- Canada

- /

- Metals and Mining

- /

- TSX:CG

3 Undervalued Small Caps In Canada With Insider Action

Reviewed by Simply Wall St

The Canadian market has stayed flat over the past seven days but is up 21% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying undervalued small-cap stocks with insider action can offer unique opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Vermilion Energy | NA | 1.1x | 47.45% | ★★★★★★ |

| Trican Well Service | 7.7x | 1.0x | 12.98% | ★★★★★☆ |

| Nexus Industrial REIT | 3.8x | 3.8x | 20.52% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 48.23% | ★★★★★☆ |

| Rogers Sugar | 15.5x | 0.6x | 47.72% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.3x | -30.46% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -56.04% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 41.55% | ★★★★☆☆ |

| Hemisphere Energy | 6.3x | 2.4x | -226.67% | ★★★☆☆☆ |

| Metalla Royalty & Streaming | NA | 61.1x | -10.06% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

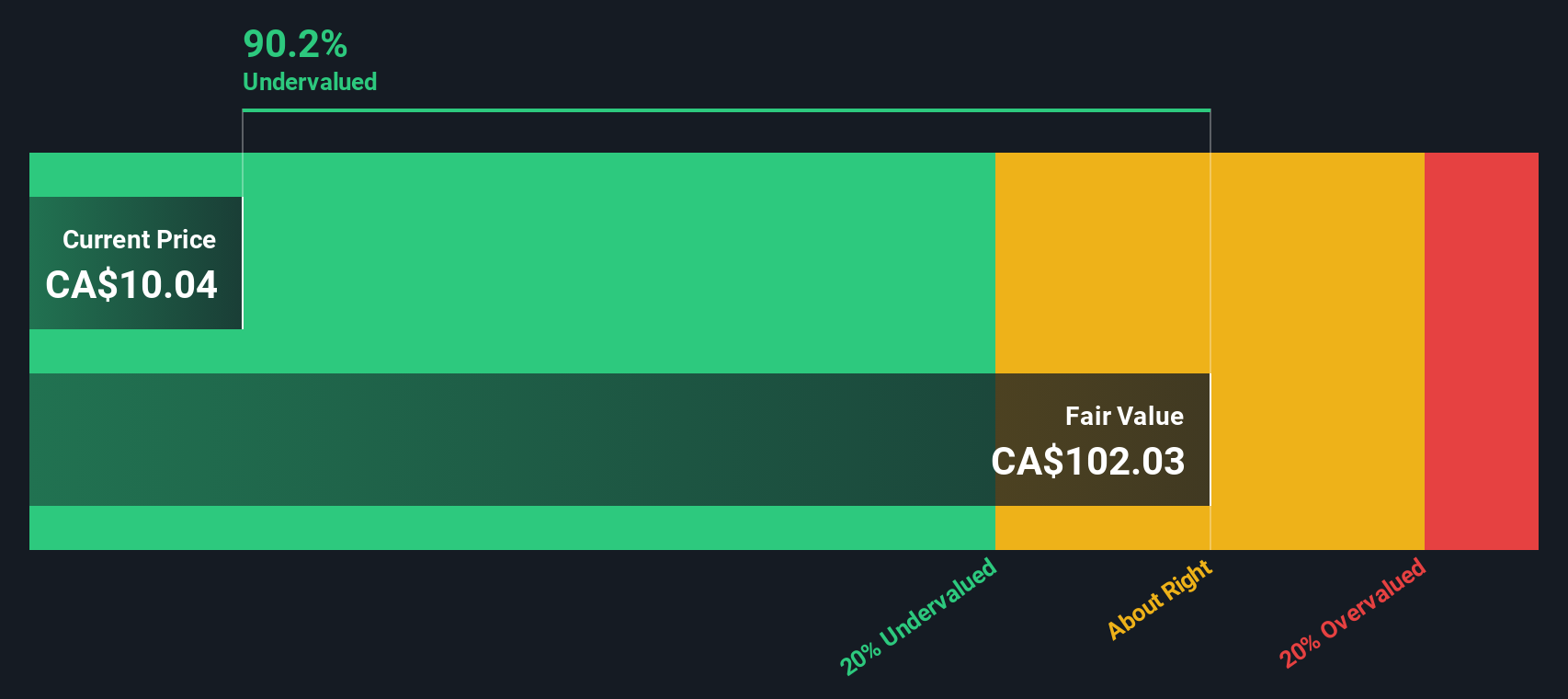

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centerra Gold is a Canadian-based gold mining and exploration company with operations in Turkey, North America, and Mongolia, and a market cap of approximately C$2.20 billion.

Operations: Centerra Gold's revenue streams primarily come from its Öksüt, Molybdenum, and Mount Milligan segments. The company's gross profit margin has varied over time, with a notable high of 58.82% in Q3 2019 and a low of 14.42% in Q1 2023. Operating expenses have ranged significantly, impacting net income margins which also show substantial fluctuations across different periods.

PE: 12.0x

Centerra Gold, a Canadian small-cap, has shown promising financial performance with Q2 2024 sales reaching US$282.31 million and net income of US$37.67 million, reversing a prior year loss. The company repurchased 1.44 million shares for US$9.8 million from April to June 2024, reflecting insider confidence in its value. Despite forecasted earnings decline by an average of 9.8% annually over the next three years, recent strategic plans for U.S molybdenum operations could bolster future growth prospects.

- Click here to discover the nuances of Centerra Gold with our detailed analytical valuation report.

Examine Centerra Gold's past performance report to understand how it has performed in the past.

