- Switzerland

- /

- Machinery

- /

- SWX:KOMN

October 2024's Estimated Value Opportunities on the SIX Swiss Exchange

Reviewed by Simply Wall St

The Swiss market experienced a modest decline recently as investors processed regional economic data and anticipated the European Central Bank's upcoming monetary policy announcement. In this environment of cautious trading, identifying undervalued stocks on the SIX Swiss Exchange involves looking for companies with strong fundamentals that may have been overlooked due to broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF306.00 | CHF563.91 | 45.7% |

| Georg Fischer (SWX:GF) | CHF59.10 | CHF109.91 | 46.2% |

| lastminute.com (SWX:LMN) | CHF18.90 | CHF29.28 | 35.5% |

| Julius Bär Gruppe (SWX:BAER) | CHF52.94 | CHF104.16 | 49.2% |

| Komax Holding (SWX:KOMN) | CHF112.80 | CHF201.89 | 44.1% |

| Clariant (SWX:CLN) | CHF12.45 | CHF21.46 | 42% |

| Comet Holding (SWX:COTN) | CHF285.00 | CHF525.41 | 45.8% |

| SGS (SWX:SGSN) | CHF95.92 | CHF150.78 | 36.4% |

| Montana Aerospace (SWX:AERO) | CHF18.30 | CHF31.60 | 42.1% |

| Sensirion Holding (SWX:SENS) | CHF66.80 | CHF117.35 | 43.1% |

Underneath we present a selection of stocks filtered out by our screen.

Komax Holding (SWX:KOMN)

Overview: Komax Holding AG, with a market cap of CHF580.33 million, operates in the automated wire processing industry through its subsidiaries.

Operations: The company's revenue is primarily derived from its Wire Processing segment, which generated CHF663.72 million.

