- Switzerland

- /

- Machinery

- /

- SWX:GF

Is Harrington’s Expanded Access to Georg Fischer's Flow Controls Shifting the Investment Outlook for SWX:GF?

Reviewed by Sasha Jovanovic

- Harrington Process Solutions recently announced an expansion of its partnership with Georg Fischer, granting Harrington full-line access to Georg Fischer's flow control products for corrosive waste and high purity applications across the United States.

- This expanded collaboration strengthens both companies' capabilities and market reach, particularly in mission-critical industries such as data centers, life sciences, and biopharmaceuticals.

- We'll examine how broader national distribution of Georg Fischer's high-purity technologies aligns with its shift toward resilient, higher-margin flow solutions markets.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Georg Fischer Investment Narrative Recap

To share in Georg Fischer’s story as a shareholder, you’d need to believe in its transition to a pure-play flow solutions provider, centered on resilient, high-margin markets like water infrastructure and advanced fluid systems. While the expanded Harrington partnership gives a stronger national distribution for GF's high-purity products and supports near-term exposure to mission-critical end-markets, the overall impact on the most pressing short-term catalysts, order intake and earnings visibility, appears incremental. Key risks such as currency headwinds and prolonged cyclical downturns in core end-markets remain material considerations.

Among its recent strategic moves, GF’s ongoing integration of Uponor is most relevant to this development, with cross-selling and operational synergies expected to support margins and underpin group earnings. Investors will be watching whether these new channels amplify the anticipated benefits or if challenging macro conditions and adverse FX could blunt these tailwinds in the months ahead.

Yet, the real test will come if a stronger US dollar or ongoing global trade friction further clouds profitability, a factor investors should always keep in mind when...

Read the full narrative on Georg Fischer (it's free!)

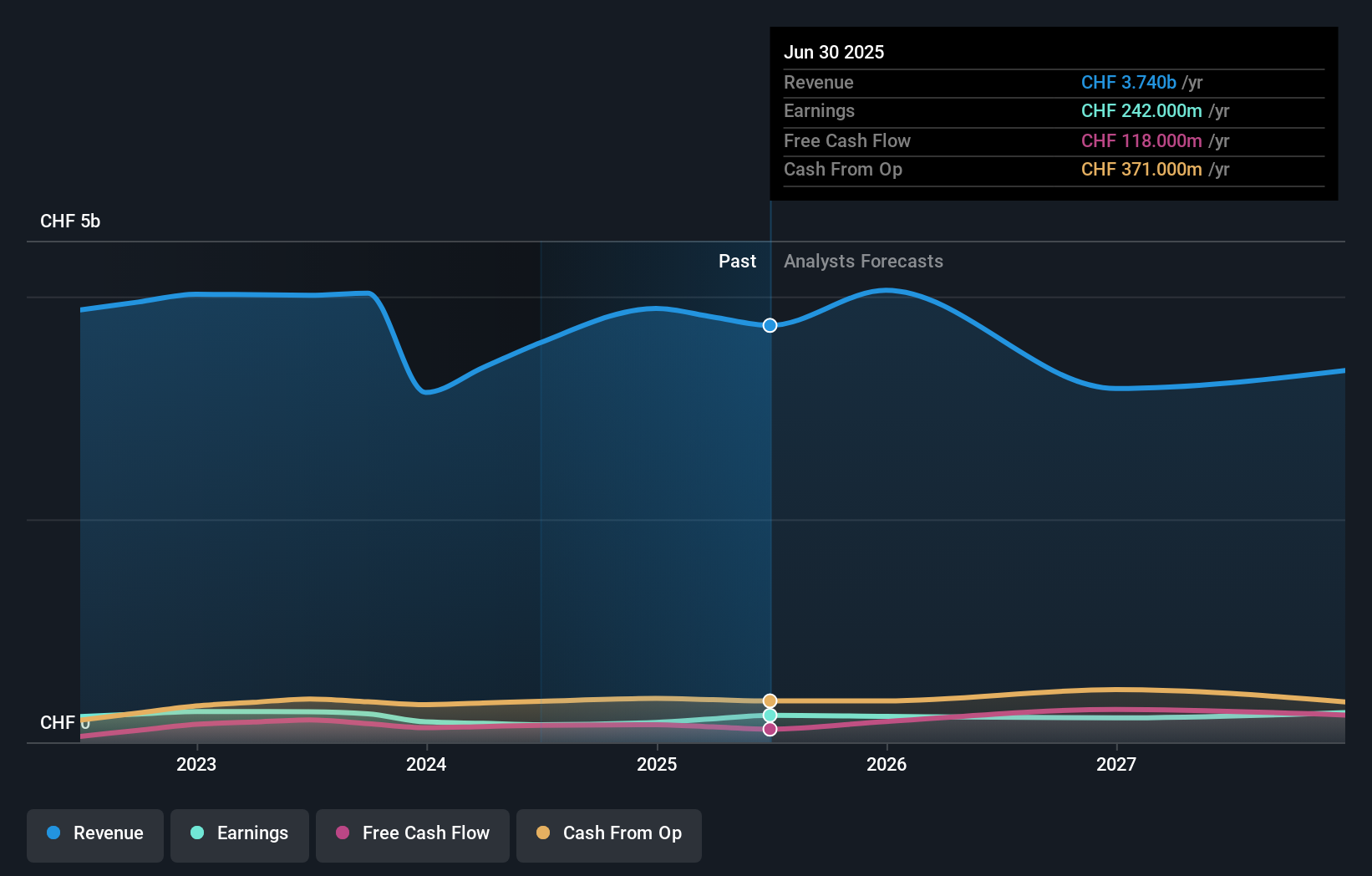

Georg Fischer's outlook anticipates CHF3.8 billion in revenue and CHF309.8 million in earnings by 2028. This scenario relies on a -0.3% annual revenue decline and a CHF67.8 million earnings increase from the current CHF242.0 million.

Uncover how Georg Fischer's forecasts yield a CHF79.40 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members estimate fair value for Georg Fischer between CHF 43.63 and CHF 79.40. While enthusiasm for growth in resilient flow solutions is strong, the risk from persistent FX pressures still weighs on the outlook; consider reviewing these diverse viewpoints to inform your approach.

Explore 4 other fair value estimates on Georg Fischer - why the stock might be worth 24% less than the current price!

Build Your Own Georg Fischer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Georg Fischer research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Georg Fischer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Georg Fischer's overall financial health at a glance.

No Opportunity In Georg Fischer?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GF

Georg Fischer

Engages in the provision of piping systems, and casting and machining solutions in Europe, the Americas, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026