- Canada

- /

- Metals and Mining

- /

- TSX:LAR

Lithium Argentina Leads 3 TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates potential interest rate cuts and bond yield fluctuations, investors are keeping a close eye on economic stabilization and market volatility. Amidst these conditions, penny stocks—despite their seemingly outdated moniker—continue to capture attention for their potential value, particularly when backed by solid financials. In this article, we explore three penny stocks that stand out for their financial strength and growth prospects, offering investors a chance to uncover hidden opportunities in smaller or newer companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.44 | CA$54.37M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.79 | CA$20.72M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.33 | CA$2.84M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.315 | CA$43.56M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.07 | CA$725.17M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$18.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.37 | CA$392.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.48 | CA$179.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.00 | CA$187.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.67 | CA$8.59M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 408 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Lithium Argentina (TSX:LAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lithium Argentina AG is a resource and materials company dedicated to advancing lithium projects in Argentina, with a market cap of CA$718.99 million.

Operations: Lithium Argentina AG has not reported any specific revenue segments.

Market Cap: CA$718.99M

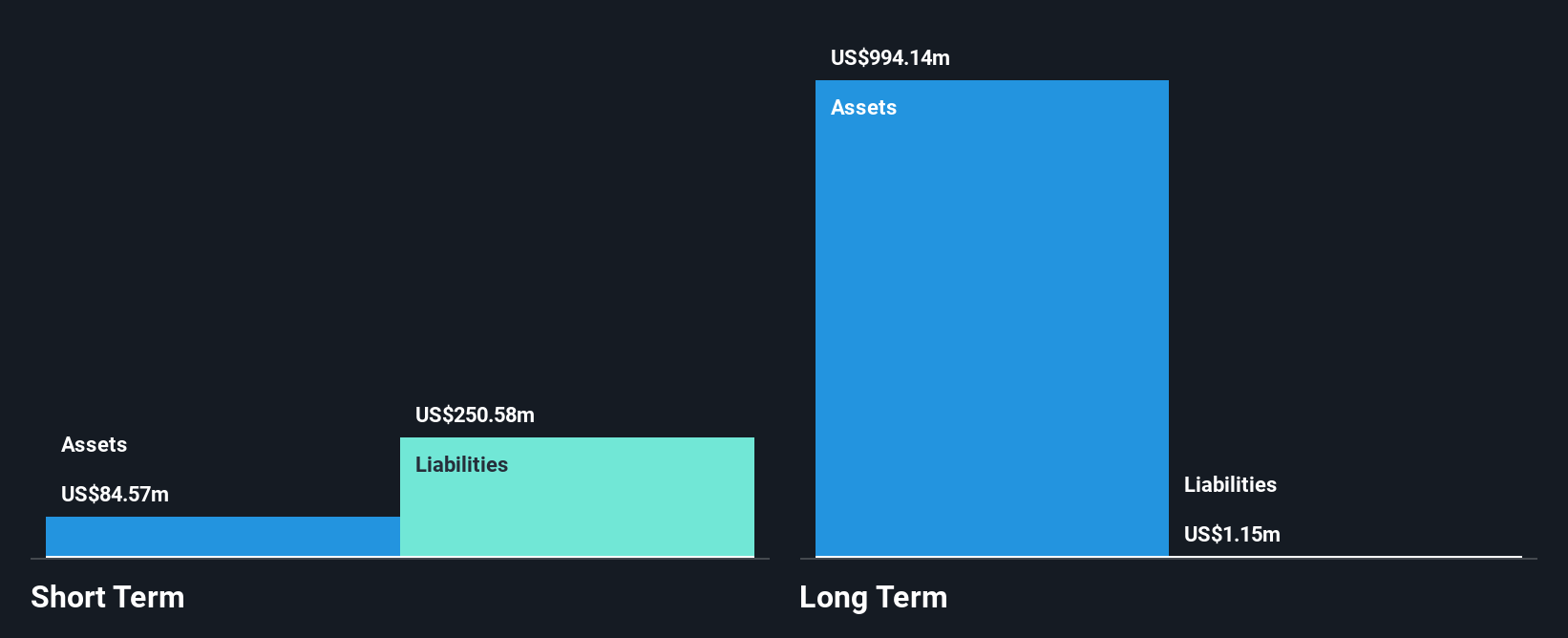

Lithium Argentina AG is a pre-revenue company focused on lithium projects in Argentina, with a market cap of CA$718.99 million. Despite being unprofitable, it has reduced losses over the past five years by 20.4% annually and maintains a satisfactory net debt to equity ratio of 17.2%. A recent strategic alliance with Ganfeng Lithium aims to consolidate resources and pursue joint financing for project development, supported by a $130 million debt facility from Ganfeng. While short-term liabilities exceed assets, the company has sufficient cash runway for over two years if free cash flow growth continues at historical rates.

- Navigate through the intricacies of Lithium Argentina with our comprehensive balance sheet health report here.

- Evaluate Lithium Argentina's prospects by accessing our earnings growth report.

Atlas Engineered Products (TSXV:AEP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlas Engineered Products Ltd. designs, manufactures, and sells engineered roof trusses, floor trusses, and wall panels in Canada with a market cap of CA$51.28 million.

Operations: The company's revenue is derived from its Building Products segment, which generated CA$56.28 million.

Market Cap: CA$51.28M

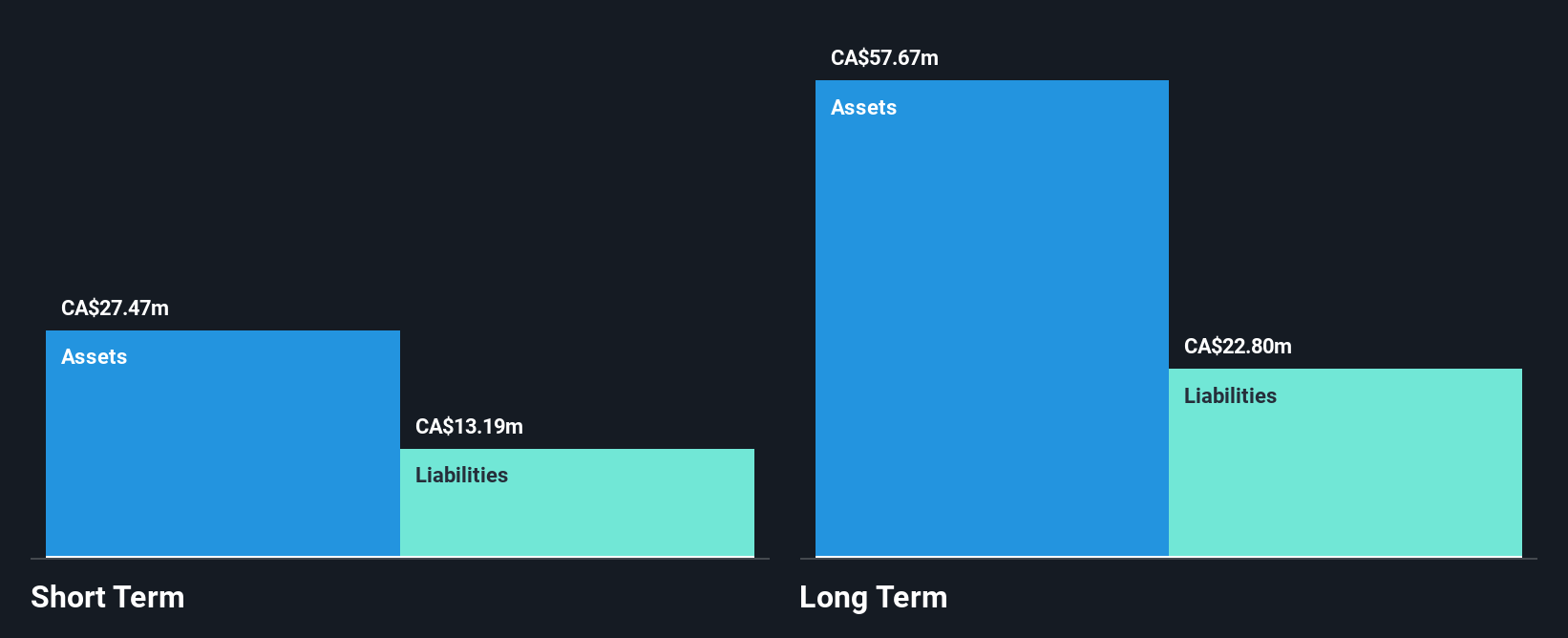

Atlas Engineered Products Ltd., with a market cap of CA$51.28 million, reported a decrease in sales to CA$13.65 million for Q2 2025, down from CA$15.09 million the previous year, resulting in a net loss of CA$0.71 million compared to a profit last year. Despite its unprofitability and negative return on equity (-3.13%), the company has reduced its debt-to-equity ratio from 61.2% to 41.1% over five years and maintains short-term assets exceeding both long-term and short-term liabilities significantly, indicating financial stability amidst challenges in earnings growth and interest coverage issues.

- Click to explore a detailed breakdown of our findings in Atlas Engineered Products' financial health report.

- Gain insights into Atlas Engineered Products' future direction by reviewing our growth report.

Westbridge Renewable Energy (TSXV:WEB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westbridge Renewable Energy Corp. focuses on acquiring and developing solar photovoltaic projects across Canada, the United States, the United Kingdom, and Italy, with a market cap of CA$54.37 million.

Operations: No specific revenue segments are reported for Westbridge Renewable Energy Corp.

Market Cap: CA$54.37M

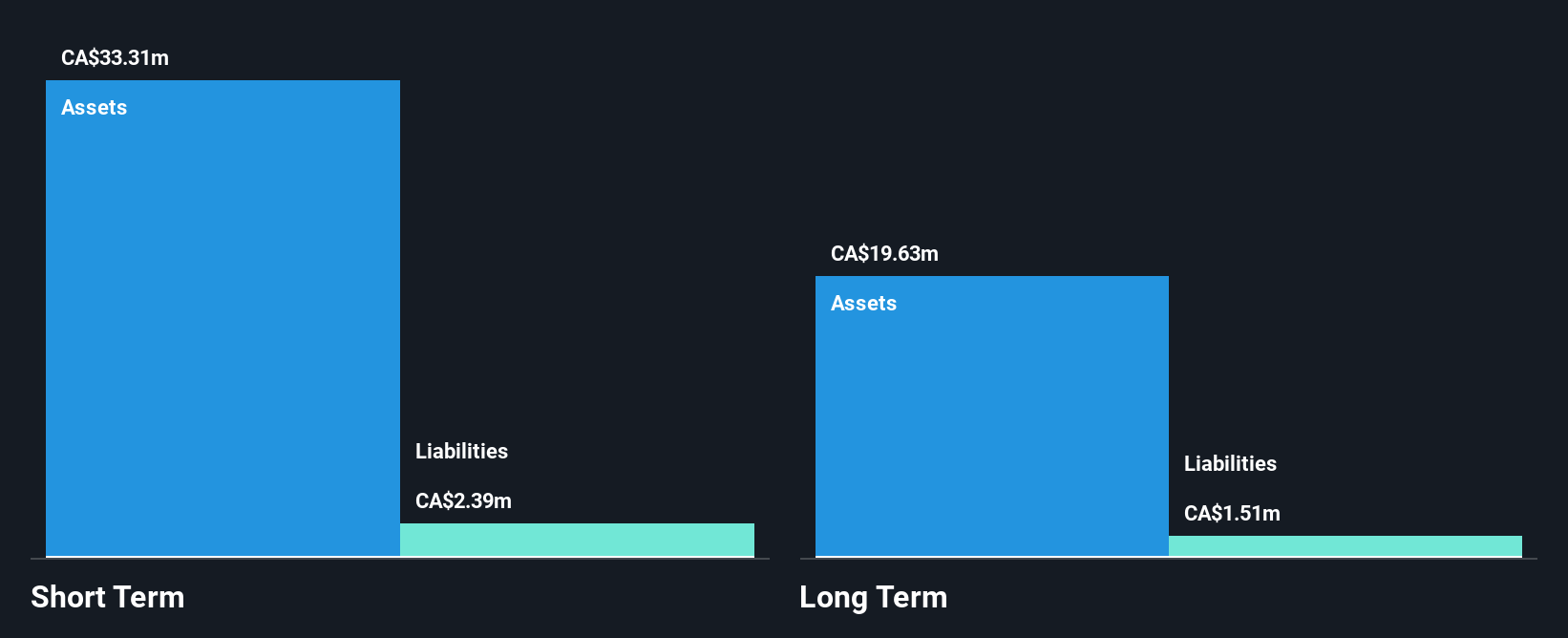

Westbridge Renewable Energy Corp., with a market cap of CA$54.37 million, is currently pre-revenue, making less than US$1m. Despite this, the company is trading at a significant discount to its estimated fair value and shows financial stability with short-term assets of CA$33.3M exceeding both short-term and long-term liabilities. The company's return on equity stands at a high 36%, though recent earnings have declined significantly by 45.4% over the past year. A recent 1:4 stock split may impact investor sentiment, while insider selling raises concerns about internal confidence in future performance.

- Get an in-depth perspective on Westbridge Renewable Energy's performance by reading our balance sheet health report here.

- Understand Westbridge Renewable Energy's earnings outlook by examining our growth report.

Seize The Opportunity

- Reveal the 408 hidden gems among our TSX Penny Stocks screener with a single click here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LAR

Lithium Argentina

A resource and materials company, focuses on advancing lithium projects in Argentina.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)