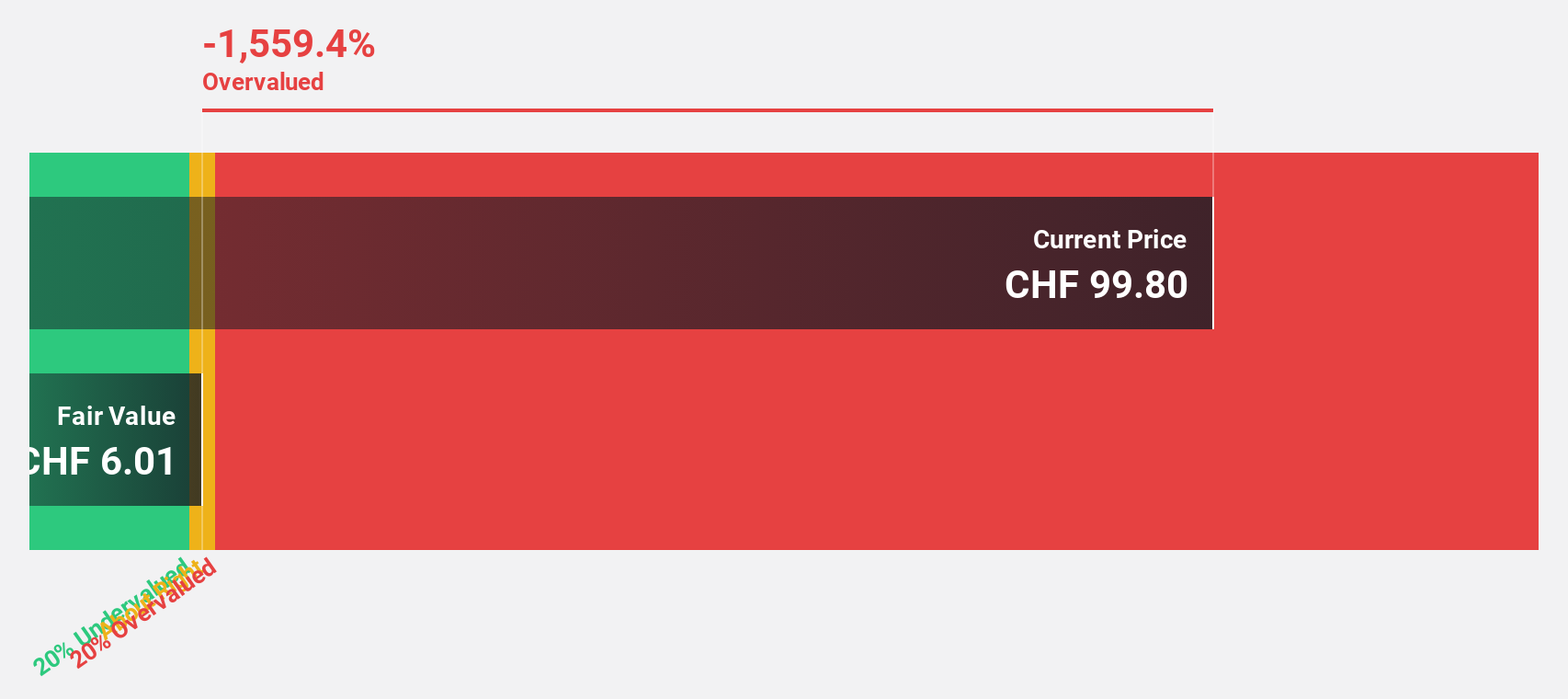

Estimated Discount To Fair Value: 44.1%

Komax Holding is trading at CHF112.8, significantly below its estimated fair value of CHF201.89, indicating it may be undervalued based on cash flows. Despite recent challenges with declining revenue and net income in the first half of 2024, earnings are forecast to grow substantially at 54.52% annually over the next three years, outpacing the Swiss market's growth rate. However, profit margins have decreased to 0.9%, and dividend coverage remains weak at 2.66%.

- The growth report we've compiled suggests that Komax Holding's future prospects could be on the up.

- Navigate through the intricacies of Komax Holding with our comprehensive financial health report here.

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide, with a market cap of CHF4.65 billion.

Operations: The company's revenue is derived from two main segments: Product, contributing $879.99 million, and Services, accounting for $132.98 million.

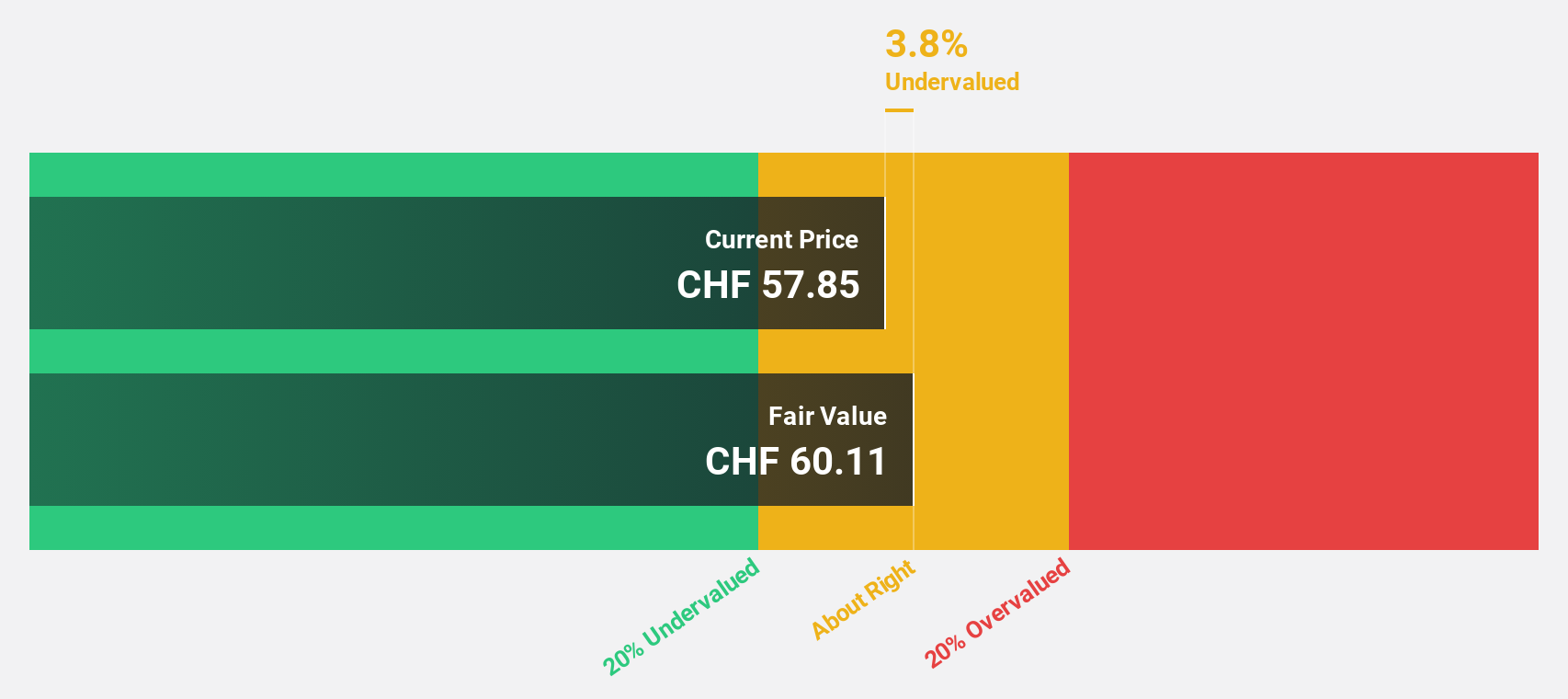

Estimated Discount To Fair Value: 19.4%

Temenos, trading at CHF63.6, is undervalued relative to its estimated fair value of CHF78.88. Its earnings are projected to grow 14.36% annually, surpassing the Swiss market average of 11.6%. Despite a high debt level, Temenos has completed a CHF200 million share buyback and is considering selling its fund management unit for EUR600 million to bolster financial flexibility. Recent executive appointments aim to enhance technological innovation and expand global reach through cloud-based platforms and AI solutions.

- The analysis detailed in our Temenos growth report hints at robust future financial performance.

- Dive into the specifics of Temenos here with our thorough financial health report.

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets products and services for GPS/GNSS satellite positioning systems across automotive, industrial, and consumer markets globally, with a market cap of CHF586.06 million.

Operations: The company's revenue from Wireless Communications Equipment amounts to CHF365.79 million.

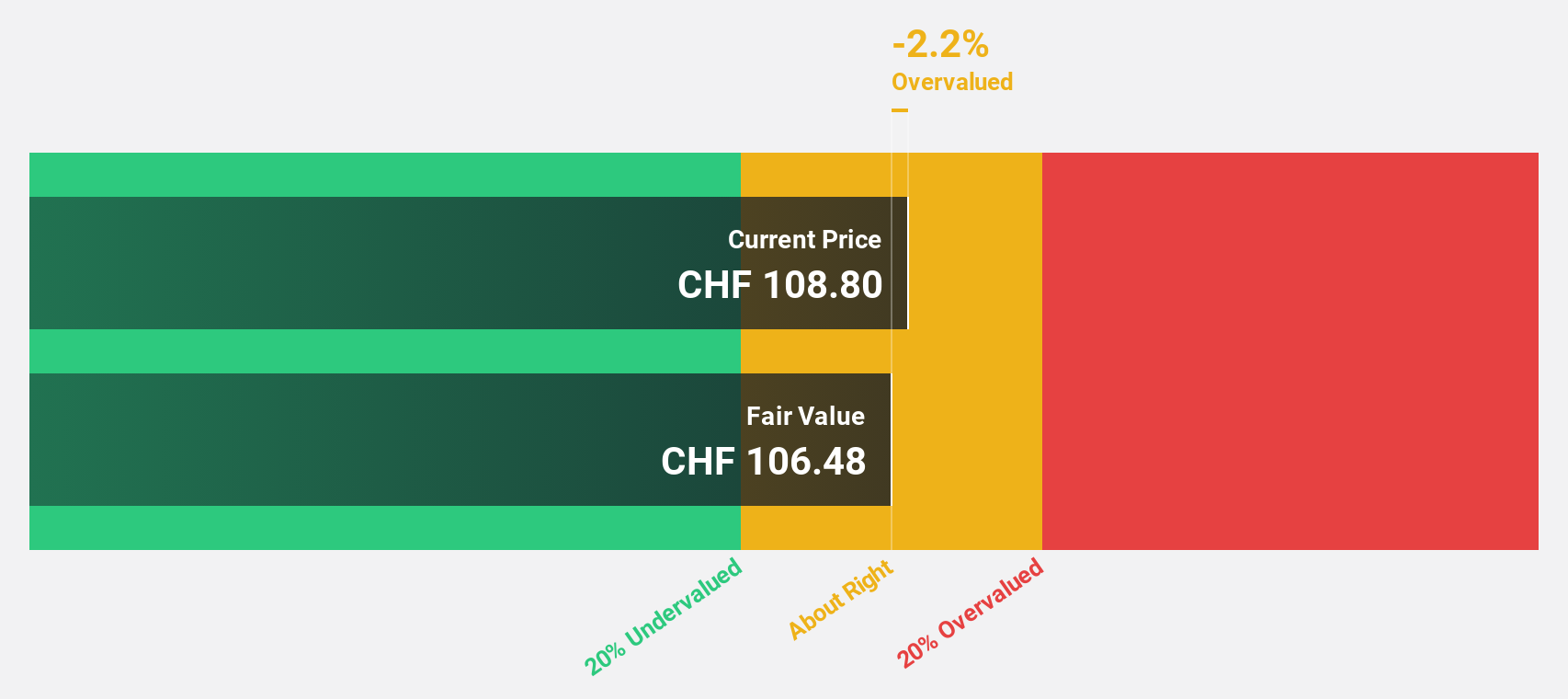

Estimated Discount To Fair Value: 19.4%

u-blox Holding, trading at CHF78.2, is priced below its estimated fair value of CHF97.07, offering potential value based on cash flows. Despite a recent net loss and shareholder dilution, the company is forecasted to achieve profitability within three years with earnings expected to grow significantly. Recent product innovations like the X20 GNSS platform and strategic partnerships highlight its commitment to expanding in high-precision positioning and IoT markets, potentially boosting future revenue growth beyond Swiss market averages.

- Our comprehensive growth report raises the possibility that u-blox Holding is poised for substantial financial growth.

- Click here to discover the nuances of u-blox Holding with our detailed financial health report.

Where To Now?

- Gain an insight into the universe of 19 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komax Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KOMN

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives