- Canada

- /

- Renewable Energy

- /

- TSX:NPI

Dividend Cut To Fund Offshore Wind Might Change The Case For Investing In Northland Power (TSX:NPI)

Reviewed by Sasha Jovanovic

- Northland Power Inc. recently announced a Monthly dividend of CA$0.0600 per share, payable on January 15, 2026, with the ex-dividend and record dates on December 31, 2025, reflecting a 40% reduction in its annualized payout to CA$0.72 amid higher funding costs and expanding investment opportunities.

- Management framed the dividend cut as a way to protect the balance sheet and keep financial flexibility while completing large offshore wind projects in Taiwan and Poland, even as director Doyle Nolan Beneby increased his shareholding through a significant insider purchase on December 1, 2025.

- We’ll now examine how this dividend reduction, aimed at preserving flexibility for major offshore wind investments, affects Northland Power’s investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Northland Power Investment Narrative Recap

To own Northland Power, you need to believe in its ability to turn a large, capital intensive offshore wind and storage pipeline into durable cash flow, despite recent losses and wind and power price volatility. The 40% dividend cut directly affects the short term catalyst of strengthening the balance sheet for Baltic Power, Hai Long and new storage projects, while also underlining the biggest near term risk around heavy debt, high interest costs and refinancing exposure.

The most relevant recent announcement here is Northland’s shift to a lower CA$0.72 annualized dividend, which followed weak Q3 2025 results that included a CA$412.67 million quarterly net loss. Viewed together, the earnings pressure, reduced payout and large ongoing investment in offshore wind and Polish battery projects all put the focus firmly on whether these assets can eventually support the new dividend level and service sizeable debt commitments in a more demanding funding environment.

But while the reset dividend may improve financial breathing room, investors should still be aware that refinancing large project debts could become far more challenging if...

Read the full narrative on Northland Power (it's free!)

Northland Power’s narrative projects CA$2.7 billion revenue and CA$454.1 million earnings by 2028. This requires 7.2% yearly revenue growth and about a CA$505.8 million earnings increase from CA$-51.7 million today.

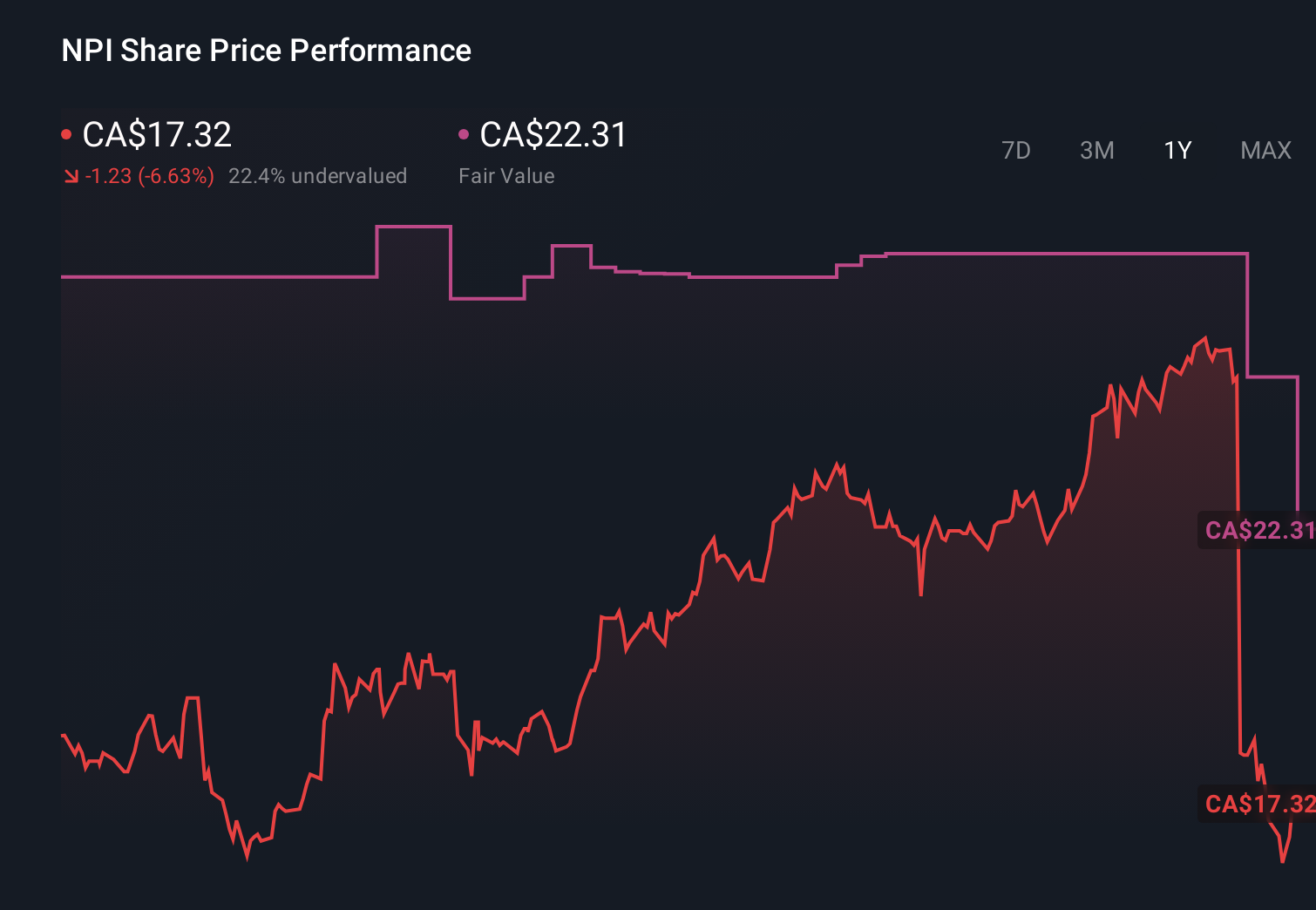

Uncover how Northland Power's forecasts yield a CA$22.31 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly CA$17.94 to CA$22.31, showing how differently private investors are weighing Northland’s prospects. You can compare those views against the current focus on balance sheet strength and offshore project execution to judge how funding risks might influence the company’s longer term performance.

Explore 5 other fair value estimates on Northland Power - why the stock might be worth as much as 30% more than the current price!

Build Your Own Northland Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northland Power research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northland Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northland Power's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Northland Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NPI

Northland Power

Operates as a power producer in Canada, the Netherlands, Germany, Colombia, Spain, the United States, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)