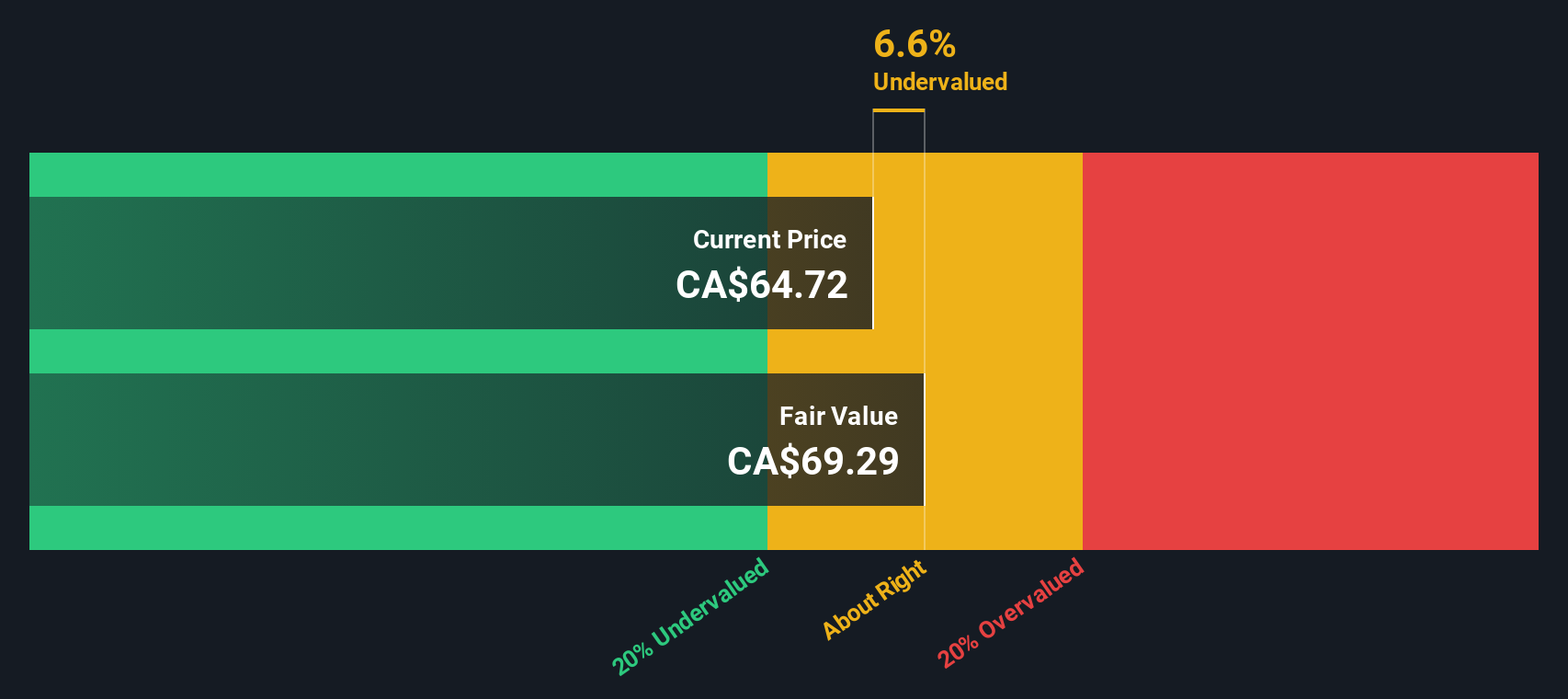

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income is a diversified acquisition-oriented company focused on the aerospace, aviation, and manufacturing sectors with a market cap of approximately CA$2.13 billion.

Operations: Exchange Income generates revenue from two primary segments: Manufacturing and Aerospace & Aviation. For the period ending September 30, 2024, the company reported a gross profit of CA$905.09 million on revenue of CA$2606.69 million, resulting in a gross profit margin of 34.72%. Operating expenses for this period were CA$614.63 million, while net income stood at CA$115.73 million with a net income margin of 4.44%.

PE: 21.1x

Exchange Income, a small-cap Canadian company, recently reported Q2 2024 earnings of C$426.92 million, up from C$372.36 million the previous year. Despite lower net income (C$32.65 million vs. C$36.9 million), the firm continues to pay consistent monthly dividends of C$0.22 per share and has shown insider confidence with recent purchases by executives in July and August 2024. The company’s Atik Mason Pilot Pathway program highlights its commitment to community engagement and workforce development among Indigenous students in Nunavut and Manitoba.

- Delve into the full analysis valuation report here for a deeper understanding of Exchange Income.

Review our historical performance report to gain insights into Exchange Income's's past performance.

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust focuses on owning and managing healthcare real estate properties with a market cap of approximately CA$2.83 billion.

Operations: The company generates revenue primarily from the healthcare real estate industry, with a notable gross profit margin of 77.81% as of June 30, 2024. Operating expenses and non-operating expenses significantly impact net income, contributing to recent negative net income margins.

PE: -3.6x

NorthWest Healthcare Properties Real Estate Investment Trust, a small cap in Canada, shows significant insider confidence with Independent Trustee Peter Aghar purchasing 100,000 shares valued at C$477,861. Despite reporting a net loss of C$122 million for Q2 2024 and lower sales compared to last year (C$119 million vs. C$126.5 million), the company continues to distribute monthly dividends of C$0.03 per unit. Future earnings are forecasted to grow by 117.9% annually, indicating potential recovery and growth opportunities ahead.

- Take a closer look at NorthWest Healthcare Properties Real Estate Investment Trust's potential here in our valuation report.

Learn about NorthWest Healthcare Properties Real Estate Investment Trust's historical performance.

Turning Ideas Into Actions

- Unlock our comprehensive list of 18 Undervalued TSX Small Caps With Insider Buying by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

A gold mining company, engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives