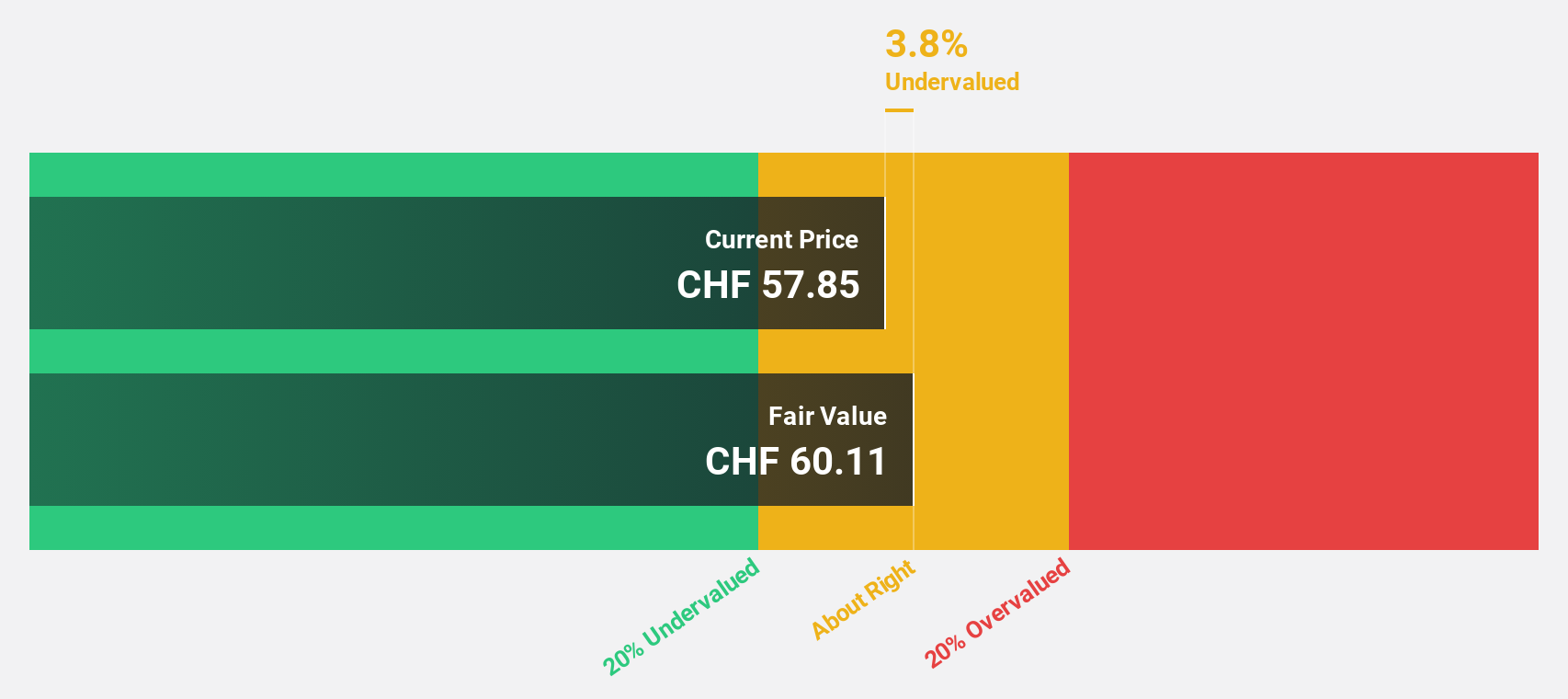

Estimated Discount To Fair Value: 24.6%

Temenos is trading at CHF59.05, below its estimated fair value of CHF78.28, indicating potential undervaluation based on cash flows. Despite high debt levels, Temenos's earnings are expected to grow 14.4% annually, surpassing the Swiss market average of 11.7%. Recent executive changes aim to enhance technological innovation and global expansion efforts. While revenue growth is projected at 7.6% per year, slower than significant benchmarks, it remains above the Swiss market rate of 4.3%.

- According our earnings growth report, there's an indication that Temenos might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Temenos.

Taking Advantage

- Unlock more gems! Our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener has unearthed 13 more companies for you to explore.Click here to unveil our expertly curated list of 16 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ALSO Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALSN

ALSO Holding

Operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives